Market Update: 9th April 2024

Daily updates by analyzing OG brains on CT and Youtube

Market Overview

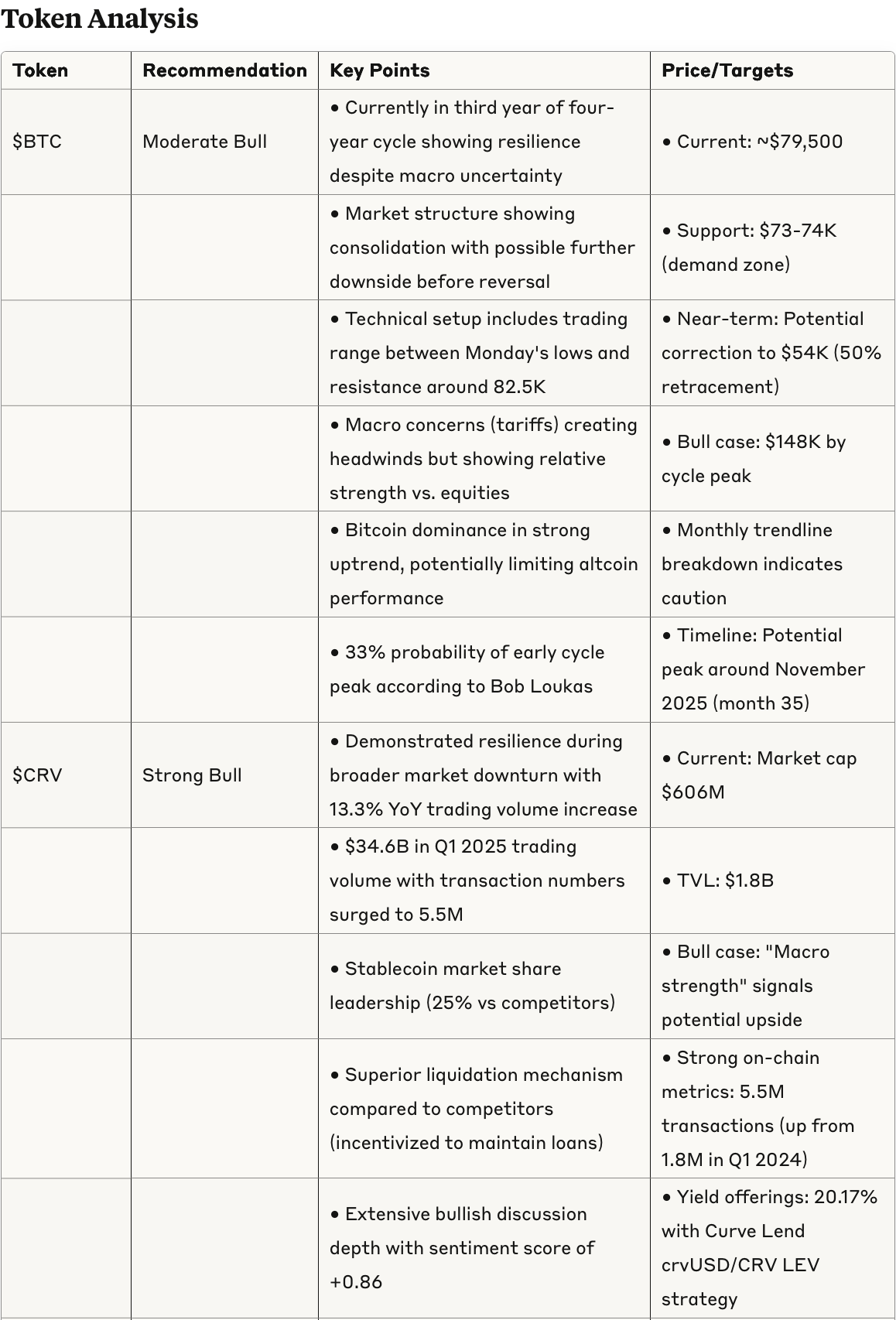

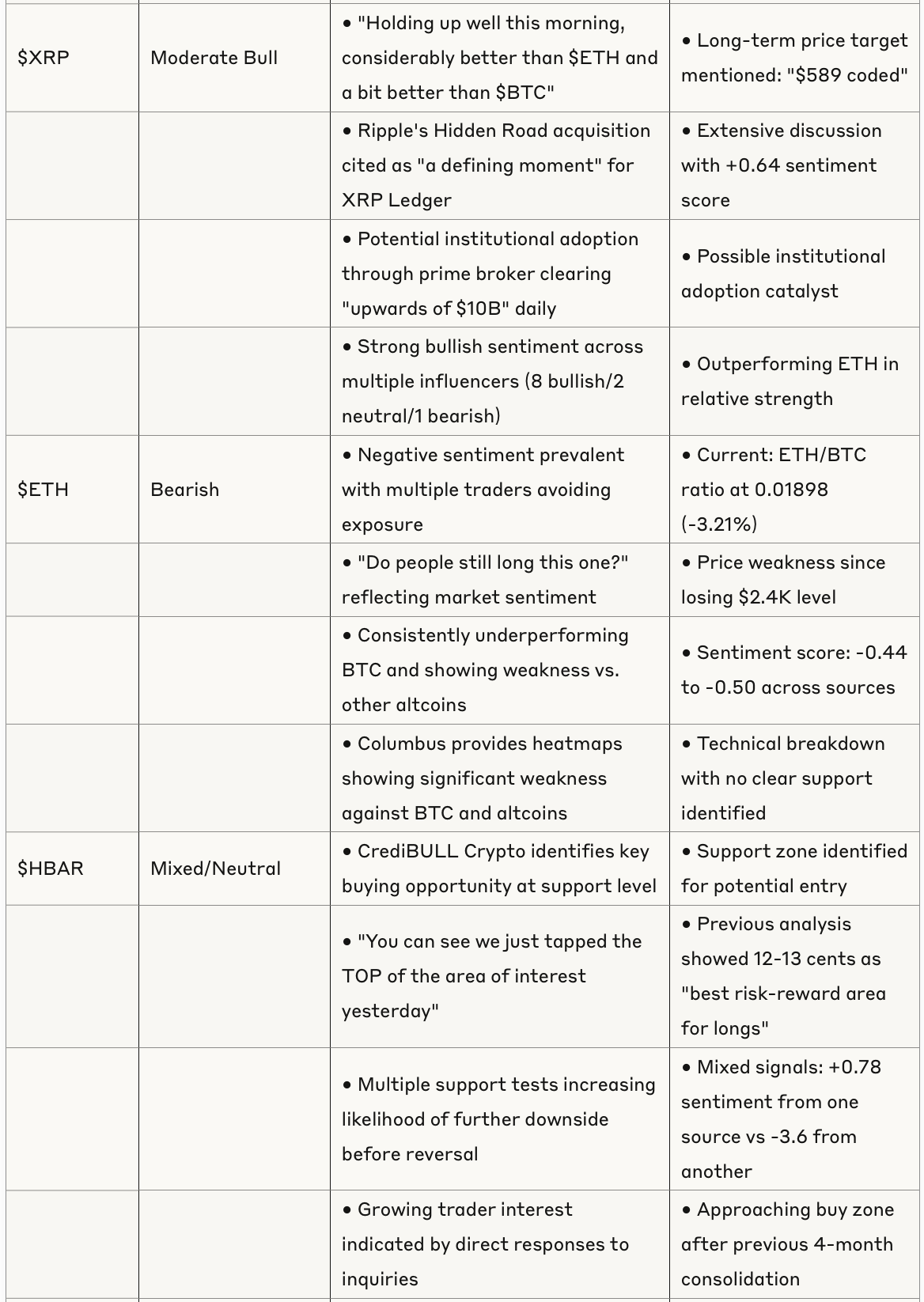

The cryptocurrency market is currently experiencing a period of mixed sentiment with a cautiously bullish bias despite significant short-term risks. Bitcoin is in the third year of its four-year cycle, showing potential for higher peaks but with elevated risk of an early top. Market participants are closely monitoring macro factors, particularly tariffs and potential recession concerns, which are creating notable headwinds.

Key Market Metrics:

Bitcoin dominance in strong uptrend (approaching critical 64% level)

Signs of altcoin weakness against BTC

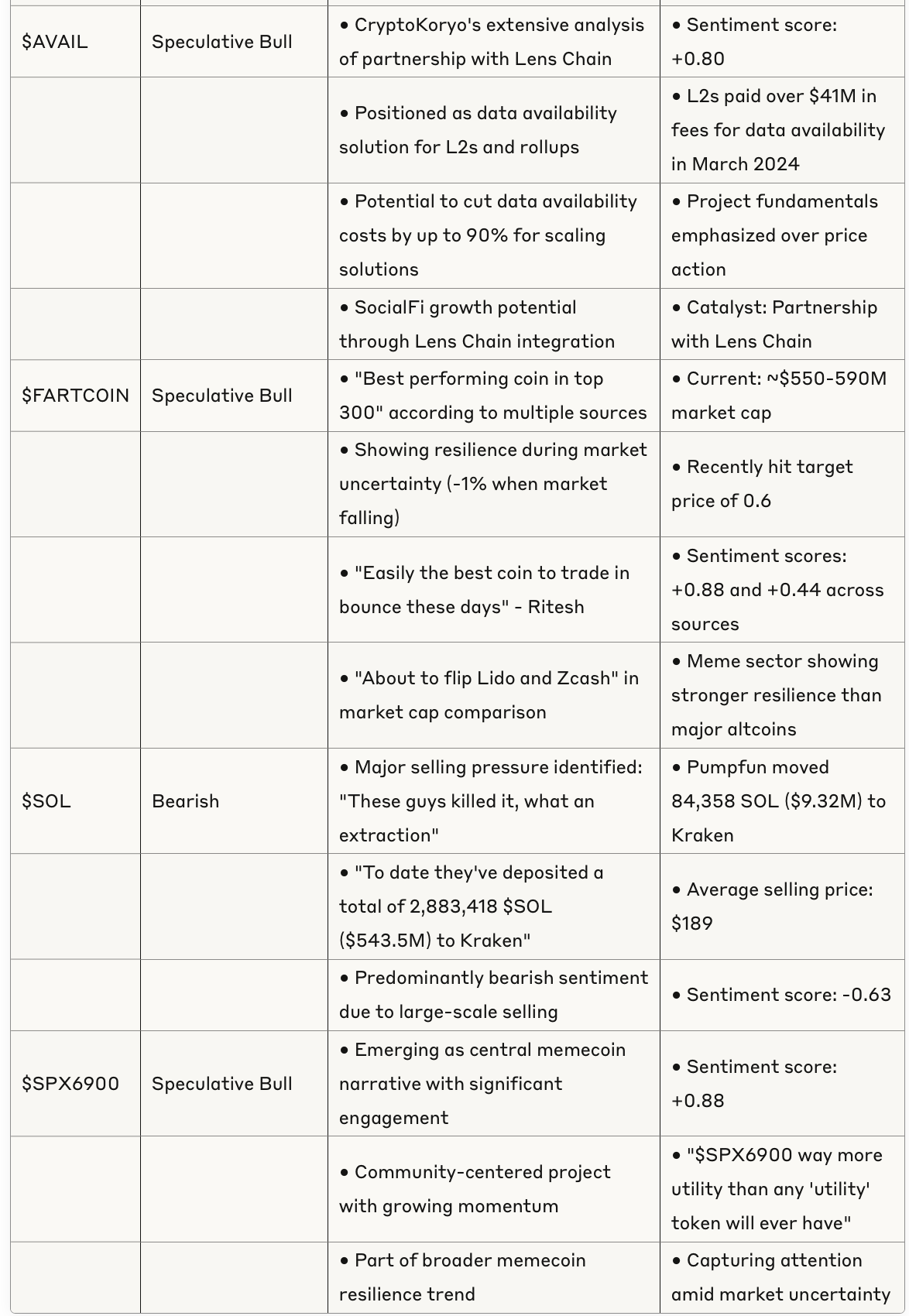

Evidence of memecoin resilience despite broader market uncertainty

DeFi sector showing strength in specific protocols (Curve ecosystem)

Primary Market Drivers:

Macro uncertainty from Trump administration tariffs

20% drop in equities creating correlation risks

Technical formations driving short-term trading strategies

Sector rotation dynamics (DeFi outperformance, ETH weakness)

Emerging Narratives

1. DeFi Resilience During Market Downturn

The Curve Finance ecosystem ($CRV, $crvUSD) demonstrates remarkable resilience during broader market uncertainty. With a 13.3% YoY increase in trading volume and transaction numbers surging to 5.5 million (up from 1.8 million in Q1 2024), Curve is outperforming the broader DeFi sector. Its stablecoin market share leadership (25% versus competitors) and strong yield offerings (20.17% with Curve Lend crvUSD/CRV LEV strategy) are driving interest despite market turbulence.

2. Stablecoin Competition Reaching Equilibrium

The stablecoin DEX landscape shows four major players with similar market share: Curve (25%), Uniswap (23%), Maverick (22%), and Fluid (21%). Market downturn appears to be driving increased stablecoin demand as safe haven behavior emerges. The competition between stablecoin protocols appears to be reaching an equilibrium point, with differentiation in liquidation mechanisms and user incentives becoming key factors.

3. Protocol Design Philosophy Divergence

A clear narrative is emerging around liquidation mechanism differences between protocols. Curve's approach is described as superior to competitors like Maker: "Curve's incentivized to keep your loan alive, CurveDAO loses if you are liquidated." This user-aligned incentive structure is gaining recognition as a fundamental advantage, with one source noting: "If you'd like to get liquidated during big liquidation cascades, choose Maker. If you would like to retain your position and only be charged a nominal fee during larger than anticipated market dumps, choose Curve."

4. Memecoin Resilience & Narrative Power

Despite market uncertainty, memecoins are showing surprising strength with tokens like $FARTCOIN, $RFC, $BUTTCOIN, and $HOUSE posting positive performance. The emergent narrative suggests memecoins may possess unique market dynamics that allow them to outperform during periods of uncertainty. As one source suggests: "The next Bitcoin isn't going to be a Currency or a Blockchain: It's going to be a Memecoin."

5. Bitcoin Dominance Cycle and Altcoin Season Timing

Bitcoin dominance is in a strong uptrend since early 2023, potentially heading toward the 64-71% range. Historical analysis suggests that when Bitcoin dominance breaks above 64%, it enters an overextension period in its uptrend, eventually followed by rejection and collapse (signaling altcoin season). Current projections indicate a potential 37-41% crash in Bitcoin dominance when the top is reached, though timing remains uncertain.

6. Post-Hype Cycle in NFTs & Web3

Evidence of a post-hype cycle in NFTs and Web3 emerges from multiple sources. One example highlights Virtual's revenue collapse: "From peaking to over $500k in revenue in a single day to doing less than $500 today." This suggests a shift in market focus away from previous hype cycles toward more sustainable revenue models.

Risk Assessment

Market-Wide Risks

Macro Uncertainty: Trump administration implementing significant tariffs causing market volatility

Equity Correlation: 20% drop in equities creating correlation risks for crypto assets

Technical Breakdown: Bitcoin's monthly trendline breakdown indicates potential for further downside

Early Cycle Top: 33% probability of early cycle peak according to Bob Loukas

Token-Specific Risks

$BTC: Potential for continued correlation with equity markets during stress periods

$CRV/$crvUSD: Competition in stablecoin market from established players

$ETH: Persistent weakness against BTC and other altcoins without clear catalysts for reversal

$HBAR: Multiple support tests increasing likelihood of further downside

$AVAIL: Speculative nature of partnerships and adoption timeline

Memecoins: Inherent volatility and narrative-dependent performance

Timing Considerations

Bitcoin cycle analysis suggests potential peak around November 2025 (month 35)

Altcoin season probability diminishing but still likely when Bitcoin dominance peaks

Evidence of diminishing returns in altcoin seasons compared to previous cycles