Market Update: 12th April, 2025

Daily insights from best brains on CT and YT

MARKET SUMMARY

Macro Economic Context

The global financial landscape in April 2025 is characterized by unprecedented volatility, triggered by significant geopolitical and economic shifts. The recent "Liberation Day" tariff announcements and subsequent policy revisions have created a complex market environment that has dramatically impacted crypto and traditional financial markets.

Market Dynamics

Total Crypto Market Cap: Experiencing significant fluctuations

Volatility Index: Extremely high, with VIX spiking above 40

Key Market Drivers:

Regulatory developments

Institutional crypto adoption

Emerging technological narratives

Macroeconomic policy uncertainties

Performance Highlights

Bitcoin: Demonstrated remarkable resilience

Ethereum: Facing significant challenges and underperformance

DeFi Tokens: Showing selective strength in yield-generating protocols

AI Crypto Tokens: Emerging as a new frontier of market interest

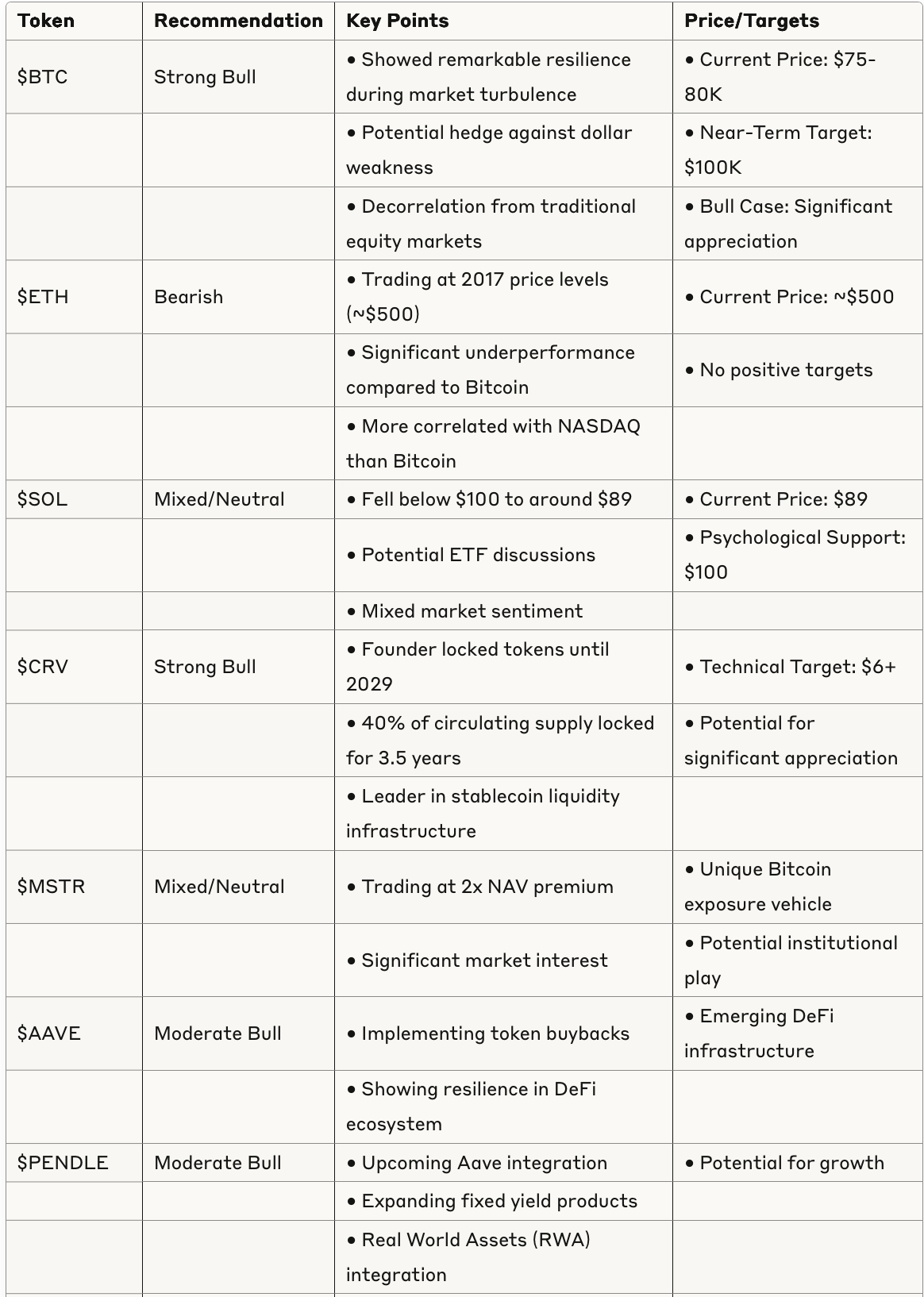

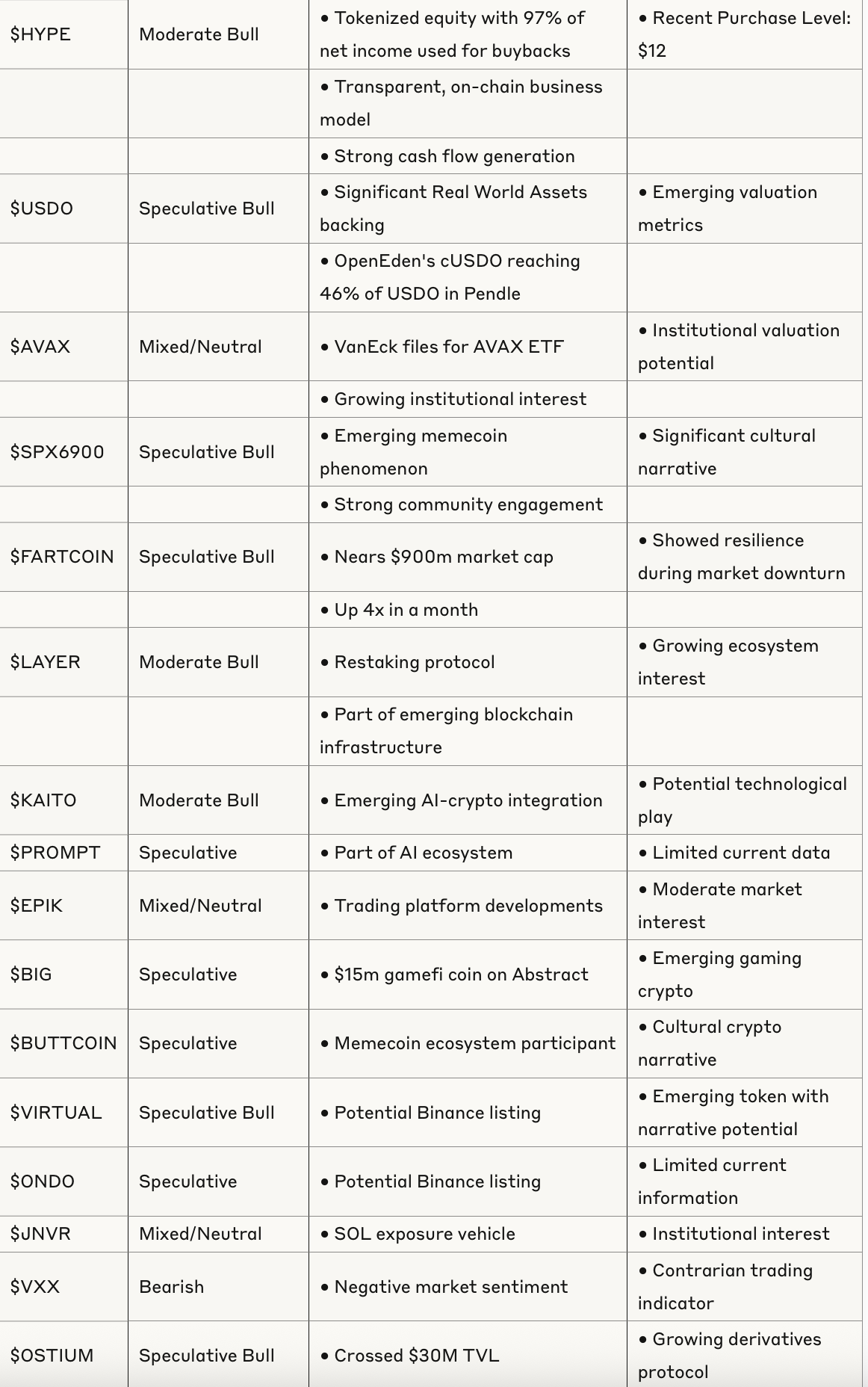

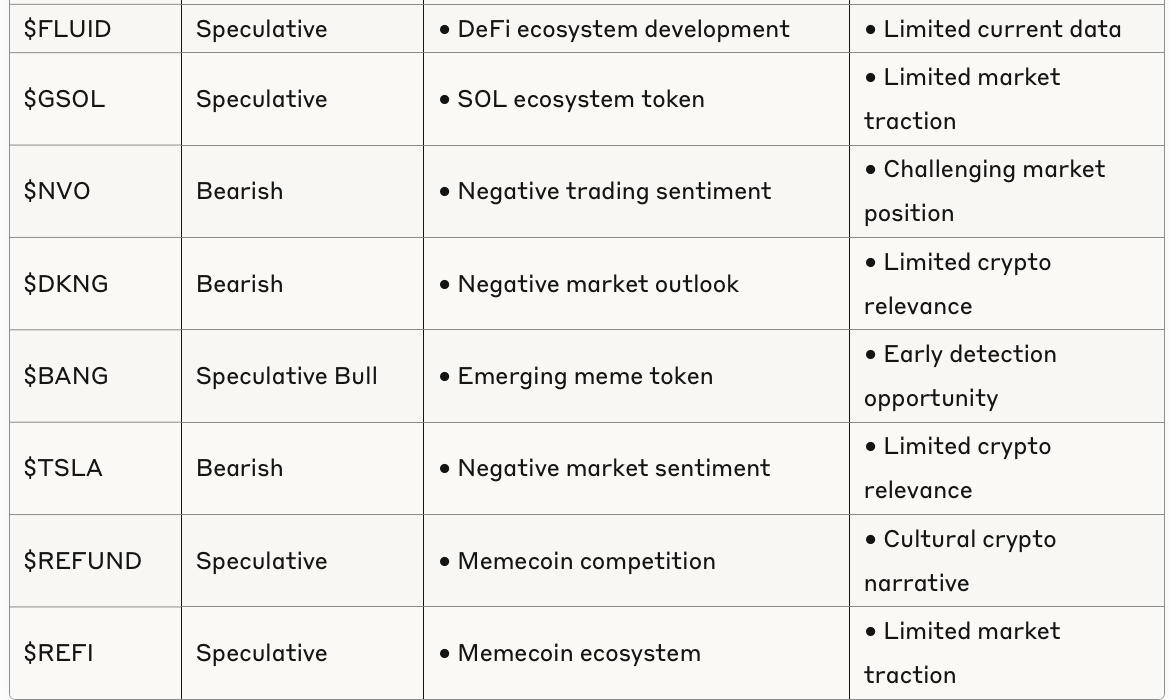

Token Landscape

Risk Landscape

Extreme market volatility

Regulatory uncertainty

Technological disruption

Shifting global economic paradigms

Sentiment Overview

Overall Market Sentiment: Cautiously optimistic with significant divergence

Bitcoin: Strongly bullish

Altcoins: Mixed to bearish, with selective opportunities

Emerging Technologies: High enthusiasm, particularly in AI and infrastructure tokens

Critical Narratives

Potential erosion of US dollar's global reserve currency status

Increasing importance of decentralized and alternative financial instruments

Growing interest in assets perceived as hedges against economic uncertainty

Investment Landscape

Shift from speculative investments to fundamentally backed assets

Increasing importance of cash flow and utility

Emerging opportunities in tokenized real-world assets

Growing institutional infrastructure for crypto investments

CONCLUSION

The crypto market in April 2025 demonstrates a complex ecosystem with diverse token categories. Bitcoin and select DeFi tokens show fundamental strength, while AI and utility tokens present emerging opportunities. The market continues to evolve, with increasing emphasis on technological utility and fundamental value.