Market Edge, 30th May, 2025

Alpha from CT/ YT

Crypto Market Analysis - May 30, 2025

Based on the provided documents covering newsletters, daily updates, YouTube analysis, and crypto Twitter sentiment from May 29, 2025, here's a comprehensive market analysis:

Overall Market Context

Market Phase: Mid-cycle bull market with constructive pullback patterns. Bitcoin showing institutional strength above $100k while Ethereum prepares for potential breakout. Strong stablecoin narrative driving crypto adoption with treasury market dynamics supporting Bitcoin's structural bid.

Key Themes:

ETH resurgence and "EVM season" potential

Stablecoin growth strategy central to Trump administration policy

AI infrastructure tokens gaining traction

Hyperliquid ecosystem development

Community-driven meme tokens showing resilience

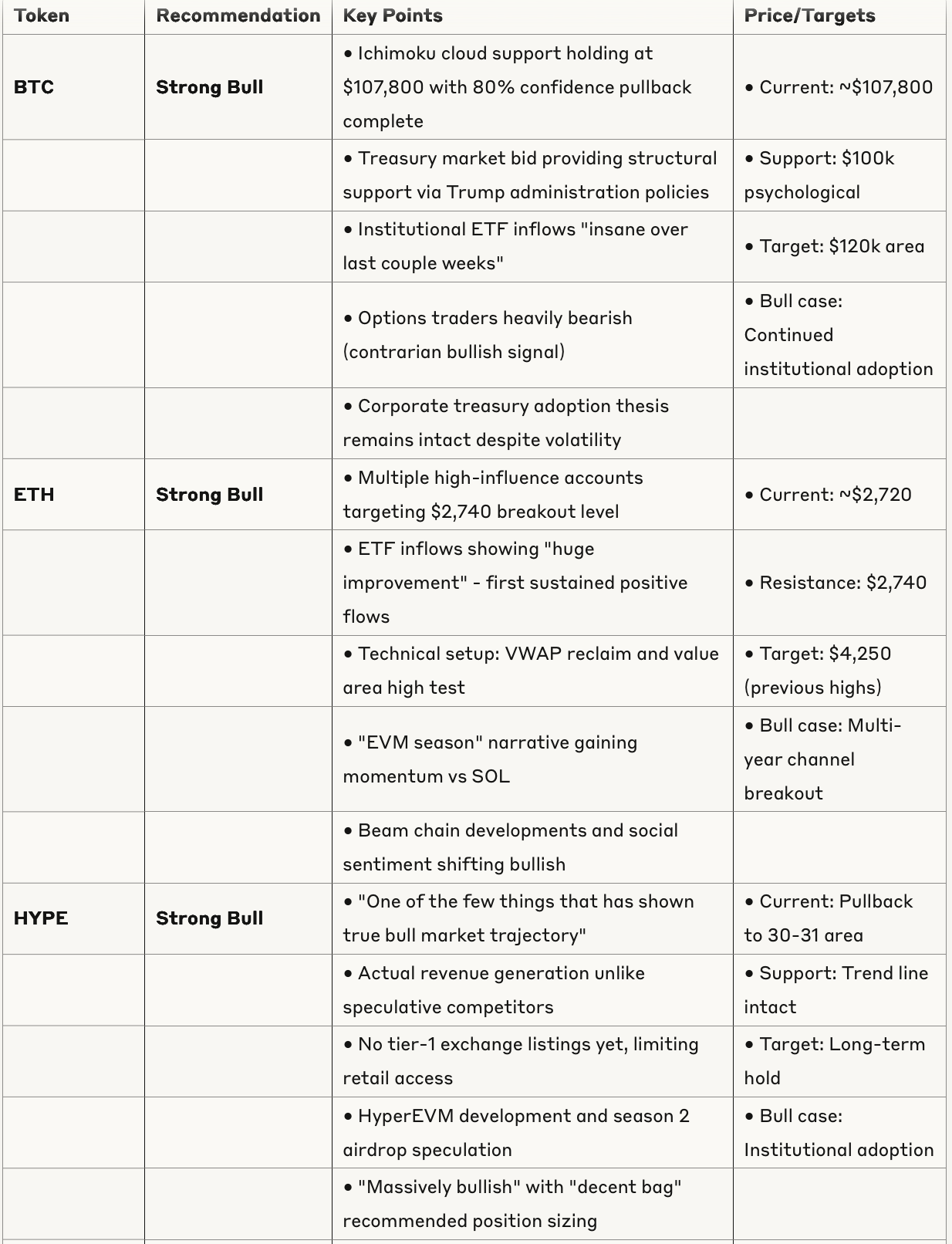

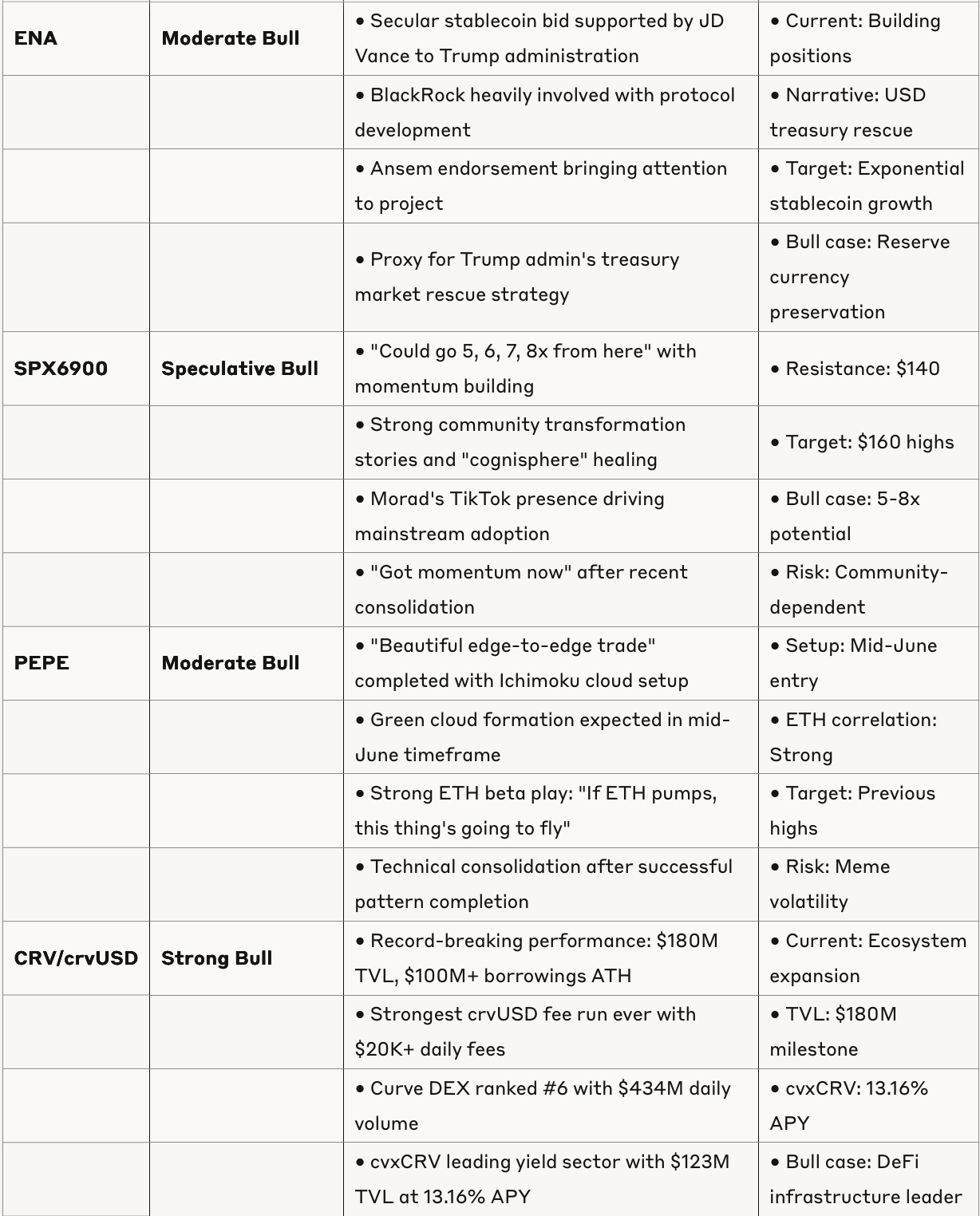

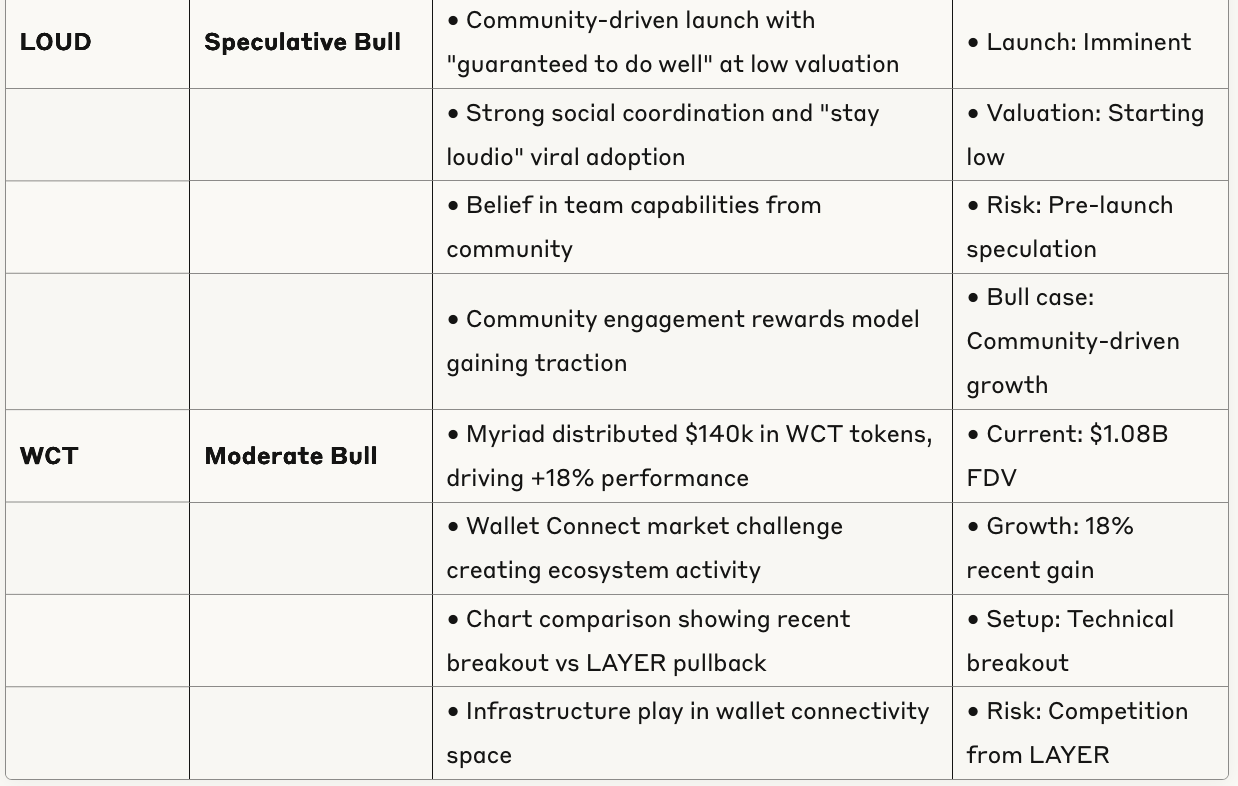

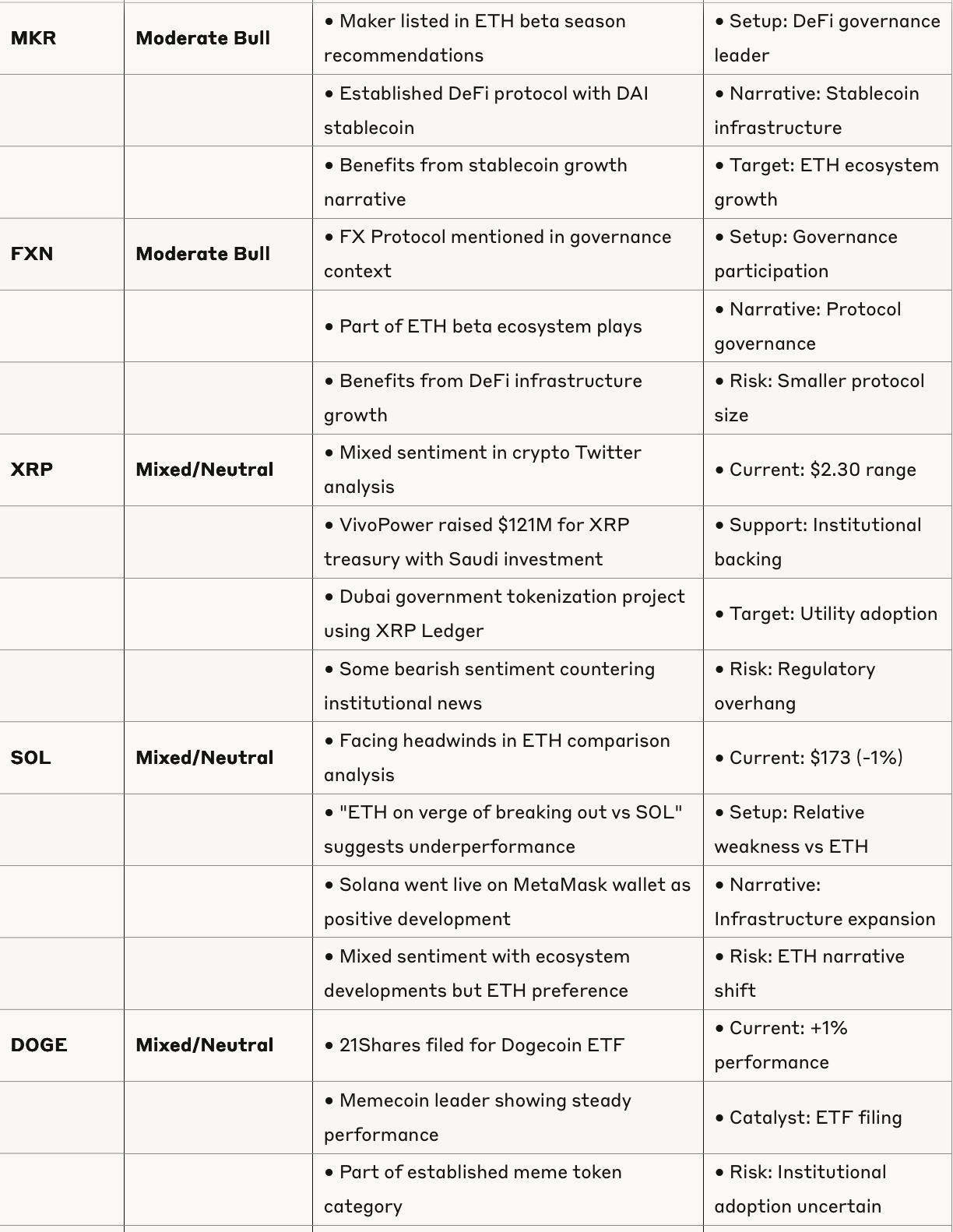

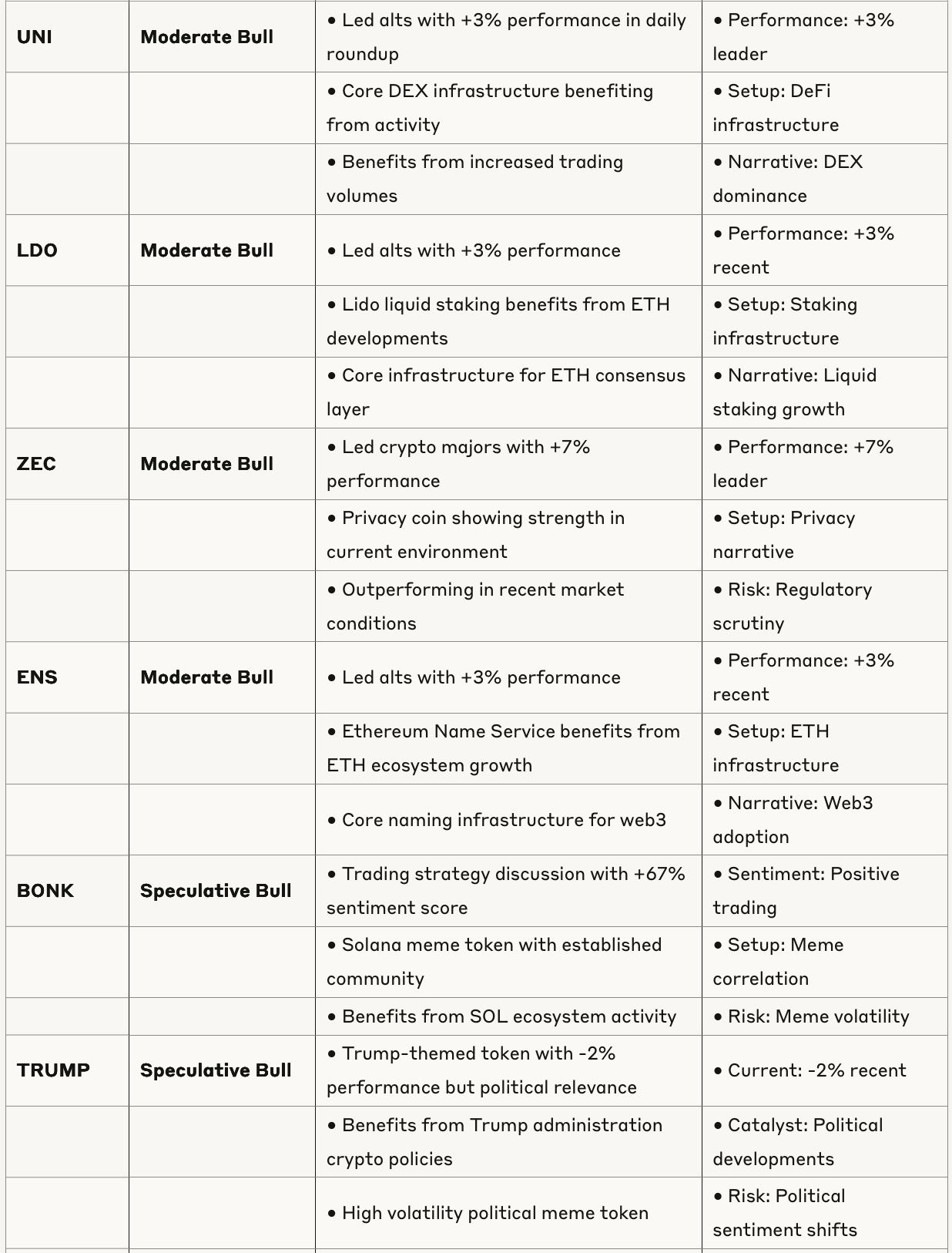

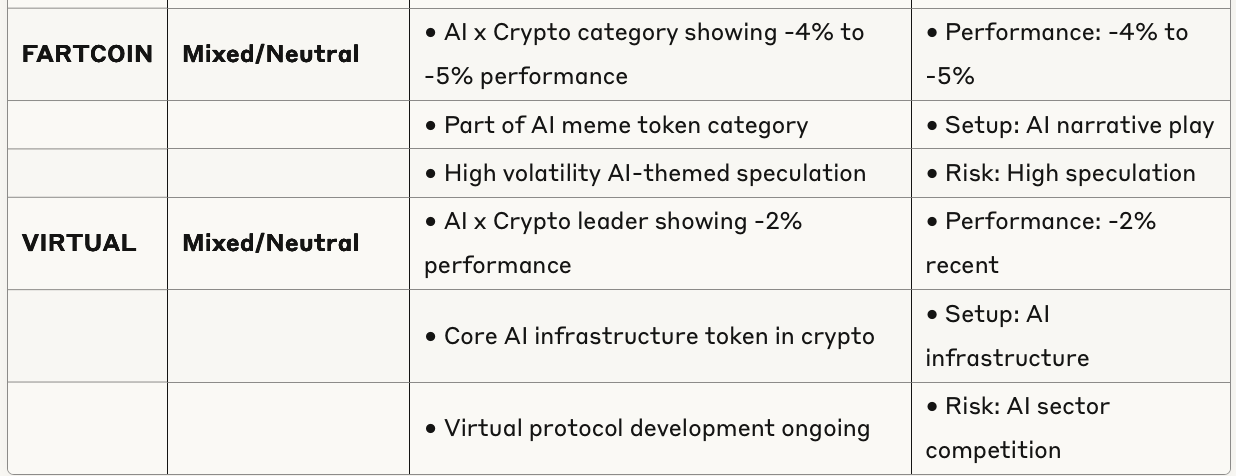

Token Analysis Table

Sector Analysis

DeFi Infrastructure: Curve ecosystem leading with record metrics. Yield innovation focusing on automated, risk-adjusted products like GammaSwap's IL-hedged offerings.

Stablecoins: Central narrative with ENA positioned as key beneficiary of Trump administration treasury market strategy.

AI Infrastructure: Hyperliquid demonstrating actual revenue vs speculative competitors. Mira Network presenting potential farming opportunities.

Memes: Community-driven tokens like SPX6900 showing resilience with transformation stories. PEPE positioned for ETH correlation play.

Layer 1s: ETH showing strongest setup vs BTC ratio. Solana facing headwinds in comparative analysis.

Risk Assessment

Market Risks:

Potential summer chop if BTC closes below $100k

Trump tariff policy uncertainty creating volatility

Options positioning showing 2-sigma downside events possible

Token-Specific Risks:

Meme tokens dependent on community sentiment maintenance

Pre-launch speculation in tokens like LOUD

AI sector competition and regulation uncertainty

Technical Risks:

ETH needs $2,740 break for continuation

BTC cloud support critical at current levels

Funding rates and technical indicators showing some froth

Investment Implications

Portfolio Construction: Focus on tokens with actual revenue generation (HYPE), infrastructure leaders (CRV), and ETH ecosystem plays positioned for breakout.

Timing: Mid-June window identified as potential entry point for several setups, particularly PEPE's green cloud formation.

Risk Management: Position sizing should reflect recommendation strength, with speculation limited to community-driven plays with strong viral potential.

Narrative Alignment: Stablecoin growth and ETH resurgence represent dominant themes with policy support and technical confirmation.