Market Edge, 3rd June, 2025

Alpha from CT/YT

Based on comprehensive analysis of multiple crypto research sources, social sentiment, and video content from June 2-3, 2025.

Current Market Overview

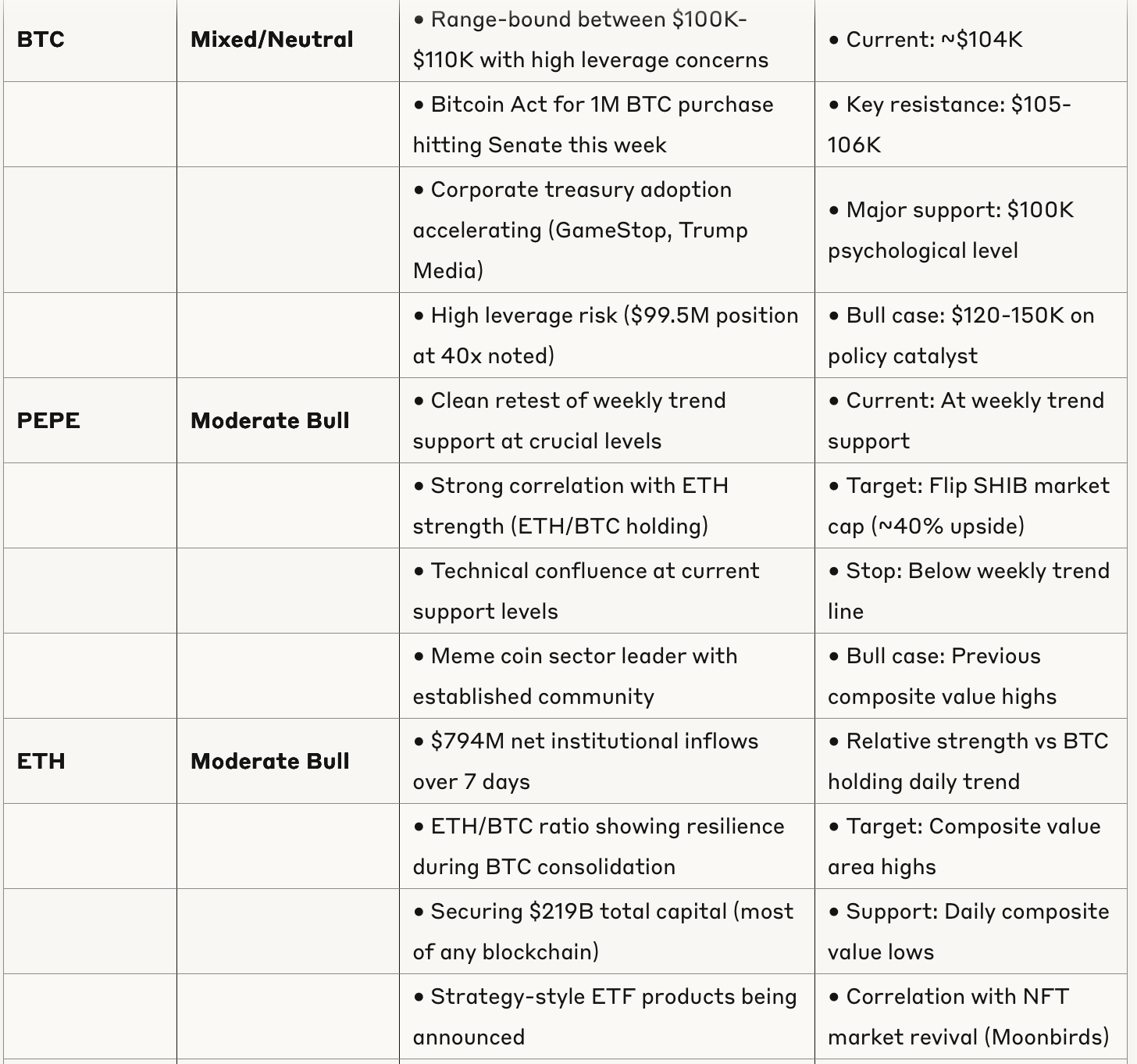

Market Phase: Mid-cycle consolidation with selective strength in DeFi infrastructure and AI tokens. Bitcoin showing range-bound behavior around $104K while institutional adoption accelerates through corporate treasury strategies.

Key Narratives:

Corporate Bitcoin treasury arms race intensifying

DeFi infrastructure evolution (AAVE upgrades, Curve innovations)

AI token platforms showing systematic growth patterns

Stablecoin adoption reaching new milestones ($2.3T monthly volumes)

Perpetual DEX volumes hitting records ($248B monthly on Hyperliquid)

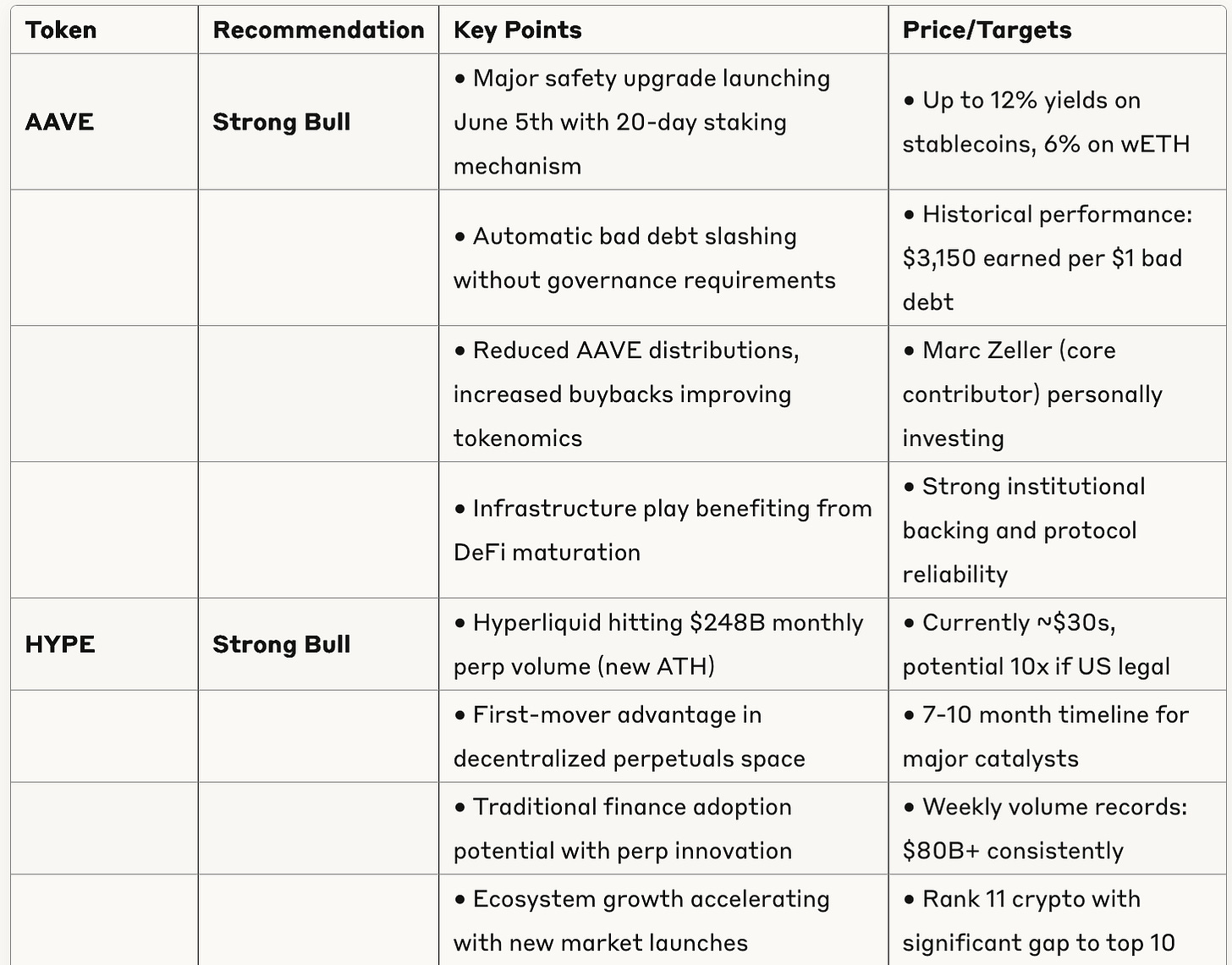

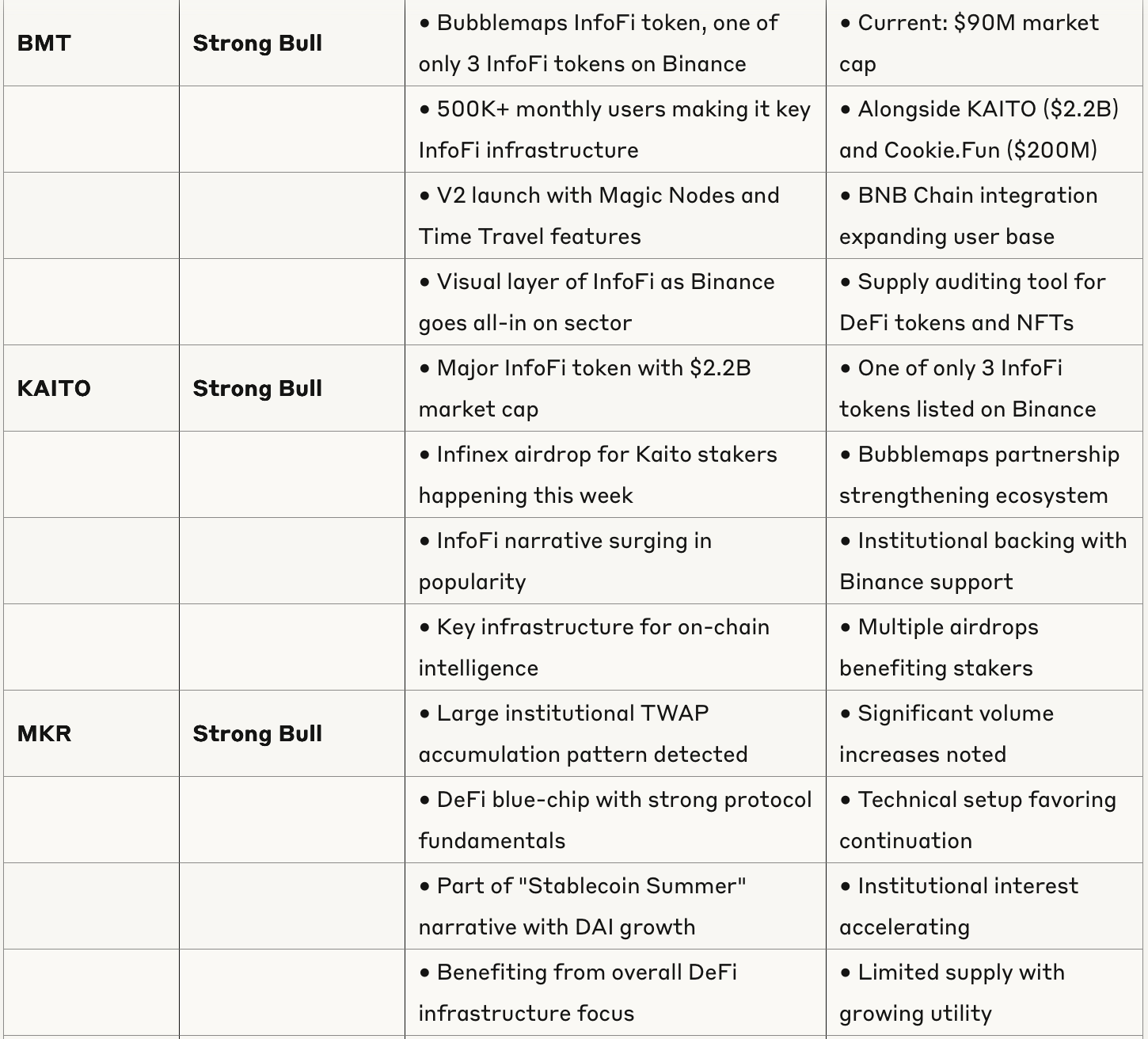

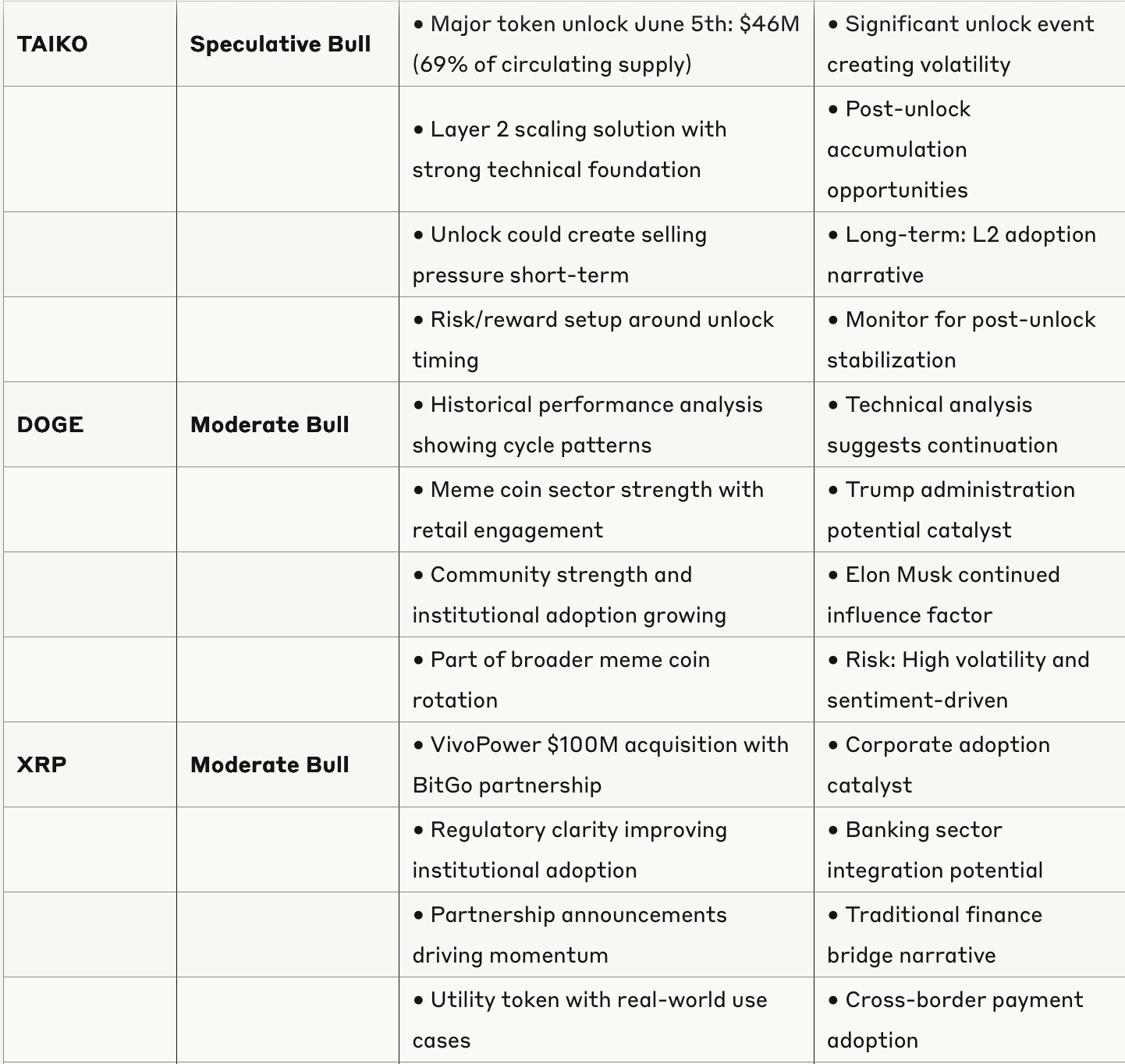

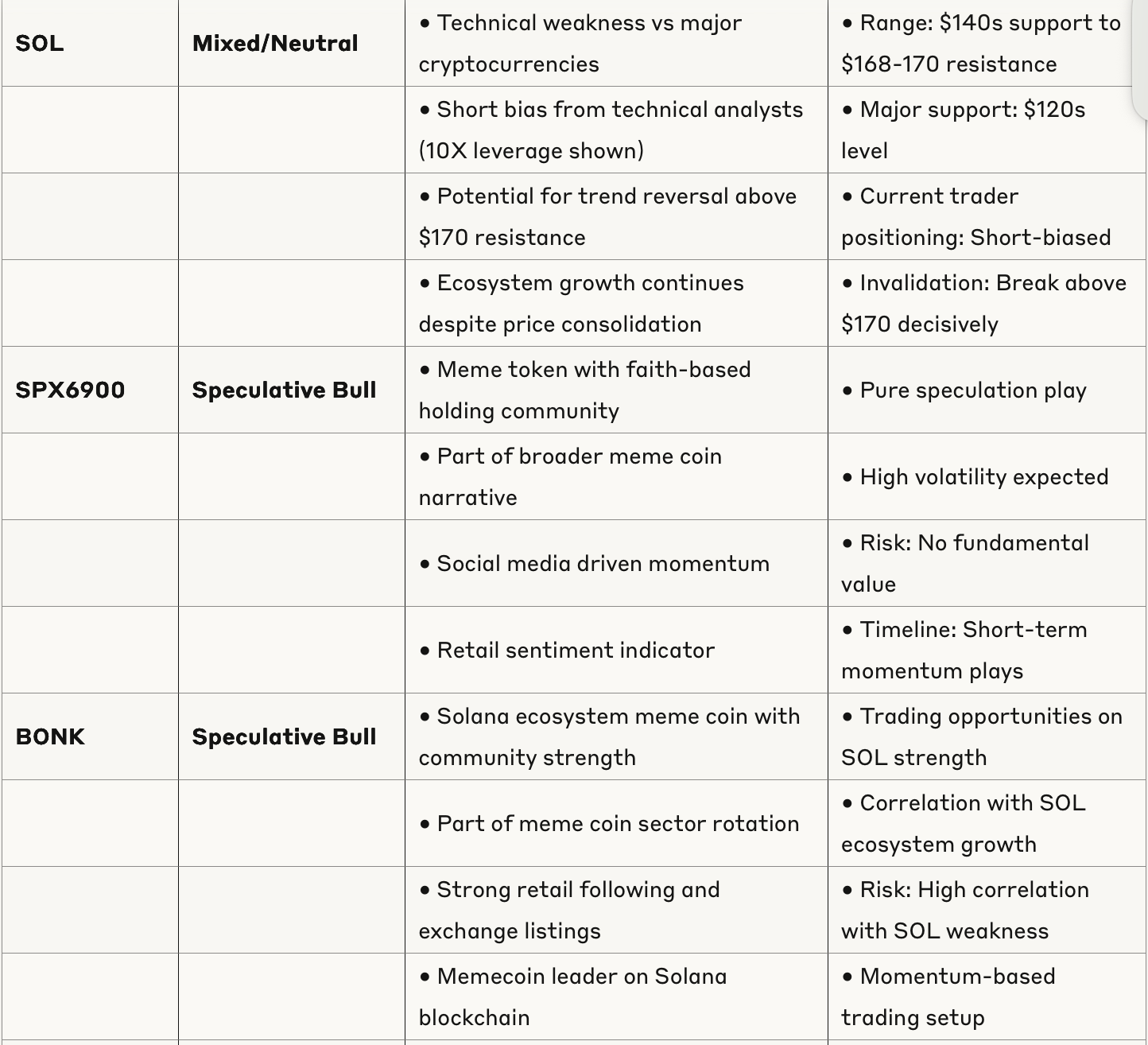

Token Analysis & Recommendations

Sector Analysis

DeFi Infrastructure (Strongest Conviction)

Leading the current cycle with mature protocols solving fundamental problems. AAVE's safety upgrade represents institutional-grade risk management, while Curve's stablecoin innovations show technical leadership.

AI Token Platforms (High Growth Potential)

Systematic approach to token launches showing predictable patterns. Virtuals ecosystem demonstrating 10x-200x historical performance on genesis launches.

Corporate Treasury Plays (Institutional Theme)

Accelerating adoption with companies like GameStop, Trump Media planning multi-billion dollar Bitcoin strategies. Competition intensifying to avoid missing opportunities.

Perpetual DEX (Infrastructure Winner)

Hyperliquid leading decentralized derivatives with record volumes. Traditional finance adoption potential massive if regulatory clarity achieved.

Key Risks & Considerations

Market Structure Risks:

High leverage in Bitcoin ($99.5M position at 40x noted)

Range-bound consolidation could continue 6-9 months

Overleveraged positioning in majors

Narrative Risks:

Corporate treasury competition could peak

DeFi yield opportunities may compress

AI token speculation could face correction

Technical Risks:

Bitcoin breakdown below $100K would impact all crypto

ETH/BTC ratio failure would hurt altcoin sentiment

Liquidation cascades from high leverage positions

Timeline & Catalysts

Immediate (This Week):

AAVE safety upgrade (June 5th)

Bitcoin Act Senate vote

Circle IPO debut

Near-term (1-4 weeks):

Corporate Bitcoin treasury announcements

DeFi yield farming opportunities from AAVE upgrade

AI token genesis launch patterns

Medium-term (1-6 months):

Hyperliquid US regulatory clarity

Corporate treasury adoption acceleration

DeFi infrastructure maturation

Market Conviction Level: High for DeFi infrastructure, Moderate for major cryptocurrencies, Speculative for AI tokens and treasury plays.