Portfolio Update: 4th August

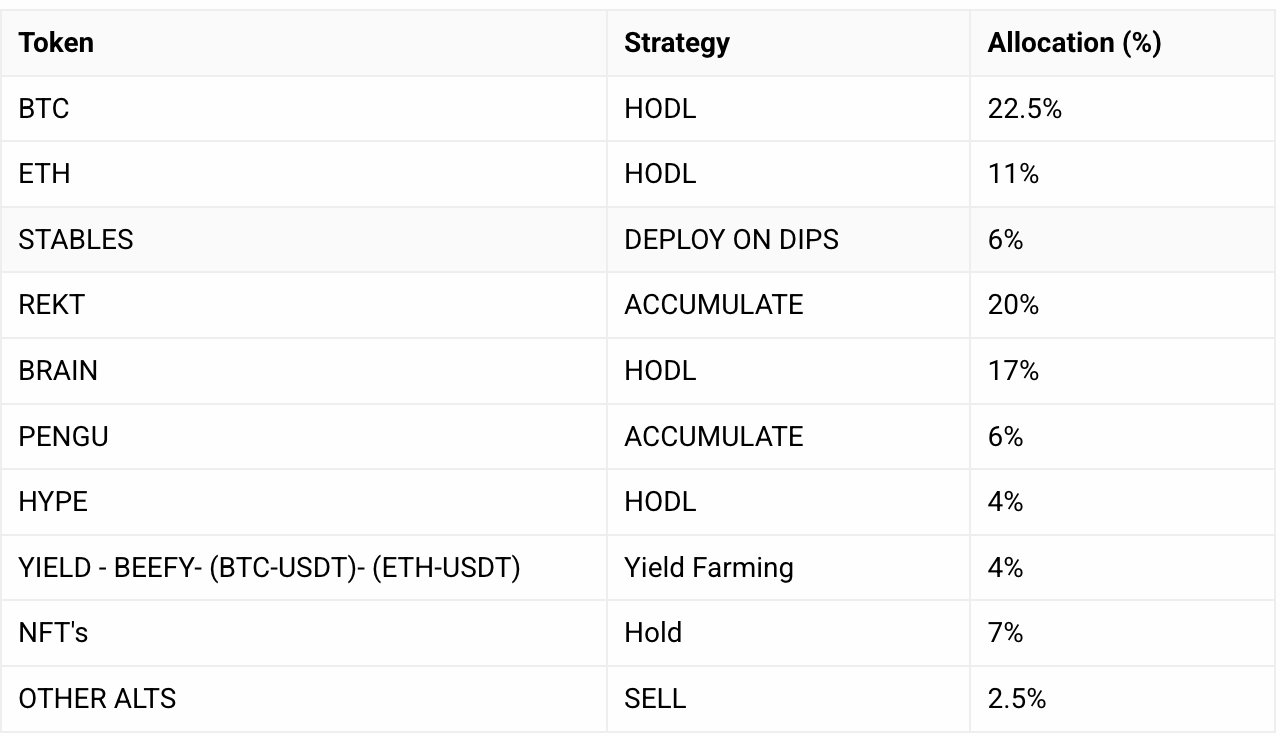

Current Portfolio Allocation

Portfolio Construction Philosophy

Our portfolio follows a barbell strategy, concentrating positions in two key segments:

Established large-cap tokens (BTC, ETH)

High-conviction emerging projects (REKT, BRAIN)

This focused approach with a limited token selection (10 core positions) enables:• Efficient position monitoring• High-conviction execution• Rapid tactical adjustments

We complement core holdings with tiled yield-generating positions, particularly in tokens we have long-term conviction. While not maximally capital efficient, this passive fee generation approach removes timing bias from accumulation.

The overall concentrated barbell strategy may produce higher volatility, but aligns with our high-conviction investment style and risk tolerance.

Token Analysis

Bitcoin (BTC) & Ethereum (ETH)

Current thesis: These are in never sell category token list. The bull case for this has been explained this many time over. My only recommendation is that instead of selling these always borrow on Aave to get cash and then manage that risk by becoming delta neutral when market turns

Action items: Hold and buy any dips

REKT ( $REKT)

Current thesis: One of my favs being built by a GOAT team. The sales of cans is going to further lead to higher buybacks. Also, now its getting main stream attention.

- My thesis you can read here: -https://x.com/saushank_/status/1915836006068326892

Action items: Hold and buy any dips

BRAIN( $BRAIN)

Current thesis: I have known the team from before inception of this and can safely say that their agentic architecture for trading is the best in space. As LLM’s get better these agents will just crush it.

My thesis written a while ago but still valid i think

Action items: Hold and buy any dips

PENGU( $PENGU)

Current thesis: One line. You don’t bet against Luca especially when his ambition is to be one of the biggest IP brand. Valuation which may appear reach doesn’t appear so in longer time horizons

Need to write a detailed thesis on this

Action items: Hold and buy any dips

YIELD ( BTC-USDT & ETH-USDT on Beefy)

Current thesis: If one is long on BTC and ETH this is a no brainer. Beefy keeps adjusting the ranges at certain frequency so that you are not out of range. When the market trends upwards or downwards you tend to lose, but when range bound you make APY usually > 40%. And markets mostly are range bound with occasional bouts on upside and downside. Average yield is around 20%

Action items: Keep Selling crappy stuff in portfolio to deploy here

NFT

Current thesis: Holding very few like Pudgy, REKT, Captainz. The art NFTs which are to be never sold are not part of this.

Action items: Wait and Watch

Other Alts

Sell on each rise. These are mostly seed round investments ( past sins) which have no chance of recovery.