Market Update: 14th April

Daily alpha from CT & YT

Overall Market Context

The crypto market appears to be in a selective phase where quality projects with strong fundamentals are gaining strength, while speculative assets face increased scrutiny. Bitcoin shows signs of technical strength with key support levels being confirmed, while ecosystem-specific tokens (particularly in the Curve ecosystem) are showing notable momentum. Market volatility remains high, creating both opportunities and challenges for traders.

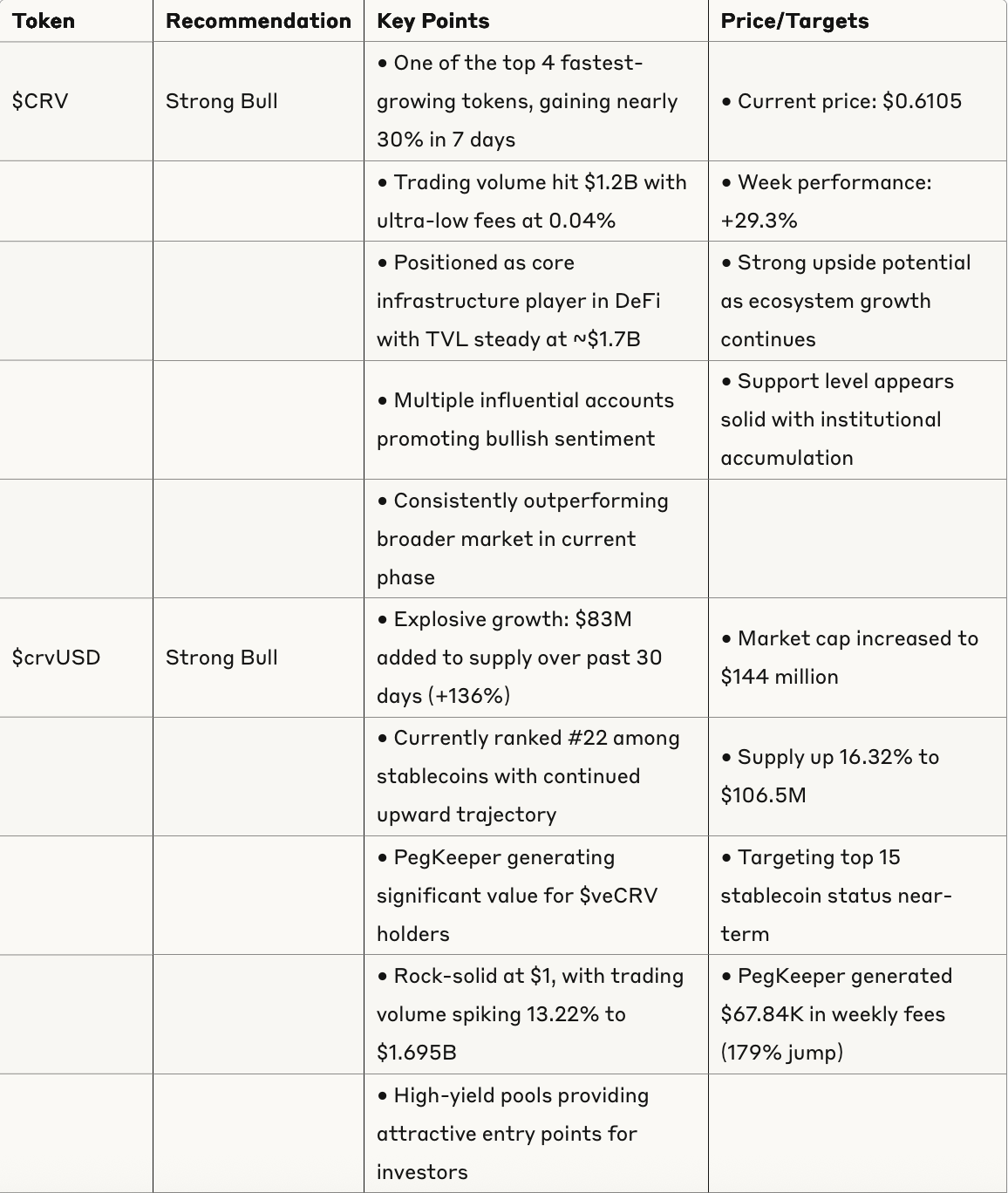

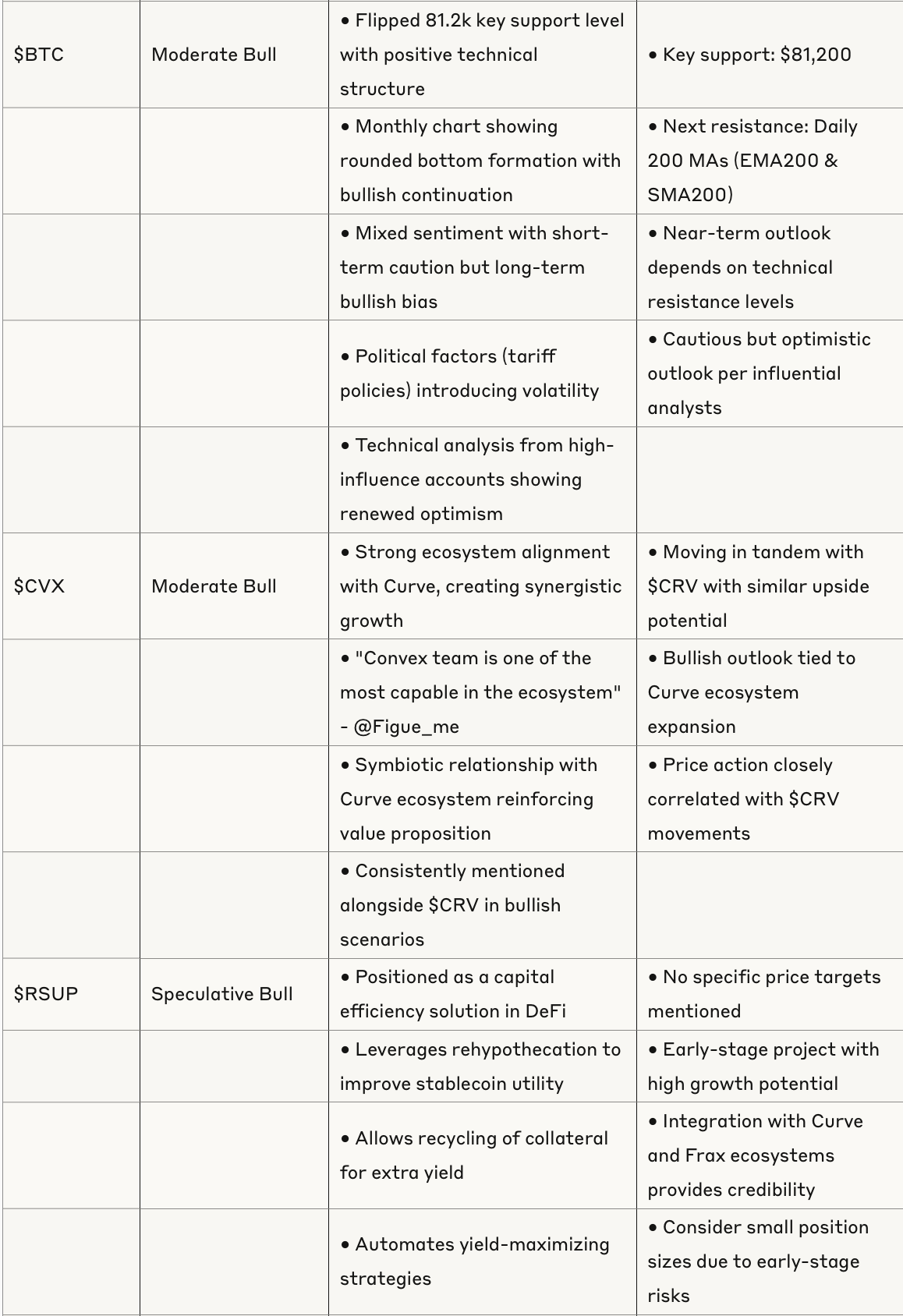

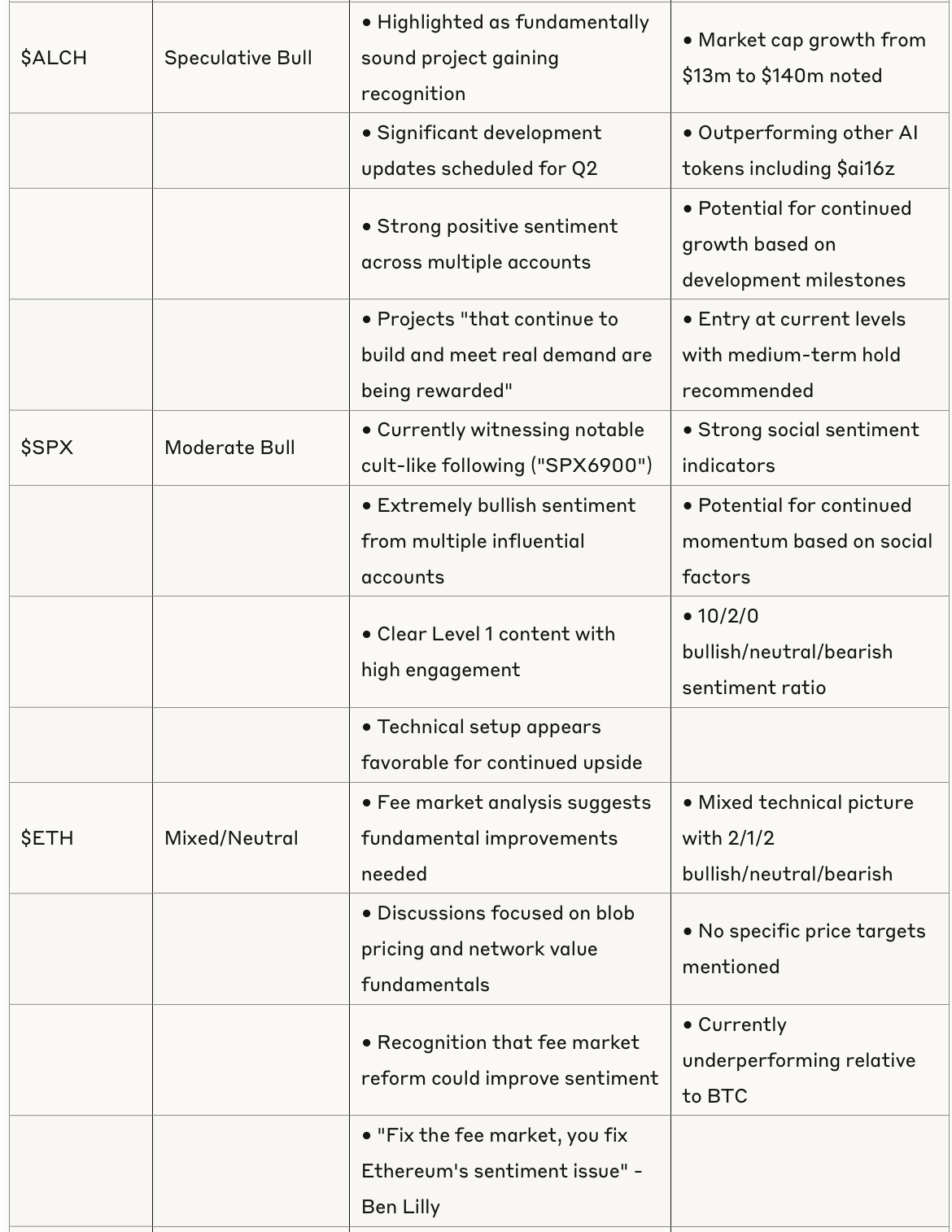

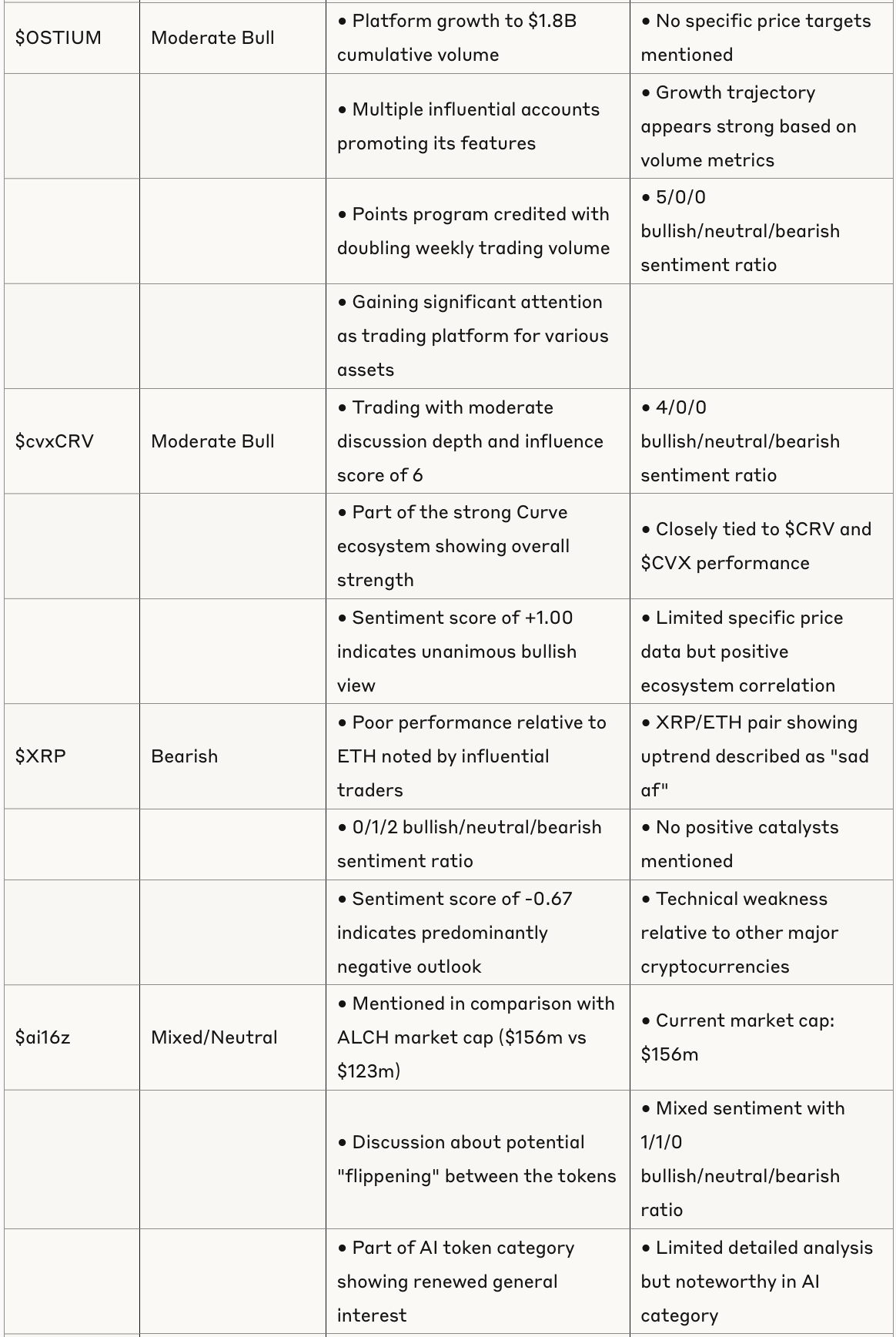

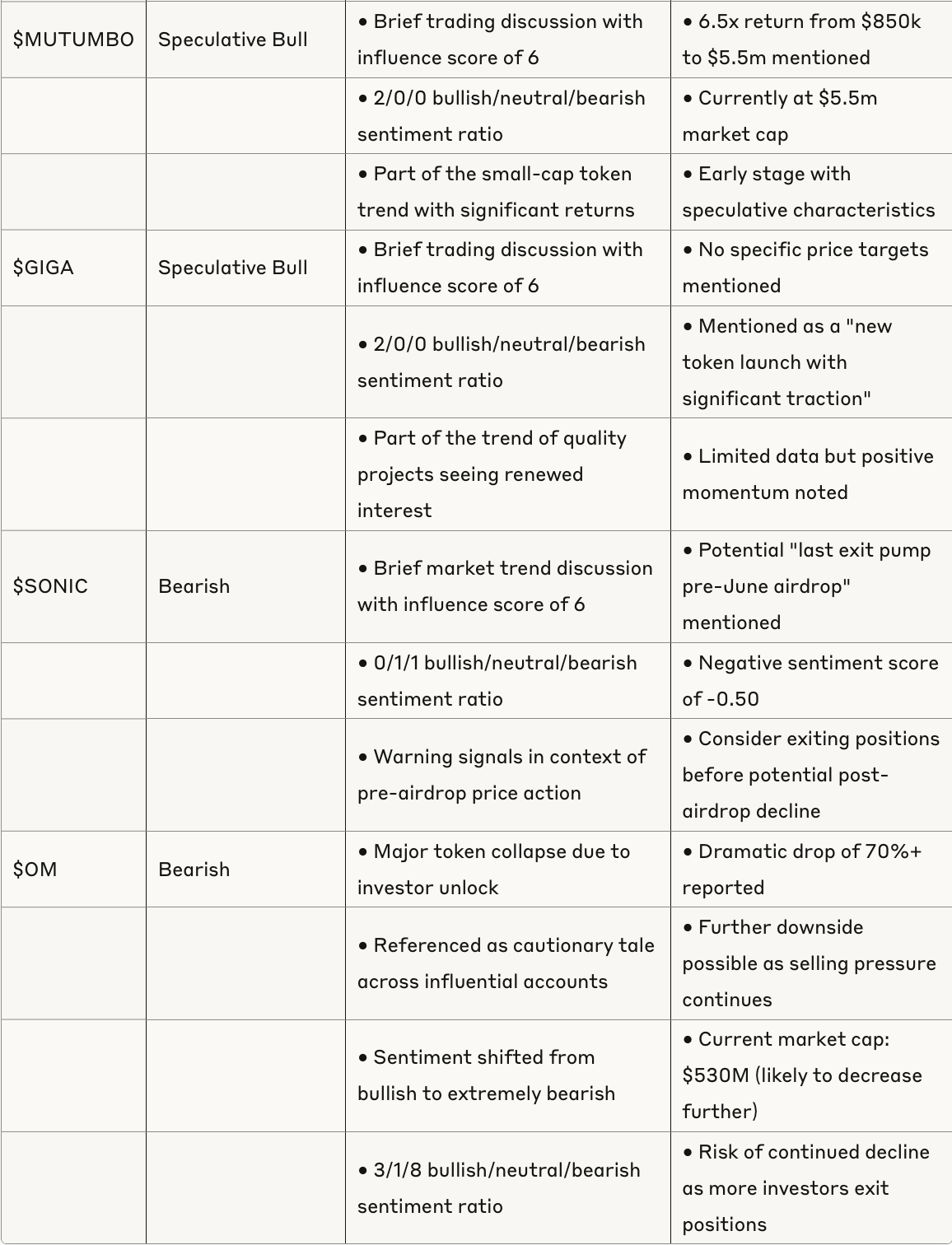

Token Analysis Table

Emerging Trends & Key Narratives

1. Curve Ecosystem Dominance

The Curve ecosystem ($CRV, $crvUSD, $CVX) shows exceptional strength with multiple tokens experiencing significant growth

$crvUSD stablecoin gaining significant market share with 136% growth in 30 days

High yield opportunities across Curve pools generating substantial attention

Strong positioning as "DeFi's backbone" and "stablecoin king"

Emphasis on Curve's role in providing liquidity across chains

2. Quality Over Speculation

Projects with strong fundamentals and actual utility ($ALCH, $CRV) outperforming pure speculation plays

Emphasis on tokens showing genuine development and addressing real market needs

"Projects that continue to build and meet real demand are beginning to be rewarded again" - Deep Value Memetics

Greater focus on tokens showing genuine development vs pure hype

3. Market Volatility Management

Traders adapting to high-volatility environment with more selective positioning

Political factors (tariff policies) creating trading opportunities but requiring risk management

Trend toward smaller position sizes and quicker profit-taking

"You can't make the realized vol go away" - Derivatives Don

Increasing comfort with market volatility as a feature rather than a bug

4. Chain Activity Hierarchy

Solana maintaining position as most active chain for new token trading: "solana still main character"

Base chain showing "slight uptick in volume" but secondary to Solana

Ethereum facing challenges but maintaining core ecosystem value

Trading environment described as "giga choppy" with reduced risk-taking

High-Yield Opportunities

Significant attention is being paid to yield opportunities, particularly in the Curve ecosystem:

$msUSD/$FRAX/$USDC on Ethereum: 38.4% APY

$msETH/$WETH: 43.9% APY

$CRV/$vsdCRV/$asdCRV on Arbitrum: 21.8% APY

$reUSD/scrvUSD: 29.8% APY

GMAC/crvUSD/ETH Cryptoswap pool: Base vAPY 35.67% daily, 7.11% weekly, with CRV rewards 42.31% → 105.77%

Stablecoin pools broadly showing yields of 5-15% APY

Risk Assessment

Political Uncertainty: Tariff policies creating unpredictable market swings

Early Investor Unlocks: Potential for more token collapses similar to $OM as early investors reach profitability

Volatility Impact: Increasing volatility reducing available market leverage

FOMO Risk: Selective performance creating potential for poor decision making

False Signals: Bear market rallies potentially being mistaken for regime shifts, as warned by Trader XO

Timeline Uncertainty: Market improvement projected between "Q3 this year and Q1 next" according to experienced traders

Notable Quotes

"Curve will lead the Bull." - @CFrogE1

"Fix the fee market, you fix Ethereum's sentiment issue." - Ben Lilly

"Projects that continue to build and meet real demand are beginning to be rewarded again." - Deep Value Memetics

"Humans underestimate Exponentials." - Murad on memecoin cycle

"You can't make the realized vol go away" - Derivatives Don

"Instead of letting collateral sit idle, Resupply lets you recycle it for extra yield." - @KM_crypto1

Conclusion

The current market phase rewards quality projects with strong fundamentals while punishing speculative assets without clear utility. The Curve ecosystem stands out as particularly strong, with multiple tokens showing significant growth and positive sentiment. Bitcoin maintains a moderately bullish outlook with key technical levels being reclaimed, while Ethereum faces challenges that require fundamental improvements.

Trading strategies should focus on quality projects, manage position sizes carefully in the volatile environment, and monitor political developments that could impact market stability. The contrast between $ALCH's growth and $OM's collapse highlights the importance of fundamental analysis and understanding token unlock dynamics.