Market Update: 10th April 2024

Daily updates by analyzing OG brains on CT and Youtube

Overall Market Context

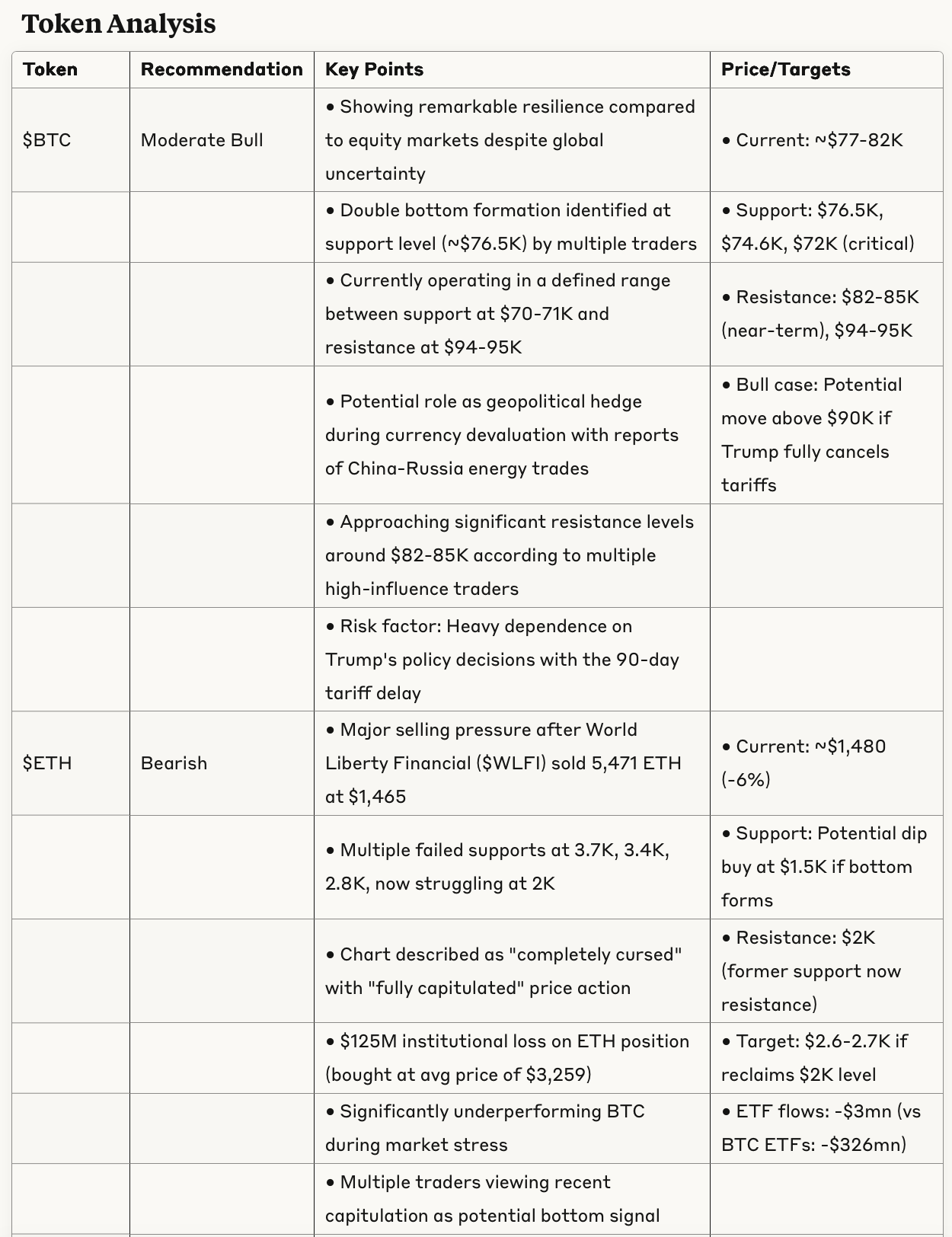

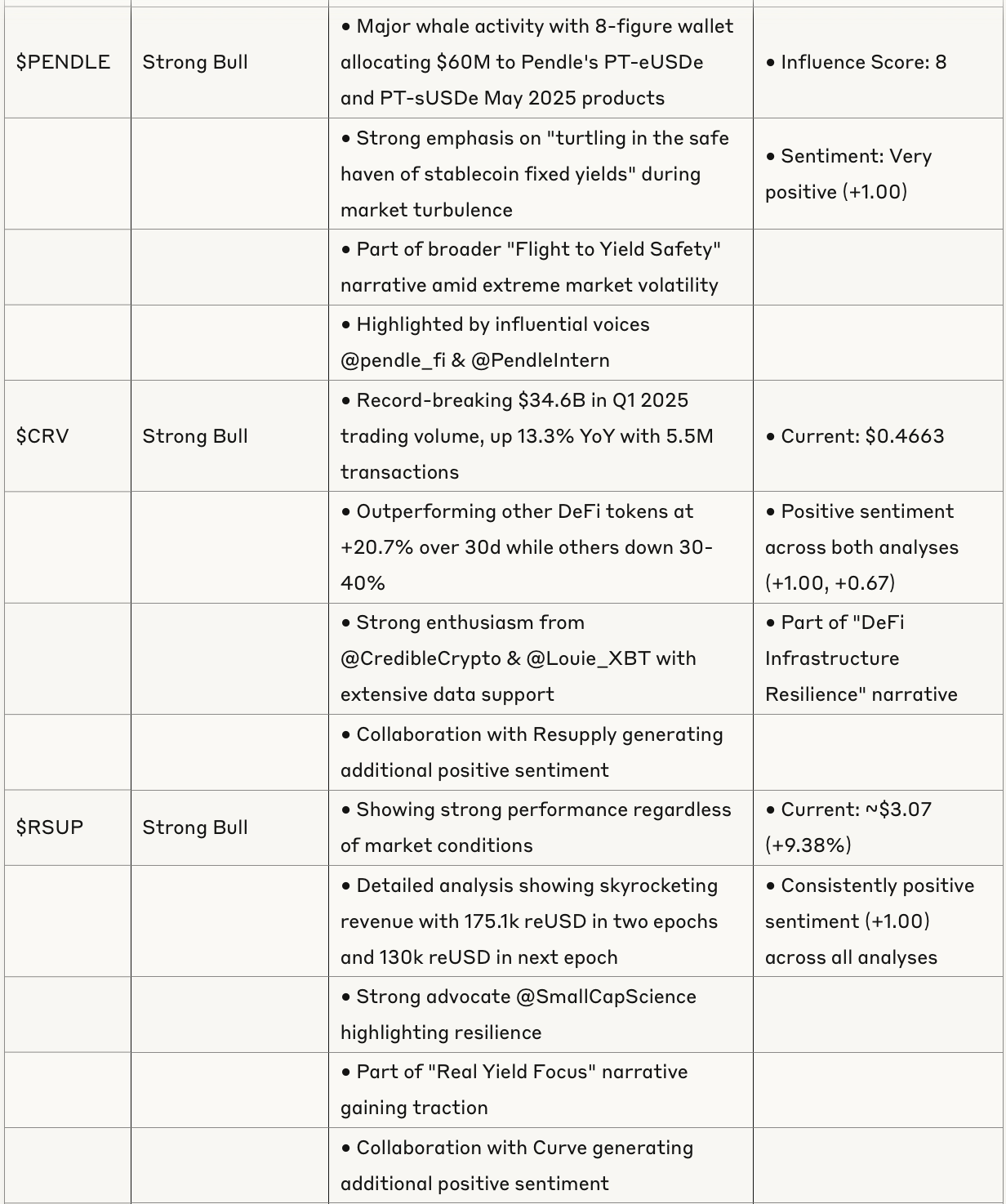

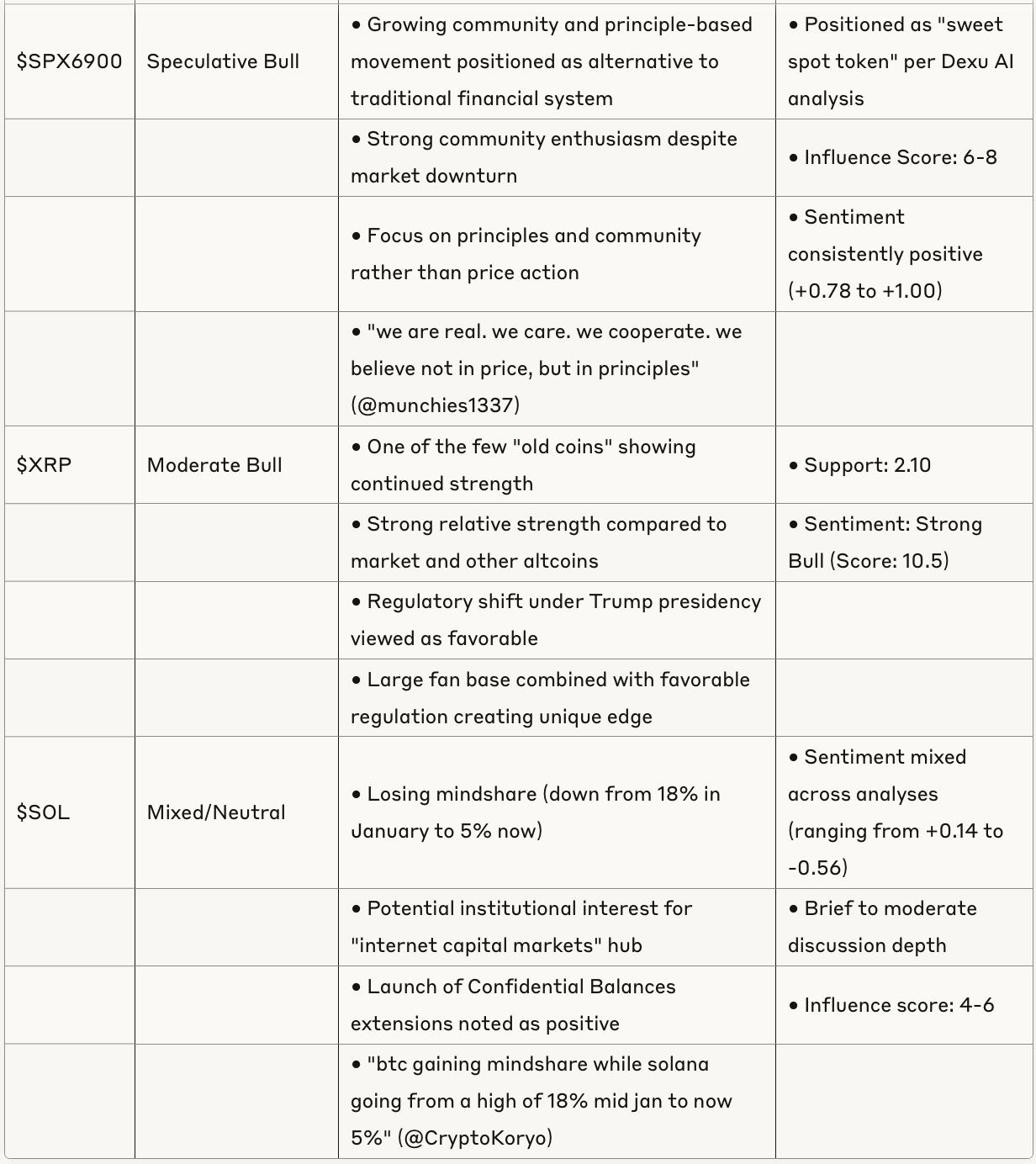

The crypto market is currently experiencing significant volatility driven by several key factors:

Geopolitical Tensions: Major trade war escalation with China raising tariffs to 84% on US goods, followed by Trump administration's recent announcement of a 90-day pause on most tariffs (excluding China, which received 125% tariffs)

Treasury Market Volatility: US 30-year yields showing unusual volatility, suggesting financial instability

De-dollarization Moves: Reports of China and Russia settling energy trades in Bitcoin

Market Volatility: ETH experienced a -30% move followed by a +20% move in just 9 days

Institutional Liquidations: World Liberty Financial ($WLFI) sold 5,471 ETH at $1,465, taking a $125M loss

Sector Performance & Narratives

1. Flight to Yield Safety

The most prominent narrative is a strong pivot to yield-generating assets as traditional markets experience extreme volatility:

Whale Activity: Major allocations to fixed-yield products

Stablecoin Fixed Yields: Emphasis on stability during market turbulence

Real Yield Focus: GammaSwap highlighting 27.74% APY in real yield

Stablecoin-Related Projects: Multiple tokens related to stablecoins showing strength (PENDLE, CRV, RSUP)

2. DeFi Infrastructure Resilience

Despite broader market downturn, core DeFi infrastructure shows remarkable stability:

Curve Finance Growth: Record-breaking volume and transaction metrics

Protocol Proliferation: Number of protocols with significant TVL above 2022 highs

Security Partnerships: Increased focus on security audits

Cross-chain Connectivity: Growing emphasis on bridges and cross-chain solutions

3. Volatility Opportunities

Market participants positioning to capitalize on extreme volatility:

GammaSwap Strategy: Detailed approaches for longing volatility

Leverage Deployment: References to 75% leverage with low borrowing rates (4.57% APR)

Upcoming Catalysts: Inflation data release anticipated for April 10

Positioning: Traders moving from directional bets to volatility-focused strategies

4. Emerging Sectors

Based on Dexu AI analysis, leading sectors include:

AI agents and DeFAI

"Sweet spot" tokens

Memecoins (FARTCOIN showing +100%)

DeFi (particularly stablecoin-related)

Risk Assessment

Market-Wide Risks

Policy Uncertainty: The 90-day tariff delay is temporary, and market remains heavily dependent on Trump administration decisions

Geopolitical Tensions: Escalating China-US tariff situation could create liquidity crisis

Technical Resistance: BTC faces significant resistance at $82-85K range

Liquidity Concerns: Potential for market makers to step back in volatile conditions

Excess Optimism: Several traders warning about overly enthusiastic buying at current levels

Token-Specific Risks

ETH Liquidation Pressure: Potential for further institutional selling following WLFI's $125M loss

Correlation Risk: Increased correlation between traditionally uncorrelated assets during sell-offs

Memecoin Volatility: Projects like FARTCOIN showing extreme price movements (+100%)

Technical Breakdown: Critical support levels for BTC at $72K could lead to accelerated selling

Catalyst Timeline

April 10, 2025 (Today): CPI print expected to be soft, potentially prompting Fed rate cut discussions

Next 90 Days: Market watching Trump administration's tariff policy developments

China-US Relations: Ongoing monitoring of trade tensions and potential impact on crypto markets

Treasury Market Stability: Watching for stabilization in bond yields which have shown unusual volatility

Conclusion

The crypto market is at a critical juncture with significant macro influences creating both opportunities and risks. The most compelling narratives center around yield-generating assets, DeFi infrastructure resilience, and volatility opportunities. Bitcoin shows relative strength as a potential geopolitical hedge, while ETH faces challenges following significant institutional selling. Smaller tokens are showing sector rotation with stablecoin-related projects, AI tokens, and "community-driven" assets outperforming. The upcoming CPI print and developments in the 90-day tariff pause window will be crucial for market direction in the coming weeks.