Market Edge, 22nd May, 2025

CT, YT alpha using claude and prompt engineering

Current Market Overview

Bitcoin just hit $108K and is making a serious run at new all-time highs, with the entire crypto market riding this momentum. We're seeing some of the strongest institutional flows in months, with $329M flowing into BTC ETFs on May 20th alone. The vibe across crypto Twitter is electric - everyone from major analysts to degen traders is calling for a "super cycle" that could send prices way higher than anyone expected.

The big picture: We're likely in the middle stages of this bull run, not the end. Hedge funds are actually net short $25Bin equity futures (the biggest short position in a decade), which historically means they're about to get squeezed hard. Add in Texas passing their Bitcoin reserve bill and Tether printing $2B USDT, and you've got all the ingredients for continued upside.

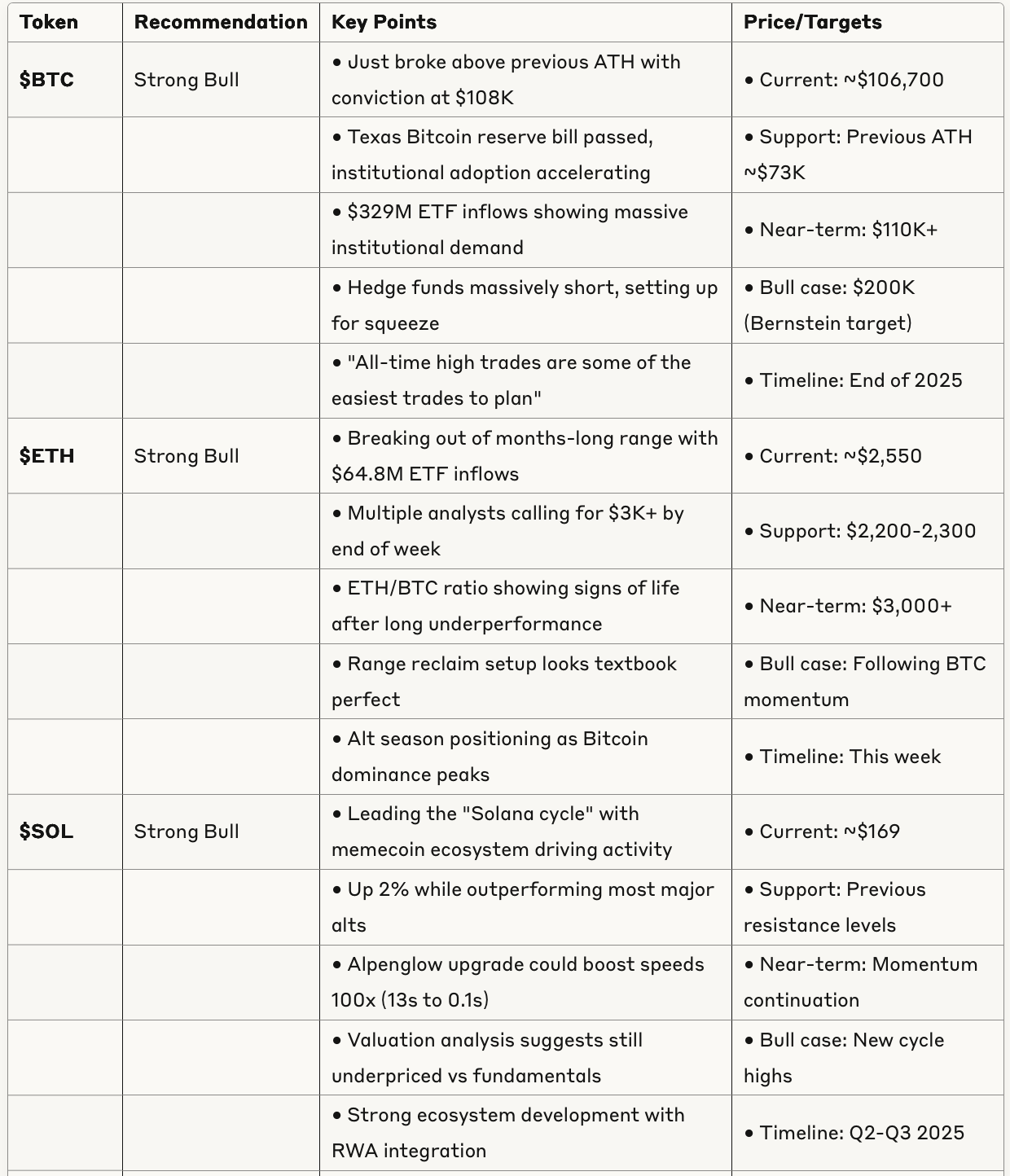

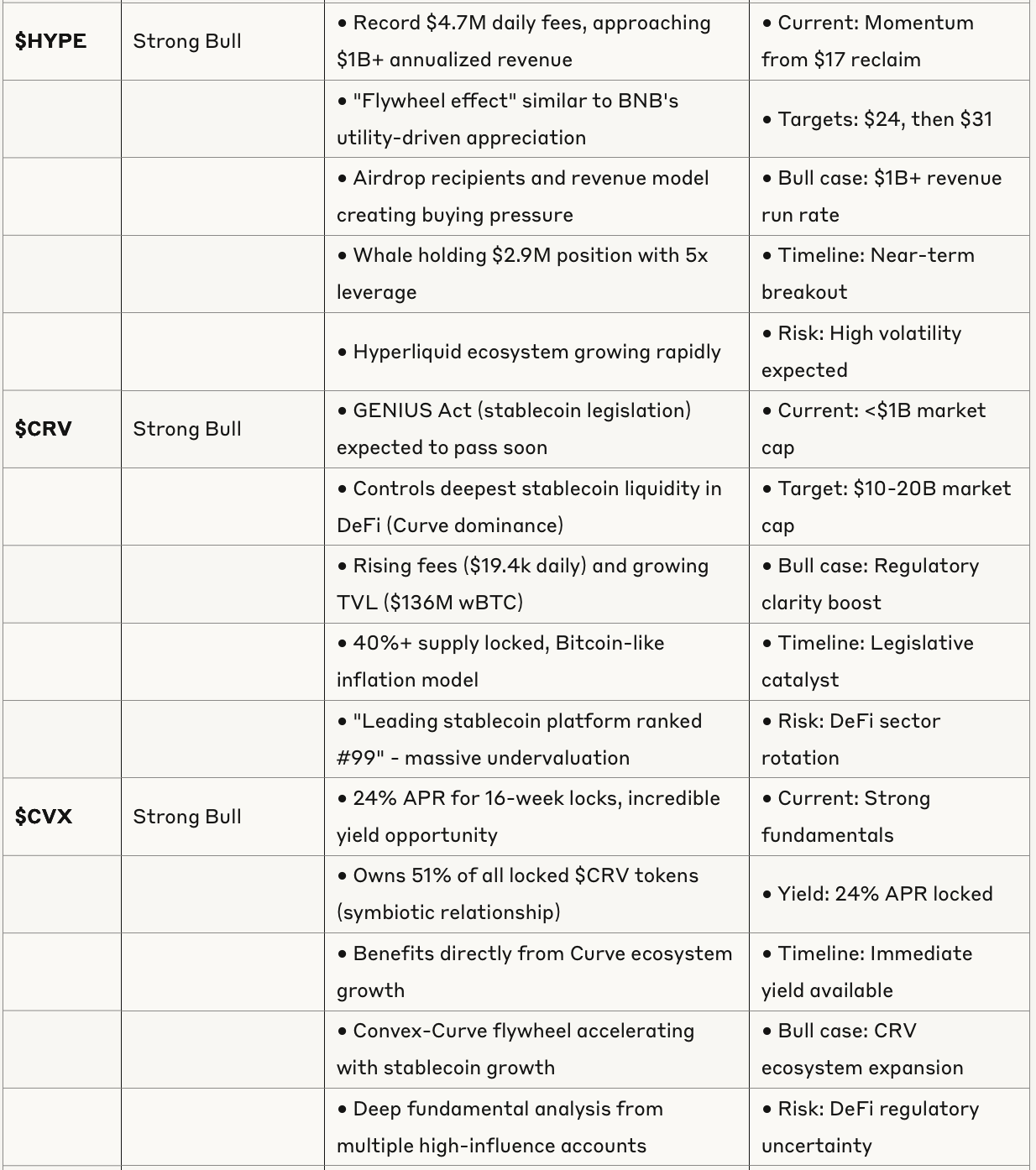

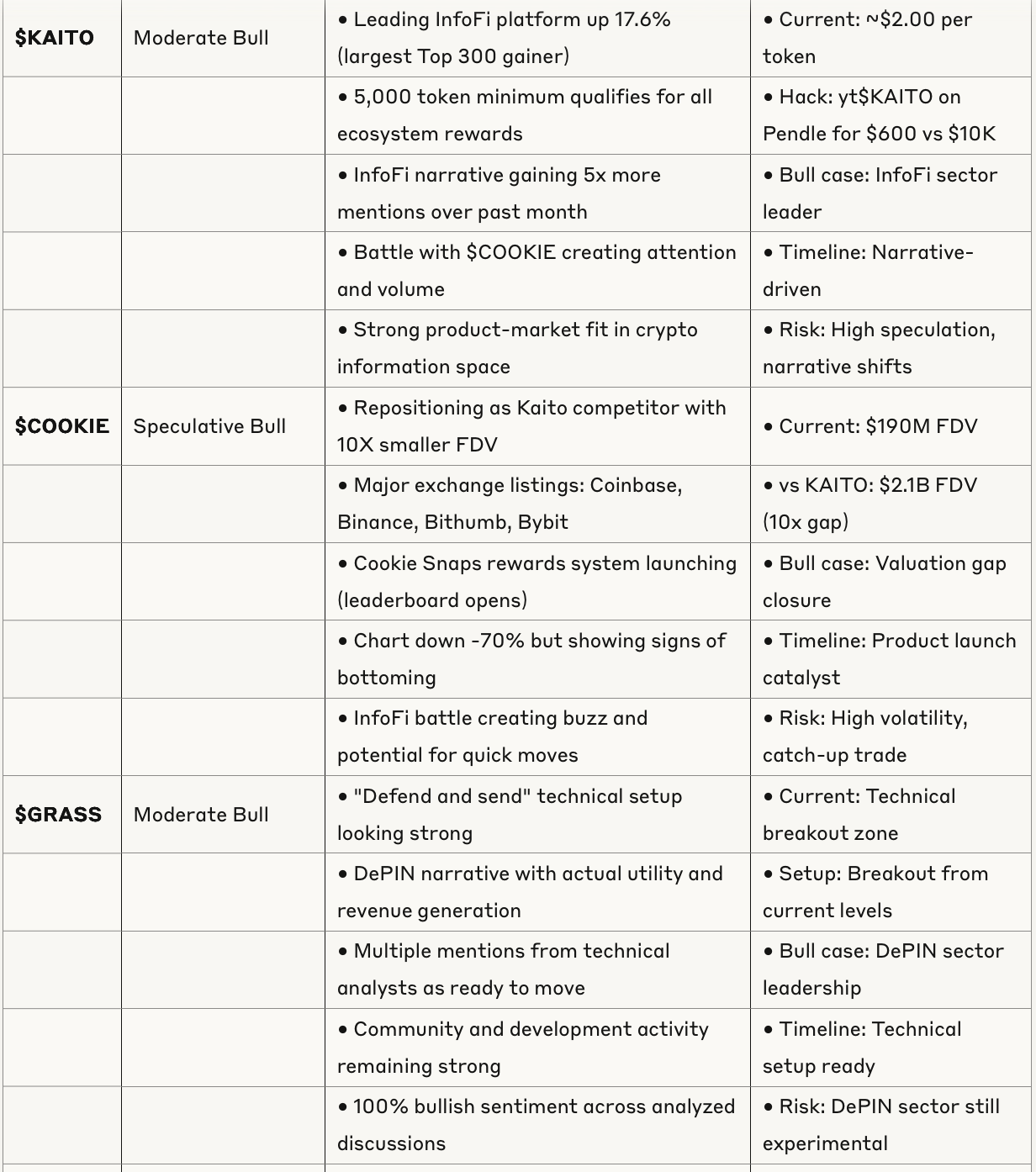

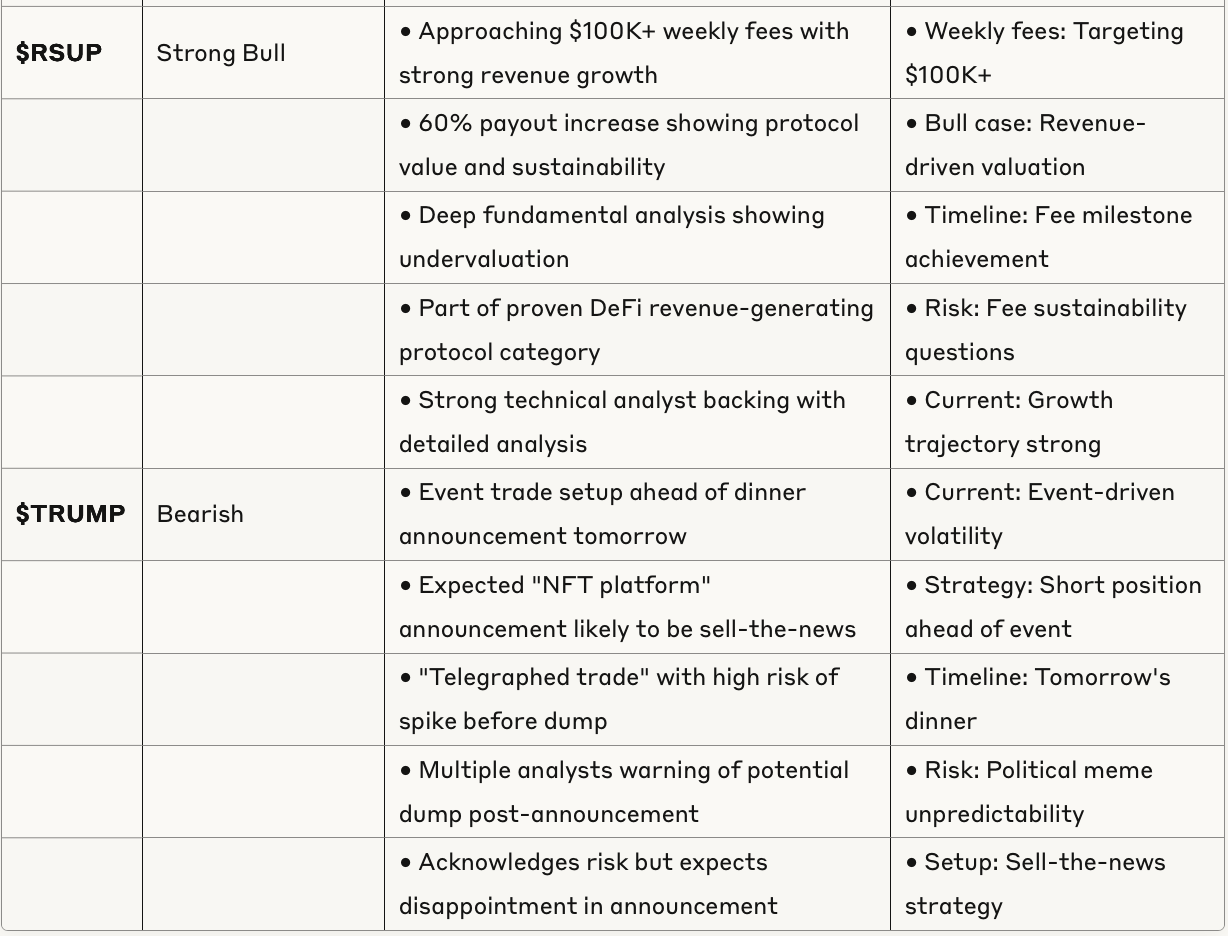

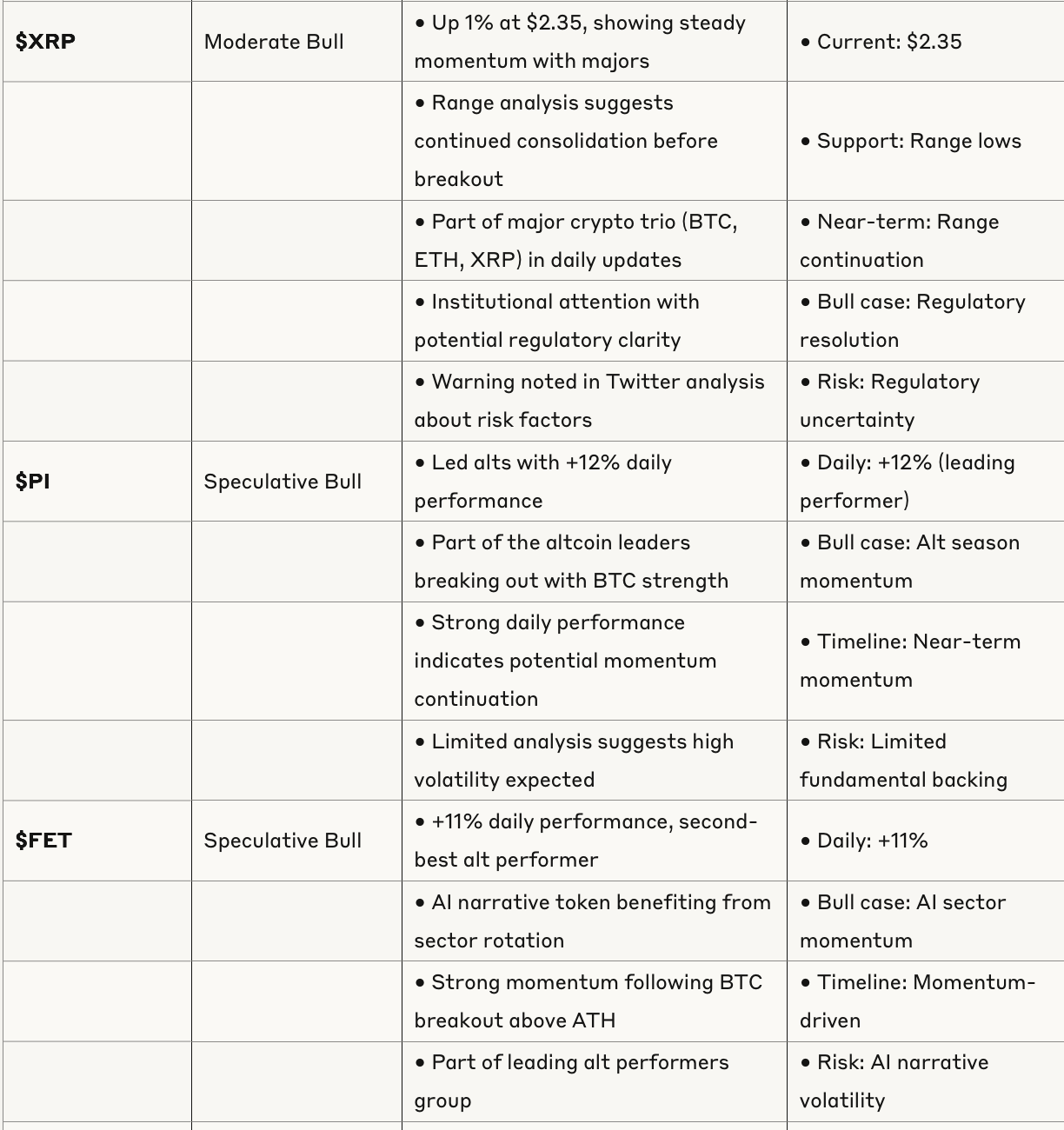

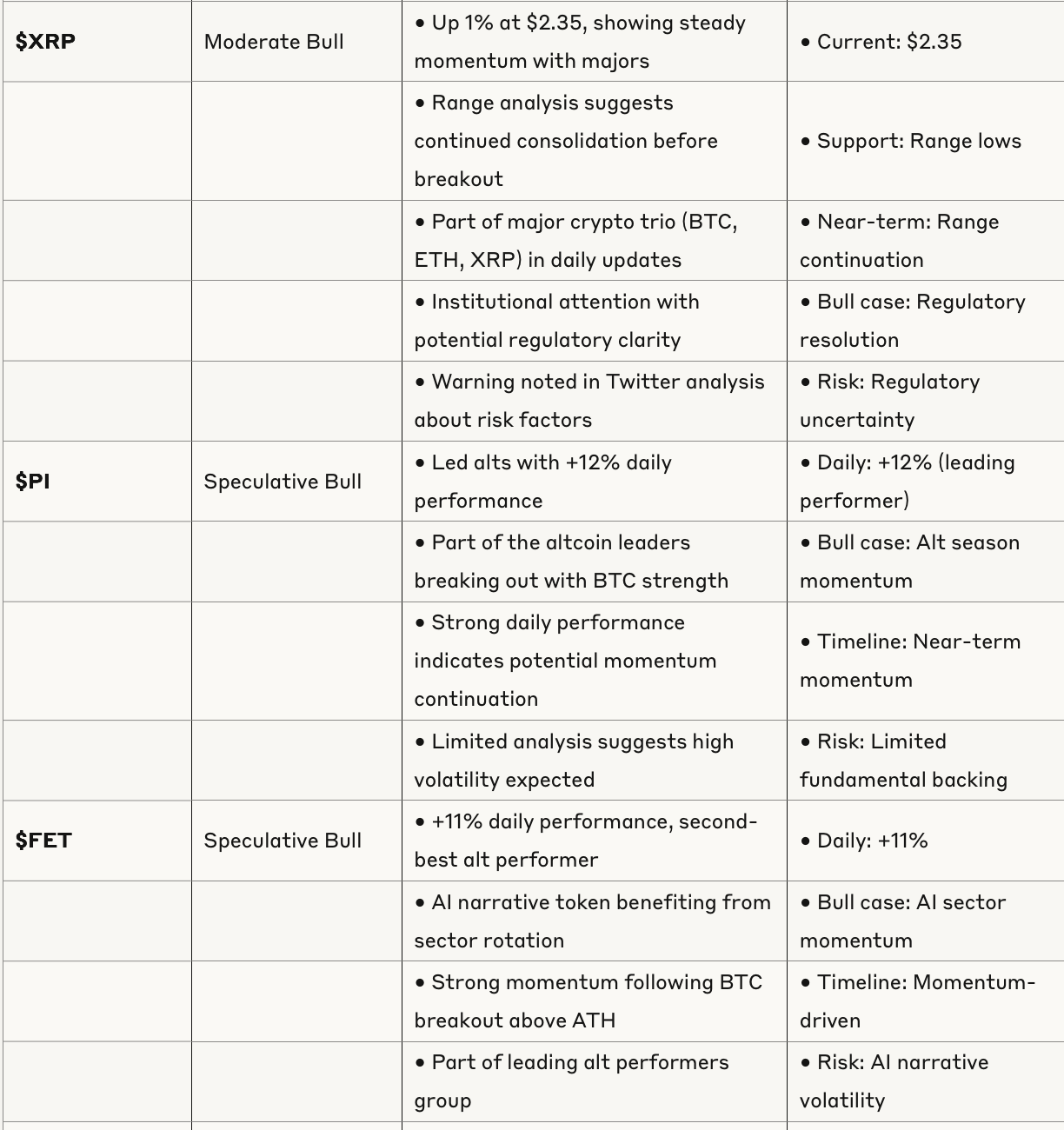

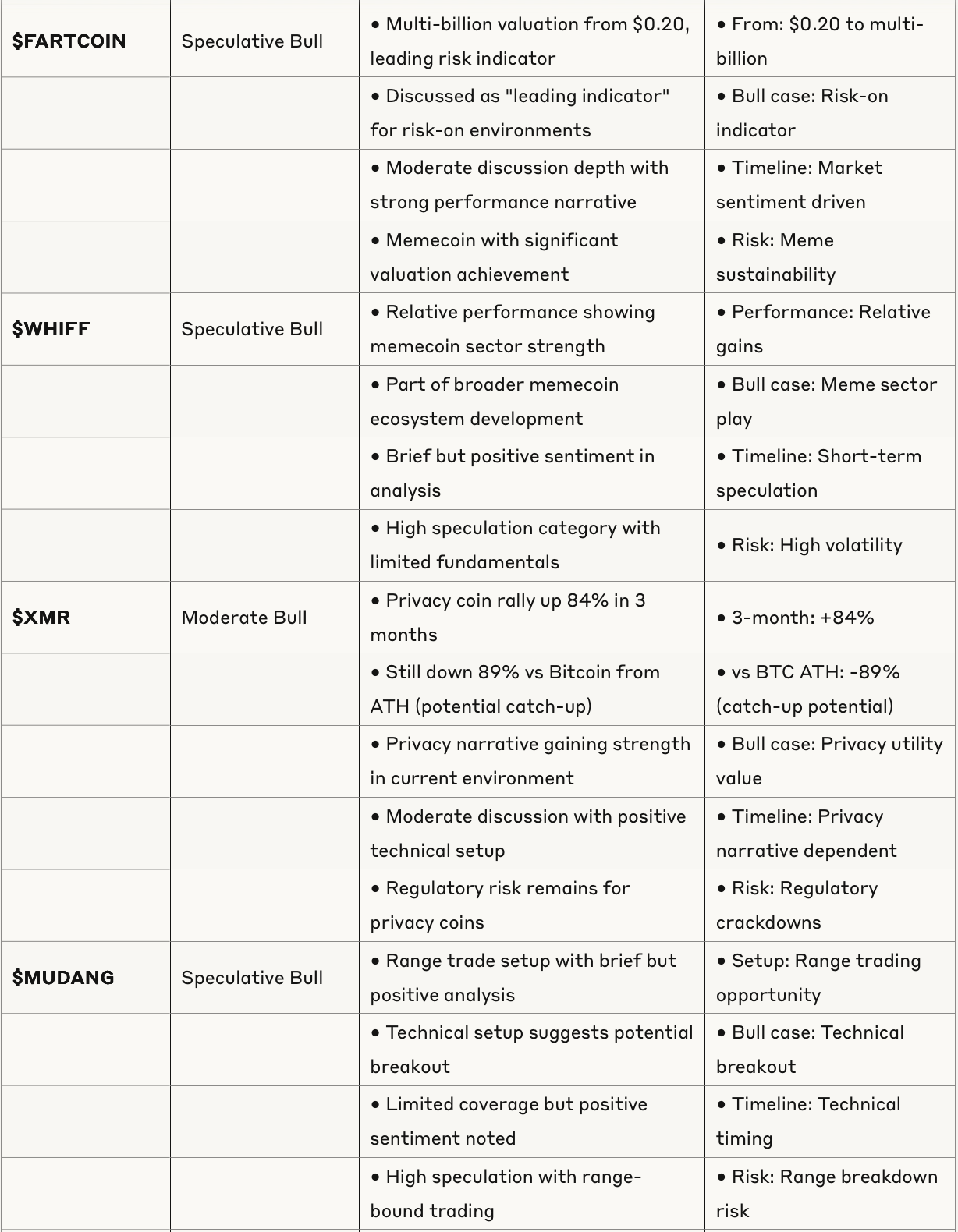

Token Analysis & Recommendations

Key Market Narratives

The "Super Cycle" is Real

This isn't just another bull run. We're seeing institutional adoption at a scale never witnessed before. Bitcoin hitting $108K isn't the top - it's the middle. When Bernstein raises their price target to $200K and Texas is building a Bitcoin reserve, we're talking about a fundamental shift in how the world views crypto.

InfoFi Wars Are Heating Up

The battle between $KAITO and $COOKIE represents something bigger - the emergence of "Information Finance" as a real sector. $COOKIE's 10X smaller valuation compared to $KAITO while getting major exchange listings could be the trade of the month if they execute their repositioning correctly.

DeFi Infrastructure Renaissance

$CRV and $CVX aren't just another DeFi play - they're infrastructure for the entire stablecoin economy. With stablecoin legislation likely passing, these protocols control the rails that trillions in stablecoin volume will flow through.

Revenue-Generating Protocols Taking Off

Forget governance tokens with no utility. $HYPE with $4.7M daily fees and $RSUP approaching $100K weekly feesshow the market is finally rewarding protocols that generate real cash flow.

Risk Factors to Watch

The $1B Liquidation Risk: There's a public $1B leveraged Bitcoin position with liquidation around $103K. If this gets hit, we could see a quick dump to sub-$100K levels before continuing higher.

Cycle Timing Concerns: Multiple analysts note we're likely in the "middle" of this cycle (½ to ¾ mark), which historically means increased volatility ahead.

Overleveraged Environment: With $1B+ in leveraged positions floating around, any significant move could trigger cascading liquidations in either direction.

Bottom Line

This market feels different. The combination of institutional adoption, regulatory clarity, and technical breakouts is creating a perfect storm for continued upside. Bitcoin above $100K isn't a ceiling - it's a floor.

The smartest money is positioning in revenue-generating protocols (HYPE, $RSUP, $CRV/ CVX) while riding theInfoFi narrative (KAITO/KAITO/COOKIE) and staying long the majors ( $BTC, $ETH, $SOL).

Yes, there's risk. Yes, leverage is dangerous. But missing this move because you're worried about a correction could be the biggest mistake of the cycle. Position appropriately, manage risk, and ride the wave.