Market Edge, 31st May, 2025

CT/YT

Current Market Phase: Structural Transition

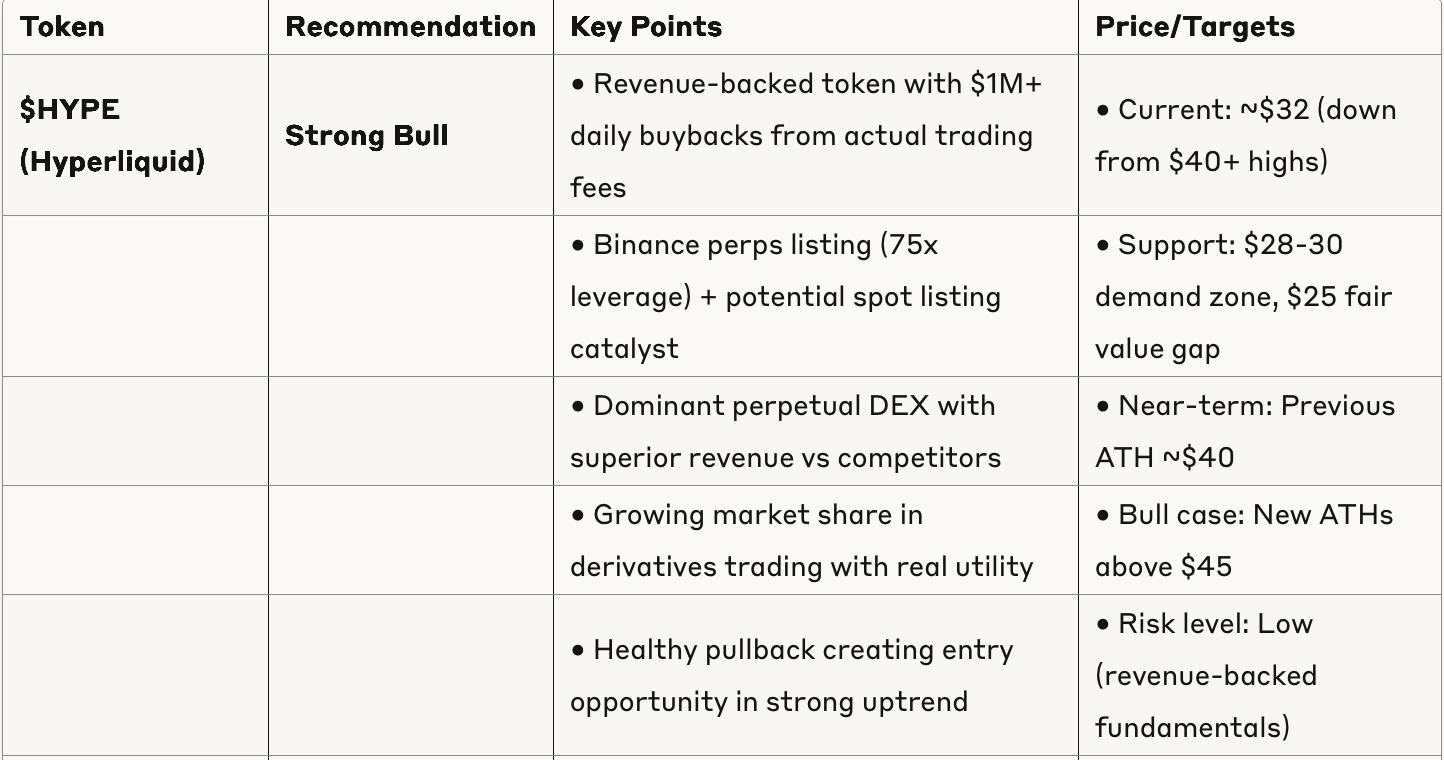

The crypto market is experiencing a fundamental shift from pure speculation to revenue and utility-focused valuations. This represents a maturation phase where tokens with actual business models (HYPE's trading fees, MAPLE's lending revenue) are outperforming narrative-only plays.

Dominant Narratives

InfoFi/Attention Economy: $LOUD pioneering monetization of social media engagement

Revenue-Based Valuations: HYPE leading with actual trading fee buybacks

Survival Stories: MAPLE, OILER proving "you just need to survive" thesis

Stablecoin Infrastructure: ENA positioned for Trump administration treasury strategy

AI Infrastructure: VIRTUAL capturing renewed AI interest with utility

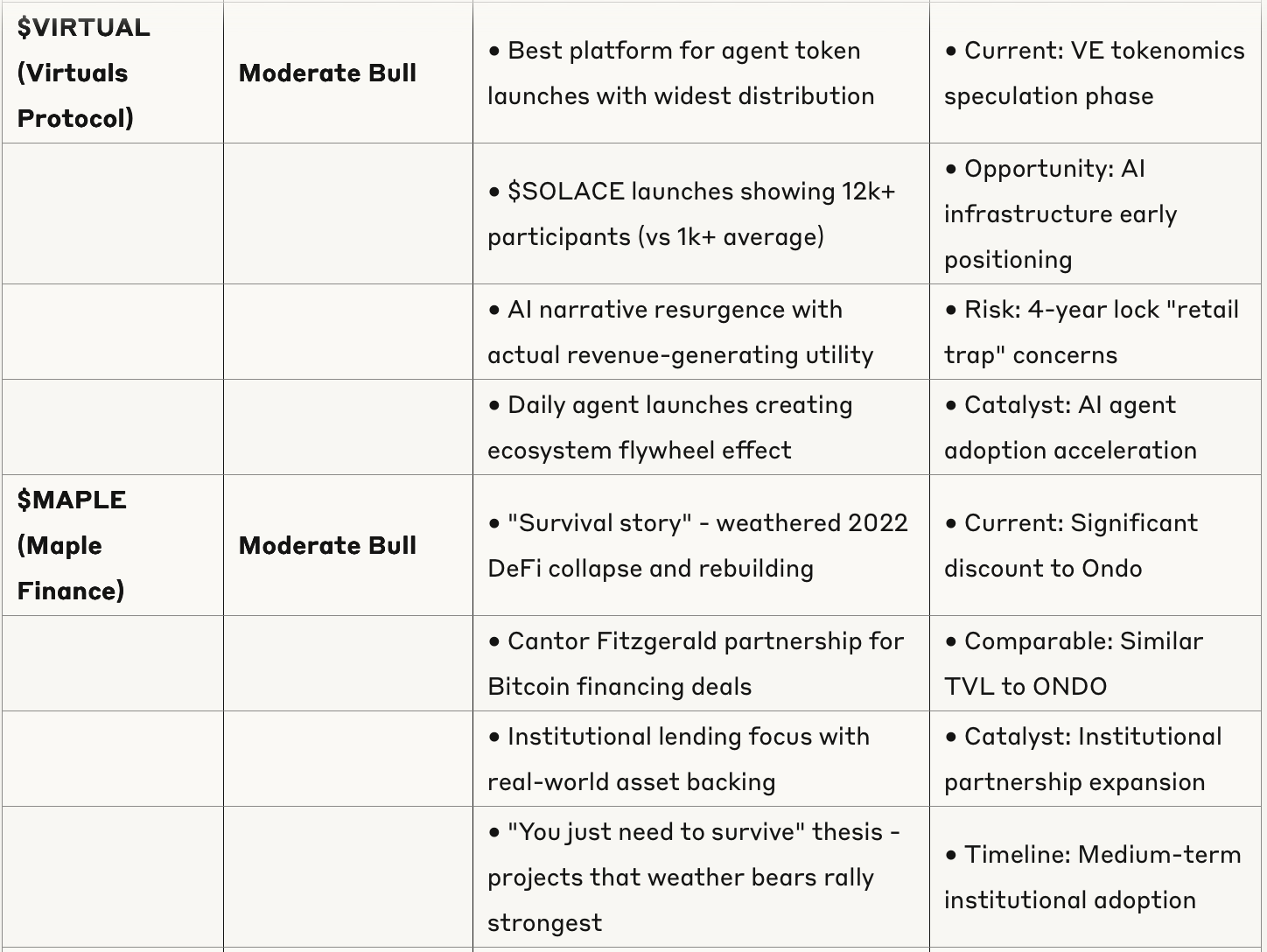

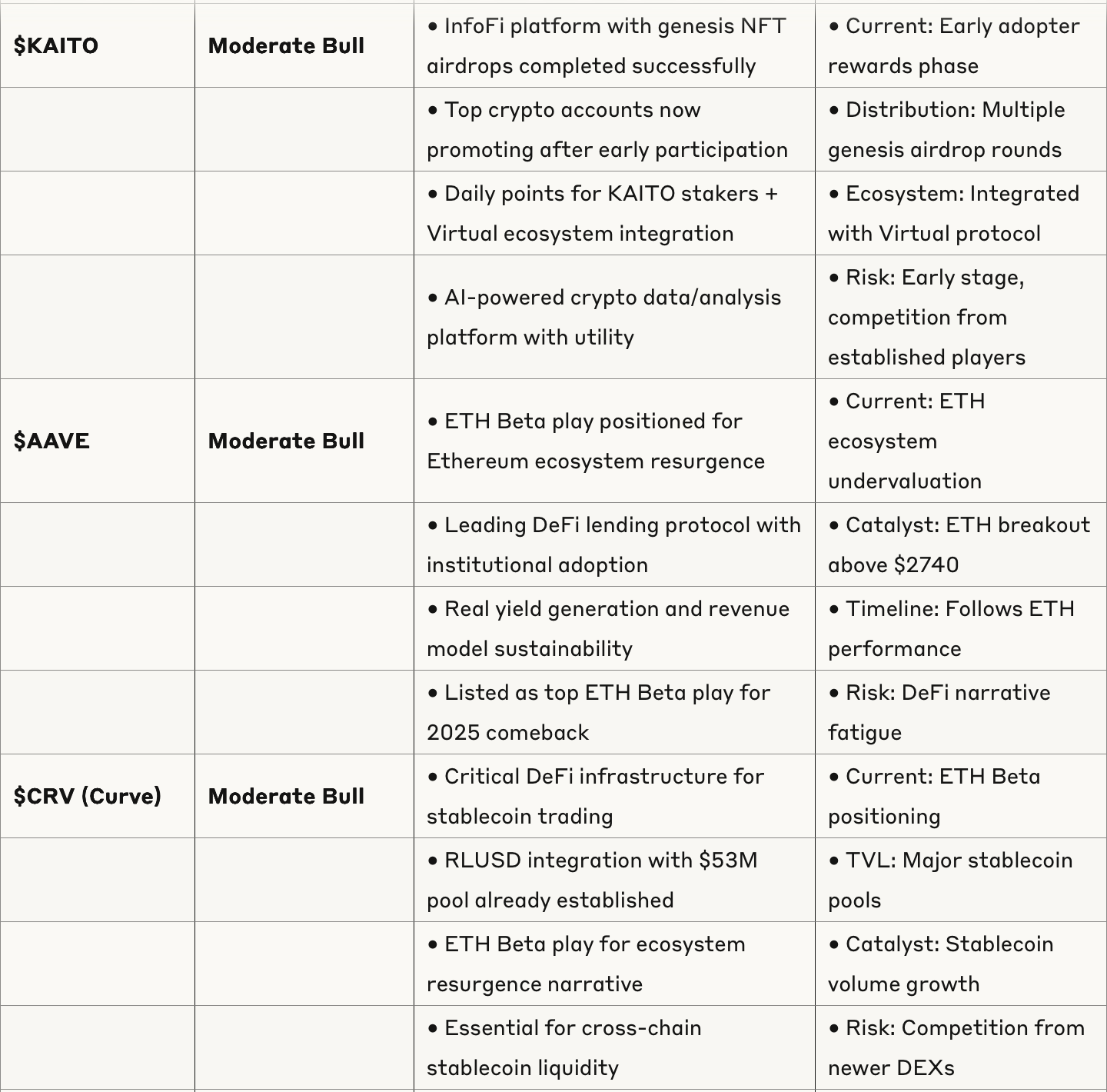

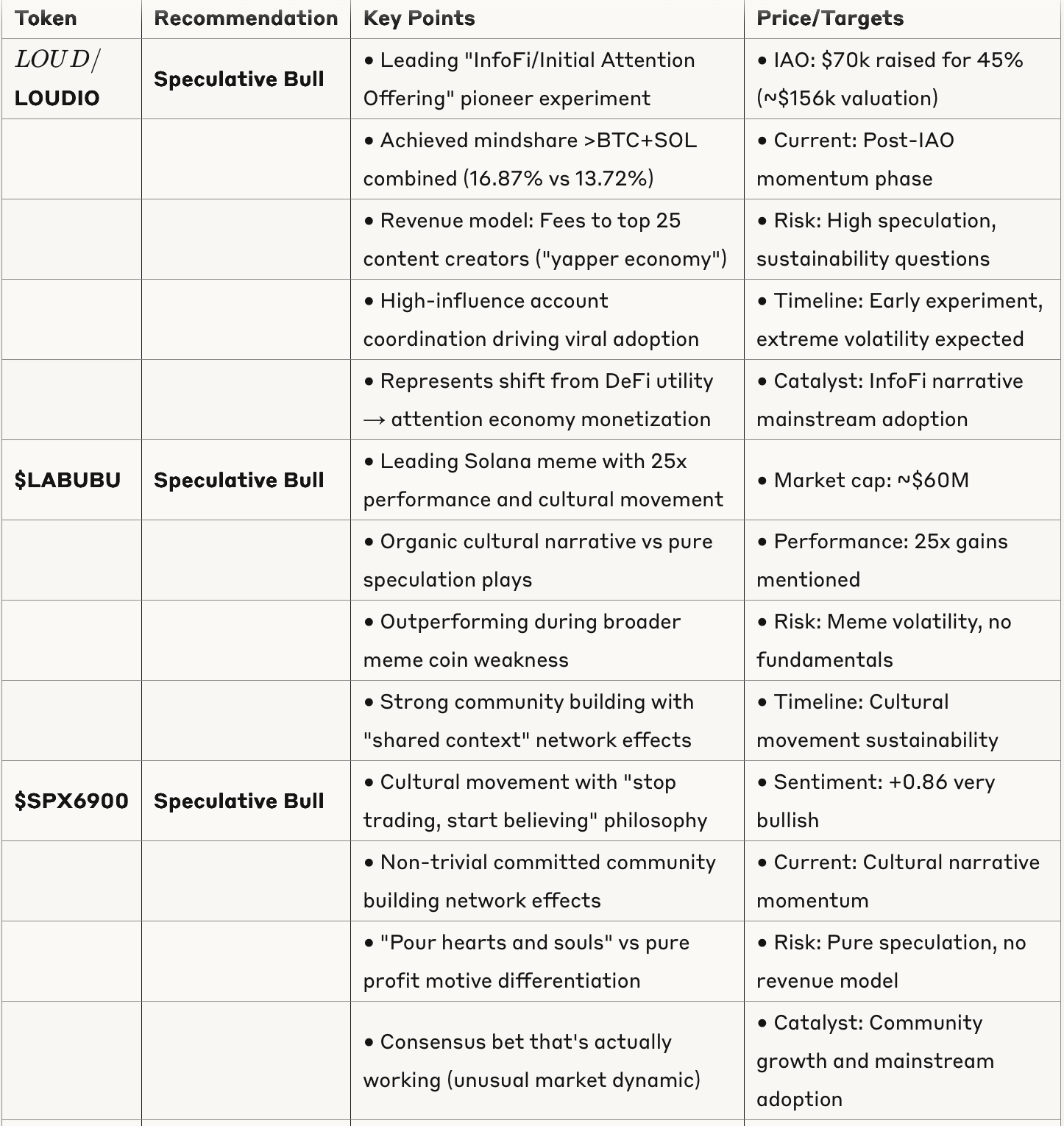

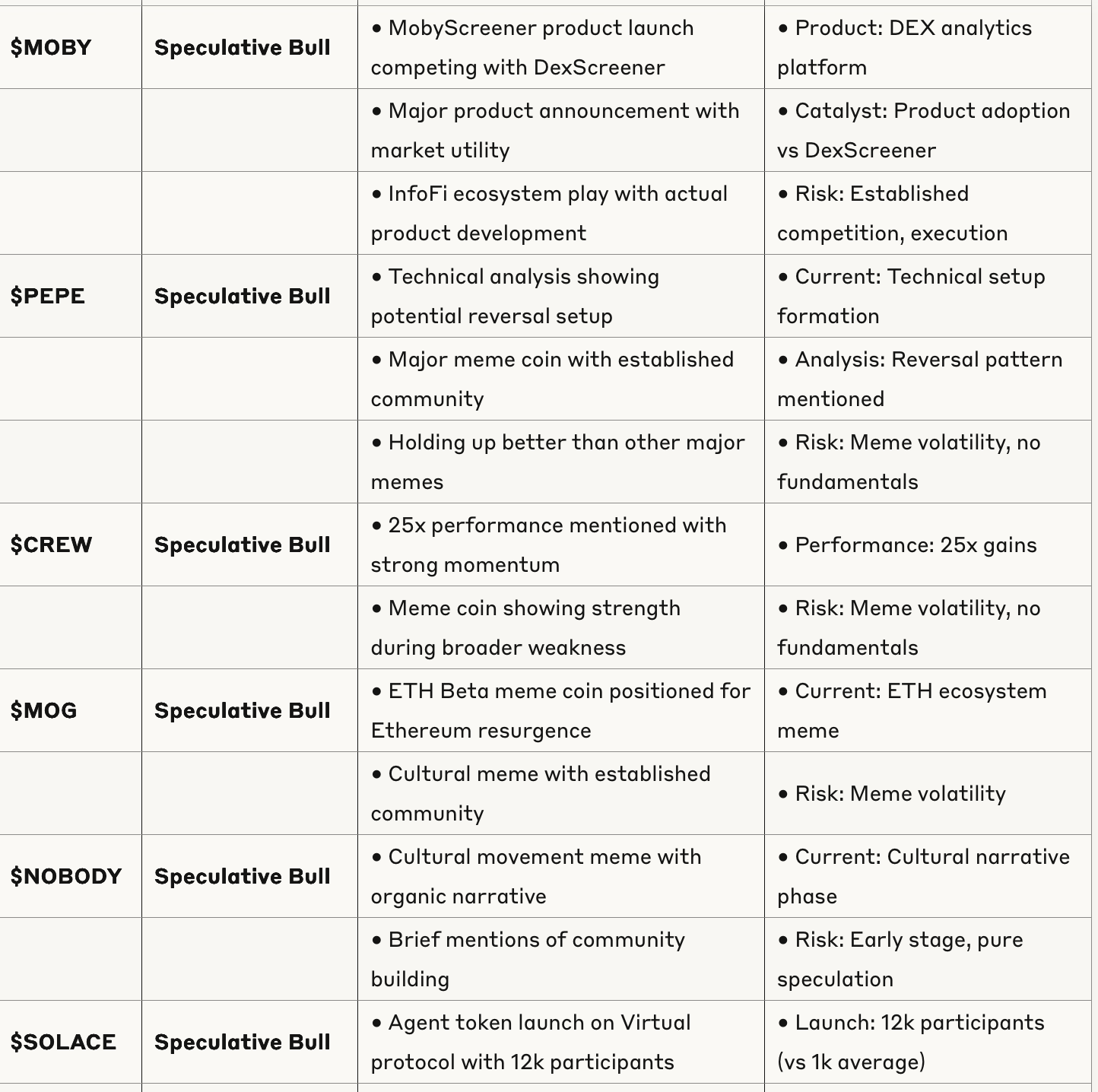

Token Analysis Table

Dominant Market Narratives

1. InfoFi/Attention Economy Revolution 🔥

$LOUD pioneering "Initial Attention Offering" model

Monetizing social media engagement and mindshare directly

Shift from DeFi utility → attention economy capture

Early experiment with extreme volatility but paradigm-shifting potential

2. Revenue-Based Token Valuations 📊

HYPE leading with $1M+ daily buybacks from actual trading revenue

Market rewarding tokens with demonstrable cash flows

Traditional speculation giving way to fundamental analysis

"Consensus bets working" for first time (unusual market dynamic)

3. ETH Beta Season Preparation 🚀

ETH positioned for major catch-up trade vs BTC

ETF inflows (+$91.9M) vs BTC outflows (-$346.8M) showing rotation

Entire ETH ecosystem (AAVE, CRV, EIGEN, etc.) positioned for resurgence

$2740 breakout level critical for "party time" confirmation

4. Corporate Bitcoin Treasury Proliferation 🏢

MSTR model spreading to multiple corporations

Permanent supply reduction as companies adopt treasury strategies

Long-term holders won't sell before 2028+ creating price floors

"Speedrunning peak SPAC mania" with treasury companies

5. Stablecoin Infrastructure Expansion 💰

Trump administration "secular stablecoin bid" for treasury market rescue

ENA, MKR, RLUSD positioned for massive market cap expansion

USD stablecoin growth needed for treasuries market support

Regulatory clarity driving institutional adoption

6. AI Agent Economy Emergence 🤖

VIRTUAL protocol becoming dominant platform for agent launches

$SOLACE showing 12k participants (vs 1k average)

AI narrative shifting from speculation to utility

Revenue-generating AI tools vs pure token speculation

7. Survival/Comeback Stories 💪

MAPLE, OILER proving "you just need to survive" thesis

Projects that weathered 2022 bear market now rallying strongest

Institutional partnerships driving comeback narratives

Market rewarding resilience and rebuilding

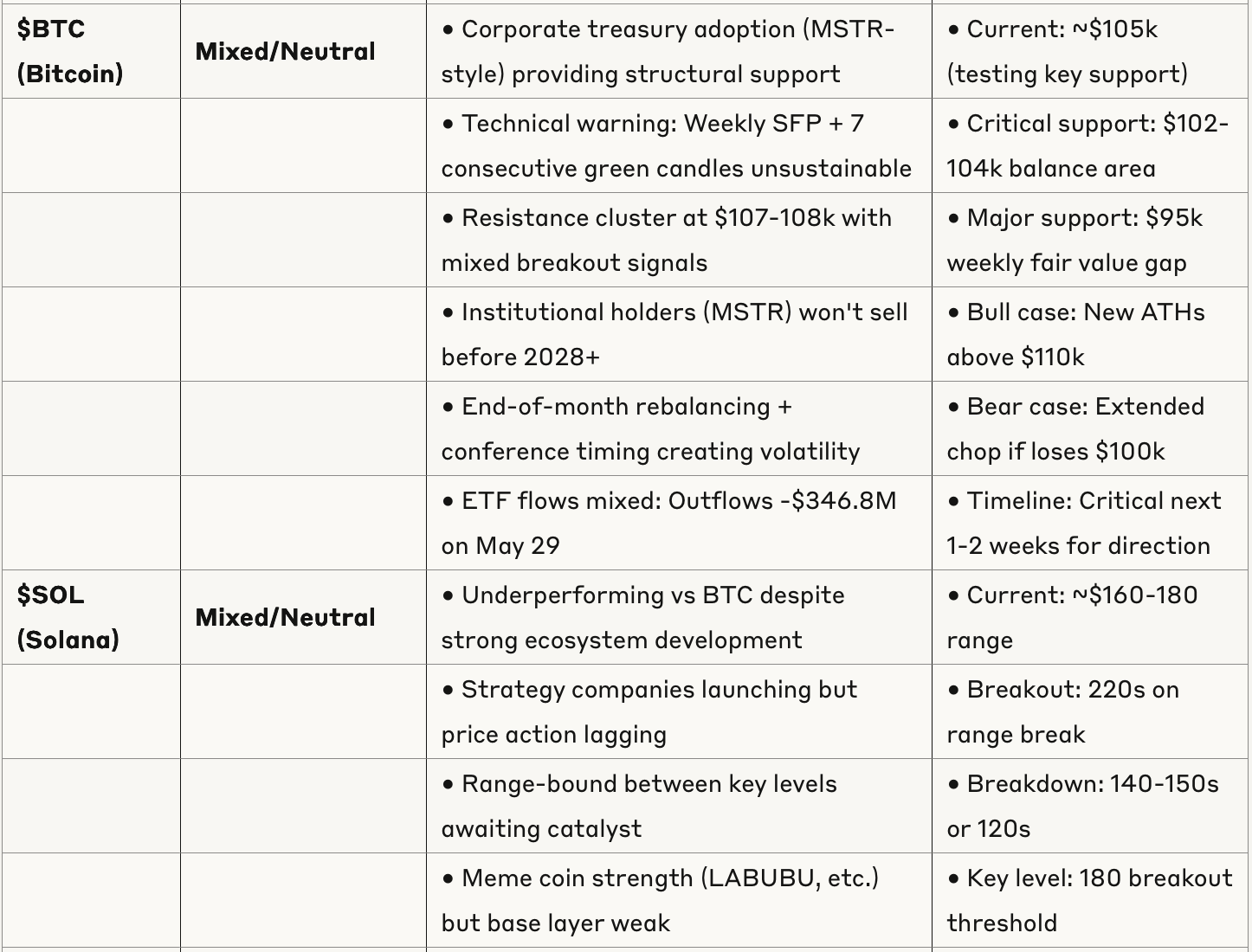

Technical Market Structure

Bitcoin Critical Inflection Point ⚠️

Testing key support at $105-107k after $108k+ rejection

Weekly SFP (Swing Failure Pattern) + 7 consecutive green candles unsustainable

25% probability: Hold and break higher

50% probability: Wick to $104-105k for bullish retest

25% probability: Extended chop or deeper correction

Corporate treasury flows providing structural support

Market Oversold Conditions 📉

Average RSI of 33.17 on 4H timeframe across major assets

$345M liquidated in 60 minutes showing leverage flush

End-of-month institutional rebalancing creating volatility

Potential bounce from oversold levels vs continued breakdown

Sector Rotation Dynamics 🔄

ETH ETF inflows vs BTC outflows showing clear rotation

InfoFi tokens (LOUD, KAITO) capturing mindshare >traditional assets

Meme coins showing divergent performance (LABUBU strong, others weak)

DeFi revival dependent on ETH breaking $2740

Liquidity and Flow Analysis 💧

Low leverage and muted spot volume throughout recent rally

Institutional froth replacing retail euphoria

Korean exchange premiums (Upbit) showing regional strength

Options unusual activity in ETH (heavy call buying)

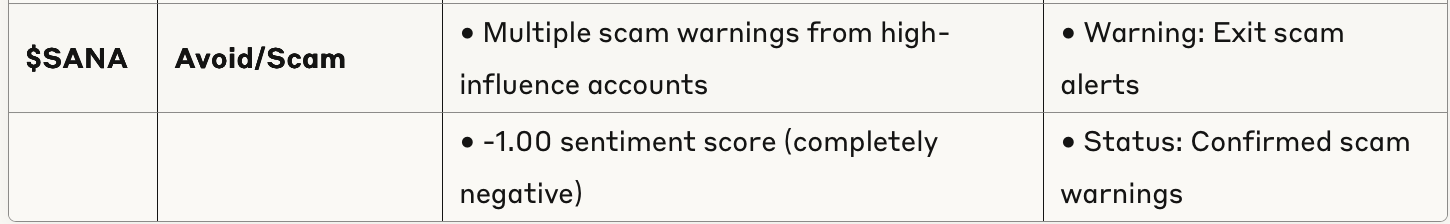

Risk Assessment

Immediate Technical Risks 🚨

Bitcoin weekly SFP completion could trigger major correction

ETH failure at $2740 could delay ecosystem revival

Oracle reliability concerns (deUSD $500k+ loss) affecting DeFi trust

High correlation risk if BTC breaks key support levels

Narrative/Fundamental Risks ⚠️

InfoFi sustainability questions ("yapper economy" viability)

Corporate treasury bubble risk (SPAC-style collapse potential)

Regulatory uncertainty around stablecoins and AI agents

Market structure change leaving traditional strategies behind

Systemic Market Risks 📊

End-of-month volatility and conference timing

Leverage unwinding if technical levels fail

Retail FOMO into treasury companies creating bubble

Consensus trades working (historically bearish signal)

Institutional Activity & Flows

ETF Dynamics 📈

ETH ETFs: +$91.9M inflow (May 29) showing institutional rotation

BTC ETFs: -$346.8M outflow indicating profit-taking/rebalancing

IBIT still seeing +$125M inflow vs GBTC -$107.5M outflow

Corporate Treasury Adoption 🏢

Multiple companies copying MSTR playbook

Fixed income market expansion with preferred stocks

Long-term supply reduction mechanism accelerating

"Each BTC bought is out of market permanently"

Regulatory Environment 🏛️

House Republicans introduced Digital Asset Market Clarity Act (May 29)

CFTC exclusive oversight of digital-commodity spot markets

Payment stablecoins explicitly not securities

DeFi projects exempted from certain SEC rules

Key Price Levels & Catalysts

Critical Technical Levels 📊

BTC: $107k resistance, $102-104k support, $95k major support

ETH: $2740 breakout = "party time", $2400-2500 range lows

SOL: $180 breakout threshold, $160-180 current range

Major Upcoming Catalysts 🎯

Bitcoin Conference (potential sell-the-news event)

ETH breakout confirmation above $2740

Additional corporate treasury announcements

Stablecoin regulatory clarity from Trump administration

HYPE spot listing confirmation (following perps)

Sector Performance & Outlook

Outperforming Sectors 🟢

InfoFi/Attention Economy (LOUD, KAITO, MOBY)

Revenue-Generating Tokens (HYPE, MAPLE)

Stablecoin Infrastructure (ENA, MKR, RLUSD)

AI Agent Platforms (VIRTUAL, AIXBT)

Survival Stories (MAPLE, OILER, HELIUM)

Underperforming Sectors 🟡

Traditional L1s (SOL, despite strong ecosystem)

Major Memes (except cultural movement types)

Traditional DeFi (awaiting ETH breakout)

High-Risk/High-Reward 🔥

Cultural Movement Memes (SPX6900, LABUBU)

Early InfoFi Experiments (LOUD ecosystem)

Agent Token Launches (SOLACE, Virtual ecosystem)

This comprehensive analysis reveals a market in fundamental transition, where traditional speculation is giving way to revenue-based valuations, attention economy monetization, and institutional adoption of crypto treasury strategies. The next 1-2 weeks will be critical for determining whether this structural shift continues or faces a significant correction.