Market Update: 11th April, 2025

Daily updates by analyzing OG brains on CT and Youtube

Overall Market Context

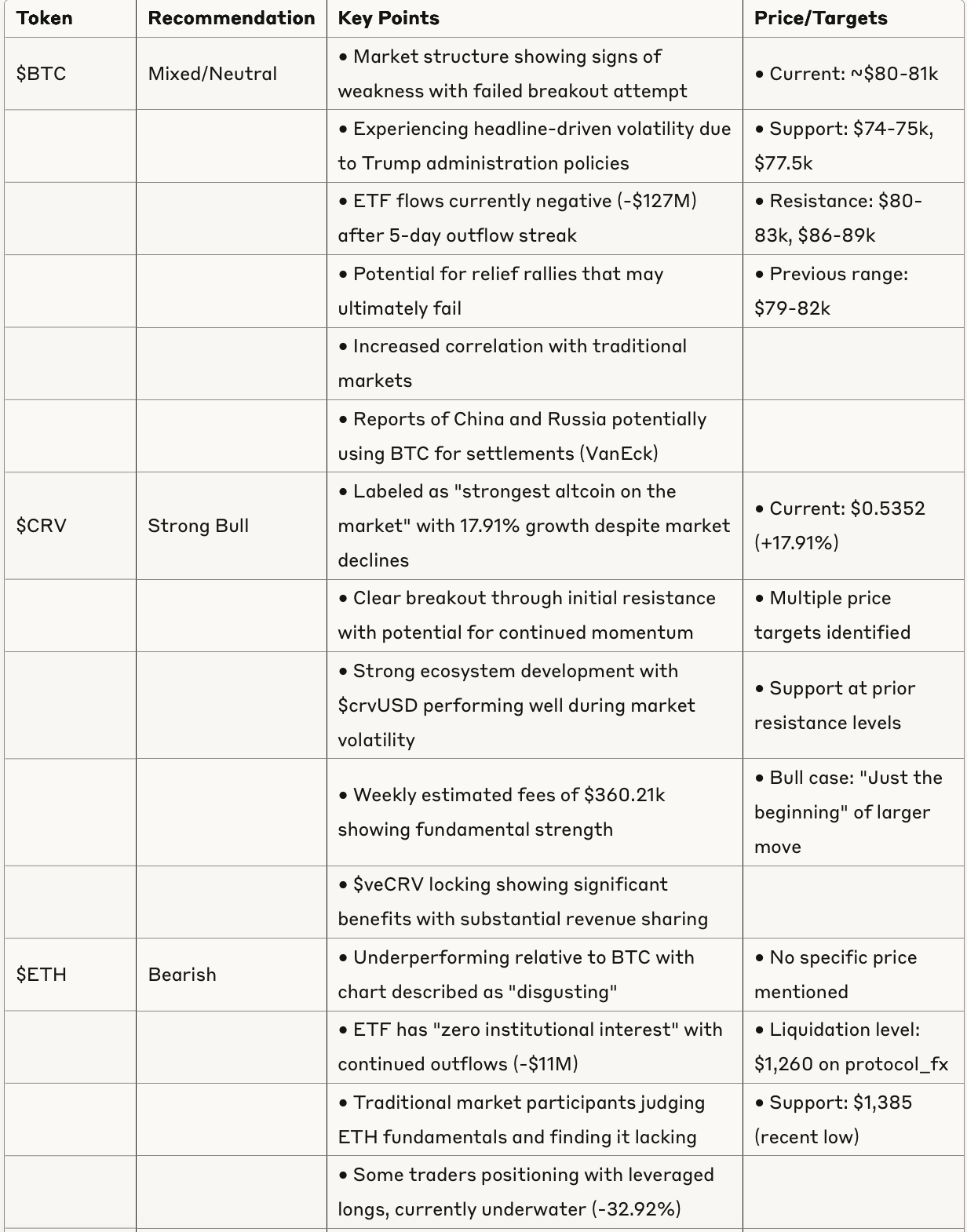

The crypto market is currently at a critical inflection point, characterized by:

Range-bound BTC trading ($74k-86k range) with key support at $74-75k and resistance at $80-83k

Mixed signals between strong altcoin performance (particularly $CRV) and uncertain BTC direction

Shifting narratives between bullish altcoin/DeFi developments and cautious macro outlook

Increased correlation with traditional markets and significant impact from geopolitical events

Trump administration policies creating headline-driven volatility

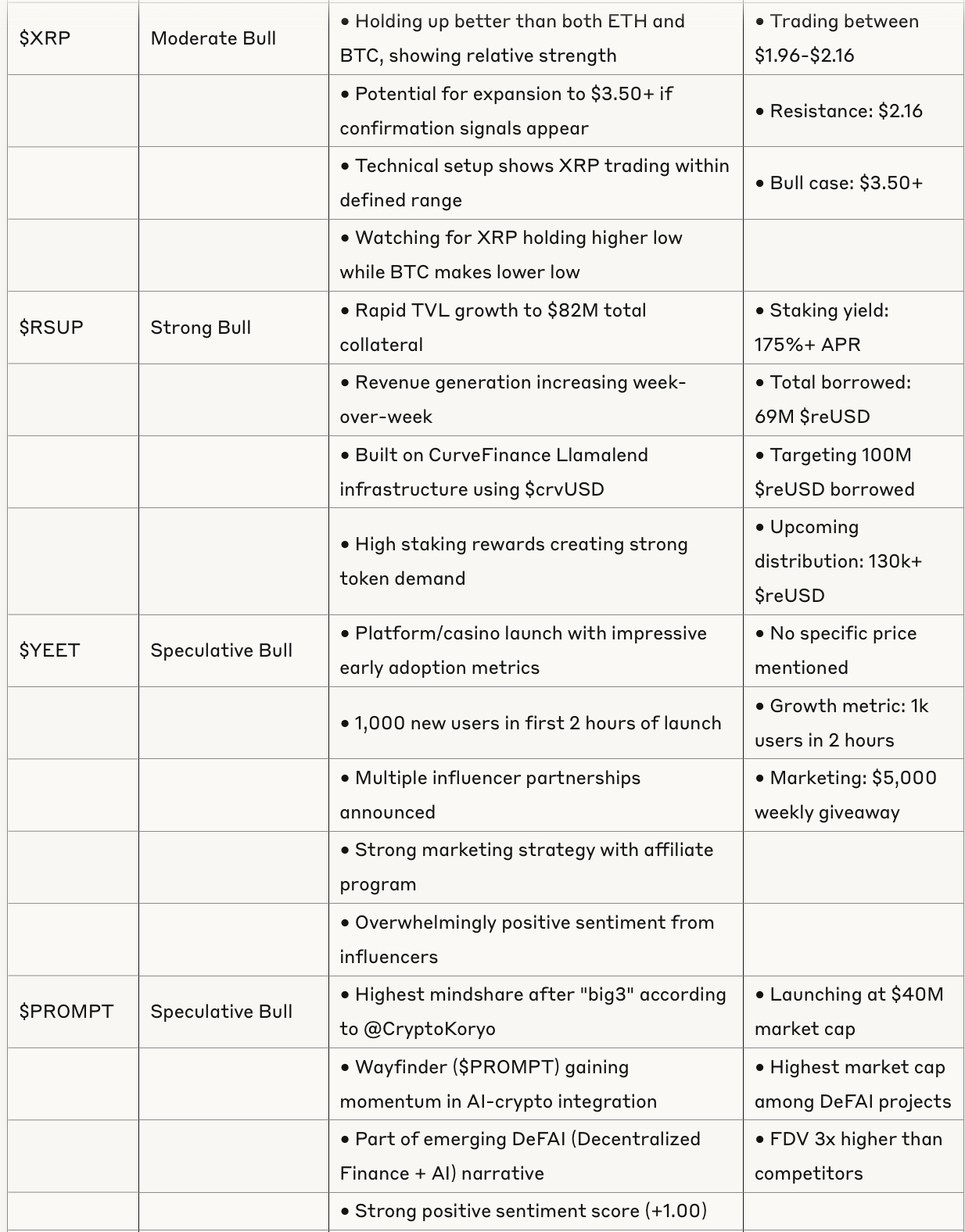

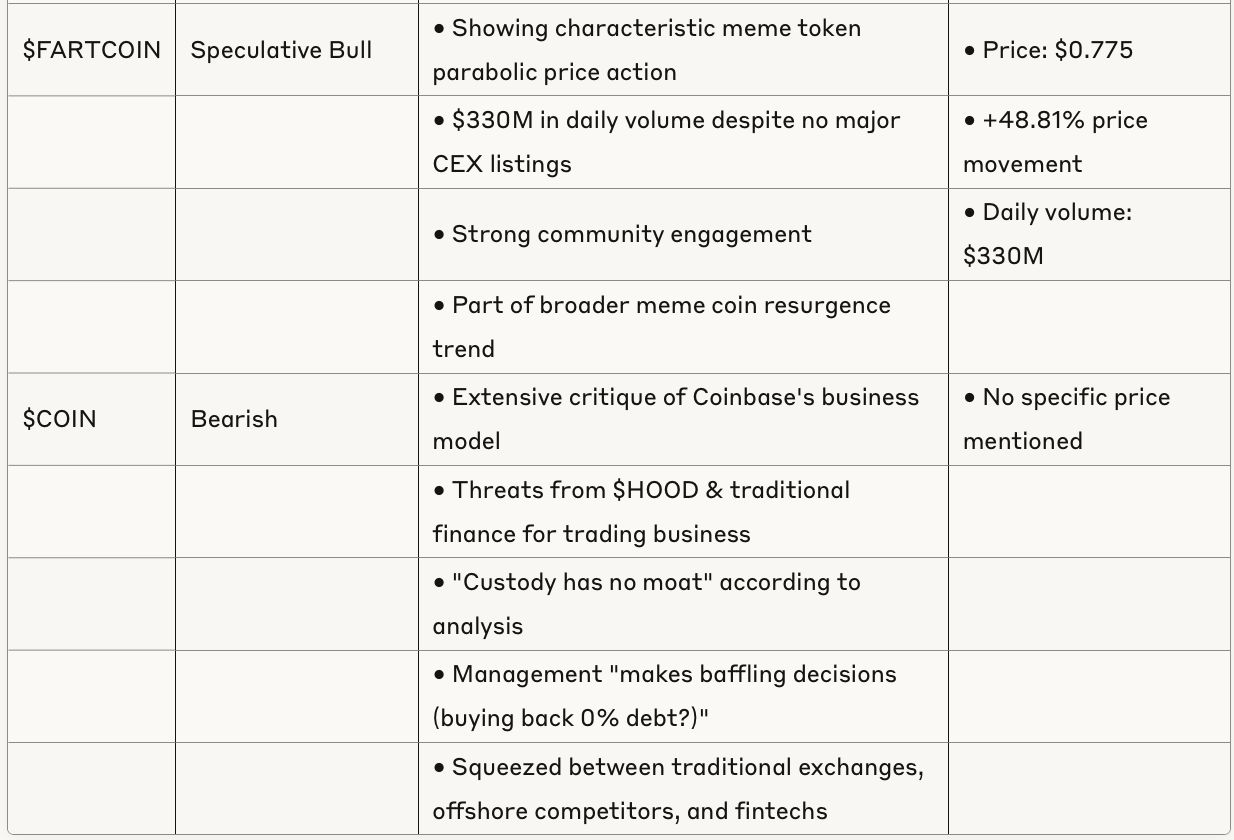

Token Analysis Table

Sector Analysis

DeFi Ecosystem

The DeFi sector is showing remarkable resilience with several positive developments:

Stablecoin Infrastructure: Projects like $crvUSD and Resupply demonstrating growth and utility during market volatility

Yield Opportunities: High yields available even in uncertain market (e.g., $RSUP offering 175%+ APR)

Protocol Revenue: Continued revenue growth for key protocols even as token prices fluctuate

Lending Markets: LLAMMA mechanism in $crvUSD receiving attention for innovative liquidation approach

Meme Coins

The meme coin sector is experiencing strong momentum:

$FARTCOIN, $42069COIN, $RFC, $BUTTCOIN, $HOUSE all showing significant strength

Trading volumes reaching hundreds of millions despite limited exchange listings

Community engagement remains high with new projects rapidly gaining attention

Characteristic of late-cycle behavior according to some analysts

AI + Crypto Integration

Emerging narrative around AI and crypto integration:

$PROMPT (Wayfinder) gaining significant mindshare

DeFAI (Decentralized Finance + AI) projects seeing valuation increases

Concerns about relative valuations compared to sector development

Gaming/Gambling Platforms

New growth area with successful launches:

YEET platform showing impressive early user acquisition

Strong marketing strategies with giveaways and affiliate programs

Multiple influencer partnerships driving adoption

Key Narratives

Bitcoin as Settlement Layer: Emerging narrative of nations using BTC for international settlements, particularly in response to de-dollarization trends

Stablecoin Growth & Utility: Extraordinary resilience in stablecoin protocols despite market volatility, with increasing TVL, borrowing activity, and revenue generation

Yield in Market Downturns: Focus on yield-generating strategies as a hedge against market turbulence, particularly in stablecoin-based protocols

Protocol Revenue Decoupled from Token Price: Continued revenue growth for DeFi protocols even as token prices decline, suggesting maturing business models

Trump Administration Impact: Markets reacting to policy statements and tariff decisions, creating headline-driven volatility

Risk Assessment

Market-Wide Risks

Headline-driven volatility from policy announcements

Liquidity concerns (VIX breaking 40, decreased market depth)

Bond market stress potentially spilling over to crypto

Range breakdown below $74k would invalidate current structure

Token-Specific Risks

BTC: Technical structure showing weakness with failed breakout attempt

ETH: Fundamental concerns from traditional financial analysts

Meme Coins: Characteristic of late-cycle behavior, potential for rapid sentiment shifts

YEET/New Platforms: Early stage execution risks

Technical Risks

Low liquidity in key markets creating potential for cascading liquidations

E-mini futures contracts showing minimal depth (1-2 contracts at top of book)

BTC range breakdown would signal further downside

Conclusion

The crypto market in April 2025 presents a complex landscape with divergent sector performance. While Bitcoin faces resistance and technical challenges, select DeFi protocols, stablecoin infrastructure, and emerging narratives in AI and gaming show considerable strength.

The most compelling opportunities appear to be in the $CRV ecosystem, the Resupply protocol, and projects building at the intersection of DeFi and real-world utility. More speculative positioning can be found in the AI integration space and the ongoing meme coin resurgence.

Market participants should maintain awareness of headline risk from policy announcements, technical levels in Bitcoin ($74k-$86k range), and the potential for rapid sentiment shifts characteristic of this market phase. Conservative positioning with defined risk levels is recommended given the current market dynamics.