Market Edge, 23rd May, 2025

Edge from CT, YT. Letter made using Claude & Prompt Engineering

Overall Market Context

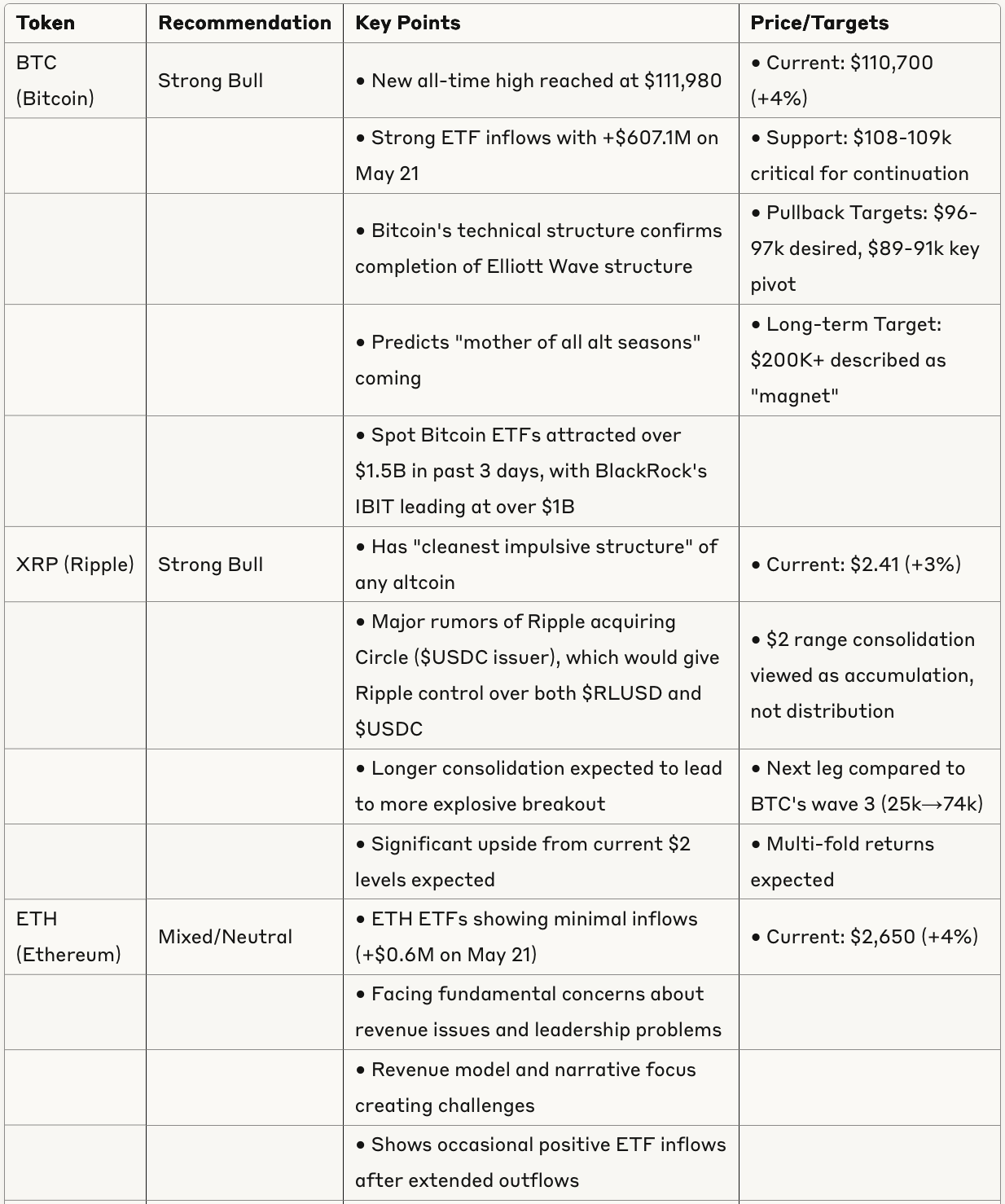

The crypto market is currently in a strong bullish phase, with Bitcoin reaching a new all-time high of $111,980. Bitcoin has seen a 4% increase to $110,700, while Ethereum is up 4% at $2,650, XRP up 3% at $2.41, and SOL up 5% at $178. With a market cap of $2.19 trillion, Bitcoin has become the fifth-largest asset globally, surpassing Amazon. BTC ETFs showed strong inflows with a total net daily flow of +$607.1M for May 21, 2025.

Several key market dynamics are worth noting:

The market is showing signs of an upcoming altcoin season, with multiple high-influence accounts positioning for altcoin outperformance.

Despite Bitcoin's price strength, there's a narrative shift questioning its status as "digital gold," with evidence suggesting it behaves more like a tech stock than gold during risk-off periods.

The overall market sentiment is cautiously optimistic with strong underlying bullishness on established projects and growing excitement around cultural phenomena.

The current technical setup supports continued bull market and alt season preparation, with strong technical confluence.

Funding rates in most crypto exchanges are at the baseline or below it, described as "the least euphoric new all time highs in the history of bitcoin."

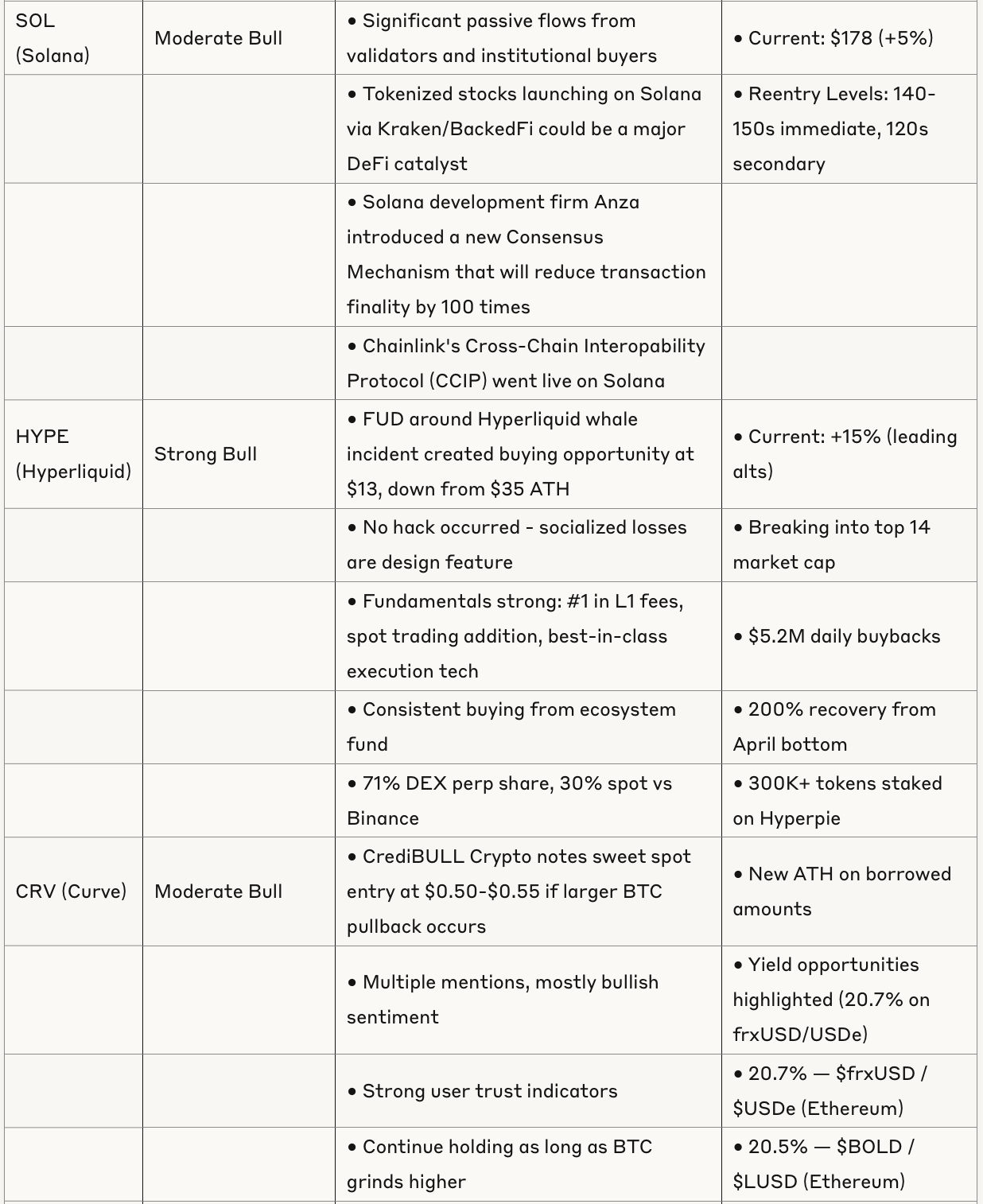

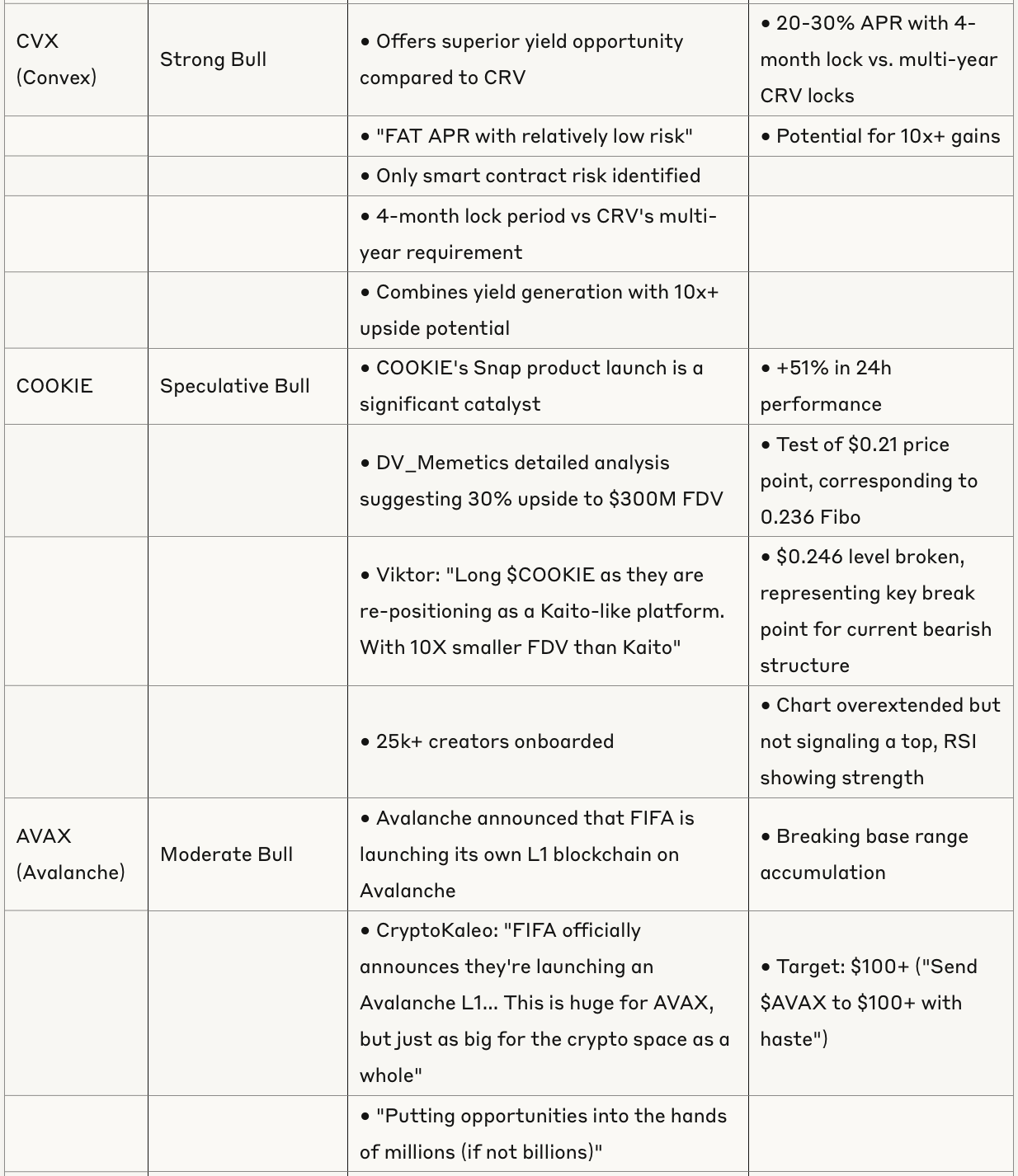

Token Analysis

Emerging Narratives

1. Major M&A Consolidation

Ripple-Circle acquisition rumors suggest major consolidation in stablecoin infrastructure, potentially reshaping DeFi liquidity flows. This would be described as "total liquidity warfare" and making Ripple the "Federal Reserve of crypto."

2. Alt Season Preparation

Multiple high-influence accounts are positioning for significant altcoin outperformance, supported by Bitcoin's technical structure completion. Bitcoin dominance is showing local weakness, setting the stage for altcoin outperformance. CryptoKaleo notes: "Resume the move lower for Bitcoin Dominance. Send the alts." XO adds: "Bitcoin dominance local lower high for now - encouraging for alts."

3. Meme Coin Evolution

SPX6900 is representing "abstracted belief" rather than pure speculation, gaining cultural significance and recognition from Bitcoin OGs. Ritesh is predicting memes as the "new meta" for Asia open.

4. DeFi Protocol Maturation

The Hyperliquid incident shows protocol resilience and design-by-feature approach. There's an evolution from "move fast and break things" to refined user experience with improvements in Ostium vault UX addressing user friction points. Aave now holds 20% of all DeFi TVL, showing consolidation in the DeFi space.

5. Traditional Finance Bridge Building

There's progress in stablecoin legislation, CFTC consideration of crypto perpetual futures in the US, and Kraken launching equities on Solana, all indicating bridge-building with traditional finance. Michigan's House introduced bills to allow state investments in Bitcoin, support crypto mining, and oppose a U.S. central bank digital currency (CBDC).

Risk Factors

Technical Risks

Miner selling pressure near ATH could create supply pressure.

Record Open Interest levels creating liquidation risk.

Bond market volatility presenting a macro headwind.

Narrative Risks

The Ripple-Circle acquisition remains an unconfirmed rumor.

Elliott Wave analysis requires continued Bitcoin strength.

Project-Specific Risks

Hyperliquid TVL dropped 19% to $480M after the whale incident (but represents <1% of TVL and ~one month's profit).

High-risk/high-reward nature of meme token plays.

Exploit activity with "Cetus on SUI faces exploit" indicating protocol risk in DeFi.

Bottom Line

The crypto market on May 22, 2025, is dominated by:

Major M&A rumors (Ripple-Circle) that could reshape stablecoin markets

Strong technical confluence supporting continued bull market and alt season preparation

Strategic positioning in quality altcoins with strong risk/reward profiles

Platform development supporting ecosystem maturation

Key action items include monitoring Ripple-Circle news verification, watching Bitcoin 108-109k support, considering accumulation zones in quality altcoins, and preparing for potential alt season rotation.

The market shows signs of a maturing ecosystem with significant institutional involvement, continued technical strength, and evolving narratives that bridge traditional and crypto finance. While Bitcoin continues to lead with new all-time highs, the stage is being set for altcoin outperformance, with particular strength in established DeFi protocols, innovative platforms, and strategic project acquisitions.