Market Edge, 24th May, 2025

CT, YT, Edge using Claude

The crypto market is experiencing a risk-on environment with Bitcoin establishing new all-time highs around $108-111K while showing early signs of potential altcoin rotation. Key themes include institutional adoption acceleration, DeFi infrastructure renaissance, and emerging yield opportunities. The market shows sophisticated fundamental analysis replacing pure speculation, with increased focus on execution-driven projects.

Market Cap Context: Bitcoin dominance showing technical breakdown from 65% (up from 55% in December), suggesting potential alt season preparation. Overall market sentiment remains bullish but with tactical caution at current levels.

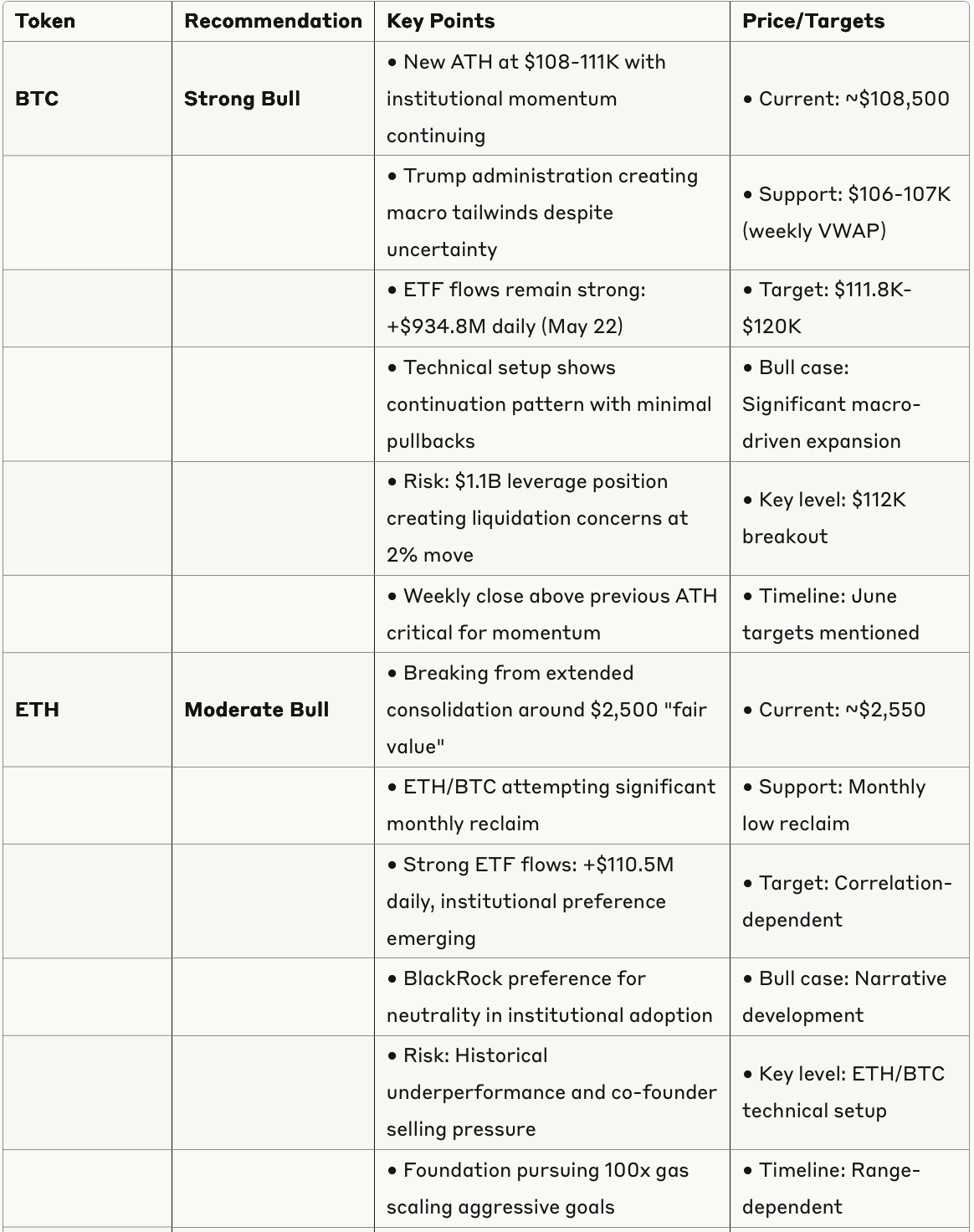

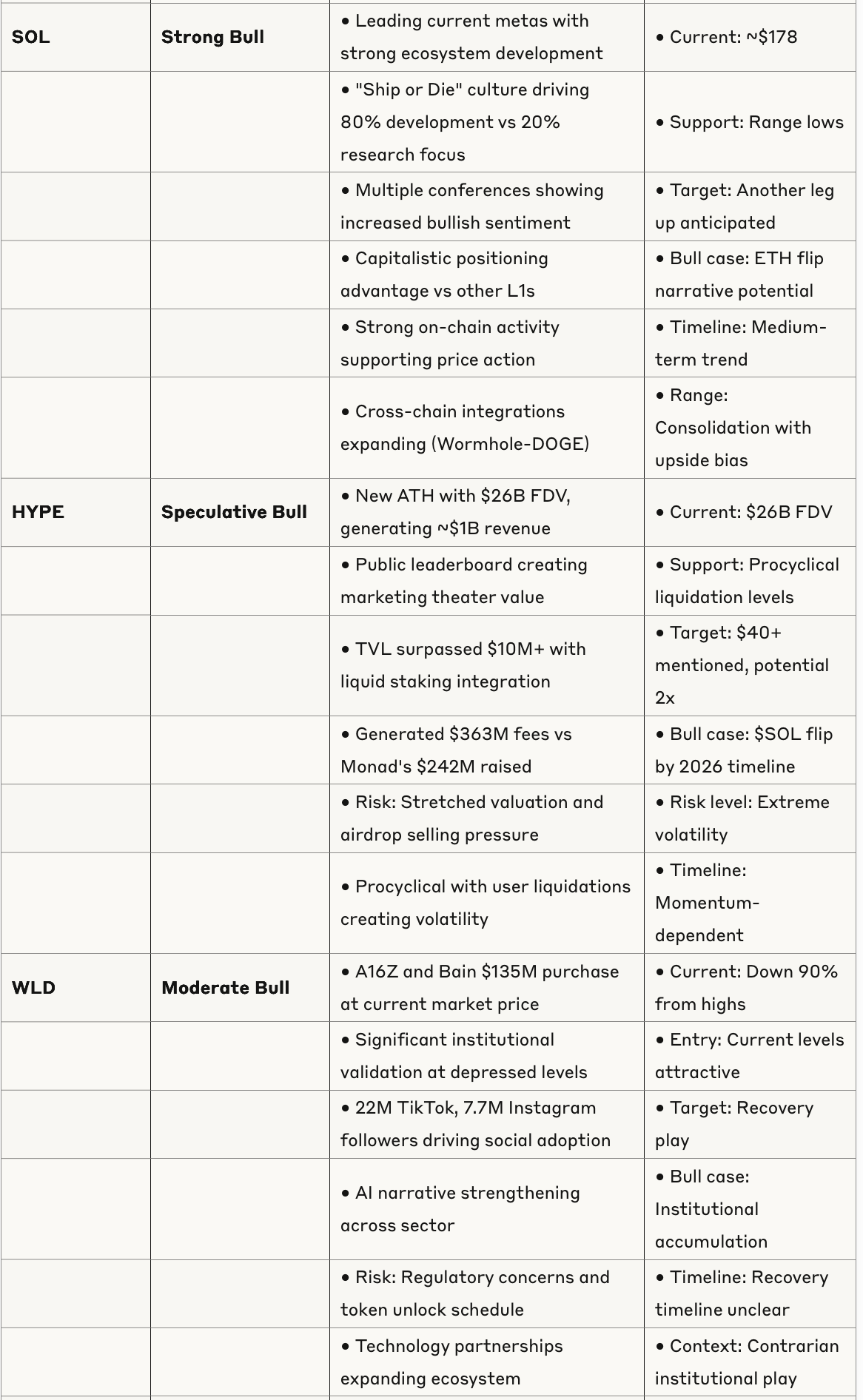

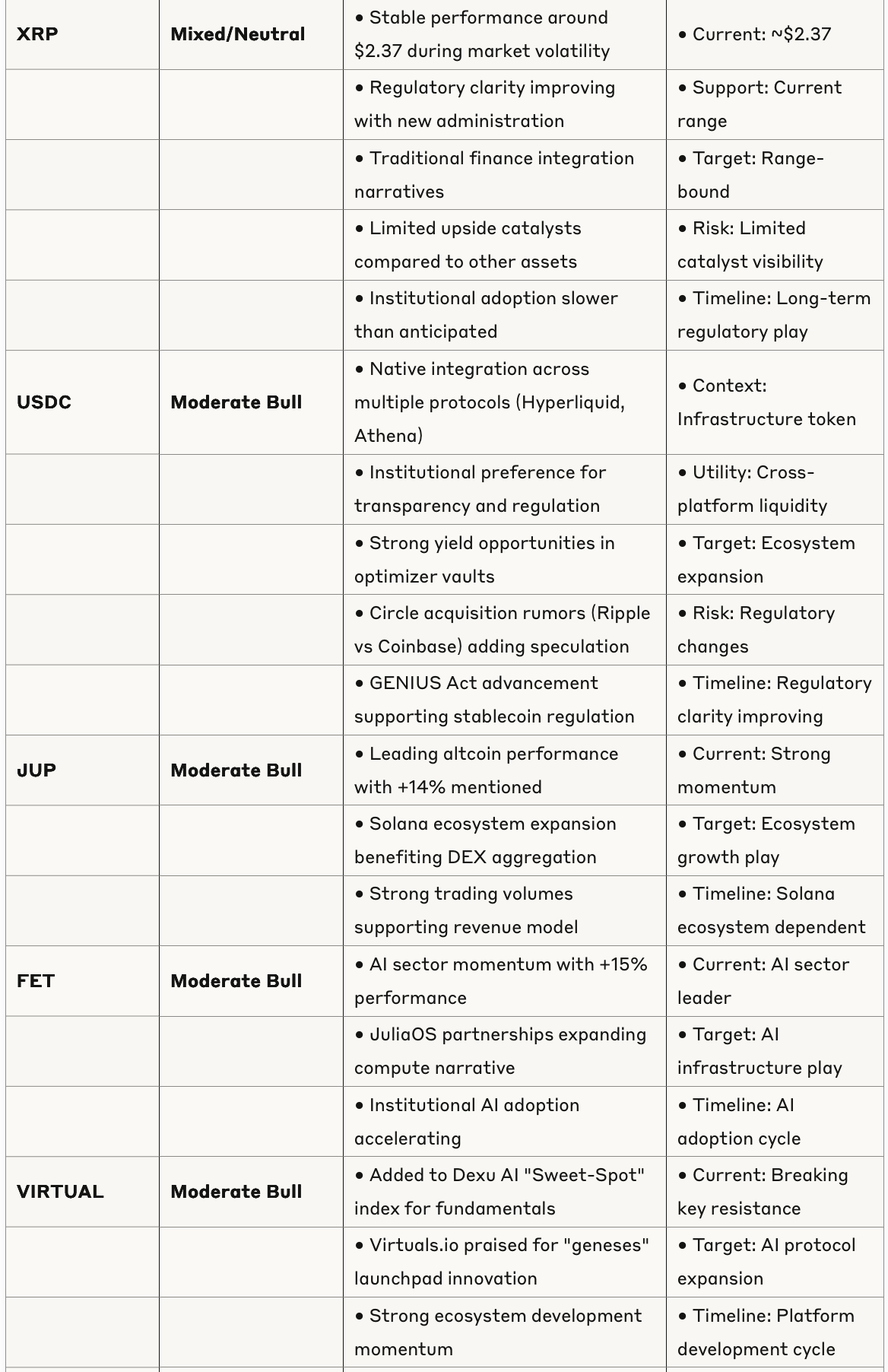

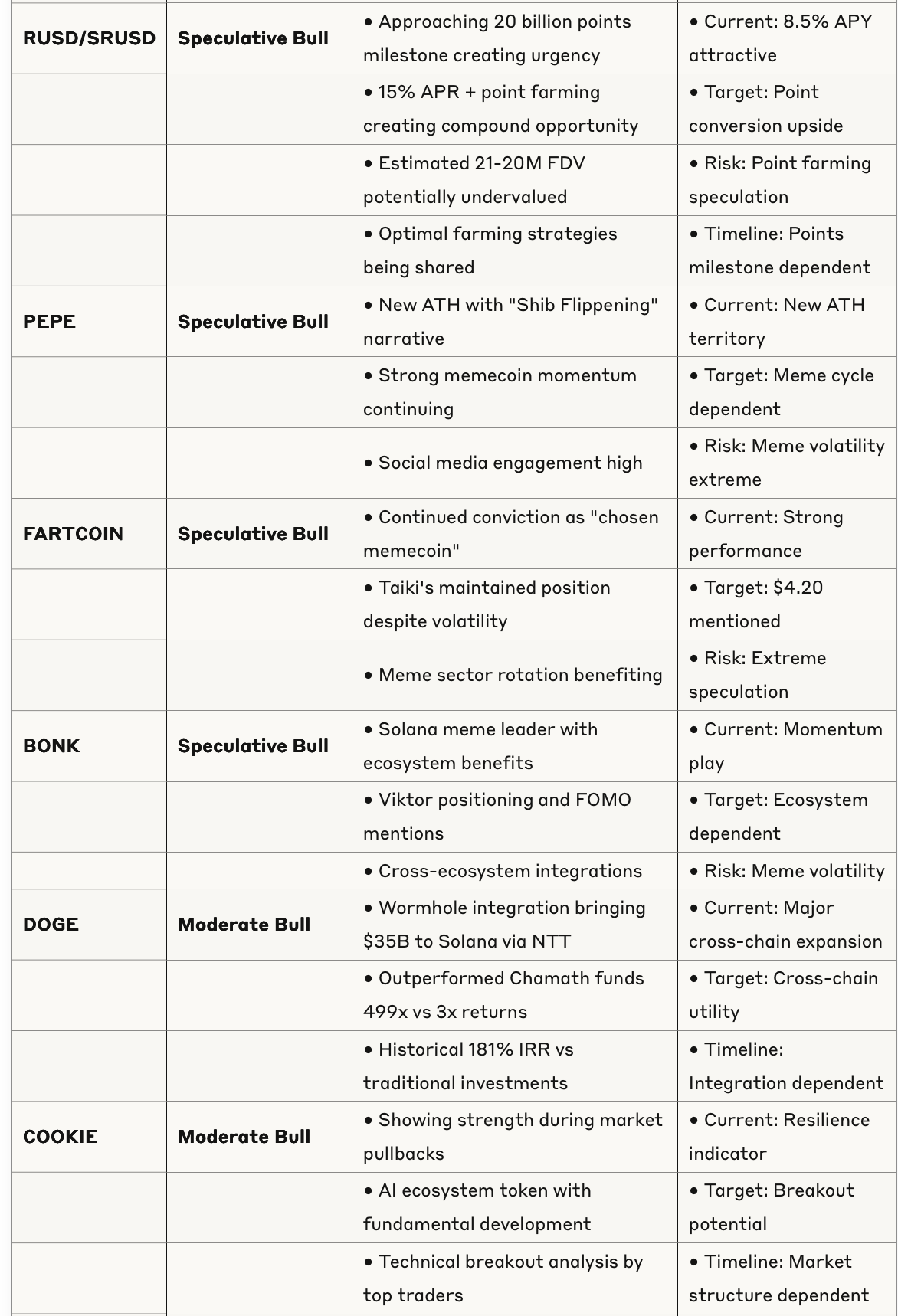

Token Analysis & Recommendations

Market Context & Sector Analysis

Overall Market Outlook

Bitcoin Dominance: Technical breakdown from 65% suggesting alt season preparation

Institutional Flows: Accelerating with ETF inflows and strategic investments

Market Phase: Late-stage accumulation transitioning to distribution preparation

Cycle Position: Mid-cycle with 6-9 months potential remaining

Narrative Evolution: From speculation to fundamental analysis and execution focus

Sector Performance Rankings

AI/Compute Tokens: Leading with fundamental development (JOS, FET, VIRTUAL)

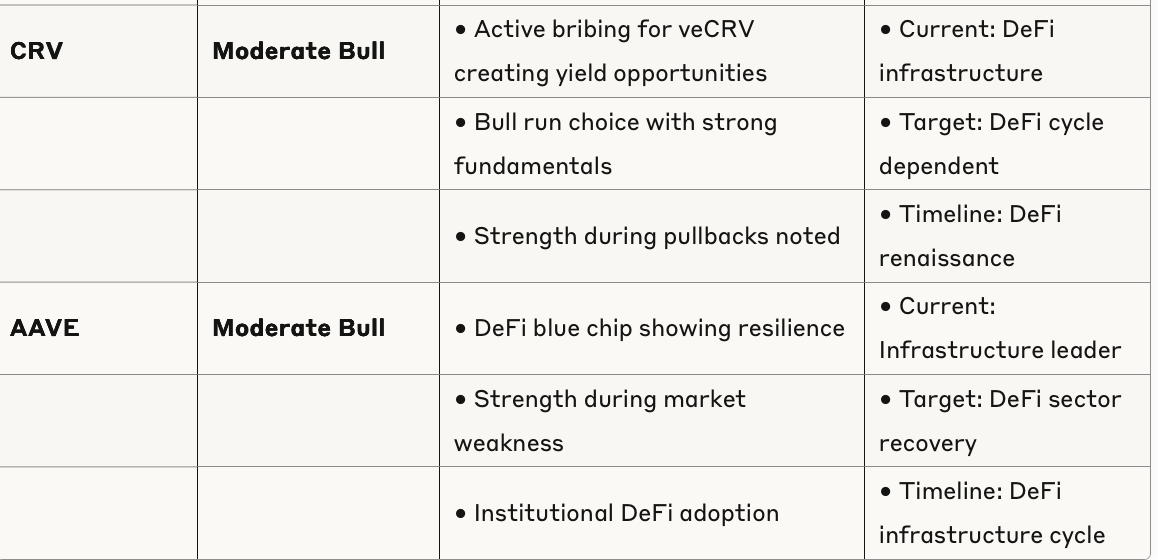

DeFi Infrastructure: Renaissance with yield focus (AAVE, CRV, HYPE)

Layer 1 Protocols: SOL leading, ETH recovering (SOL, ETH)

Meme Tokens: Selective strength with narrative evolution (PEPE, FARTCOIN)

Stablecoins: Infrastructure expansion and regulation clarity (USDC, RUSD)

Emerging Narratives

Execution Over Research: Projects shipping products gaining preference

Yield Renaissance: Complex yield strategies replacing simple farming

Cross-Chain Integration: Major assets bridging between ecosystems

Institutional Grade: Professional analysis and risk management emphasis

Regulatory Clarity: GENIUS Act and administration changes creating framework

Risk Assessment & Warnings

Market-Wide Risks

Leverage Concerns: $1.1B BTC position at risk, high funding rates

Correlation Risk: Increased TradFi correlation due to leverage at highs

Timing Risk: Extended weekend with Monday holiday creating volatility

Tariff Risk: 90-day pause expires July 9th, potential macro catalyst

Valuation Risk: Multiple tokens showing stretched metrics

Sector-Specific Risks

AI Tokens: High valuations requiring continued narrative support

Meme Tokens: Extreme volatility and speculation-driven moves

DeFi Protocols: Smart contract risks and yield sustainability

Infrastructure: Platform stability and technical execution risks

Stablecoins: Regulatory changes and competitive pressure

Technical Risk Levels

High Risk: New ATH levels with limited historical support

Medium Risk: Range-bound assets with clear support/resistance

Low Risk: Established infrastructure with fundamental support

Conclusion

The crypto market in May 2025 presents a mature bull market environment with sophisticated analysis replacing speculation. The focus on execution-driven projects, yield optimization, and institutional adoption creates multiple opportunities across sectors.

Key Takeaway: While Bitcoin continues its institutional adoption narrative, the market is preparing for broader participation with altcoins showing technical setups and fundamental improvements. Risk management remains crucial as leverage and valuations reach extended levels.

Action Items:

Monitor Bitcoin weekly close relative to ATH levels

Prepare for alt season rotation with quality asset identification

Implement yield strategies in DeFi renaissance

Maintain risk management discipline at current market levels

Track regulatory developments and institutional flows