Market Edge, 19th May 2025

CT, YT, Substack alpha from last 24 hours.

Crypto Market Analysis - May 20, 2025

Market Overview

The crypto market is experiencing an interesting inflection point right now. Bitcoin recently achieved its highest weekly close ever at approximately $106,000, but has since pulled back to around $103,000 amid increased volatility. This price action comes against a backdrop of significant macro developments, including Moody's downgrade of US credit rating on Friday and ongoing discussions about Trump's upcoming tariff announcements.

ETF flows remain a bright spot with Bitcoin ETFs recording +$260.2M in net inflows on May 16th, while Ethereum ETFs saw more modest inflows of +$22.2M. Institutional adoption continues to accelerate with Metaplanet purchasing another 1,004 BTC (~$104M) and Basel Medical Group announcing plans to acquire $1B in Bitcoin.

Let's dive into the specific opportunities across major assets and emerging sectors.

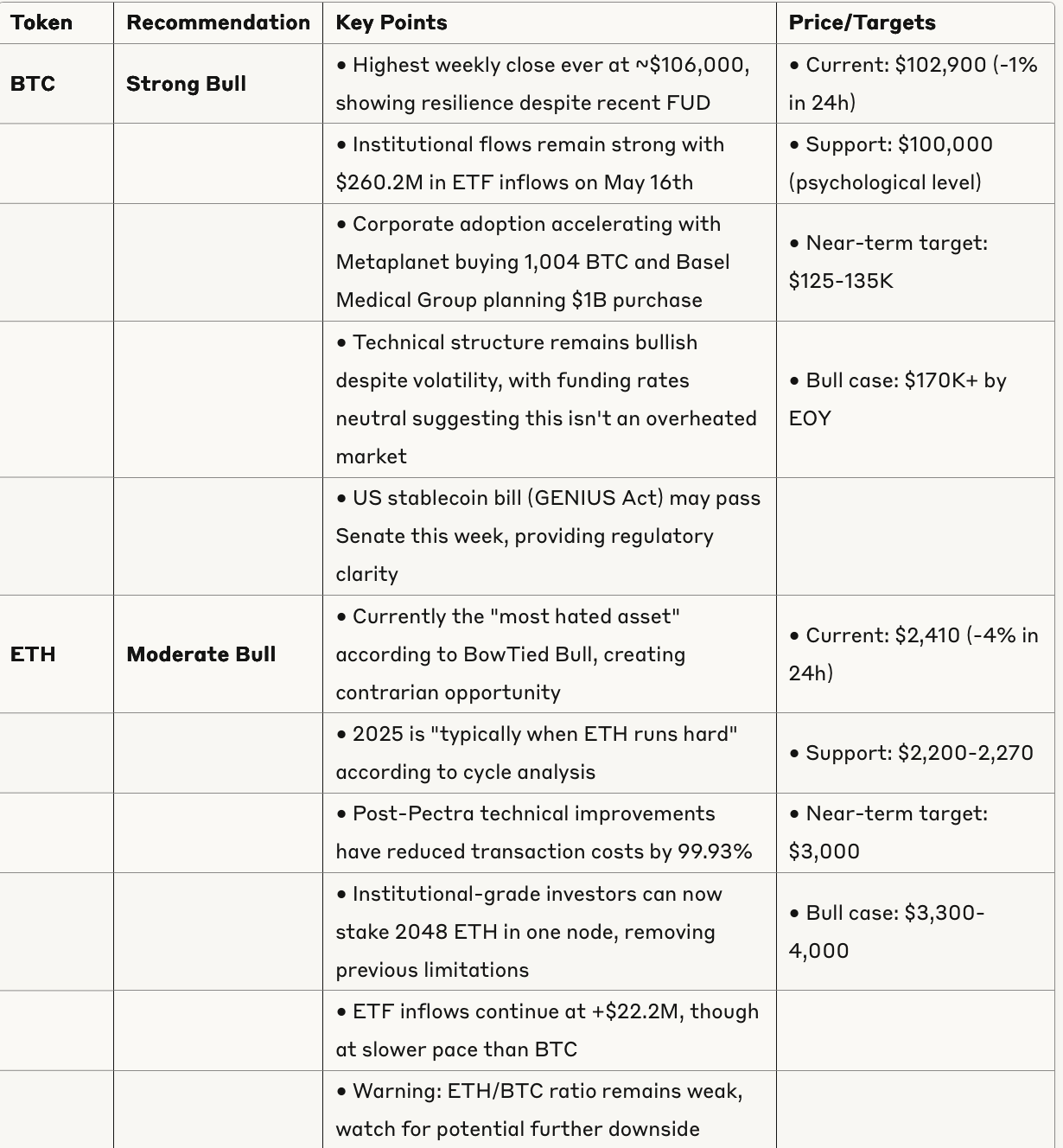

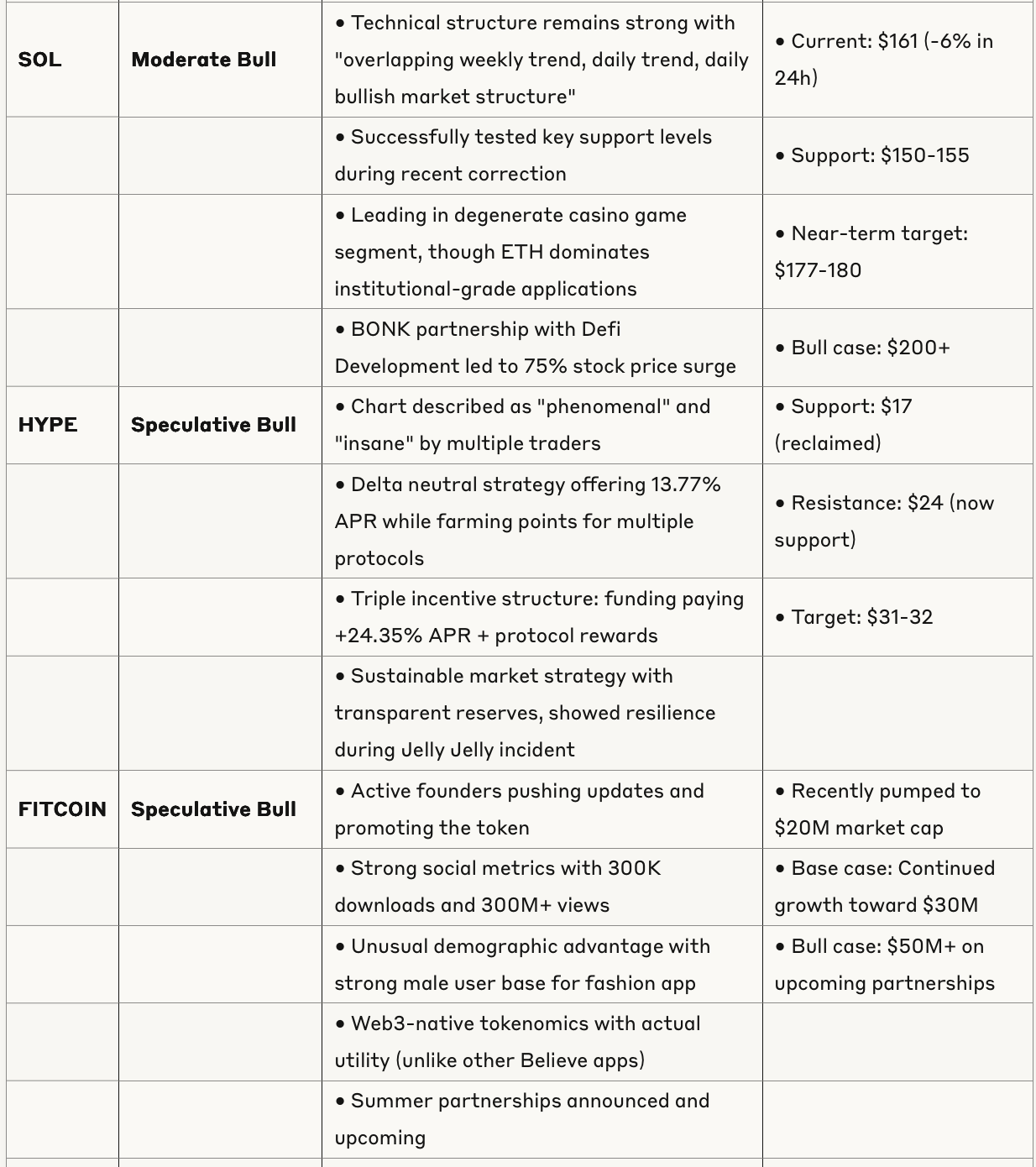

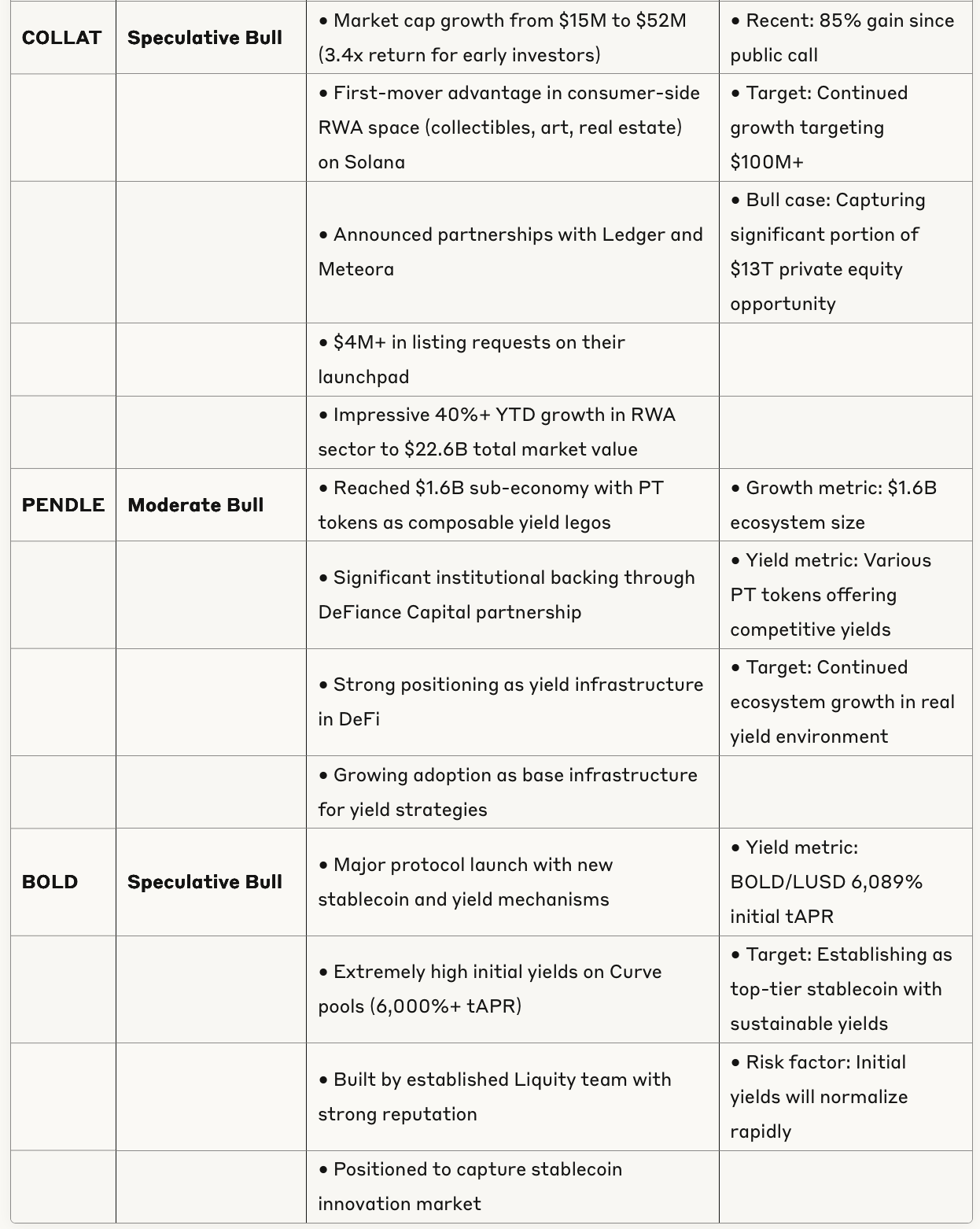

Token Analysis & Recommendations

Sector Analysis

DeFi Yield Opportunities

The yield space is showing renewed vigor with multiple high-APR opportunities emerging:

BOLD/LUSD Curve Pool: 6,089% initial tAPR with additional incentives coming

Teller Platform Yields:

USDC/MASA: 51.88% APY (425% collateralization ratio)

USDC/SPX: 43.58% APY (600% collateralization ratio)

USDC/BEAM: 38.54% APY (400% collateralization ratio)

BTC-USD Funding: ~70% APY in funding rates

Hyperliquid Delta Neutral: 13.77% APR on HYPE with airdrop exposure

The market is clearly rewarding protocols generating real yield from fees rather than pure token emissions. Pendle's positioning as a $1.6B sub-economy for fixed yield tokens shows growing institutional adoption of DeFi yield primitives.

Real World Assets (RWA)

The RWA sector continues to gain momentum with 40%+ YTD growth to $22.6B total market value. $COLLAT has emerged as a standout performer with significant growth from $15M to $52M market cap as a first-mover in the consumer-side RWA space on Solana.

Recent developments include new partnerships between traditional finance and crypto, such as BounceBit's announcement of a "dual-yield strategy powered by BlackRock's BUIDL, tokenized by Securitize."

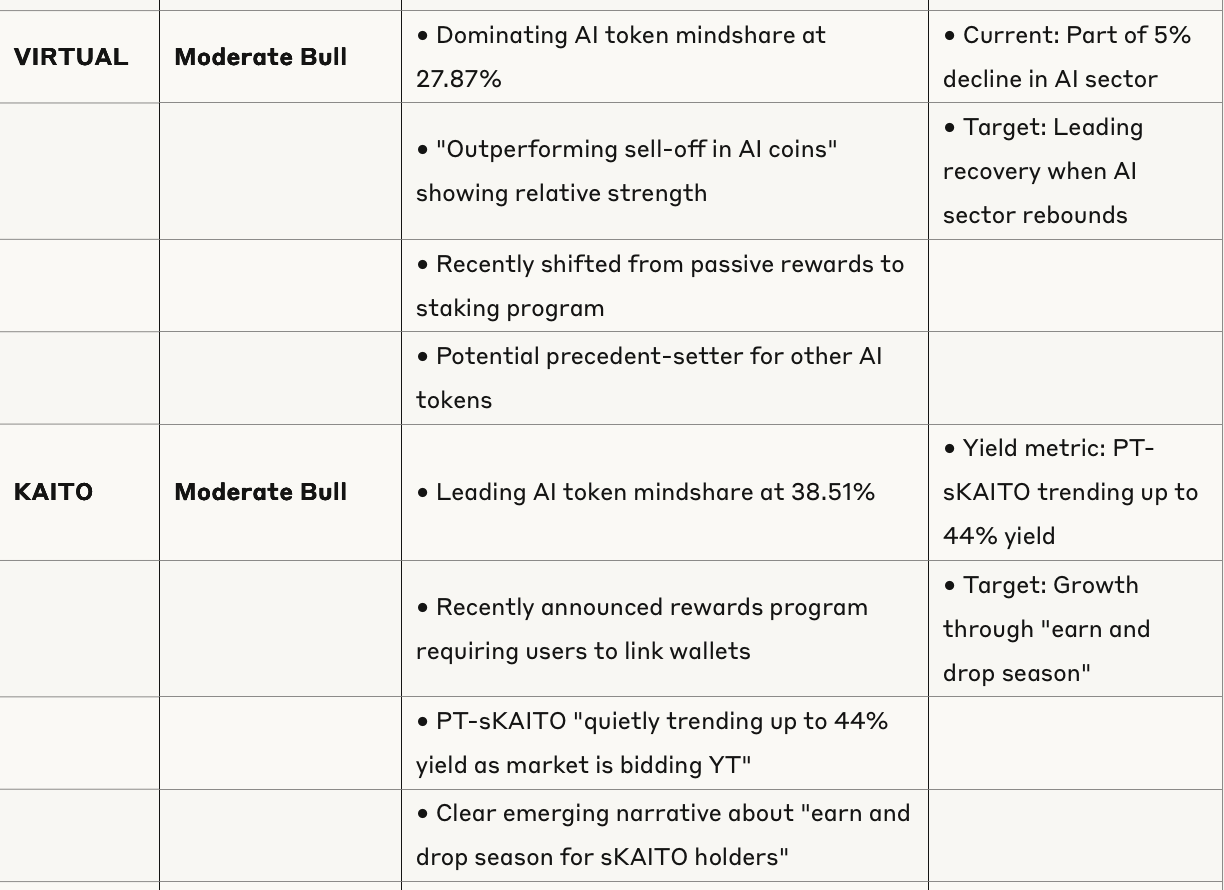

AI Tokens Ecosystem

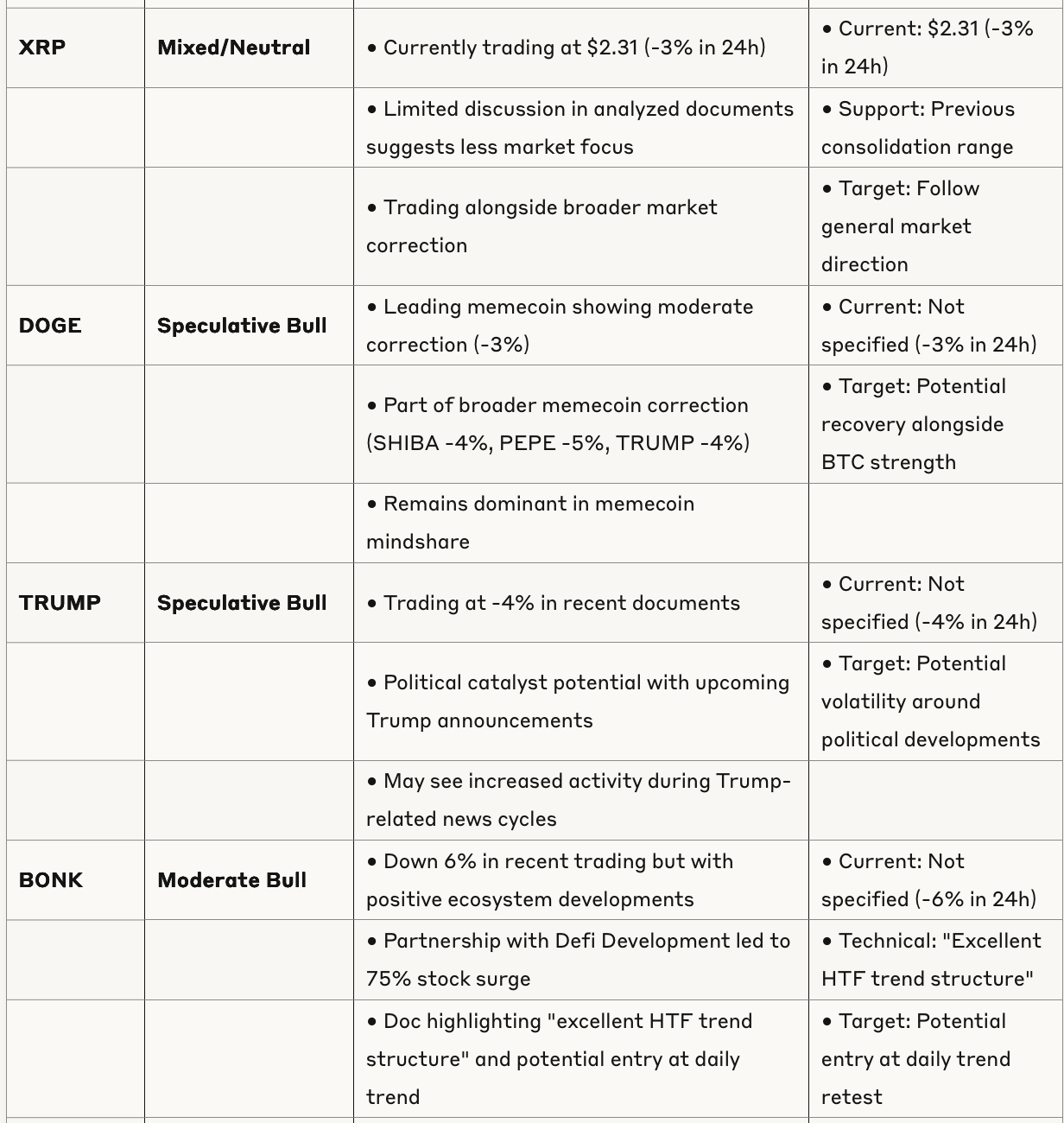

The AI token landscape shows clear mindshare leaders:

$KAITO: 38.51% of mindshare

$VIRTUAL: 27.87% of mindshare

$BNKR: 9.41% of mindshare

While the overall AI token market cap fell 5% to $10B, specific tokens like $VIRTUAL are outperforming the broader sell-off. $VIRTUAL recently announced a shift from passive rewards to a staking program, potentially setting a precedent for other AI tokens.

NFT Market

The NFT market shows signs of selective strength:

ETH NFT leaders are mostly green: Punks +2% at 46.6 ETH, Pudgy +1% at 10.1, BAYC +1% at 12.85 ETH

A Zombie CryptoPunk sold for $1.08M (440 ETH), nearly 10x the floor

A Skull of Luci sold for 100 ETH on Gondi, a new ATH for the collection

Lil Pudgy's launched a new TV show on YouTube, showing continued brand development in the space.

Risk Factors

Bitcoin Volatility Near ATH: Multiple traders warn about increased volatility near all-time highs. Cold Blooded Shiller cautions to "watch out for volatility, ltf will get whipped." Consider position sizing accordingly.

Altcoin Underperformance During BTC Breakout: CrediBULL Crypto predicts BTC dominance could lead to 30-40% drops in altcoin/BTC pairings even while USD values remain relatively stable. This suggests considering your exposure across BTC and alts.

Market Structure Concerns: Technical analysts have identified potential bearish patterns, including stop hunts in the BTC pennant pattern and possible exhaustion at resistance levels.

Macro Market Connection: With Moody's downgrade of US credit and negative stock futures, there's potential for correlation between traditional markets and crypto. The upcoming Trump-Putin call could also impact market sentiment.

Yield Protocol Risks: Many of the highest yields (like BOLD/LUSD at 6,000%+ tAPR) are likely to normalize rapidly. Newer protocols also carry smart contract and market manipulation risks.

Conclusion and Strategy

Current market conditions suggest a strategic approach:

BTC Position Management: Bitcoin remains the strongest asset with the clearest path to new all-time highs. Consider maintaining 40-50% of your crypto allocation in BTC with plans to take some profits at the $125-135K range before potentially re-entering for higher targets.

Alt Rotation Strategy: Evidence suggests defensive alt positioning may be prudent during the initial BTC breakout phase. Focus on BTC pairings rather than USD values when evaluating altcoin performance.

Sector-Specific Opportunities:

Yield: Focus on protocols generating real yield (Curve, Pendle)

RWA: Target established projects with institutional backing

AI: Monitor shifts in token mechanisms (like $VIRTUAL's staking mandate)

Meme Coins: Selective exposure to highest mindshare projects

Risk Management: With increasing volatility expected, maintain strict stop-losses and avoid over-leveraging. Consider delta-neutral strategies like the HYPE setup (13.77% APR) for lower-risk exposure.

Catalyst Timeline:

This week: US Stablecoin Bill (GENIUS Act) vote

Near-term: Trump tariff announcements

Ongoing: Institutional BTC accumulation

The most coherent short-term thesis appears to be BTC dominance with potential for $125-135K before substantial alt season momentum, with selective exposure to emerging narratives (RWA, yield) showing stronger relative performance than the general alt market.