Market Edge, 25th June, 2024

Market Context

Overall Market Assessment

The crypto market is displaying remarkable resilience with Bitcoin holding above $105k despite geopolitical tensions from Iran-Israel conflicts. Institutional adoption is accelerating faster than anticipated, with BlackRock accumulating Bitcoin at 3.7x the rate of miner production. The market appears to be transitioning from funding rate arbitrage opportunities to directional bias, creating setup for sustained moves.

Key Narratives

Institutional Treasury Revolution: Multiple companies adopting Bitcoin treasury strategies

AI Infrastructure Boom: Robotics and AI agent infrastructure gaining mainstream adoption

Stablecoin Integration: Major payment processors entering crypto rails

Community-Driven Assets: Mission-based tokens showing superior holder behavior

DeFi Yield Innovation: Solutions for impermanent loss and enhanced returns

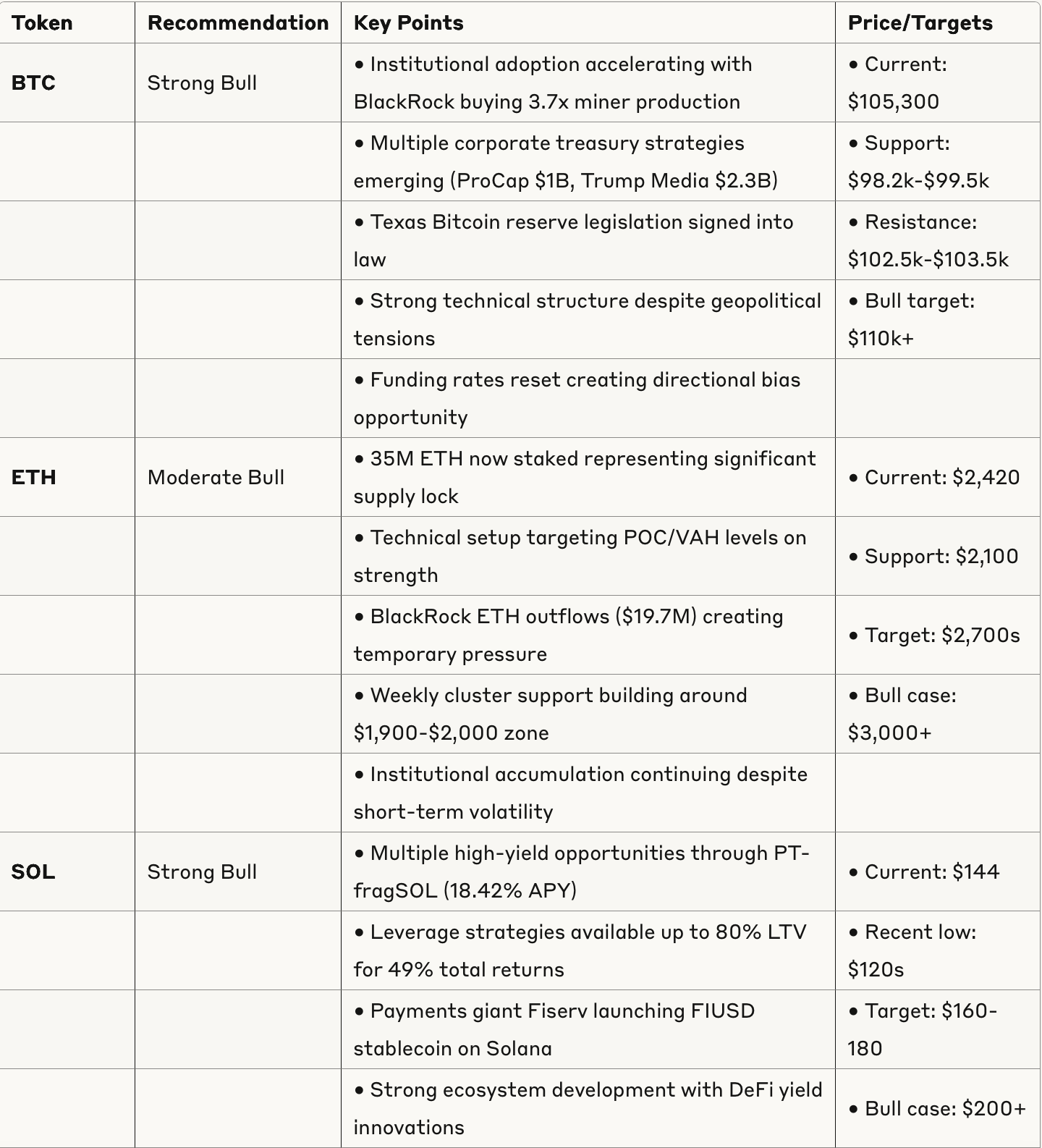

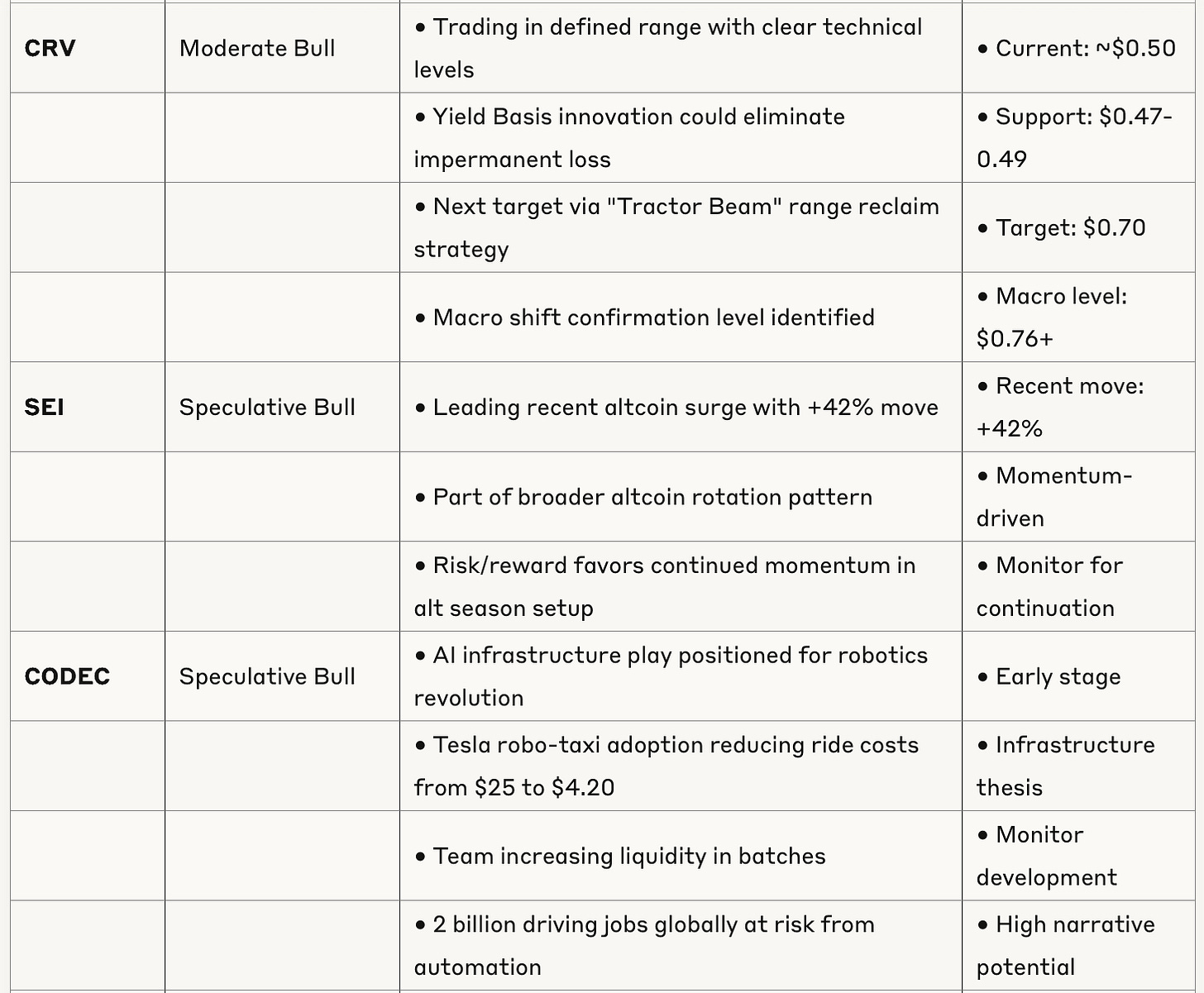

Token Analysis

Sector Analysis

Large Caps: Strong institutional flows supporting BTC/ETH

AI Tokens: $8.8B market showing 13% rebound led by infrastructure plays

DeFi: Innovation in yield optimization and cross-chain solutions

Memes: Quality metrics emerging with improved holder behavior

Altcoins: Setup for broader rotation as BTC dominance potentially peaks

Risk Assessment

Market-Wide Risks

Geopolitical tensions creating short-term volatility

Options expiration on June 27 ($15B notional) could create turbulence

Summer period expected to bring consolidation ("summer chop/blood")

Leverage strategies in yield farming carry liquidation risks

Technical Risks

ETH showing relative weakness vs BTC despite fundamentals

Funding rates indicating potential for quick reversals

Range-bound trading requiring precise timing and patience

Liquidity conditions remain challenging with ongoing "liquidity games"

Narrative Risks

AI infrastructure thesis still early stage with execution risks

Meme token volatility despite improving fundamentals

DeFi yield strategies often involve complex manual processes

Community-driven tokens susceptible to sentiment shifts

Timeline Considerations

Near-term (July): Navigate options expiration and potential volatility

Summer (Q3): Expect consolidation with selective opportunities

Q4 2025: Positioned for potential acceleration phase

Risk Management

Maintain strict position sizing on speculative plays

Use defined support levels for stop placement

Monitor funding rates for sentiment shifts

Prepare for summer consolidation period