Market Edge, 29th May, 2025

Alpha from CT and YT

The crypto market is experiencing a narrative-driven phase with strong institutional adoption, infrastructure maturation, and yield mechanism evolution. AI agents, DeFi yield primitives, and meme coin speculation dominate current discussions with Bitcoin showing consolidation patterns and Ethereum displaying relative strength.

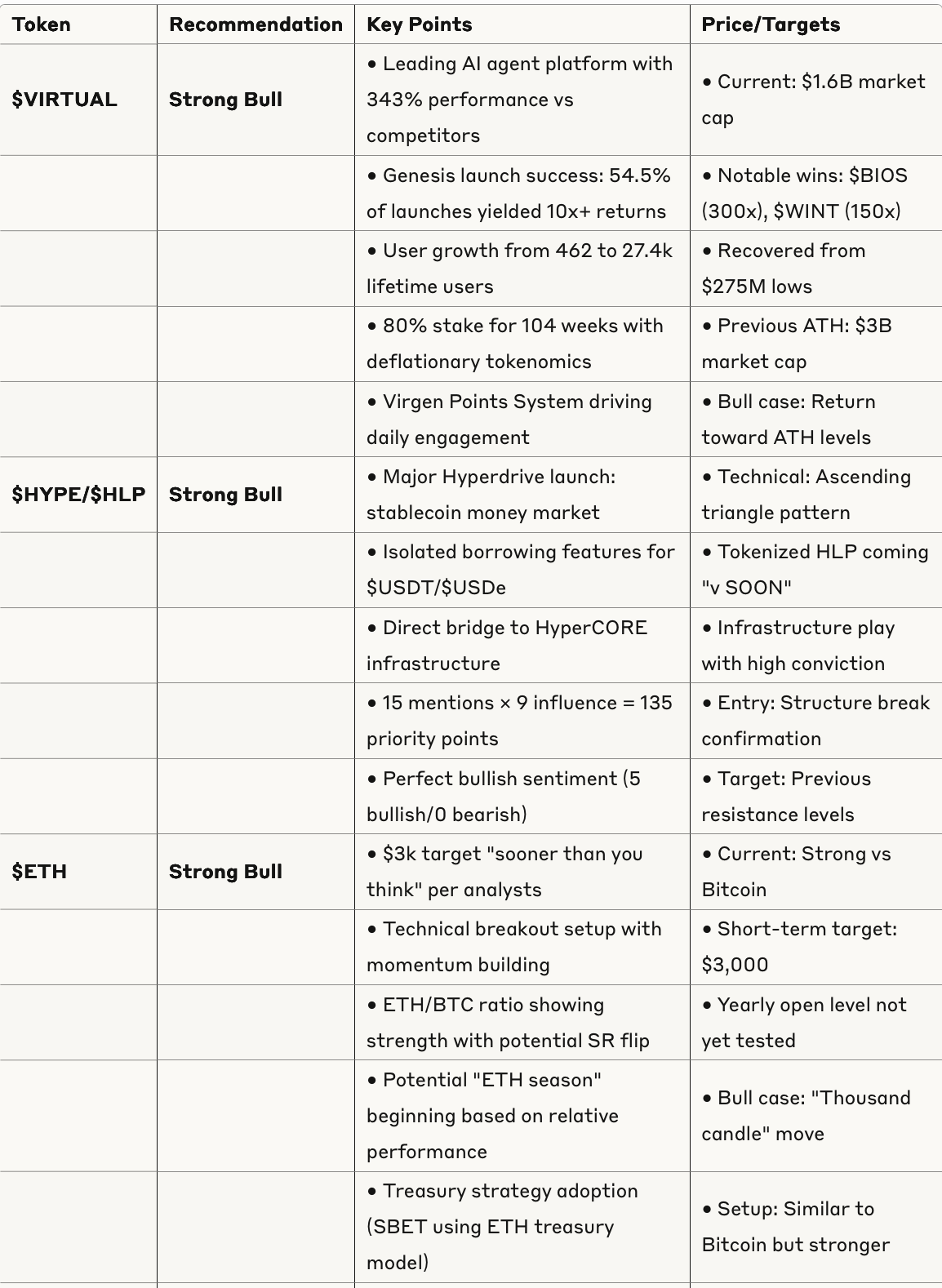

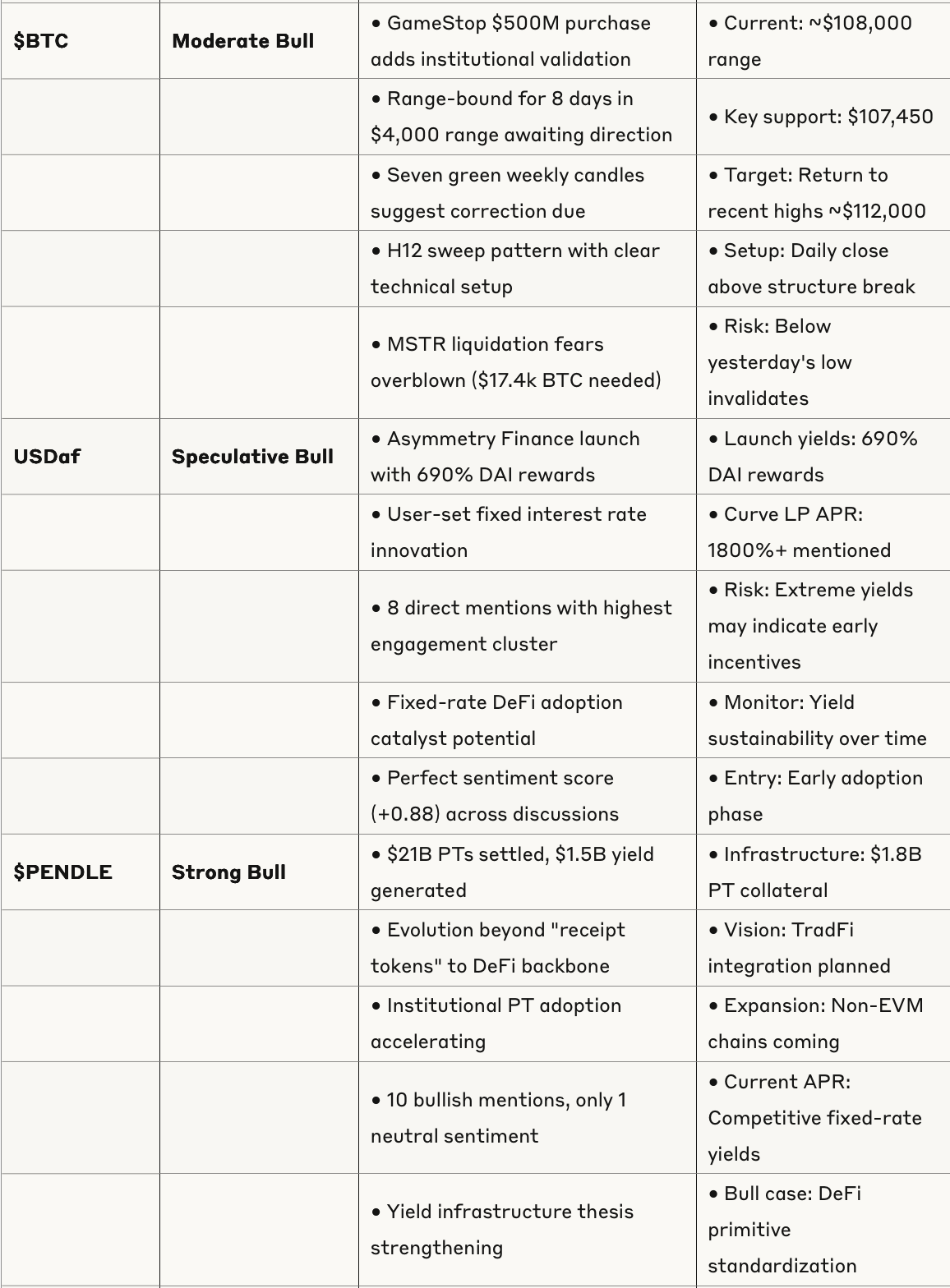

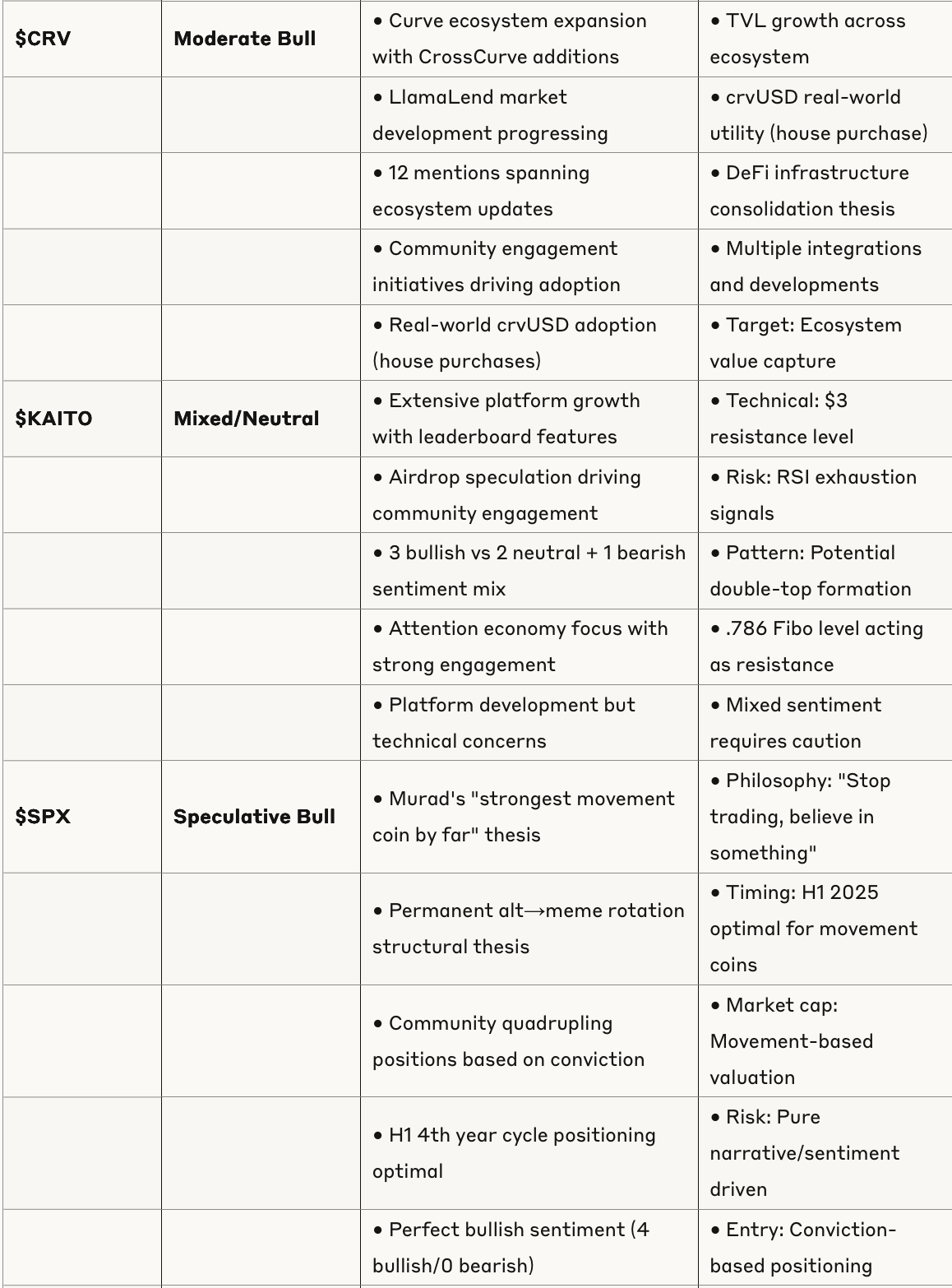

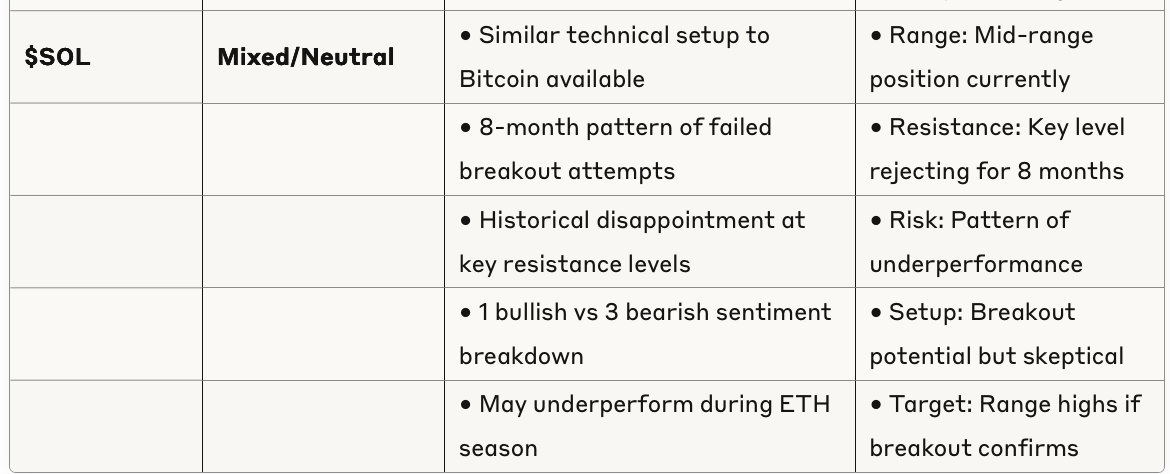

Token Analysis

Market Context Analysis

Overall Market Conditions

Cycle Position: H1 of 4th year cycle - historically optimal for movement/narrative coins

Institutional Flow: Accelerating with GameStop $500M BTC purchase, BlackRock ETF growth

Volume Trends: Meme token volume down from $18B to $8B (50% decline over two weeks)

Narrative Rotation: From pure memes → L1s → DeFi → AI agents → Infrastructure plays

Sector Performance

AI Agents: Clear leader with $VIRTUAL showing 343% outperformance

DeFi Infrastructure: Yield primitives maturing (Pendle, USDaf innovations)

Meme Coins: Facing fatigue but quality projects maintaining momentum

Traditional Alts: Struggling against meme/AI competition

Key Catalysts

Regulatory Optimism: JD Vance statements about firing Gary Gensler

Infrastructure Development: Hyperliquid ecosystem expansion

Yield Innovation: Fixed-rate mechanisms gaining adoption

Institutional Adoption: Corporate treasury strategies expanding

Risk Assessment

Market-Wide Risks

Leverage Concerns: James Wynn -$87M loss highlighting position sizing risks

Meme Fatigue: Volume decline suggests speculative cooling

Correlation Risk: Seven green weekly BTC candles historically unsustainable

Technical Risk: Multiple tokens showing exhaustion signals

Token-Specific Risks

USDaf: Extreme yields (1800%+) may indicate unsustainable incentives

$KAITO: Technical exhaustion with RSI concerns and double-top potential

$SOL: 8-month rejection pattern at key resistance levels

Yield Tokens: Interest rate model transitions can cause "sharp, unexpected drops"

Narrative Risks

AI Agent Bubble: Rapid growth may lead to correction

DeFi Complexity: Infrastructure transitions creating winners/losers

Regulatory: Despite optimism, enforcement actions remain possible

Market Structure: AMM vs CLOB debate showing infrastructure uncertainty

Investment Themes

Primary Opportunities

AI Agent Infrastructure - $VIRTUAL leading with proven track record

Yield Primitive Evolution - Pendle, USDaf driving fixed-rate adoption

Ethereum Strength - Technical and fundamental setup superior to Bitcoin

Infrastructure Consolidation - Hyperliquid ecosystem, Curve expansion

Risk Management Guidelines

Position Sizing: Learn from James Wynn situation - avoid excessive leverage

Yield Chasing: Exercise caution with extreme APR offerings (>500%)

Technical Levels: Respect support/resistance, especially on failed breakout patterns

Narrative Rotation: Be prepared for sector shifts as market matures

Conclusion

The current market phase favors infrastructure plays and proven utility over pure speculation. AI agents lead innovation, DeFi yield mechanisms are maturing, and institutional adoption provides fundamental support. However, technical exhaustion signals and extreme yield offerings warrant cautious position sizing and risk management.

Bottom Line: Focus on proven platforms ($VIRTUAL, $PENDLE), infrastructure expansion ($HYPE, $ETH), and sustainable yield mechanisms while avoiding overleveraged positions and unsustainable yield chasing.