Market Edge, 26th May, 2025

Alpha from YT/ CT using claude

Overview

The crypto market is showing signs of structural evolution with Bitcoin maintaining dominance near ATHs while selective altcoin opportunities emerge. Key themes include Hyperliquid's exceptional growth metrics, emerging data/AI narratives, and continued ecosystem development across multiple chains. The market appears to be in a "dispersion not rotation" phase, requiring selective picking rather than broad exposure.

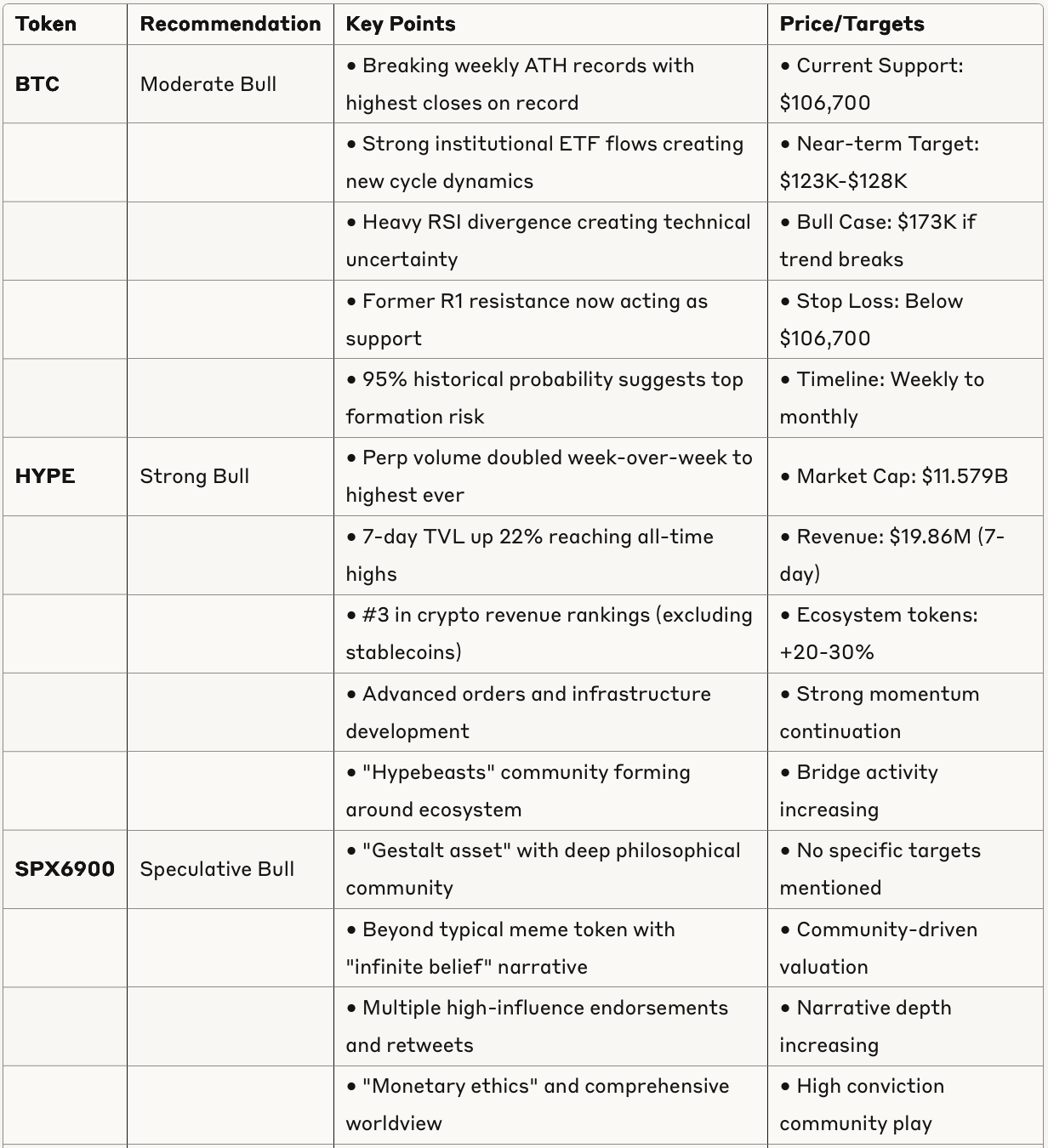

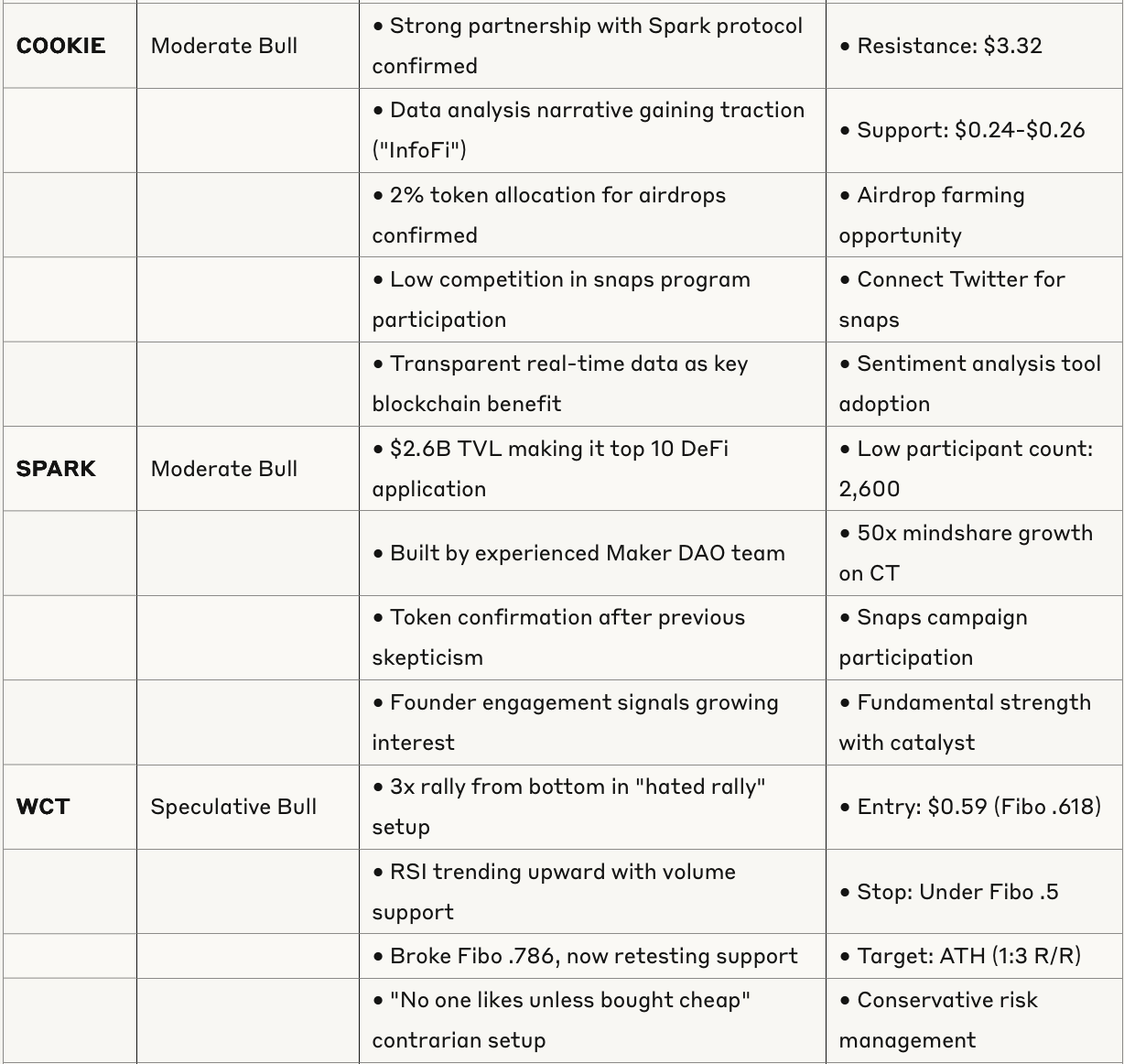

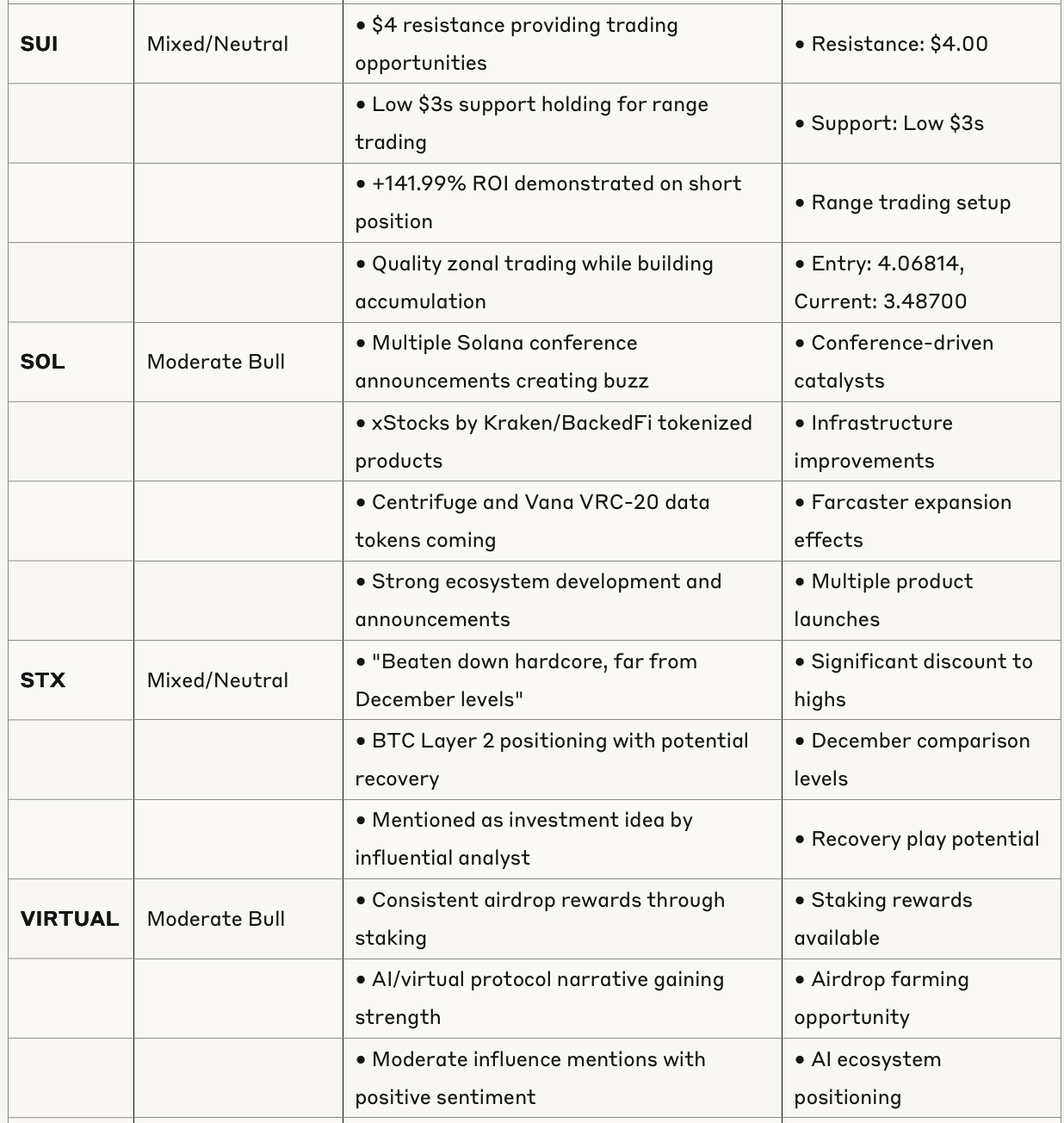

Token Analysis Table

Market Context & Sector Analysis

Overall Market Structure

The market is experiencing a "new paradigm" driven by ETF flows that differs significantly from 2017/2021 cycles. Bitcoin dominance is persisting longer than historical patterns, creating a "dispersion not rotation" dynamic where individual token selection becomes critical rather than broad sector exposure.

Key Sector Trends

🔥 Infrastructure/Trading Platforms

Hyperliquid leading with exceptional revenue metrics

Derivative platforms benefiting from Bitcoin ATH momentum

Cross-chain bridge activity increasing

📊 Data/AI Narrative ("InfoFi")

Cookie, Kaito, and similar projects gaining traction

Sentiment analysis and real-time data becoming valuable

Early adoption phase with low competition

🎮 Gaming/Social

SPX6900 showing community depth beyond typical memes

Sophia GameFi developments progressing

Social platforms integrating token mechanics

⚡ Layer 2/Scaling

Stacks (STX) positioned as potential recovery play

Solana ecosystem showing strong development activity

Cross-chain infrastructure improvements

Institutional & Macro Factors

ETF Impact Analysis

"How do we convert ETFs into alts? You really don't" - structural change

Traditional cycle patterns being disrupted

Institutional flows favoring Bitcoin over alts

Market Maturation Effects

"Already extremely diluted market" with high valuations

Systematic approach needed over speculation

Quality projects with real metrics gaining preference

Risk Assessment

Market-Wide Risks

Technical Divergences: Heavy RSI divergences on Bitcoin weekly timeframes

Funding Anomalies: Low funding at ATHs indicating potential structural changes

Cycle Timing: 18-year housing cycle analysis pointing to potential 2026 bear market

Contrarian Signals: Perennial bears turning bullish at highs

Token-Specific Risks

High Leverage Exposure: Multiple warnings about leverage at market tops

Weekend Illiquidity: "Chopfest" conditions during low-volume periods

Narrative Dependence: Many opportunities based on early-stage narratives

Regulatory Uncertainty: Limited discussion but underlying concern

Timing Considerations

Conference Catalysts: Solana announcements providing near-term momentum

Airdrop Timelines: Active farming opportunities with time-sensitive windows

Conclusion

The crypto market is in a selective phase requiring sophisticated analysis rather than broad speculation. Hyperliquid's exceptional metrics, emerging data narratives, and Bitcoin's structural strength provide the highest conviction opportunities, while traditional altcoin strategies face structural headwinds from ETF-driven market dynamics.

Key Takeaway: Success in this cycle requires being "a better picker" with systematic approaches rather than relying on broad sector rotations that may not materialize in the new ETF-influenced market structure.