Market Edge, 27th May, 2025

CT/YT/ Substack Alpha

Market Overview

The crypto market is showing cautiously bullish momentum with Bitcoin consolidating above key resistance levels around $107K while altcoins demonstrate sector rotation into AI, gaming/casino, and DeFi yield narratives. Institutional adoption continues accelerating through treasury strategies, while leverage concerns persist at current levels.

Key Market Drivers:

Bitcoin treasury strategy adoption creating systematic demand

AI infrastructure tokens maintaining strong momentum

DeFi yield optimization becoming more sophisticated

Gaming/casino narrative emerging with institutional backing

Extreme leverage positions creating liquidation risks

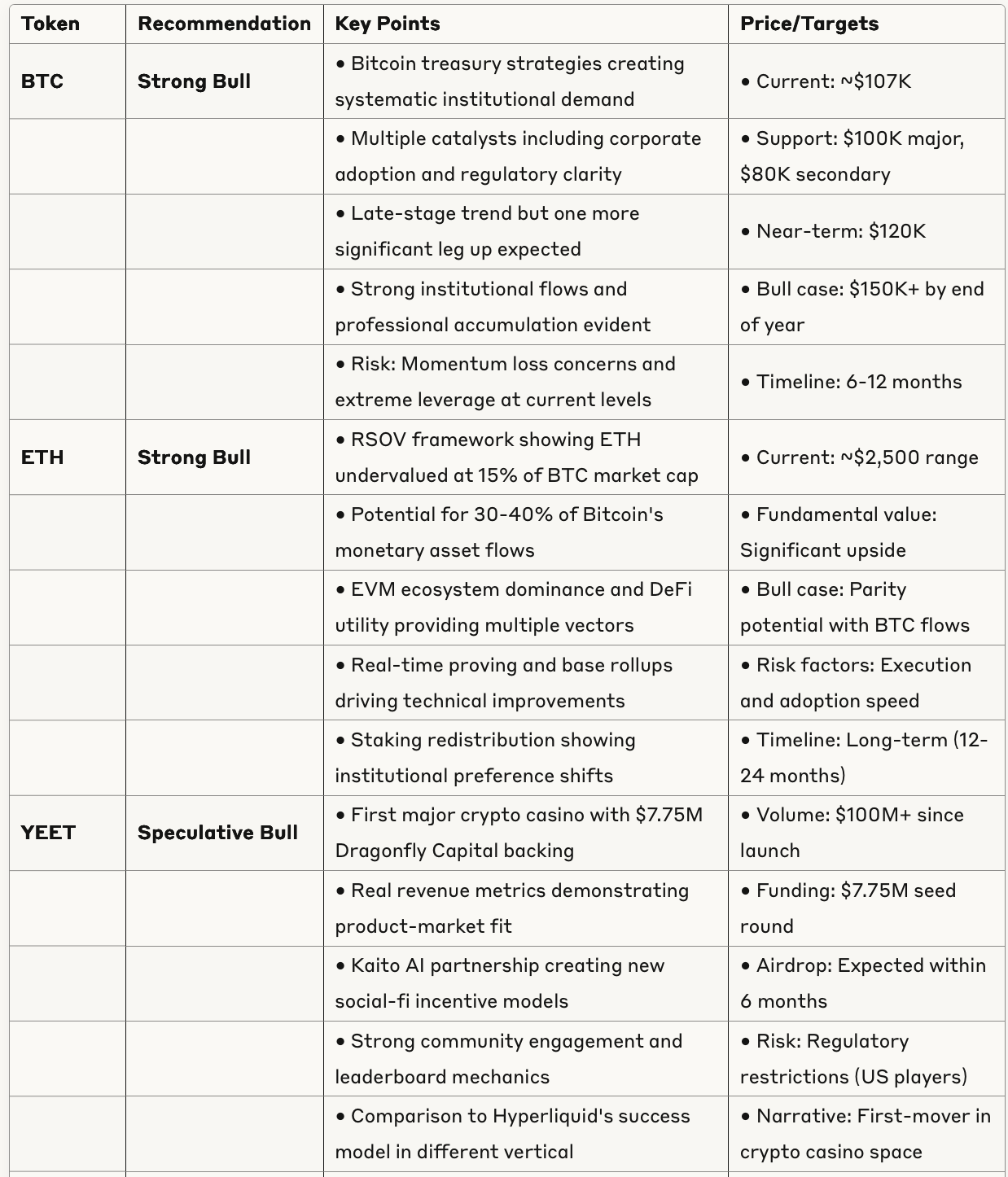

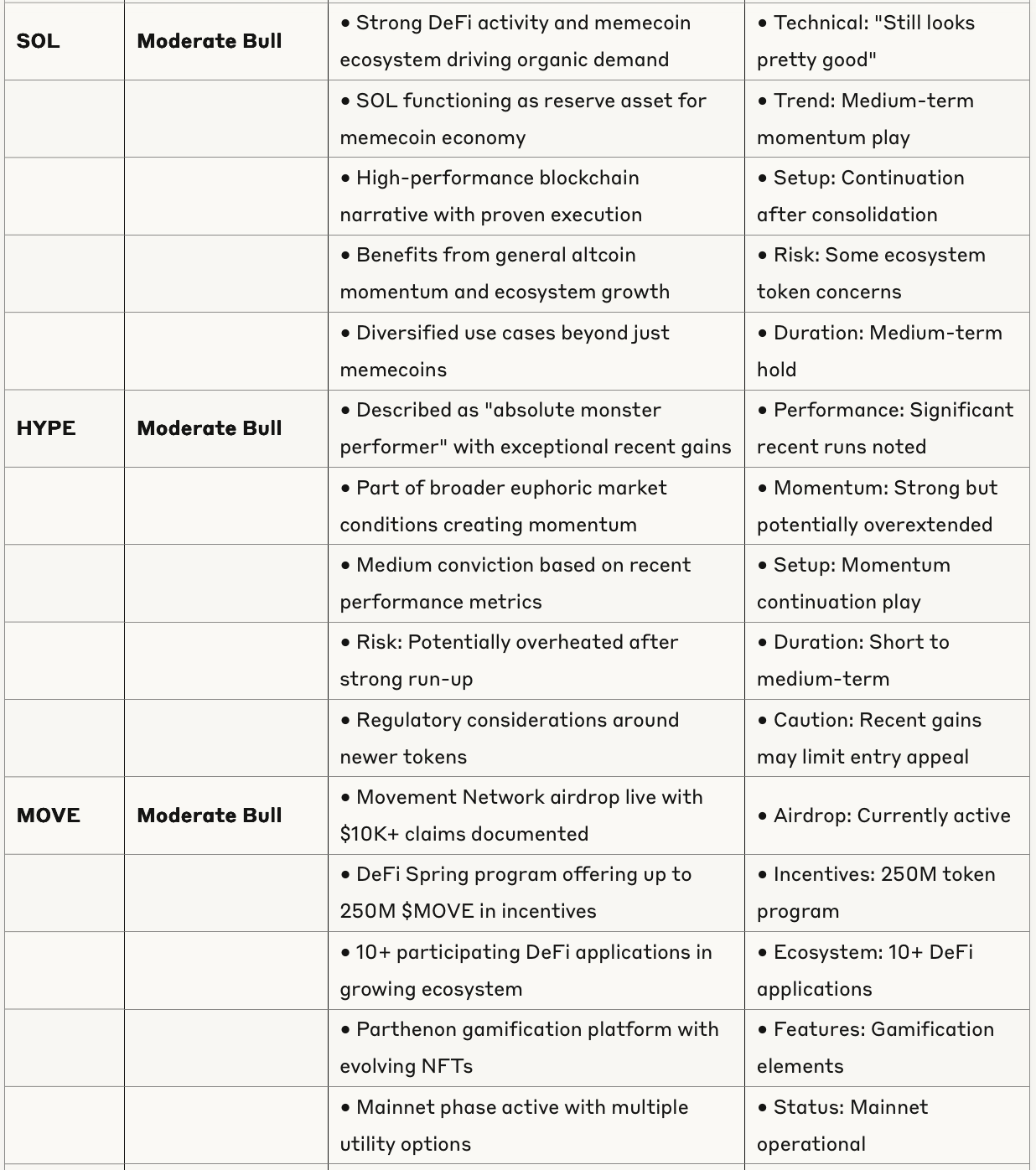

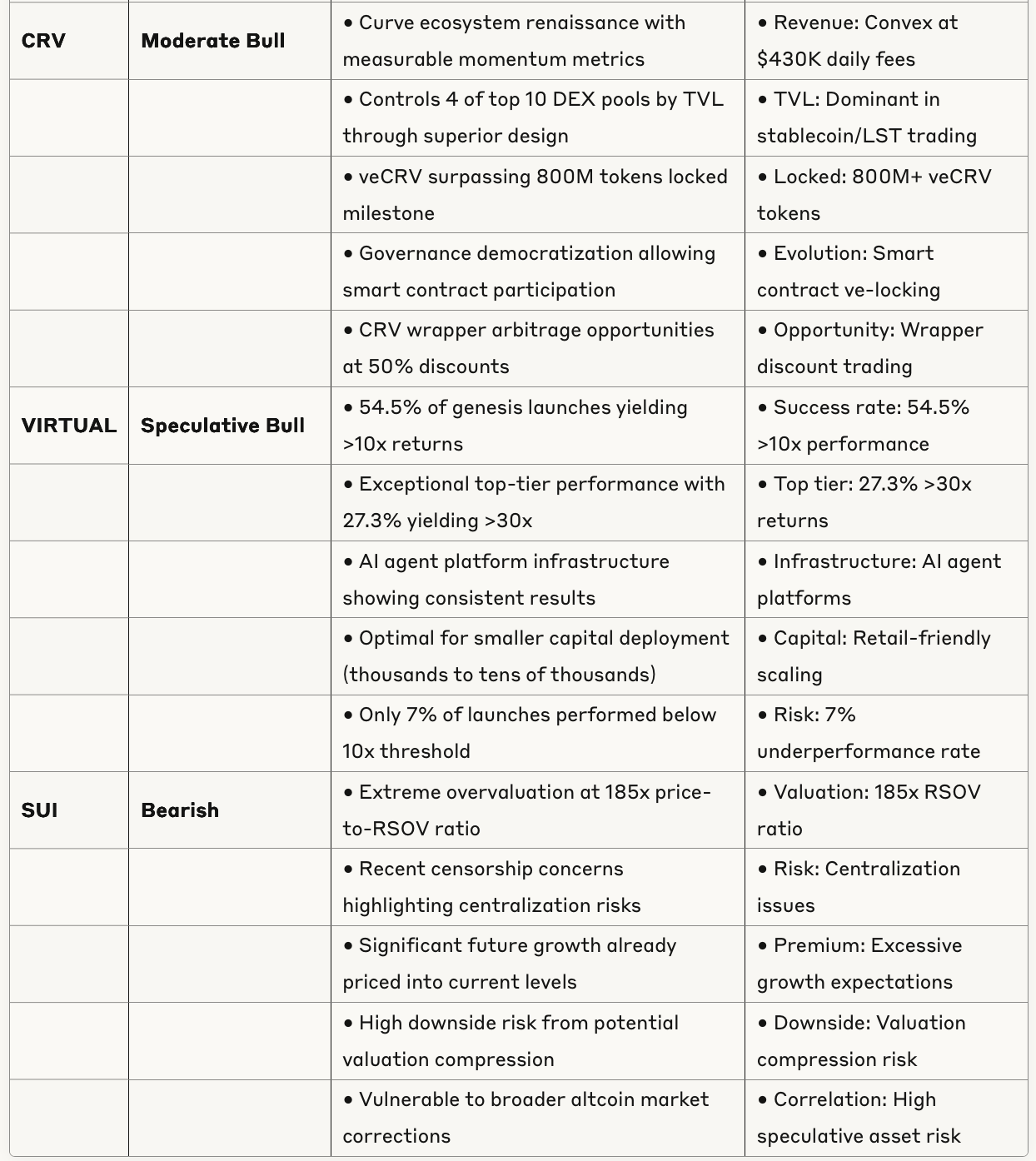

Token Analysis Table

Sector Analysis

🏆 Gaming/Casino Narrative

Emergence Level: High Priority

YEET leading with institutional backing and real metrics

First major crypto casino achieving $100M+ volume

Kaito AI integration creating new social-fi models

Regulatory arbitrage opportunities in permissionless gaming

🤖 AI Infrastructure

Momentum Level: Sustained Growth

Virtual Protocol showing consistent 10x+ launch performance

AI token market cap at $11.3B with 9% growth

Infrastructure and agent tokens leading sector performance

Retail-friendly capital deployment strategies emerging

🏦 DeFi Yield Optimization

Sophistication Level: Advanced

Curve ecosystem renaissance with measurable fee growth

CRV wrapper arbitrage showing market inefficiencies

ETH staking flow redistribution indicating institutional shifts

Real yield focus replacing airdrop speculation

💰 Treasury Strategy Adoption

Institutional Level: Accelerating

Bitcoin treasury companies expected in every major market

Capital structure arbitrage creating "Bitcoin yield"

Professional accumulation evident in flow data

Regulatory clarity improving institutional access

Risk Assessment

⚠️ High Priority Risks

Extreme Leverage: $800M+ liquidation risk around $107K BTC

Late-Stage Momentum: Market showing signs of potential exhaustion

Regulatory Uncertainty: Geographic restrictions limiting participation

Valuation Extremes: Some tokens showing unsustainable premiums

📊 Technical Risks

Bitcoin consolidation above resistance showing fragility

Fear & Greed index firmly in greed territory

USDT dominance approaching critical 4% level

High-profile trader liquidation psychology

🌍 Market Structure Risks

Correlation to traditional markets through treasury companies

Concentration risk in specific narratives (AI, gaming)

Liquidity concerns in smaller cap altcoins

Potential sector rotation creating volatility

Investment Implications

🎯 High Conviction Opportunities

Bitcoin Treasury Play: Systematic demand creation through corporate adoption

Ethereum Monetary Asset: Undervalued relative to Bitcoin using RSOV framework

Curve Ecosystem: Measurable renaissance with real revenue growth

Gaming/Casino Narrative: First-mover advantage with institutional backing

⚡ Speculative Opportunities

AI Infrastructure: Consistent performance but high volatility

DeFi Yield Optimization: Market inefficiencies in wrapper tokens

Airdrop Strategies: Movement Network showing continued value

🛡️ Risk Management Priorities

Monitor Bitcoin leverage levels for cascade effects

Watch USDT dominance for trend exhaustion signals

Track institutional flow changes for early rotation signs

Maintain position sizing appropriate for late-cycle dynamics

Timeline Considerations

⏰ Near-Term (1-3 months)

Bitcoin resistance break above $120K

YEET airdrop expected within 6 months

Movement Network ecosystem development

Leverage liquidation risks at current levels

📅 Medium-Term (3-12 months)

Treasury strategy proliferation across markets

Ethereum monetary asset thesis development

AI infrastructure platform maturation

Gaming/casino narrative expansion

🔮 Long-Term (12+ months)

Full institutional crypto adoption cycle

DeFi infrastructure reaching traditional finance parity

Regulatory framework maturation

Next cycle preparation and positioning