Market Edge, 4th June

Overall Market Context

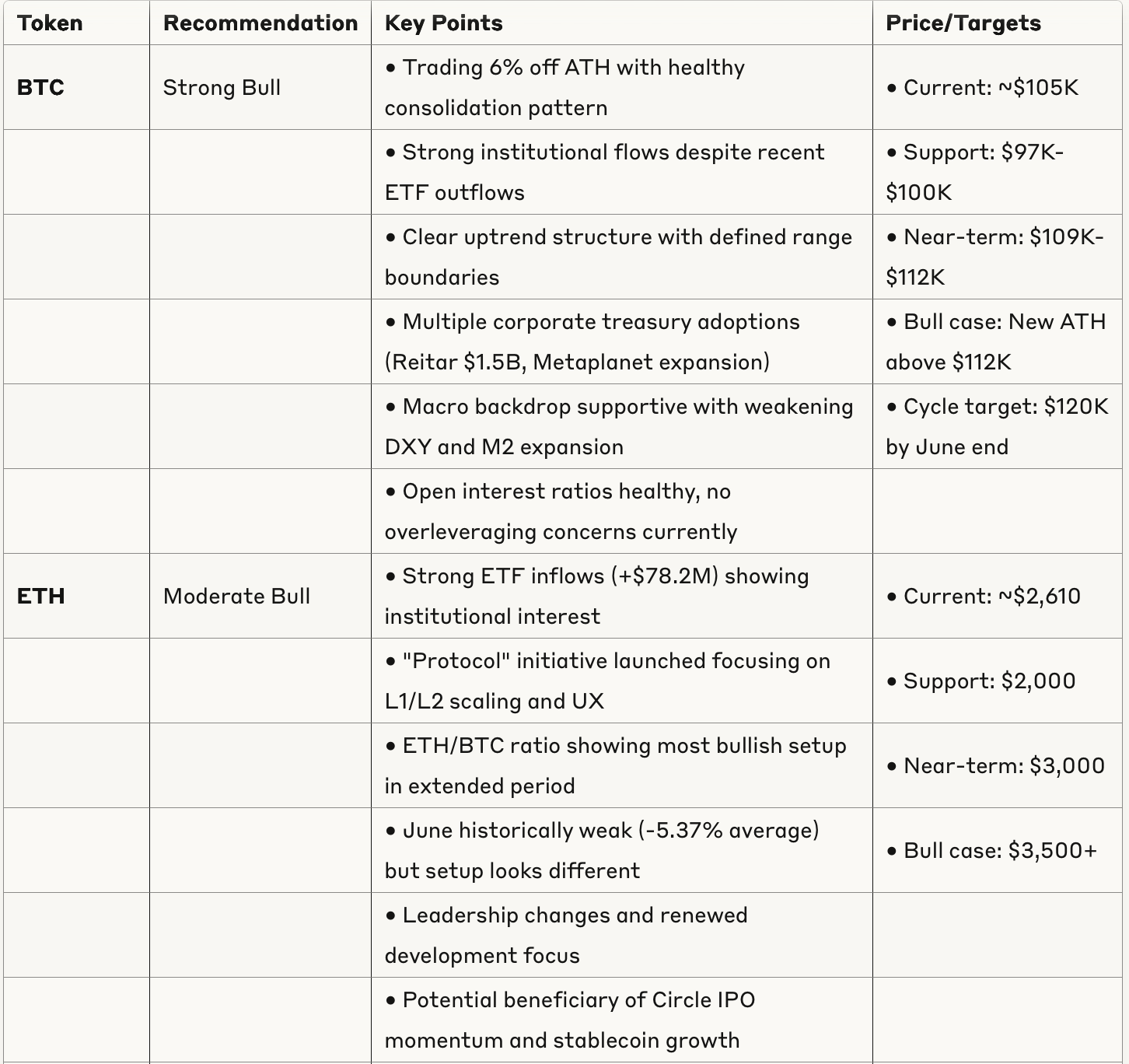

The crypto market is currently in a consolidation phase with strong institutional underpinnings. Bitcoin remains in a healthy range between $97K-$112K, showing classic accumulation patterns rather than distribution. Major narratives include institutional DeFi adoption, Ethereum's "Protocol" infrastructure upgrade, AI-DeFi integration, and evolving market structure improvements. ETF flows show mixed signals with BTC seeing outflows (-$267.5M) while ETH shows strong inflows (+$78.2M), indicating potential sector rotation.

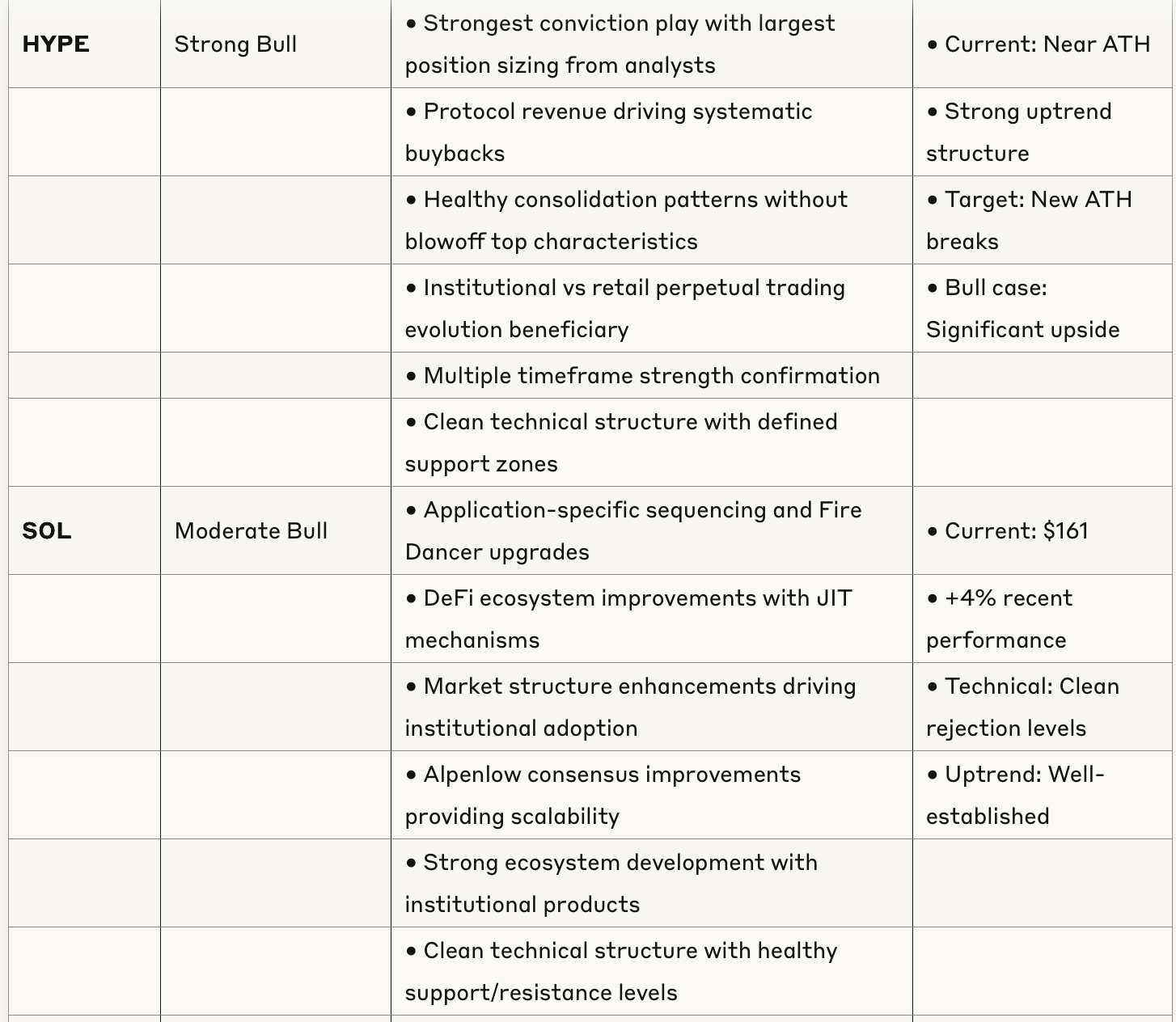

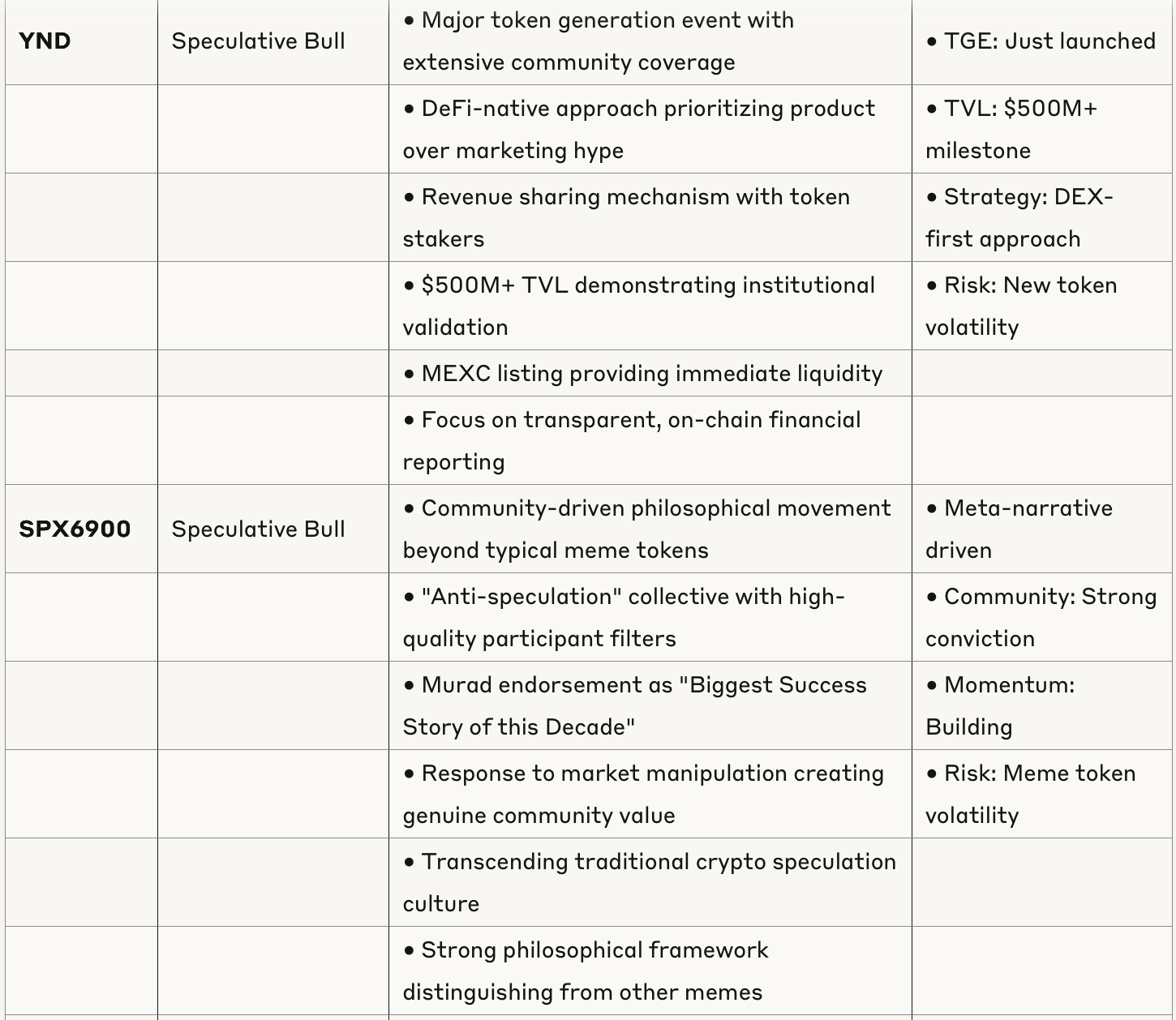

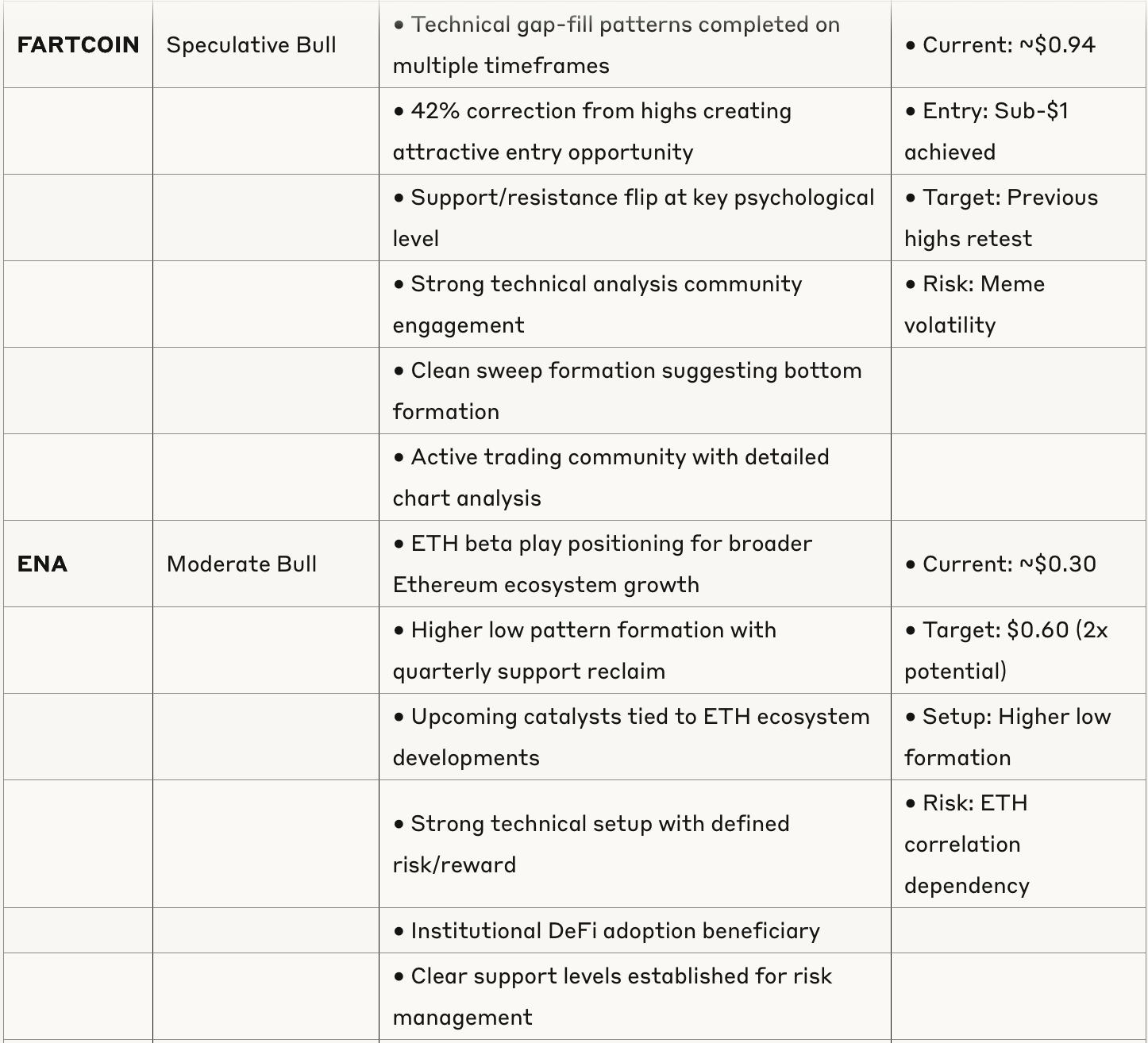

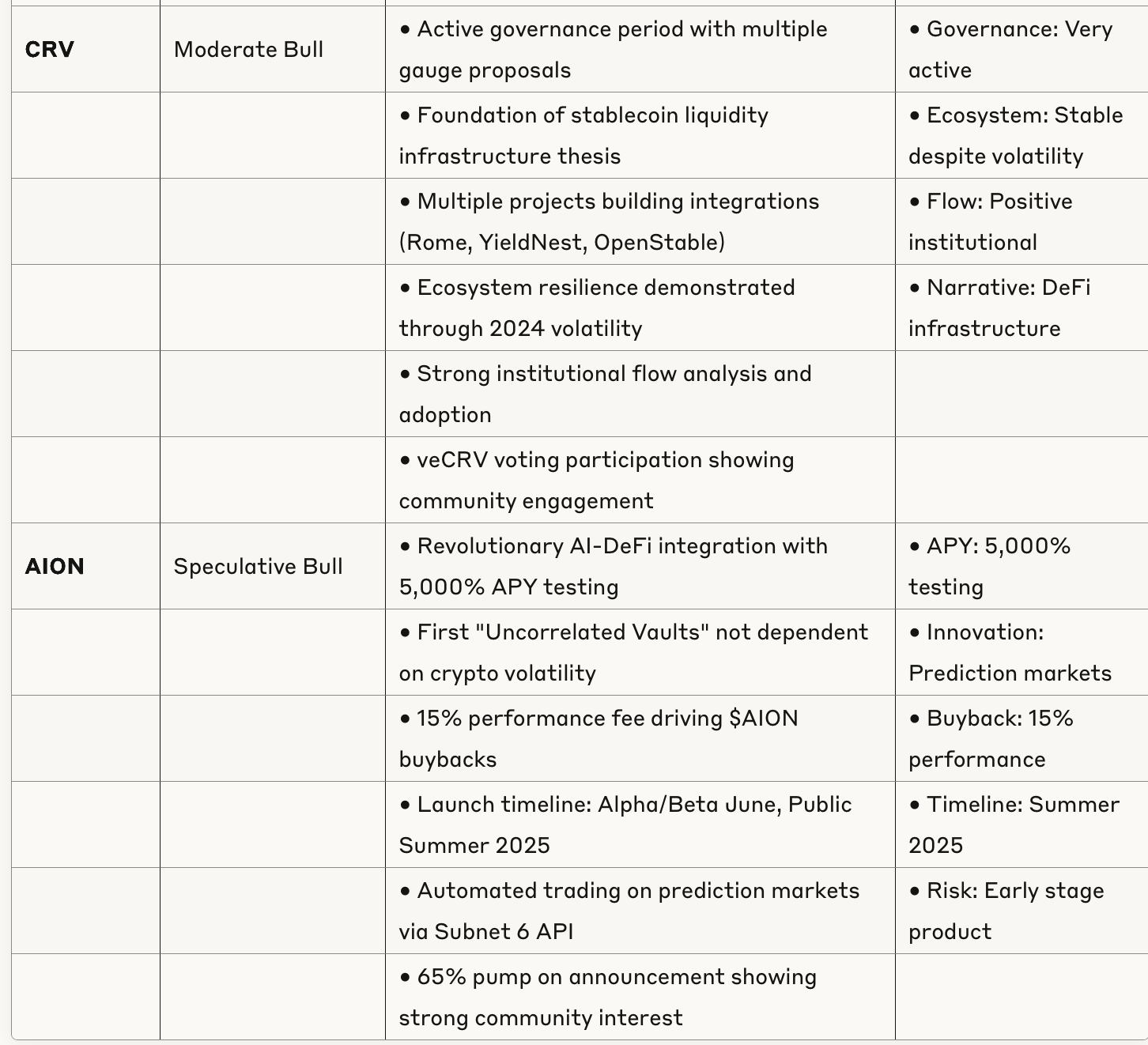

Token Analysis

Sector Analysis

DeFi Infrastructure (Strong)

The DeFi sector is experiencing a renaissance with institutional adoption accelerating. Circle IPO oversubscription, BlackRock involvement, and transparent financial reporting becoming competitive advantages. Projects like Curve, Pendle, and emerging yield innovations show strong fundamentals.

AI Integration (Emerging)

AI-DeFi integration represents the next evolution with projects like AION leading sophisticated automated yield strategies. This narrative is early but shows significant potential for differentiation.

Meme Token Evolution (Mixed)

The meme sector is maturing with philosophical movements like SPX6900 and technical setups like FARTCOIN showing that community-driven value creation is evolving beyond pure speculation.

Layer 1 Scaling (Positive)

Ethereum's Protocol initiative and Solana's continued ecosystem development show major Layer 1s are addressing scalability and user experience, crucial for next adoption wave.

Risk Assessment

Market Risks

June historically weak for ETH (-5.37% average returns)

Macro liquidity environment becoming increasingly challenging

Potential for summer consolidation period

Token-Specific Risks

New tokens (YND, AION) carry launch volatility

Meme tokens subject to narrative shifts

Correlation risks in ETH ecosystem plays

Opportunities

Institutional DeFi adoption accelerating

Technical setups showing healthy consolidation

Strong community engagement across multiple narratives

Clear support levels for risk management