Market Edge, 9th July,2025

Executive Summary

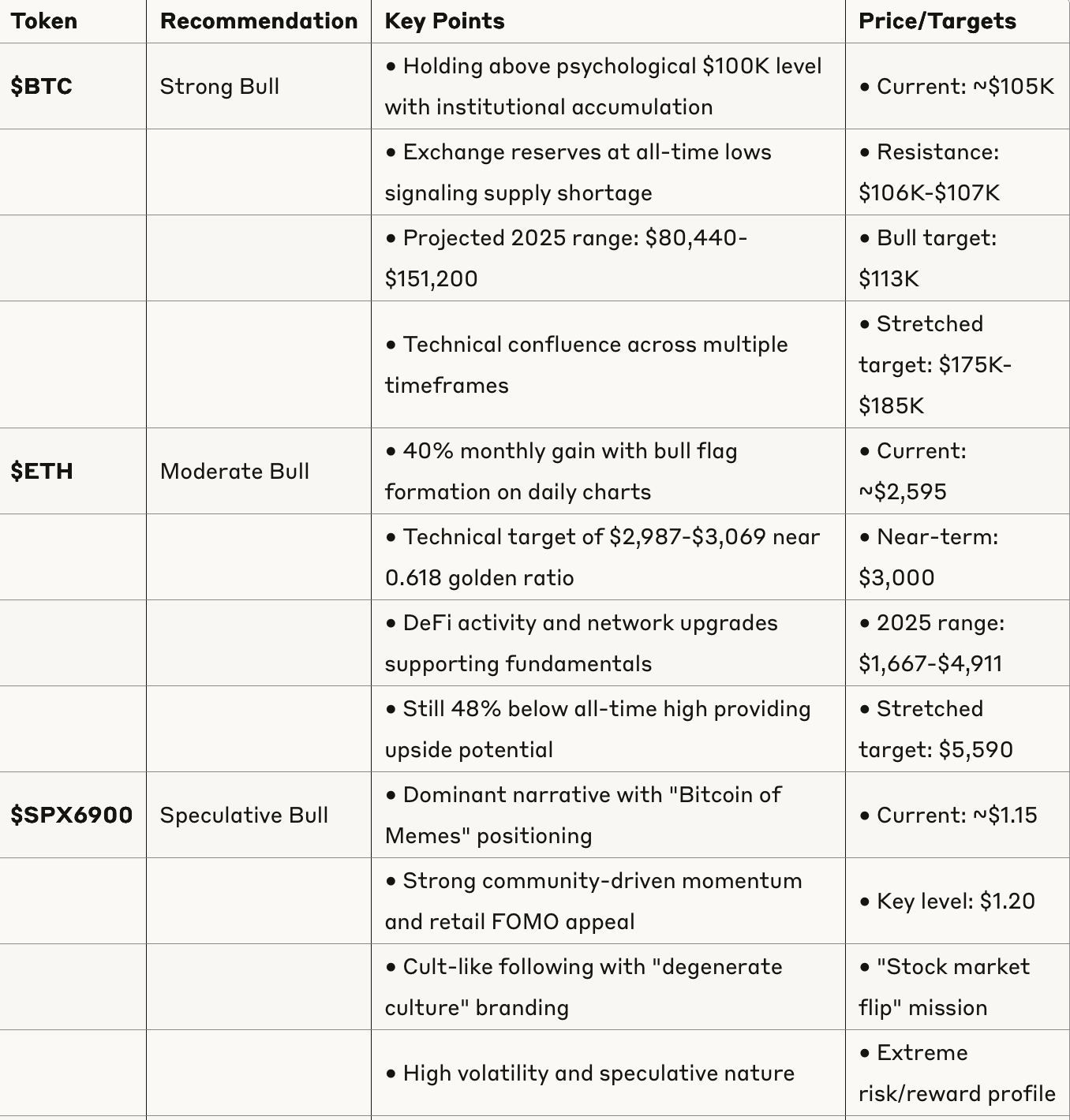

Market Context: The crypto market shows strong momentum entering June 2025, with Bitcoin establishing new support above $100K and a clear shift toward meme coin narratives and DeFi yield optimization. Bitcoin reached an all-time high of $111,980 before consolidating around $105K, while ETH has gained 40% over the past month despite remaining 48% below its all-time high.

Key Themes:

Meme Coin Dominance: SPX6900 and Solana-based memes leading narrative

DeFi Renaissance: Renewed focus on yield farming and protocol innovation

Infrastructure Development: AI tokens and L2 solutions gaining traction

Institutional Positioning: Continued accumulation despite volatility

Sector Analysis

Meme Coins

Status: Extremely Hot

SPX6900 leading May performance with community-driven momentum

Pump.fun ecosystem generating massive revenue with creator incentives

Solana meme coins benefiting from low fees and fast transactions

Risk: 99% of Pump.fun tokens fail and never graduate

DeFi Protocols

Status: Renaissance Phase

CRV ecosystem innovation with dynamic fee mechanisms

DeFi TVL reaching $129B in January 2025, up 137% year-over-year

Yield farming offering double-digit returns vs. traditional 3-5% APY

Focus: Simplification over education for retail adoption

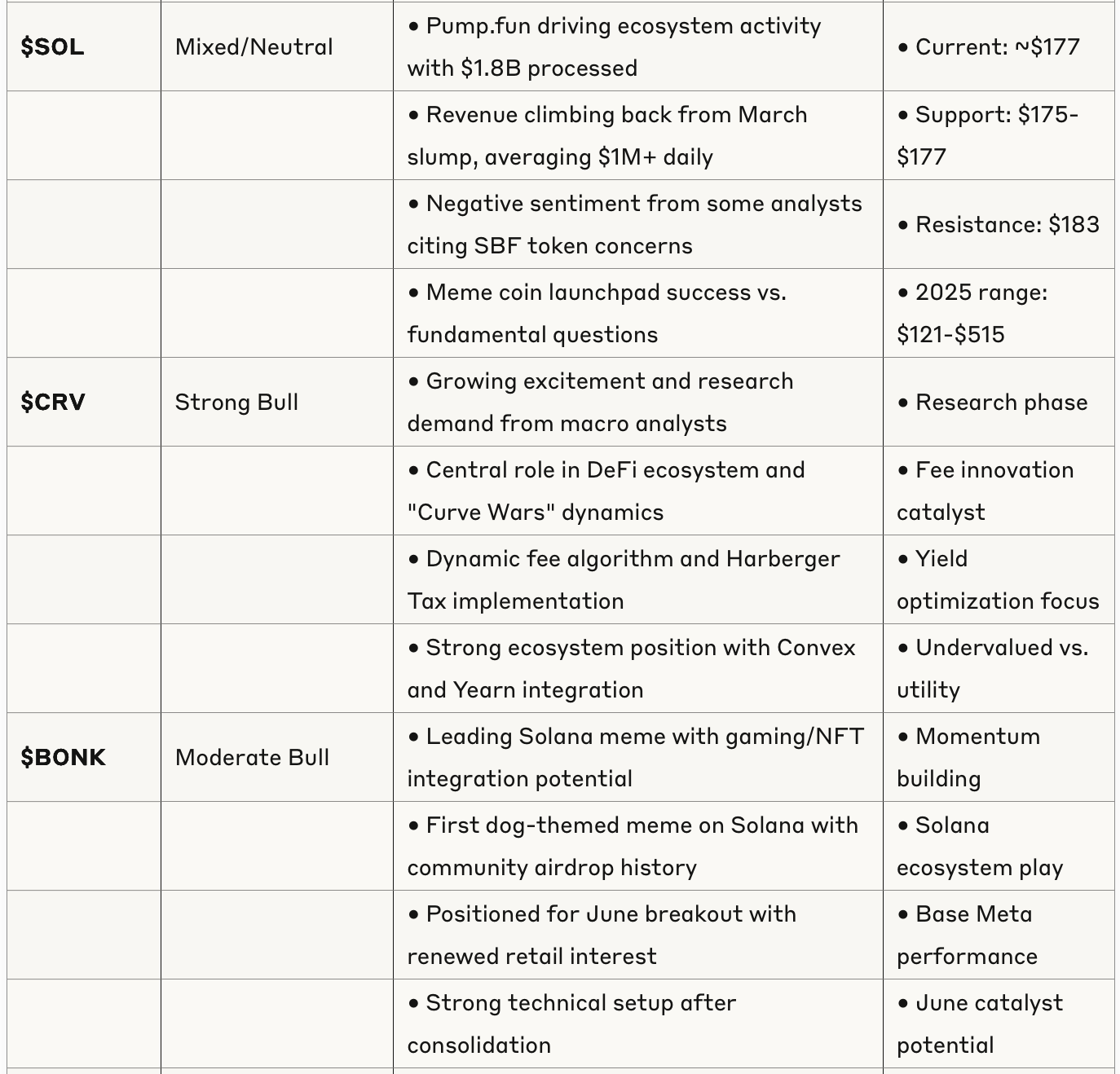

AI Infrastructure

Status: Emerging Narrative

Kaito positioning as L1 infrastructure with growing mindshare

AI content creation revolution lowering virality barriers

Multiple AI tokens showing technical setups

Risk: Early stage with high volatility

Layer 2 Solutions

Status: Development Phase

Solaxy ($SOLX) raising $41M as first Solana Layer-2

Infrastructure development for scalability

Timeline: Various projects in presale/development phases

Market Dynamics

Institutional Activity

US spot Bitcoin ETFs saw $5.24B net inflows in May

Bitcoin exchange reserves at all-time lows indicating accumulation

Five states passed Bitcoin-related legislation, Texas launched state reserve

Regulatory Environment

Stablecoin and crypto market structure legislation expected by August

ETH Foundation supporting projects with real use cases, focusing on RWA

Continued regulatory clarity providing institutional confidence

Technical Market Structure

Fear & Greed Index at neutral 57, Altcoin Season Score of 22

Bitcoin dominance breaking out, stronger than altcoin space

Overall crypto market cap at $3.27 trillion

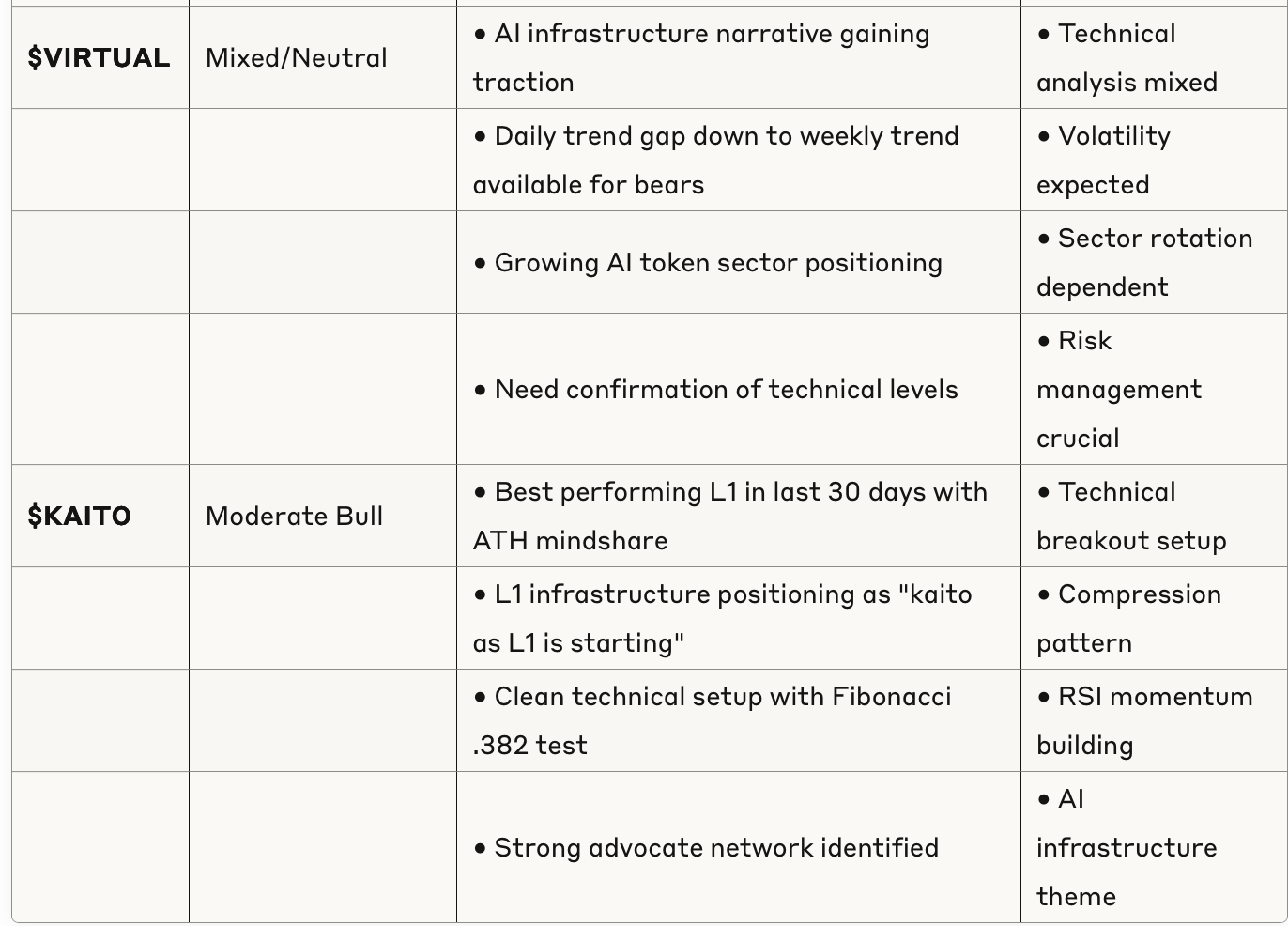

Risk Assessment

High-Risk Factors

Meme Coin Volatility: Extreme price swings based on trends and speculation

Leverage Concerns: Examples of massive position losses from high leverage

Regulatory Uncertainty: Pending legislation could impact specific sectors

Market Manipulation: Spoofing and insider trading concerns identified

Medium-Risk Factors

DeFi Smart Contract Risk: Smart contract vulnerabilities can impact yields

Yield Sustainability: High APY claims require scrutiny for long-term viability

Cross-Chain Complexity: Additional fees and security risks

Low-Risk Factors

Institutional Adoption: Continued institutional accumulation providing stability

Infrastructure Development: DeFi sector expanding with new opportunities

Regulatory Clarity: Expected legislation providing framework

Investment Themes

Primary Themes

"New Paradigm" Bullishness: Everything simply goes higher in new paradigm

Meme Coin Institutionalization: SPX6900 as "Bitcoin of Memes"

DeFi Simplification: Simplification over education for adoption

AI Infrastructure Positioning: Multiple AI tokens gaining momentum

Secondary Themes

Yield Optimization: Advanced yield strategies becoming mainstream

Cross-Chain Expansion: Leveraging multiple blockchain networks

Technical Breakout Confirmation: Bitcoin above $100K solidifying new range