Market Edge, June 24, 2025

Market Context & Outlook

Overall Market Assessment

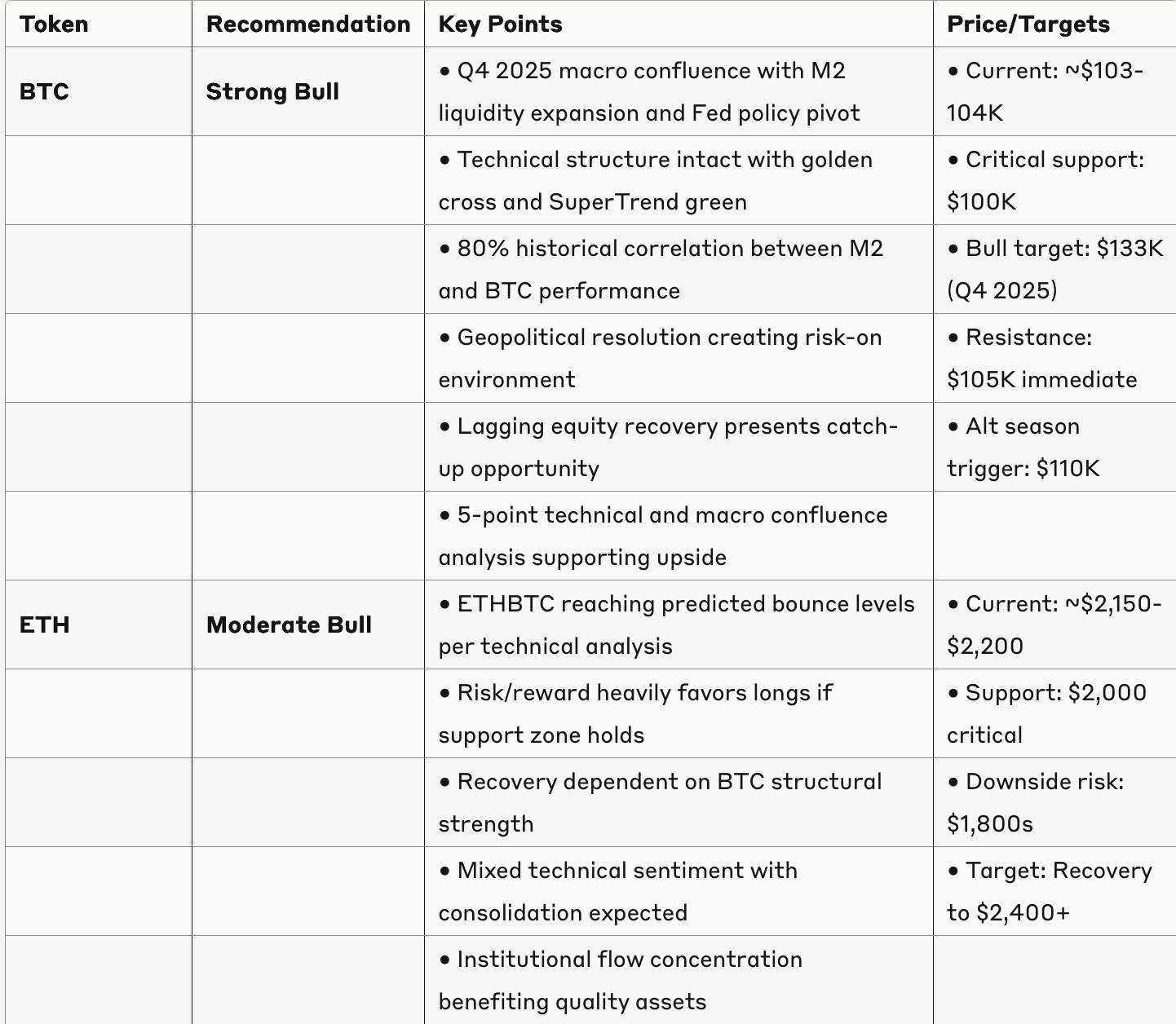

The crypto market is experiencing a significant sentiment shift from geopolitical fear to optimistic positioning for Q4 2025. The interpretation of the Iran-Israel conflict as coordinated and symbolic has removed a major overhang, while macro factors align favorably with M2 liquidity expansion and potential Fed policy pivots.

Key Market Narratives

Q4 2025 Macro Setup: Multiple analysts converging on bullish Q4 thesis with Fed policy pivot and M2 expansion

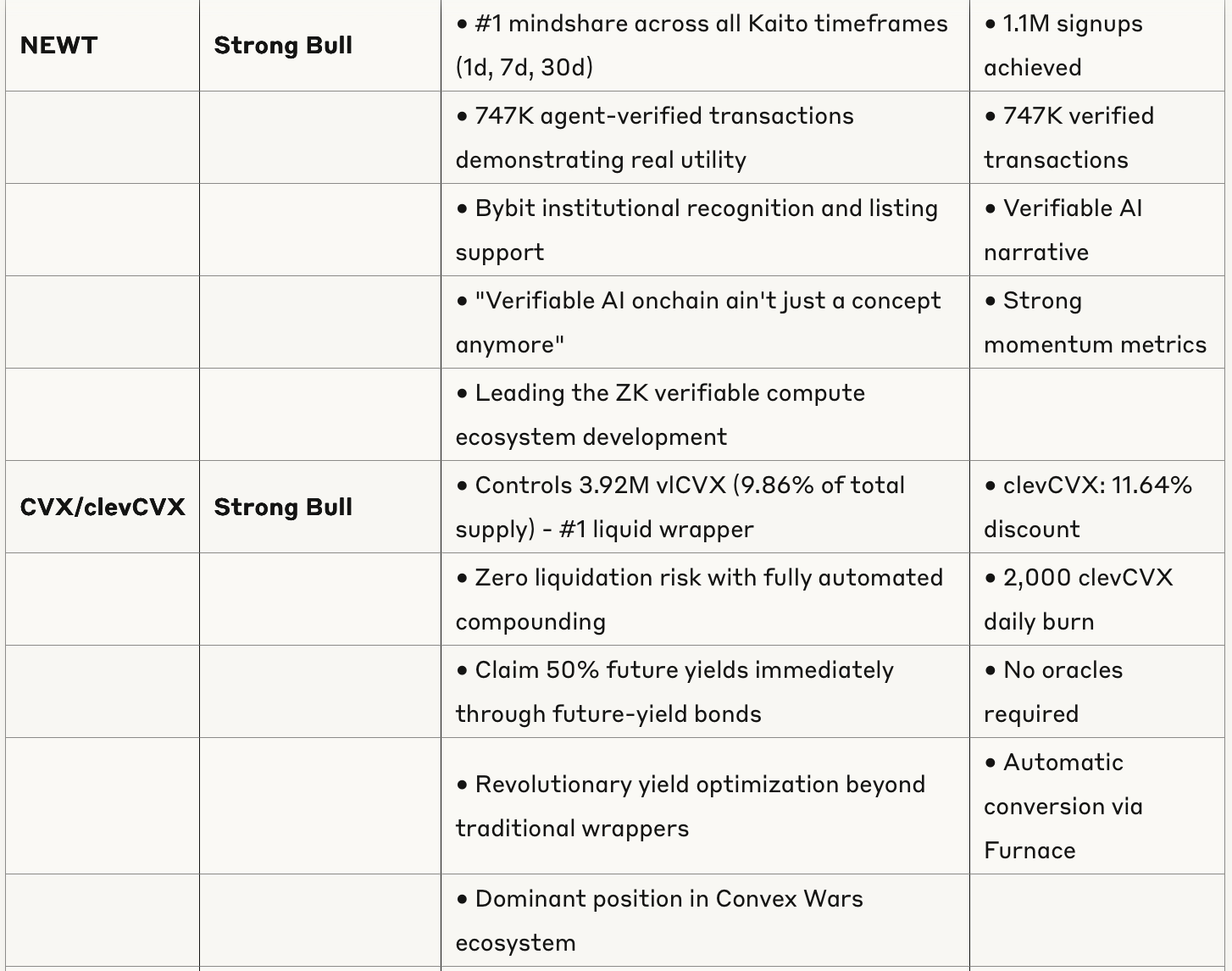

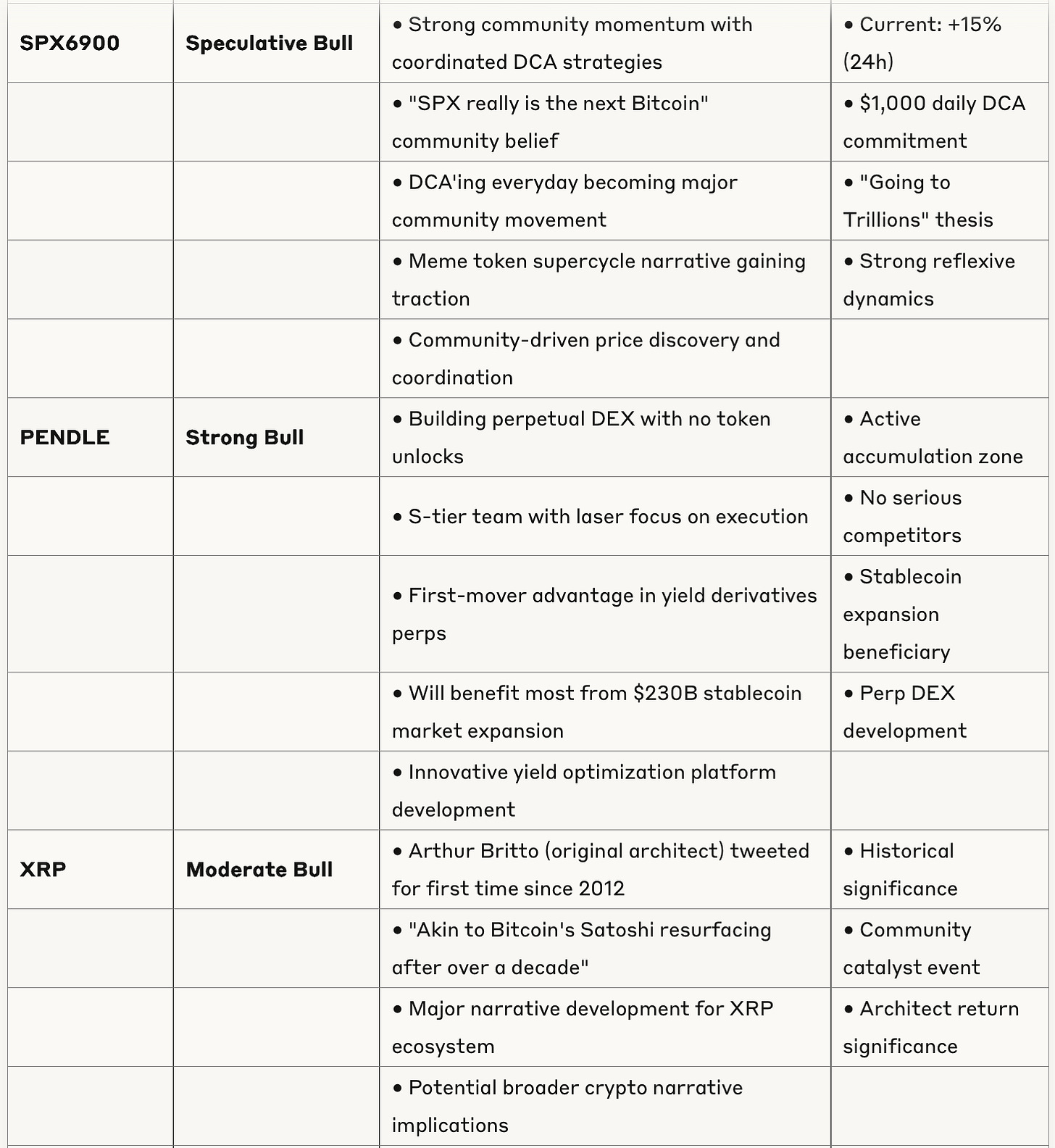

Tokenomics Quality Revolution: Market permanently shifting toward value capture and utility over speculative plays

AI Infrastructure Arms Race: ZK verifiable compute ecosystem competition driving innovation

DeFi Yield Renaissance: Infrastructure maturation enabling sustainable yield strategies

Meme Token Supercycle: Community-driven reflexive price discovery across multiple tokens

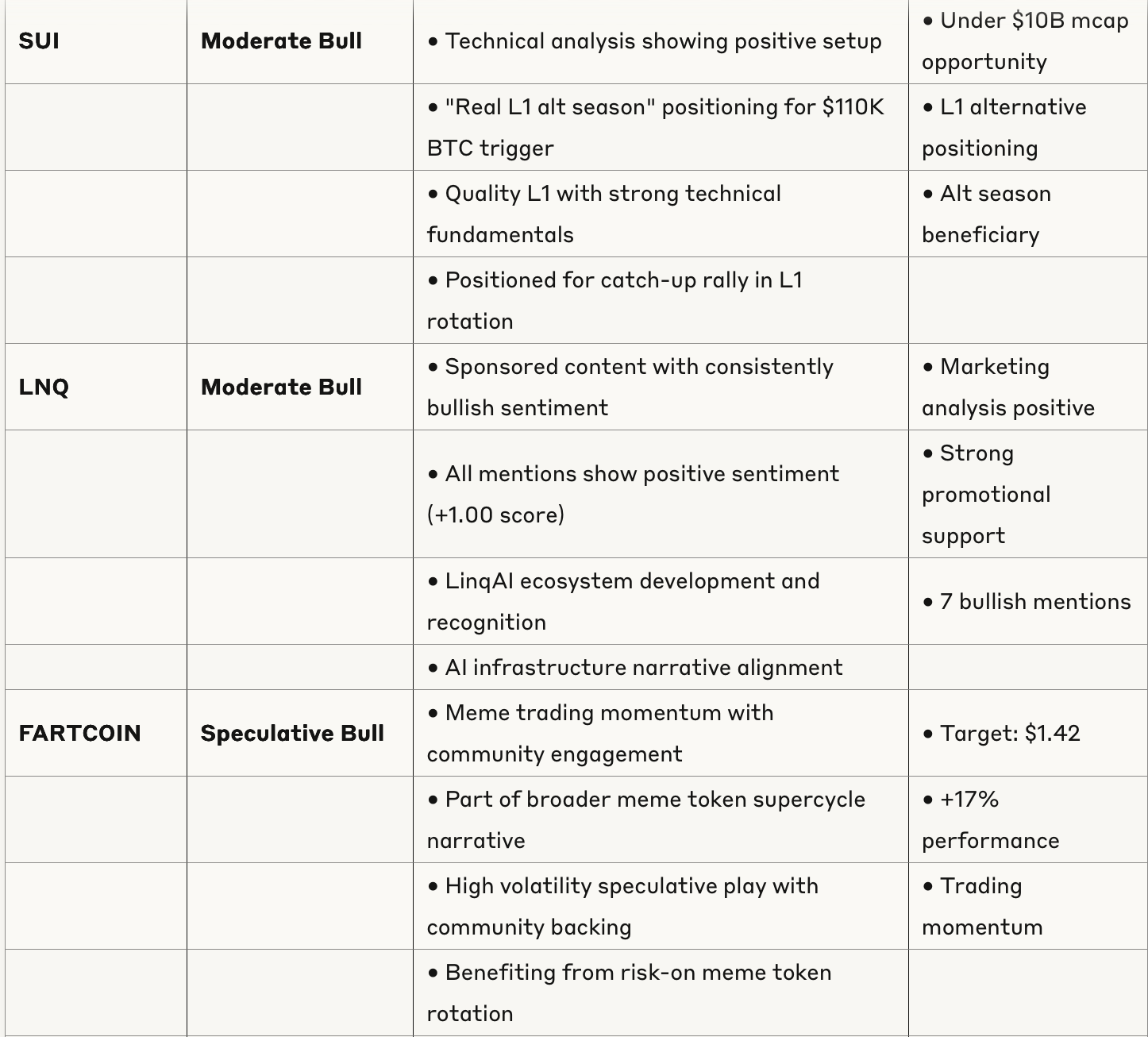

Risk Assessment

Technical Risks: BTC break below $100K could trigger cascade to $94-92K

Geopolitical Fluidity: Ceasefire situation remains dynamic despite positive interpretation

Valuation Concerns: Traditional crypto stocks showing bubble characteristics (CRCL at 348x earnings)

Summer Seasonality: Historical summer chop period expectations with patience required

Quality Filter: Permanent raising of standards eliminating weaker projects