Market Update: 15th April

Daily Alpha from CT and YT

Market Overview

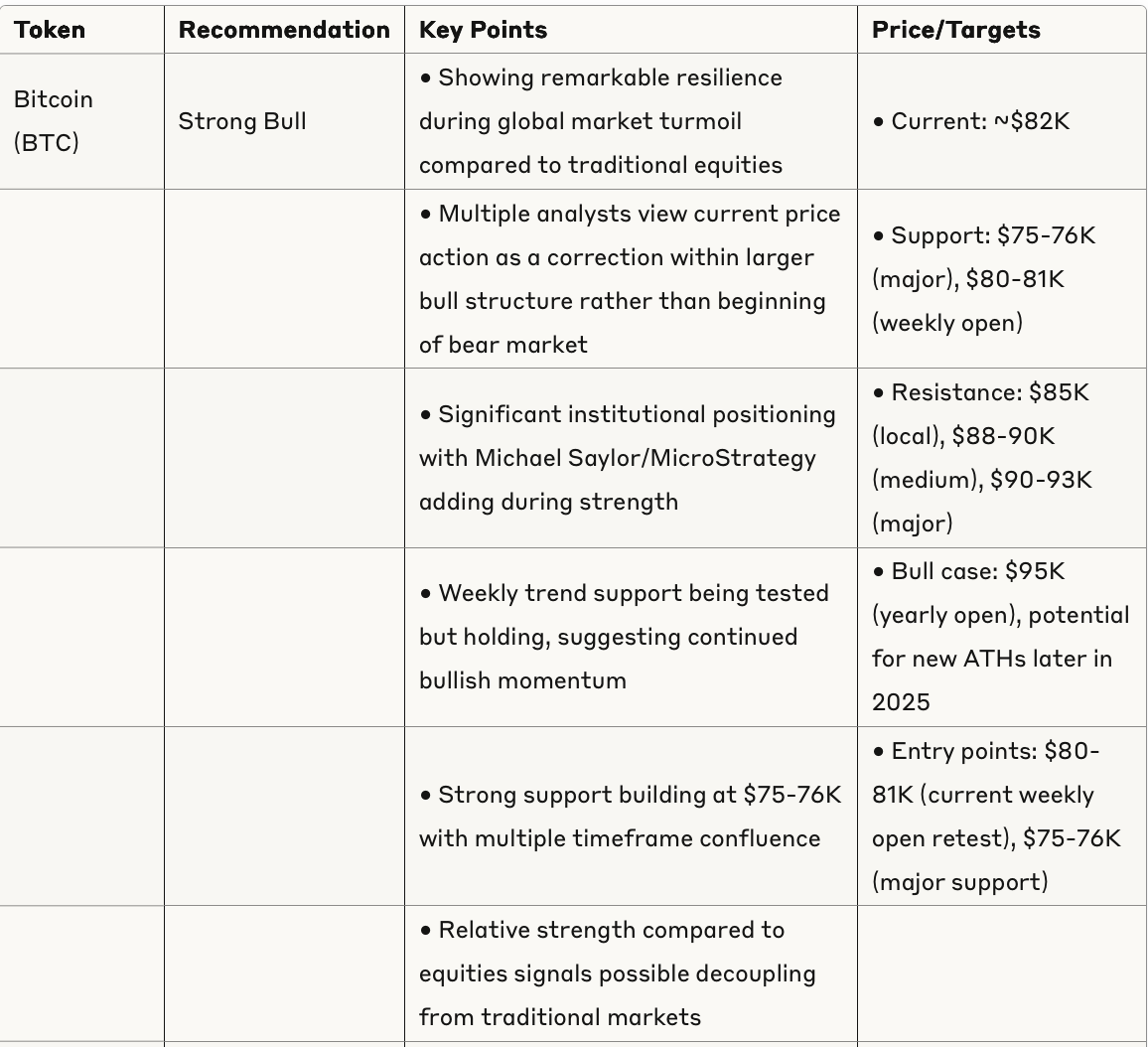

The crypto market is currently navigating significant volatility following recent global market selloffs triggered by Trump's tariff announcements. Despite broader market uncertainty, Bitcoin is demonstrating resilience by holding in the $80-85K range while traditional markets experience their most significant correction since 2020. The overall market structure suggests we're in a correction within a larger bull market rather than the beginning of a bear market.

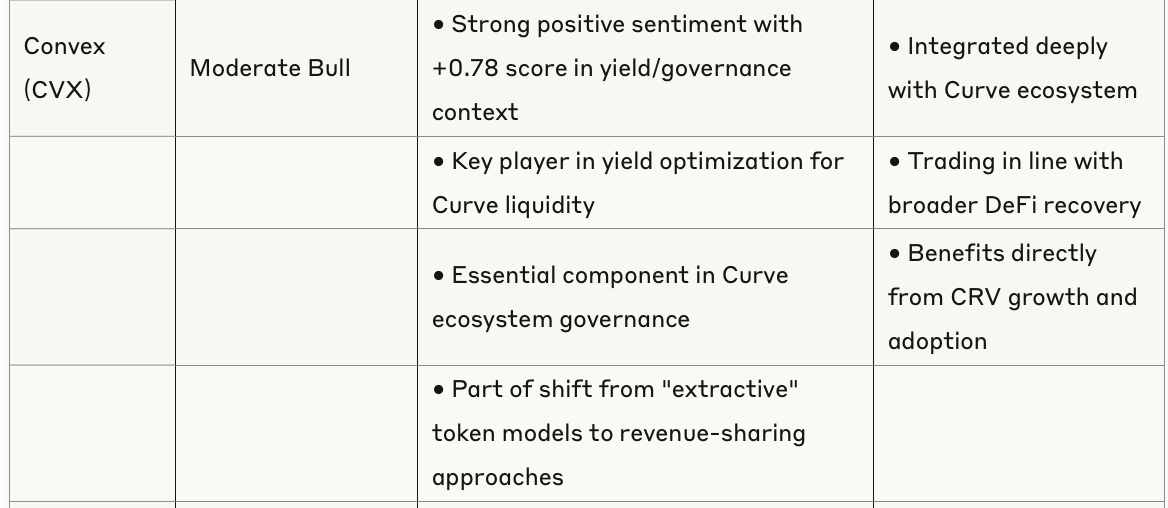

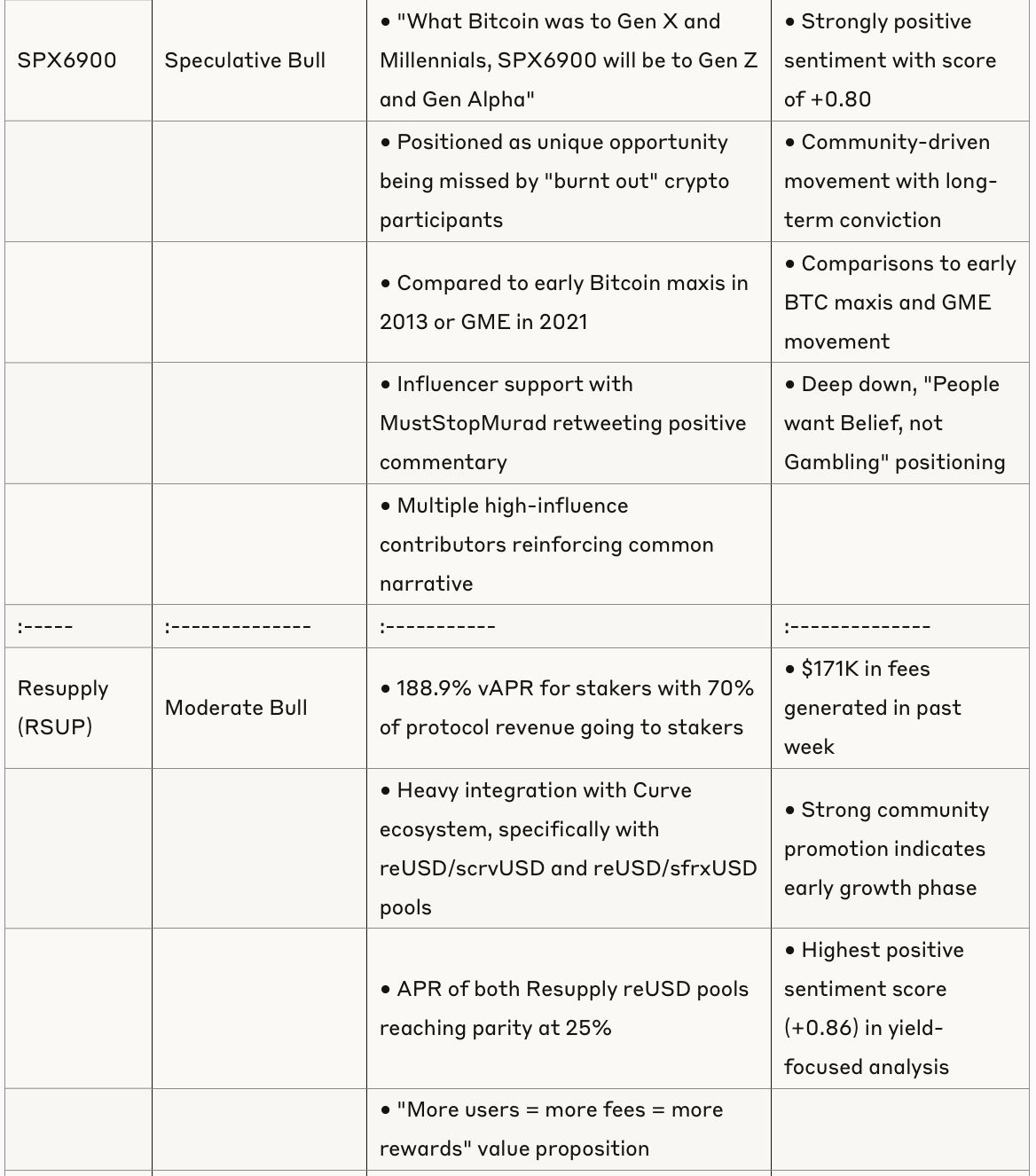

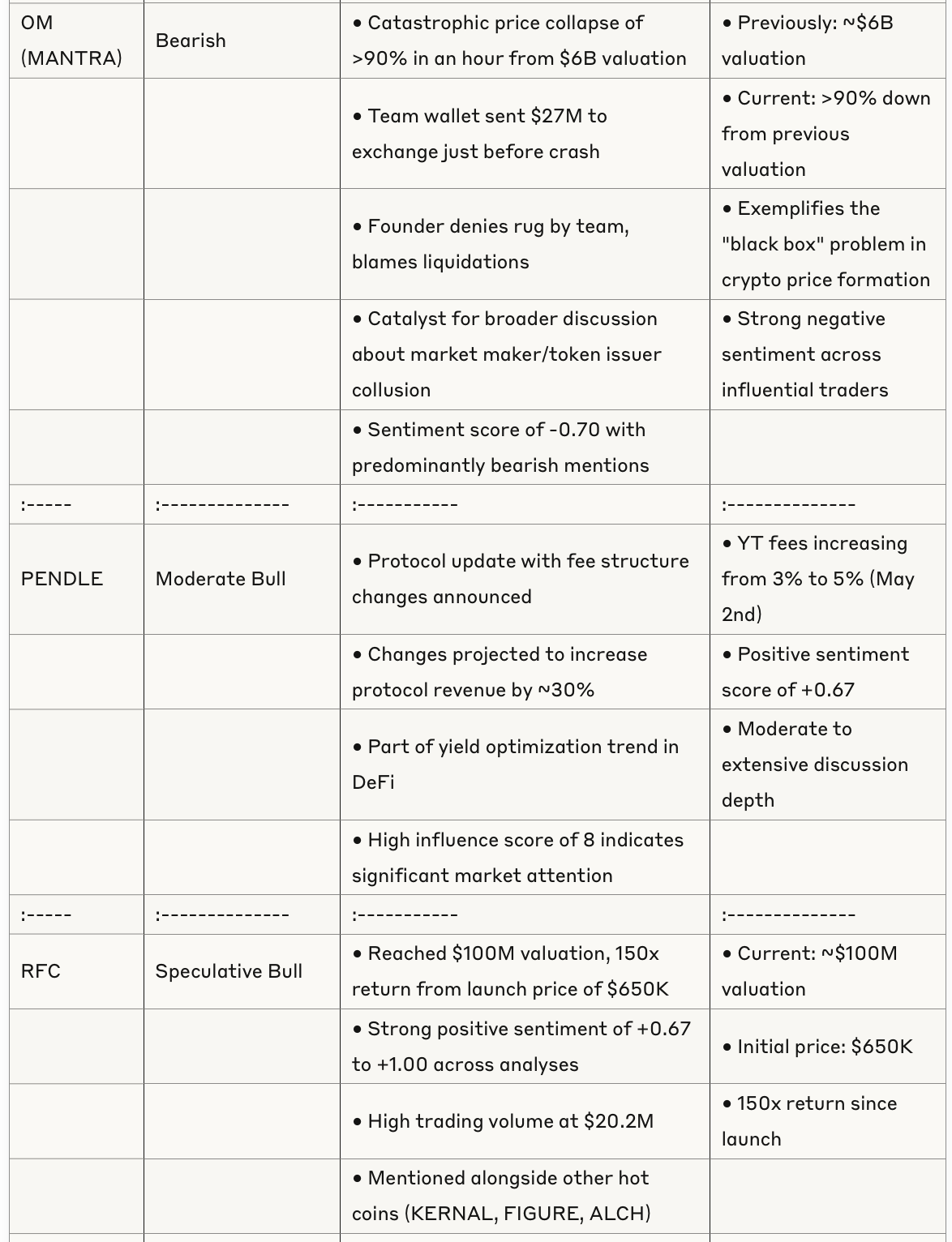

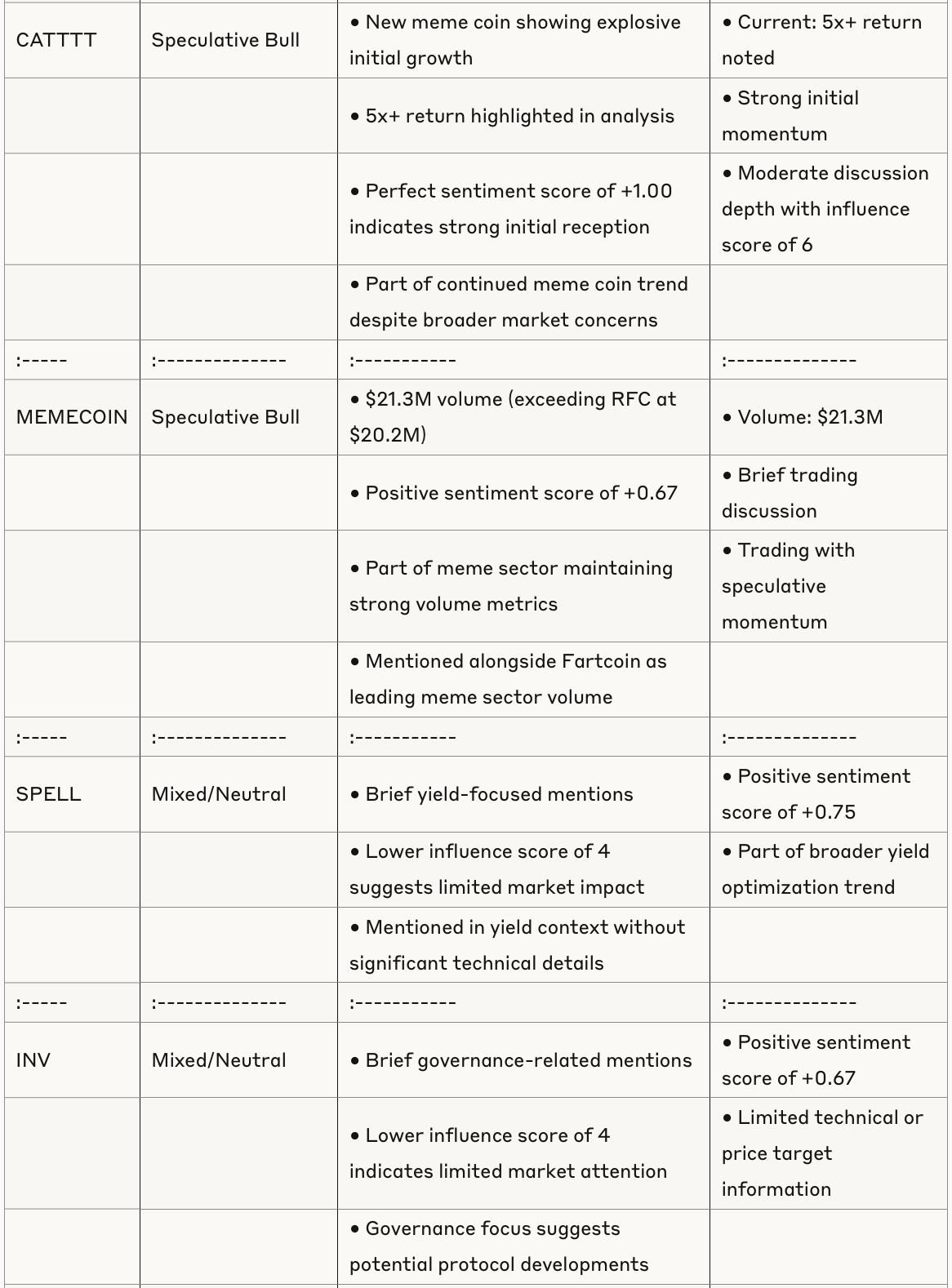

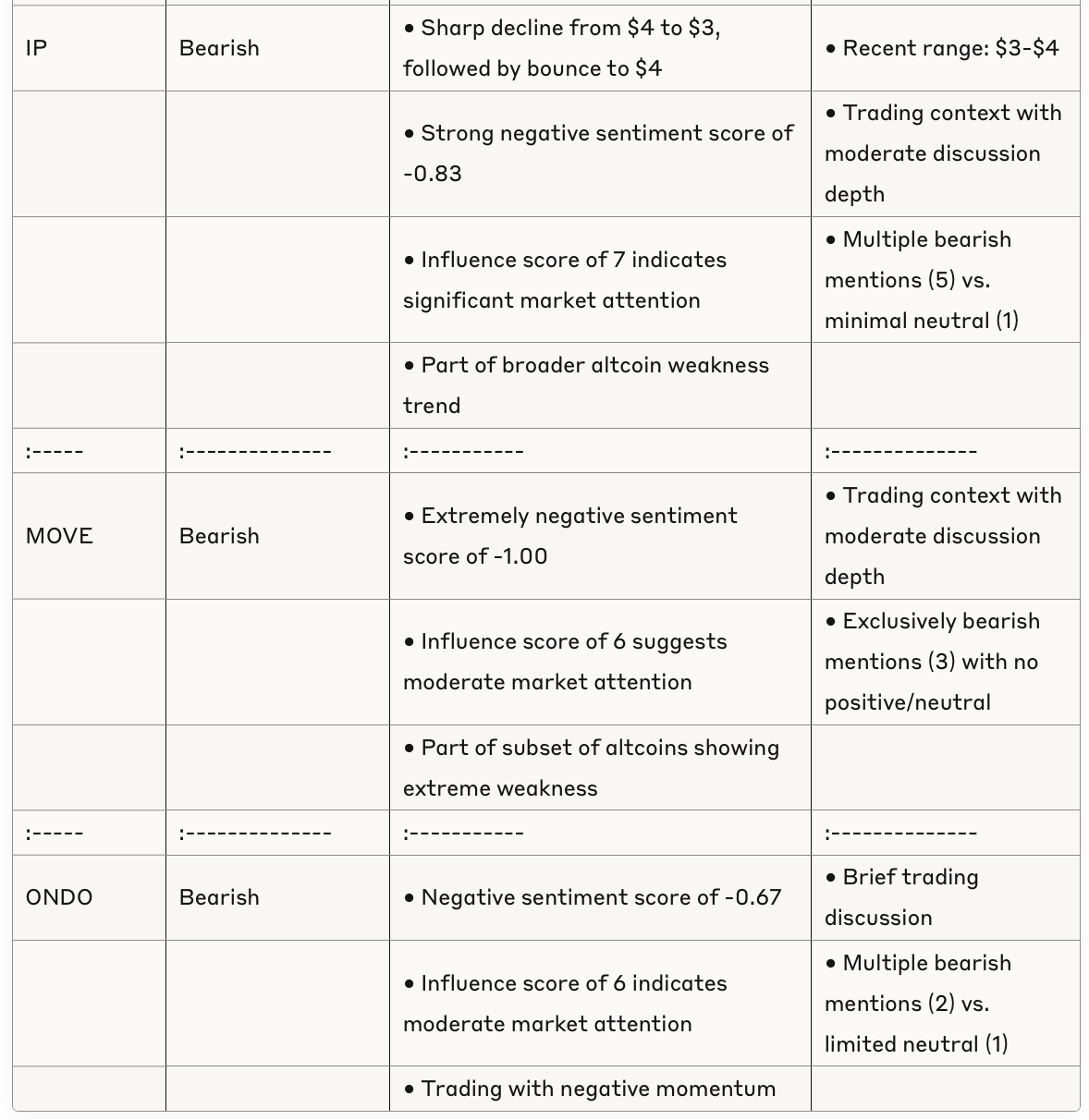

Token Analysis

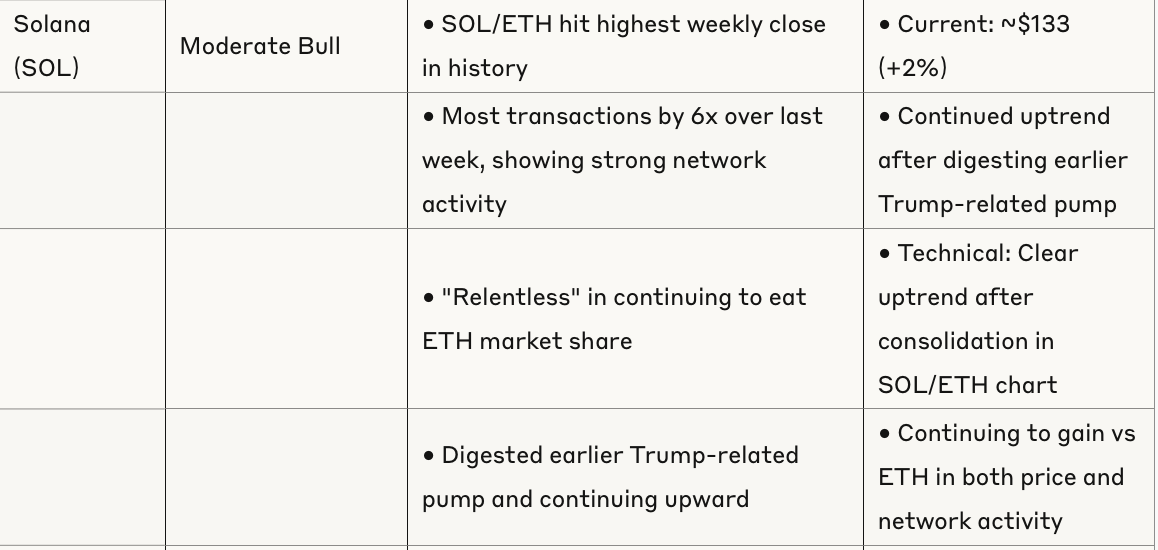

Sector Analysis

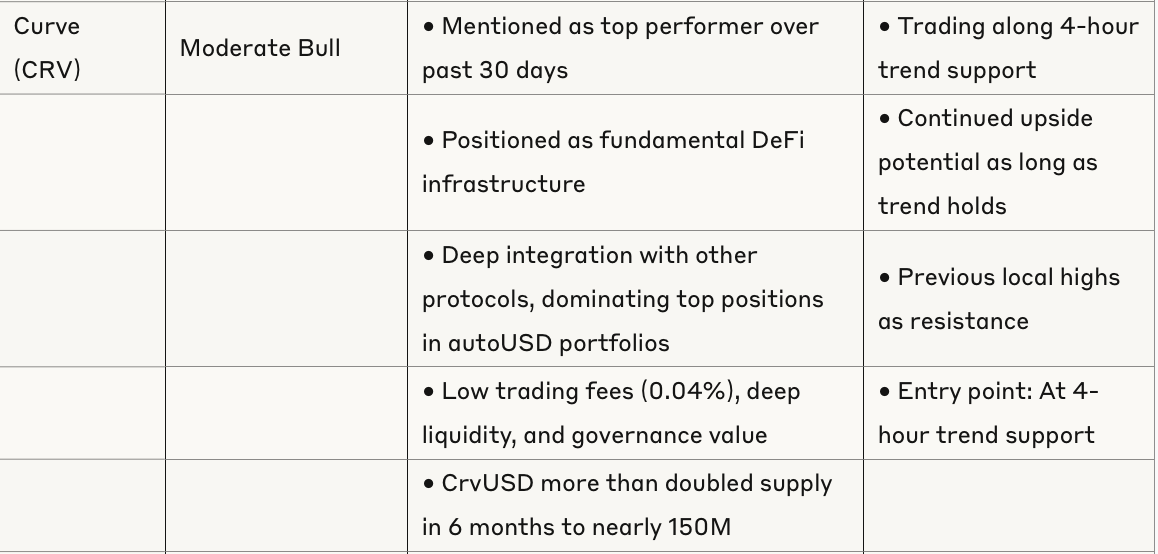

DeFi Infrastructure

DeFi platforms showing maturation with DEXs clearing $61B in volume (26% market share)

CrvUSD supply more than doubled in 6 months to nearly 150M

Growing shift from "extractive" token models to revenue-sharing approaches

Yield optimization remains central focus with Curve/Convex ecosystem at the center

Meme Coins

Fartcoin emerging as the premier risk-on trade

Several new meme coins showing strong initial performance (CATTTT with 5x+ returns)

Meme coin volume remains strong with Memecoin at $21.3M and Fartcoin leading volume

BABY by Babylon up 25% since launch with $1.2B fully diluted valuation

Layer 1 Competition

Solana continuing to gain against Ethereum in relative value

SOL/ETH at all-time high weekly close with SOL transaction volume 6x higher than competitors

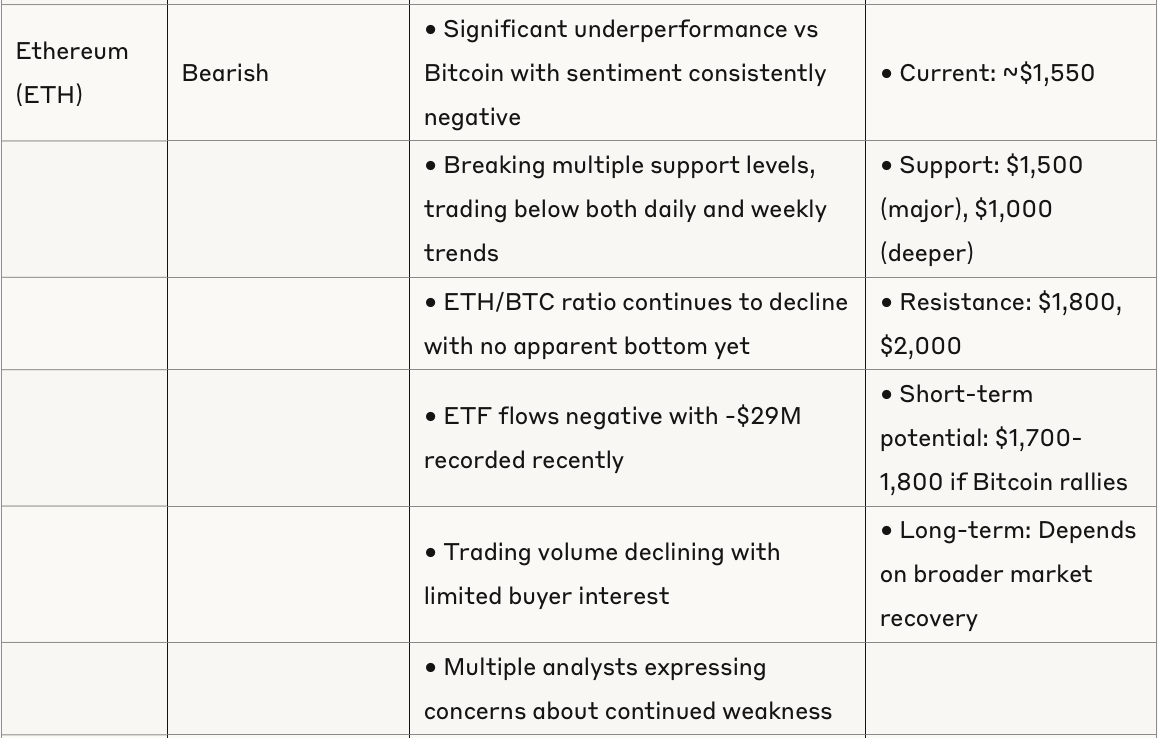

Ethereum showing weakness with negative ETF flows (-$29M)

Ethereum Foundation sharing simplified roadmap but failing to excite market

Market Risks & Concerns

Primary Risk Factors

Trump tariff situation creating market uncertainty with contradictory messaging

Several indicators suggesting recession risks (consumer confidence at 2nd lowest ever, record car payment delinquencies)

Bond markets showing stress with yields moving higher against anticipated direction

Market structure concerns regarding token issuers and market makers potentially colluding

Token-Specific Risks

OM token collapse (>90% in an hour from $6B valuation) highlighting manipulation risks

Team wallet sent $27M to exchange just before crash, raising trust concerns

Multiple high-profile traders discussing endemic problems with market maker/token issuer collusion

"The biggest problem plaguing the liquid crypto market now is the complete blackbox of how projects and market makers can work together" - Arthur_0x

Technical Risks

Bitcoin needs to reclaim previous range low of $91-94K to confirm bullish continuation

Risk of Bitcoin recoupling with equities if global selloff intensifies

Black swan scenarios could test $60-65K level for Bitcoin

Altcoin market potentially entering bear market conditions while Bitcoin maintains relative strength

Institutional Developments

Metaplanet purchases $26M BTC, becoming 9th largest holder

Sweden considering Bitcoin reserves

New York considering bill on state agencies accepting crypto

BTC OTC desks reportedly being drained at record levels

Institutional positioning remains strong despite market uncertainty

Tariff exemptions on electronics being temporary according to Lutnick

Fed official signaling readiness to "stabilize market" if needed

Emerging Trends

Bootstrapped Founder Movement

38% of startups in 2024 have solo founders with no VC funding (up from 22.2% in 2015)

Less than $20K now needed for founders to take product from idea to first revenue

Traditional VC value proposition (signaling, capital, strategic intros) breaking down

Market Integrity Concerns

Growing discussions about collusion between token issuers and market makers

OM collapse serving as catalyst for broader conversation

Public opinion potentially turning against centralized exchanges

Yield Optimization Focus

ECB rate cuts creating yield differential opportunities

EURC on Aave at 3.5% vs 2.5% traditional finance rates

Return to DeFi yield advantage in low-rate environments

Bitcoin as Recession Hedge

Emerging narrative of Bitcoin as potential hedge against fiscal uncertainty

Correlation with gold during recent market stress

Relative strength compared to equities during recent selloff

Conclusion

The crypto market is experiencing a period of adjustment within what appears to be a larger bull cycle. Bitcoin's resilience in the face of broader market turmoil suggests continued strength, while the altcoin market shows increasing divergence. Investors should focus on quality assets with proven fundamentals, exercise caution with speculative altcoins, and remain aware of the increasing concerns about market manipulation. Though short-term volatility may persist, the long-term structural bull case for Bitcoin remains intact, with the $75-76K support level providing a critical technical foundation.