Market Edge, 2nd June

Edge from CT/ YT

Market Phase

The crypto market is in a mature bull market phase with institutional adoption accelerating and regulatory clarity improving under the Trump administration. We're seeing:

Sector Rotation: From memes to DeFi to infrastructure plays

Institutional Focus: Bitcoin Act and ETH ecosystem development

Quality Premium: Execution quality becoming crucial differentiator

Narrative Maturation: Moving from speculation to utility and adoption

Key Catalysts (Next 7 Days)

Bitcoin Act Senate Floor Vote - Potential 1M BTC purchase bill

Ethereum-Base Initiative - Major ecosystem announcement

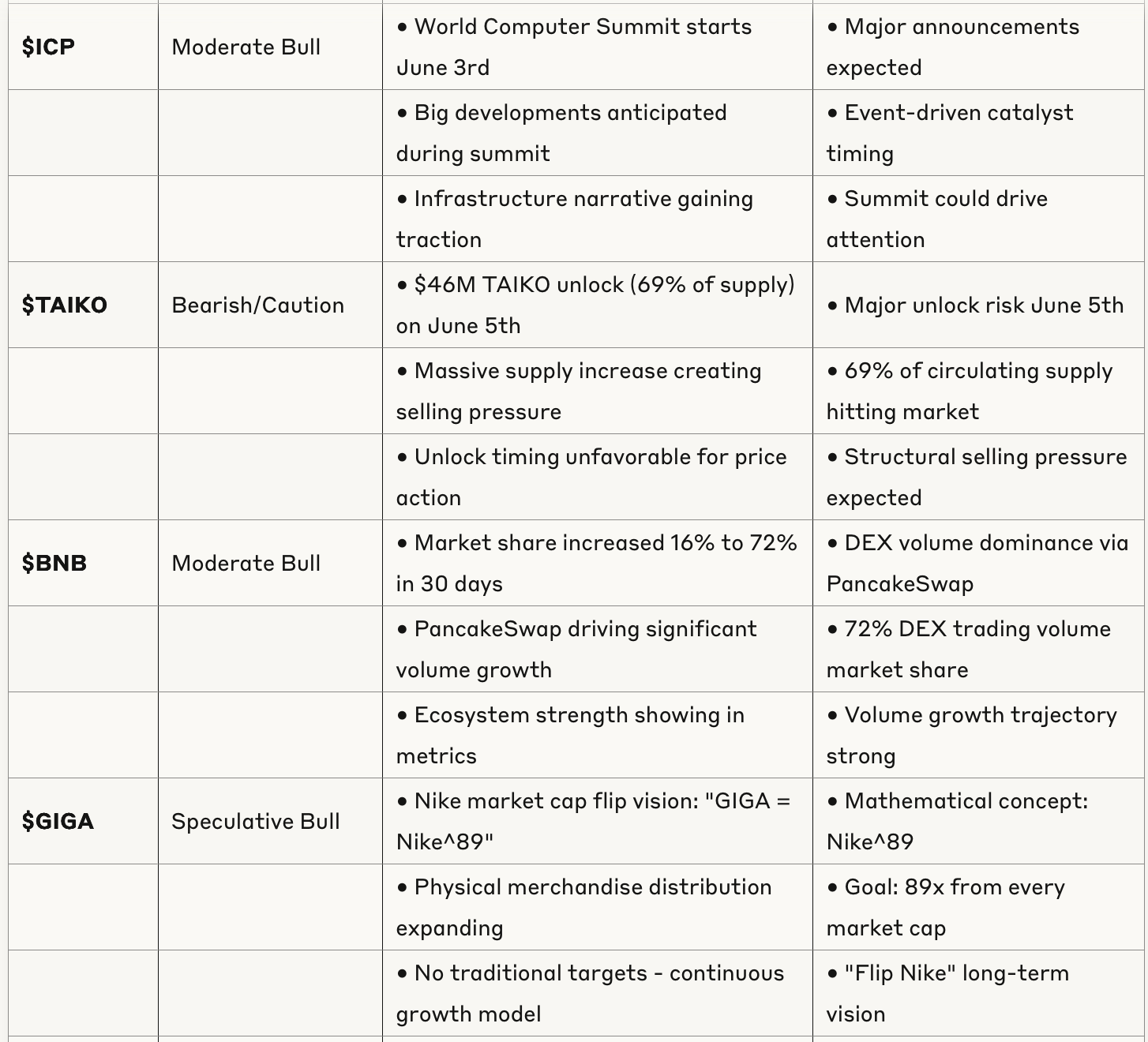

World Computer Summit (June 3) - ICP developments

Multiple Airdrops - KAITO/Infinex, others

Major Unlocks - TAIKO (June 5) creating selling pressure

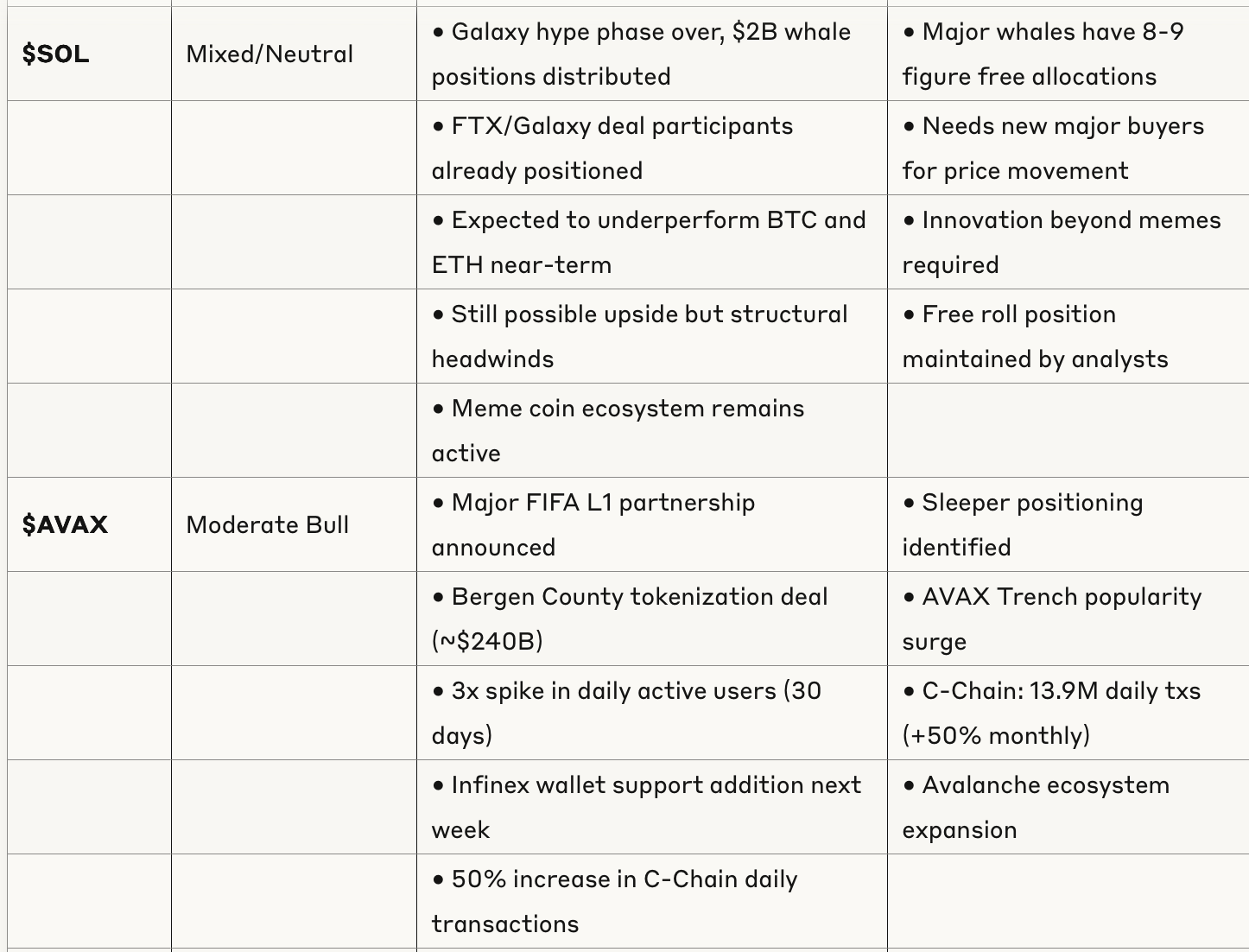

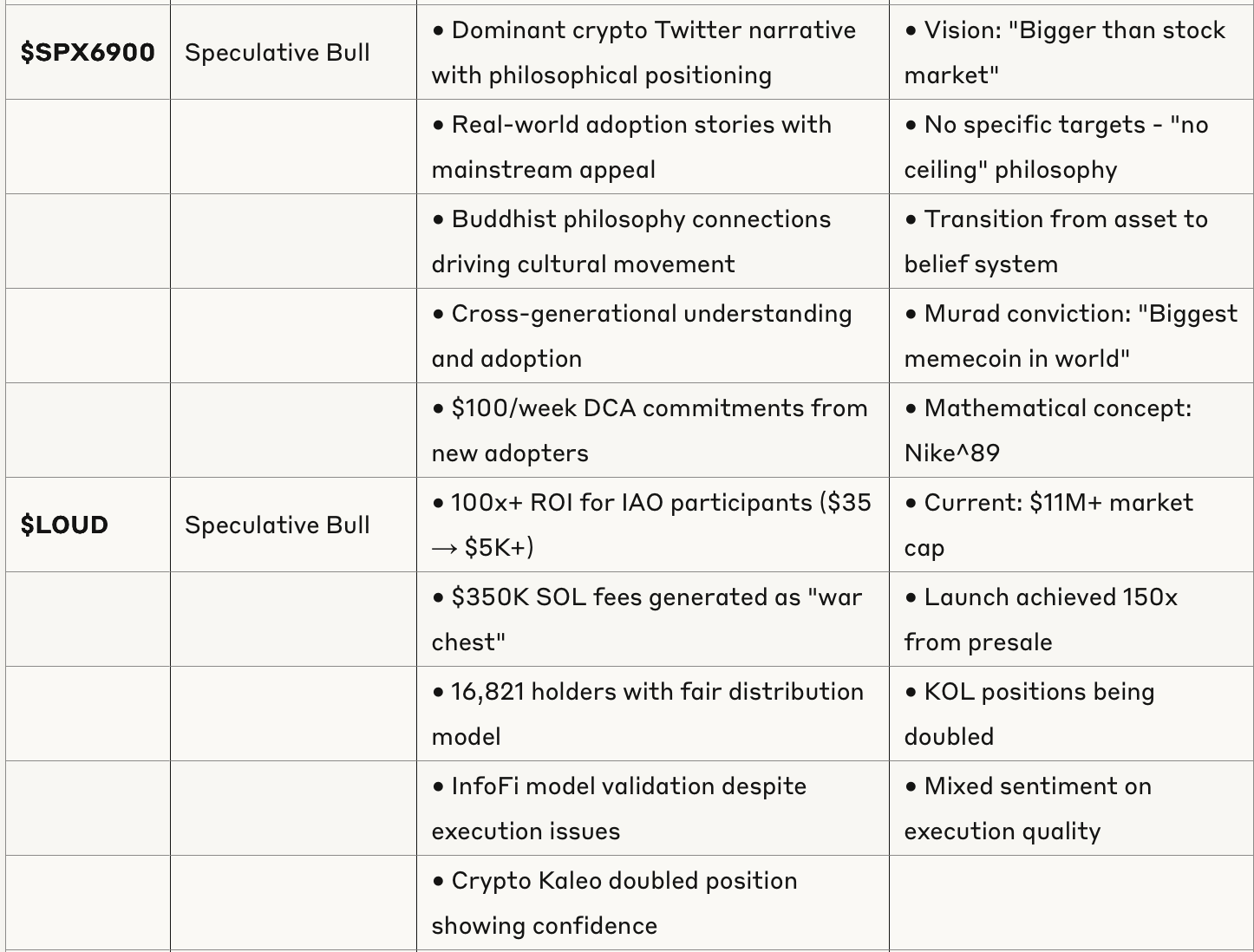

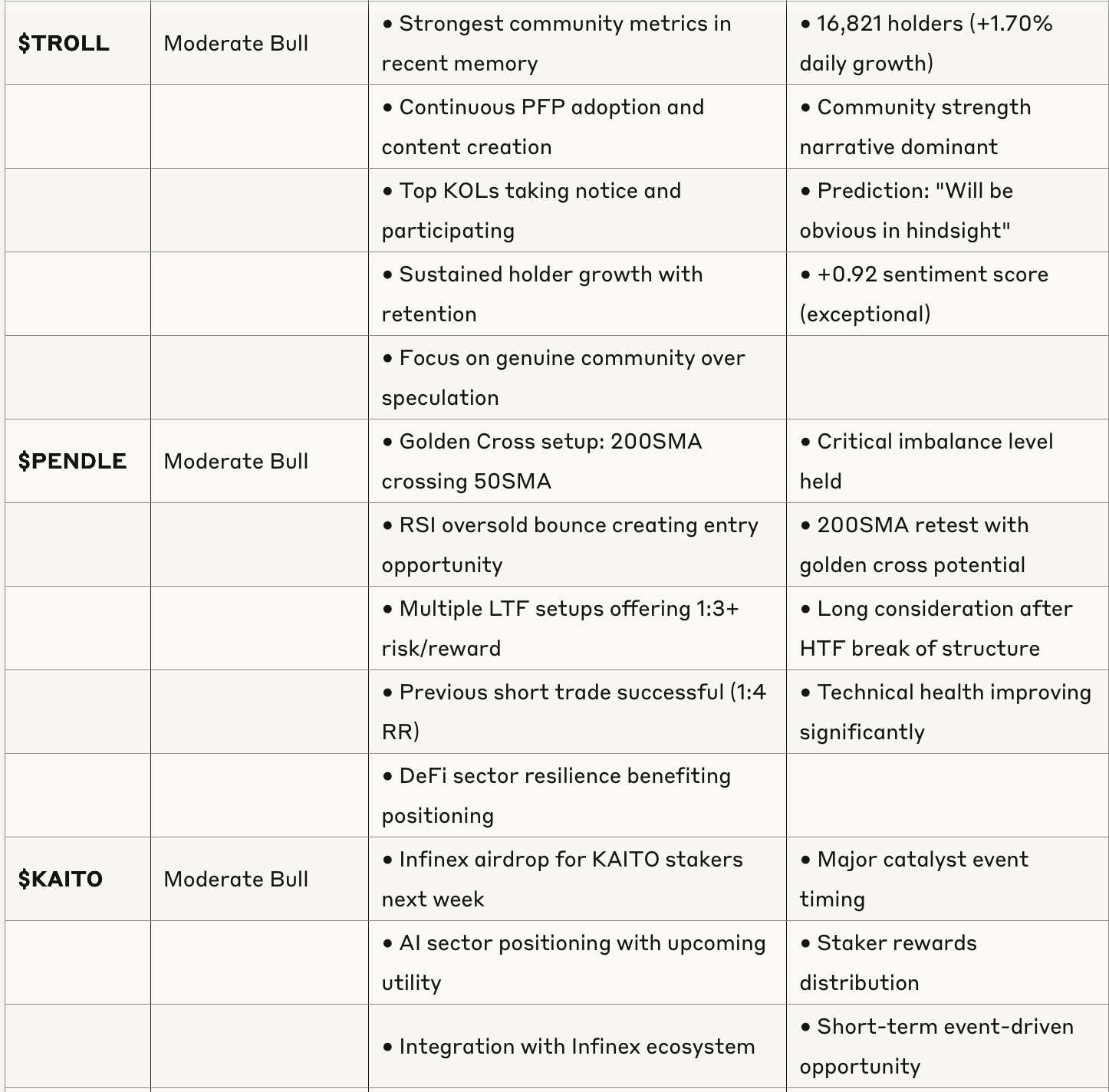

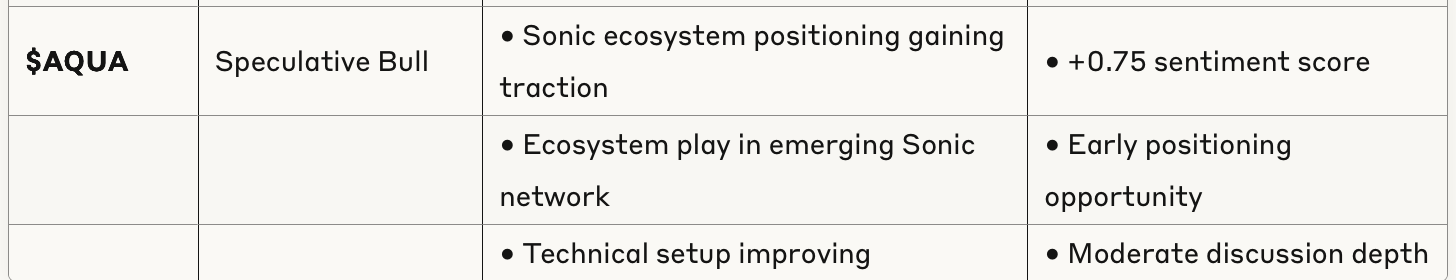

Token Analysis Table

Sector Performance

Best Performing: DeFi (May winner, ETH squeeze beneficiary)

Strongest Overall: Bitcoin (institutional adoption)

Emerging: AI agents, infrastructure, gaming

Declining: Pure meme plays without utility

Risk Assessment

Market-Wide Risks

USDT Dominance: 5-year uptrend indicating altcoin structural weakness

Token Unlocks: Accelerating unlock schedules creating selling pressure

Market Fatigue: "Exhausted onchain participants" noted

Fed Policy: Performance tied to monetary policy pivots

Sector-Specific Risks

Meme Coins: Quality execution becoming critical, narrative saturation

AI Tokens: "Sell the news" events common on launches

DeFi: Dependent on broader market liquidity and ETH performance

Infrastructure: Long development cycles, execution risk

Technical Risks

Bitcoin: 100K-102K critical support zone

Altcoins: BTC dependency for next leg higher

Correlation: Traditional finance correlation increasing