Market Edge, 19th May 2025

CT, YT and claude

Overall Market Context

The crypto market appears to be in a resilient position, with Bitcoin dominance remaining high despite recent price fluctuations. Bitcoin dominance has been rising consistently for nearly 3 years, with significant inflows over this period, making it challenging for altcoins to keep pace.

The broader market shows positive momentum, with US stock indices experiencing substantial gains. The Nasdaq 100 is up 25% from April lows, contradicting earlier predictions of a 1929-style crash. The market is currently awaiting reactions to several important economic events this week, including a Moody's downgrade, US Crude Oil Inventory data, S&P Global Manufacturing PMI data, and housing sales data, alongside 14 Federal Reserve speaker events.

Market sentiment is predominantly bullish, with notable strength in the SOL ecosystem and Believe platform tokens. However, there are some unusual market structure indicators around Bitcoin that warrant caution despite approaching all-time highs.

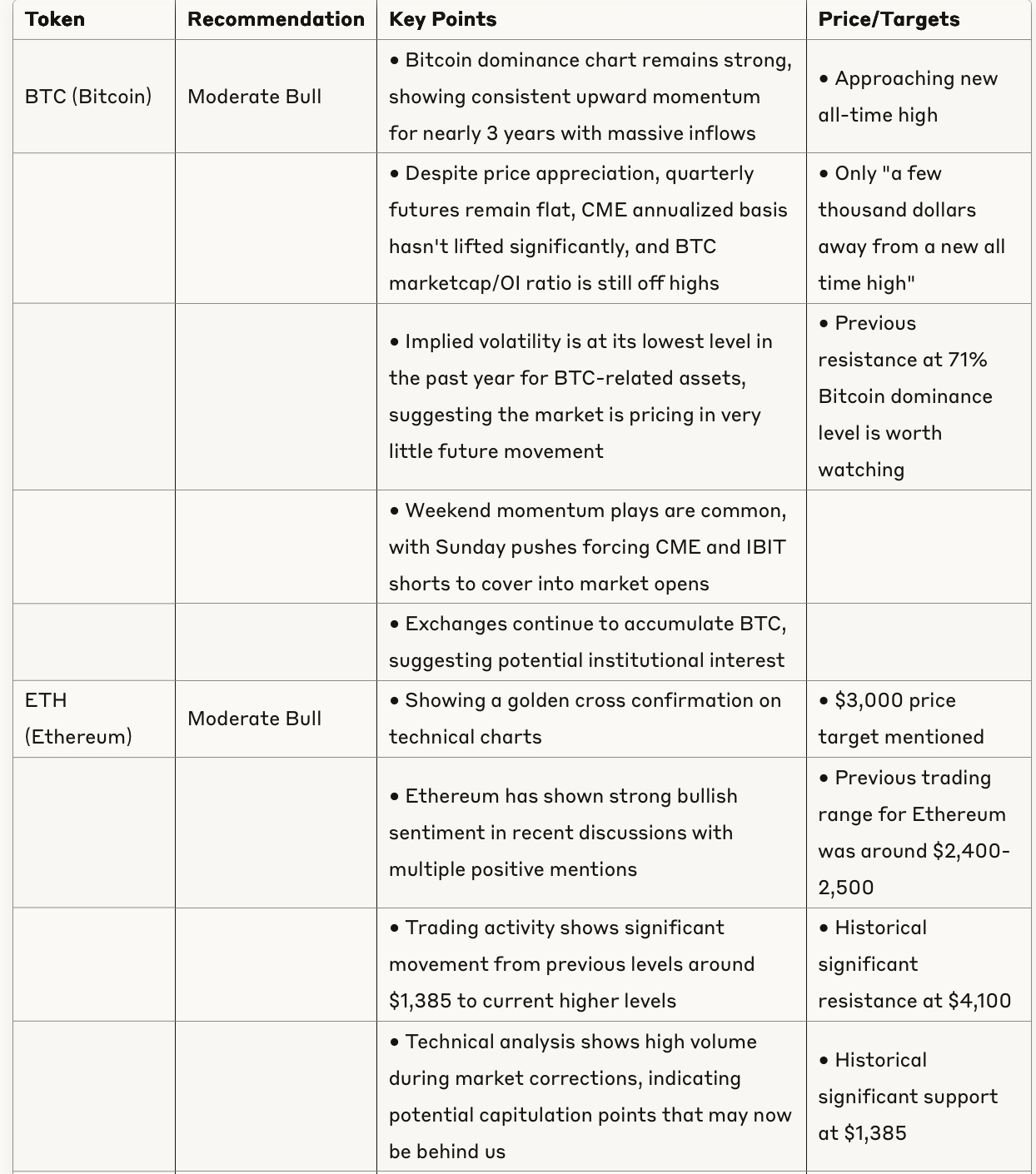

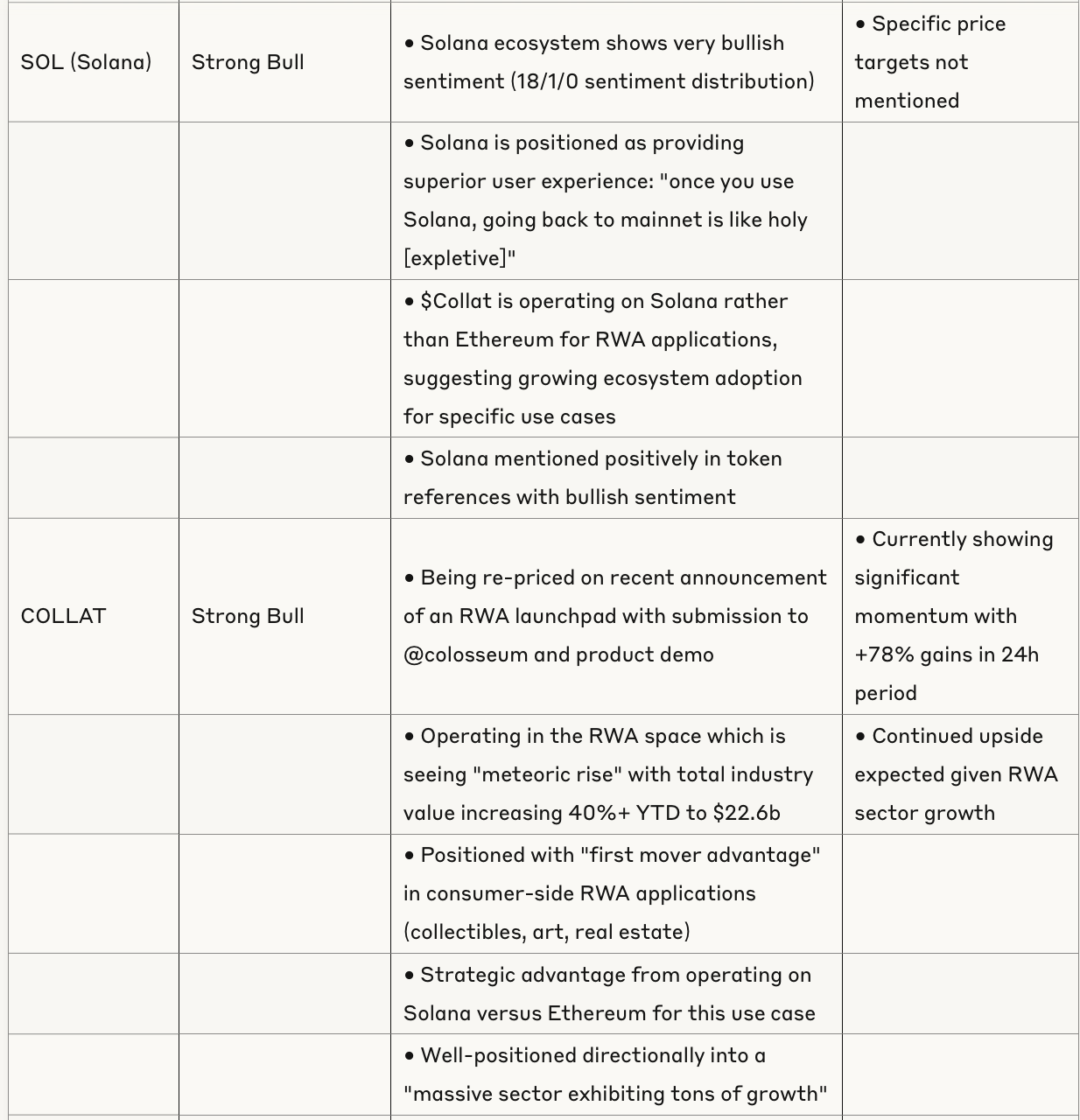

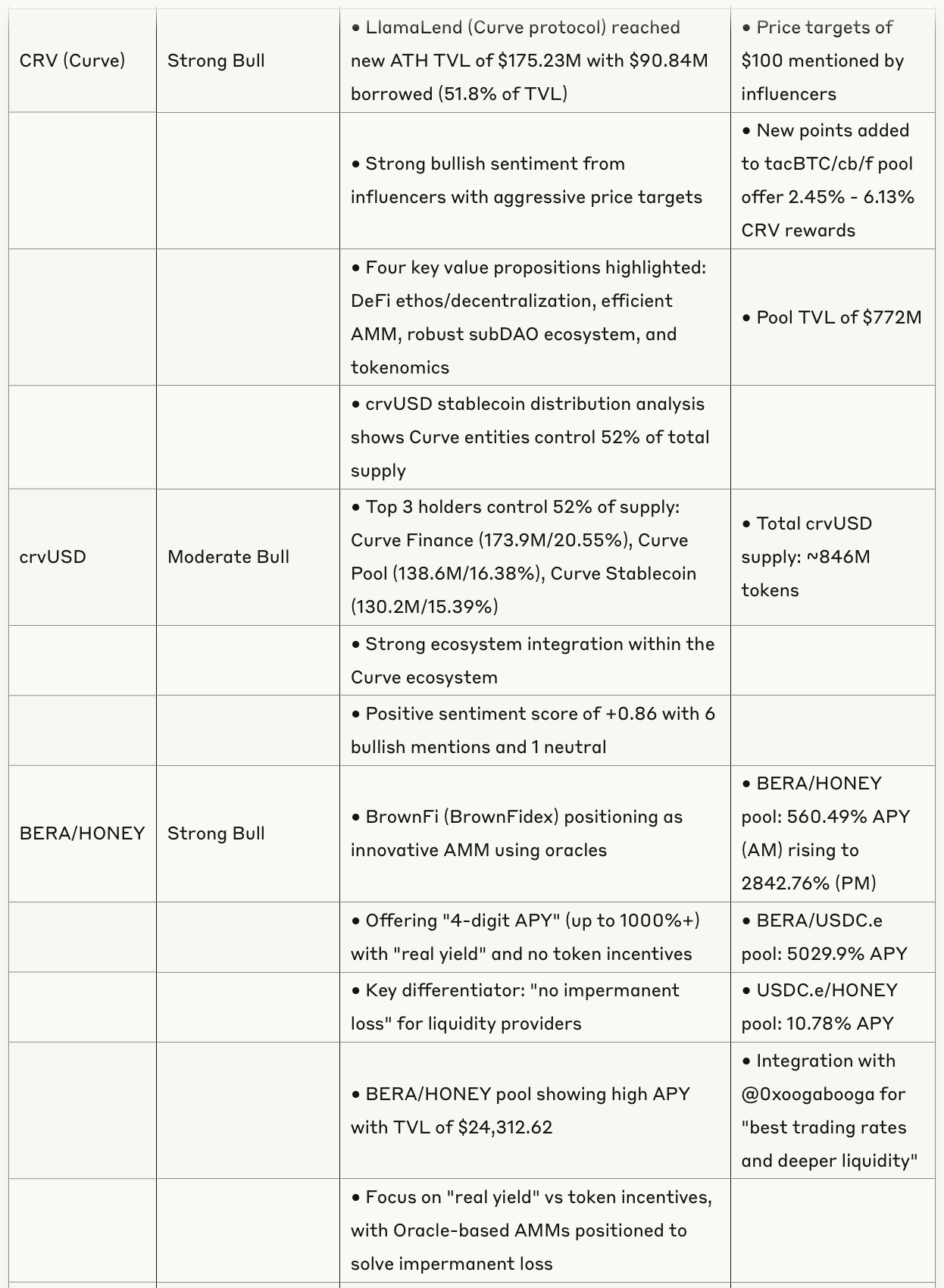

Token Analysis Table

Key Market Narratives

1. Real World Assets (RWA) Gaining Momentum

The RWA space is experiencing a meteoric rise, with total industry value increasing by over 40% year-to-date to $22.6 billion. Projects like COLLAT are positioning with "first mover advantage" in consumer-side applications such as collectibles, art, and real estate. There's a strategic advantage for some RWA applications operating on Solana rather than Ethereum.

However, there are competing views in the market about tokenized equities specifically, with some influential traders considering them "probably a big ol' nothing burger" whose main purpose is "to allow onchain users to speculate on equities," essentially providing "a way for VERY high-risk degens to chase slightly less risky, lower-yield assets." Despite this skepticism, some believe that "whichever chain wins the 'tokenized equities' meta in the coming quarters is going to win the next phase of the blockchain war."

2. Real Yield Focus Across DeFi

The market continues to prioritize sustainable "real yield" over token incentives, with protocols like BrownFi and Curve emphasizing actual returns. BrownFi is offering "4-digit APY" (up to 1000%+) with "real yield" and no token incentives, with a key differentiator being "no impermanent loss" for liquidity providers.

There's a consistent theme across multiple sources of market participants looking for sustainable yield generation in sideways or choppy markets, with yield generation in these conditions positioned as superior to simple holding strategies.

3. Bitcoin Approaching ATH With Unusual Market Structure

Bitcoin is only "a few thousand dollars away from a new all time high," yet implied volatility is at its lowest level in the past year for BTC-related assets, suggesting the market is pricing in very little future movement. Despite price appreciation, quarterly futures remain flat, CME annualized basis hasn't lifted significantly, and BTC marketcap/OI ratio is still off highs.

Weekend momentum plays are common in the Bitcoin market, with Sunday pushes forcing CME and IBIT shorts to cover into market opens. Strong Sunday drives don't necessarily mean-revert just because it's Sunday—they're just as likely to trap late sellers as they are to fizzle.

4. Ecosystem Expansion In Established Protocols

Established protocols like Curve are growing their ecosystems through strategic integrations and sub-protocols. LlamaLend (Curve protocol) reached new ATH TVL of $175.23M with $90.84M borrowed (51.8% of TVL). The crvUSD stablecoin distribution analysis shows Curve entities control 52% of total supply.

Other project updates show significant innovation across the space, including Worldcoin's launch of the Orb Mini for portable human verification, Nous Research's introduction of Psyche (a decentralized AI training network with a 40B parameter LLM), and Prime Intellect's open-sourcing of INTELLECT-2, a 32B model surpassing QwQ-32B in math and code capabilities.

5. Chain Competition Dynamics

There is observational evidence of projects choosing Solana over Ethereum for specific use cases, particularly in the RWA sector. Discussions around which chain will dominate the "tokenized equities" meta suggest ongoing competition between major blockchains.

Solana is positioned as providing superior user experience, with one source stating "once you use Solana, going back to mainnet is like holy [expletive]." The Solana ecosystem shows very bullish sentiment in market analysis (18/1/0 sentiment distribution).

6. Gaming, Gambling, and Community Tokens

The YEET platform is showing a growing user base and wagering volume, approaching "$100 millionth wager," with multiple retweets about successful gambling outcomes suggesting increased user adoption.

Community-focused tokens like SPX6900 are described as "World of Warcraft with real people, a collective vision and one very real quest," with claims of benefits beyond financial returns, such as "curing gambling addictions, loneliness."

Risk Factors

Market-Wide Risks

BTC volatility compression could presage larger-than-expected moves

Divergence between price action and derivatives metrics for BTC suggests caution

Skepticism about tokenized equities indicates potential for overhyped narratives

Several traders noting excessive optimism in market, particularly in meme tokens

"PVP" nature of onchain activity suggests manipulation and coordinated action by insiders

Market structure is described as "a fundraising system" where projects "want to extract your money"

Market psychology where retail buys the top and sells the bottom, benefiting sophisticated operators

Risk Factors by Category

Leverage Risk: Leverage was identified as a significant risk: "Don't leverage too much if you like to use leverage"

Volatility Risk: Market volatility and "emotional roller coasters" were cited as reasons "most day traders fail"

Position Sizing Risk: Position sizing was emphasized as crucial for risk management: "Stay small enough... Don't expose yourself to the point where you're going to freak out when the market goes down."

Liquidity Risk: DeFi liquidity was characterized as "not that deep" with "a lot of slippage in DeFi" across markets.

Technical Risks: New phishing vectors emerging despite account abstraction improvements with three main attack vectors identified: SetApprovalForAll, pre-approved assets, Permit2 signatures

Conclusion and Outlook

The crypto market is showing predominantly bullish sentiment in mid-May 2025, with Bitcoin approaching all-time highs despite some unusual market structure indicators. The ecosystem has evolved significantly, with multiple sectors developing simultaneously: RWA applications (particularly on Solana), gaming/gambling tokens, AI-agent projects, and community-focused tokens.

Key trends include the prioritization of sustainable "real yield" over token incentives, the expansion of established protocols through strategic integrations, and competition between major blockchains for specific use cases. The RWA sector shows particular promise with total industry value increasing by over 40% year-to-date to $22.6 billion.

While market sentiment is broadly positive, risks remain, including compressed volatility potentially leading to larger-than-expected moves, divergence between price action and derivatives metrics for Bitcoin, and the "PVP" nature of onchain activity suggesting potential manipulation by insiders.

For investors and traders, focusing on established protocols with genuine ecosystem growth, RWA applications with real-world utility, and projects demonstrating sustainable yield generation appears to be the most prudent approach in the current market environment.