Market Edge, 11th June, 2025

Market Context

Total Crypto Market Cap: Growing with institutional inflows

Dominant Narrative: Regulatory clarity driving institutional adoption

Cycle Position: Early bull market "fun stages" beginning

Risk Environment: Risk-on with credit cycle support

Institutional Flow: $300M+ corporate treasury additions

Sector Performance

Layer 1s: ETH leading, SOL setup bullish, BTC approaching ATH

DeFi: Regulatory clarity driving 20%+ moves in AAVE, strong fundamentals

Memecoins: Surprising resilience with institutional narratives emerging

AI Tokens: Virtuals ecosystem showing continued "insanity"

Yield Protocols: Revenue-sharing models (HYPE) proving sustainable

Key Catalysts

SEC Chair Paul Atkins: DeFi exemption framework, self-custody rights

ETF Flows: ETH 16-day streak, Solana approval timeline

Corporate Adoption: Multiple $300M+ treasury additions

Technical Setups: Multiple tokens breaking key resistance levels

Regulatory Clarity: "DeFi values are American values" framework

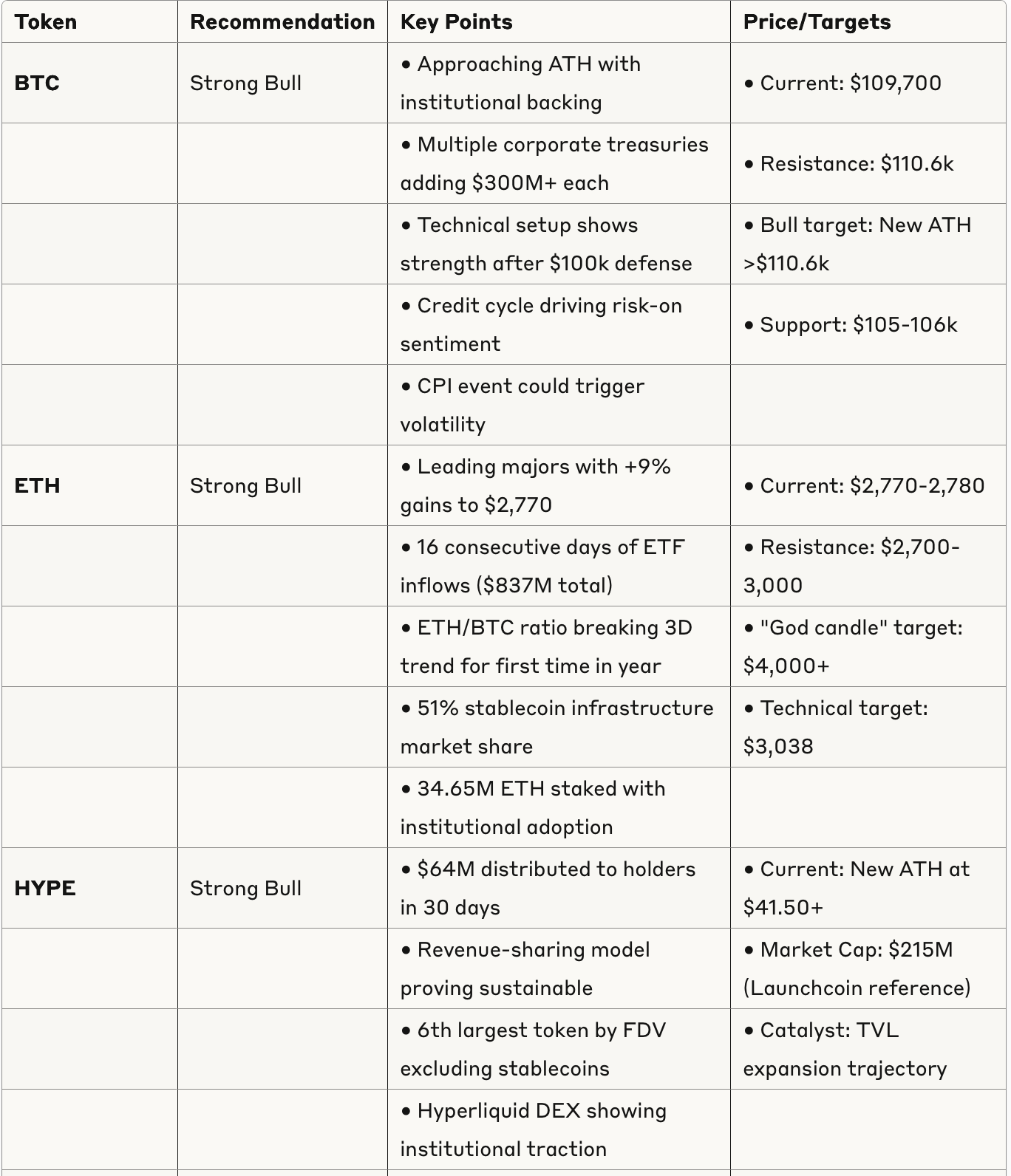

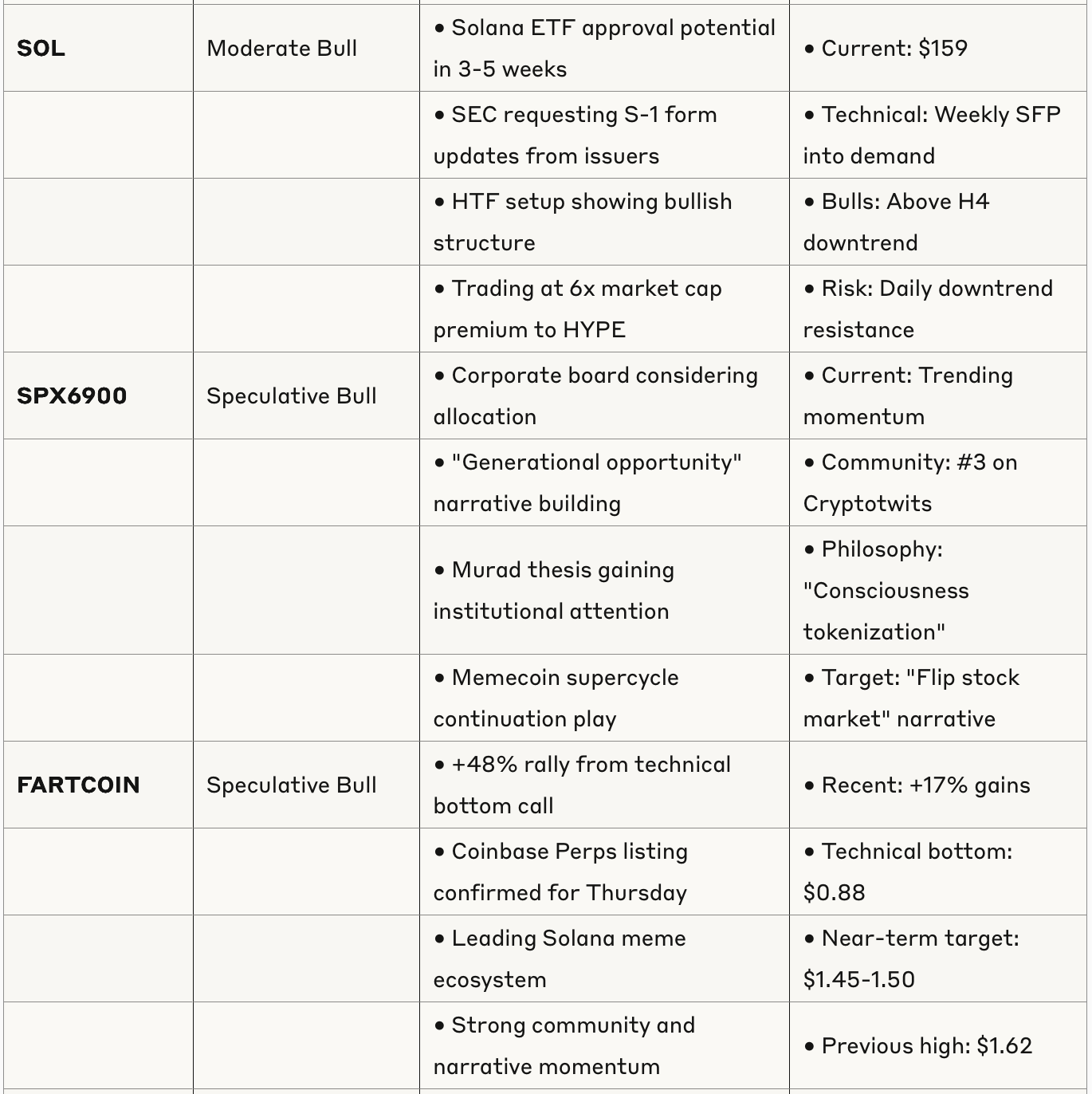

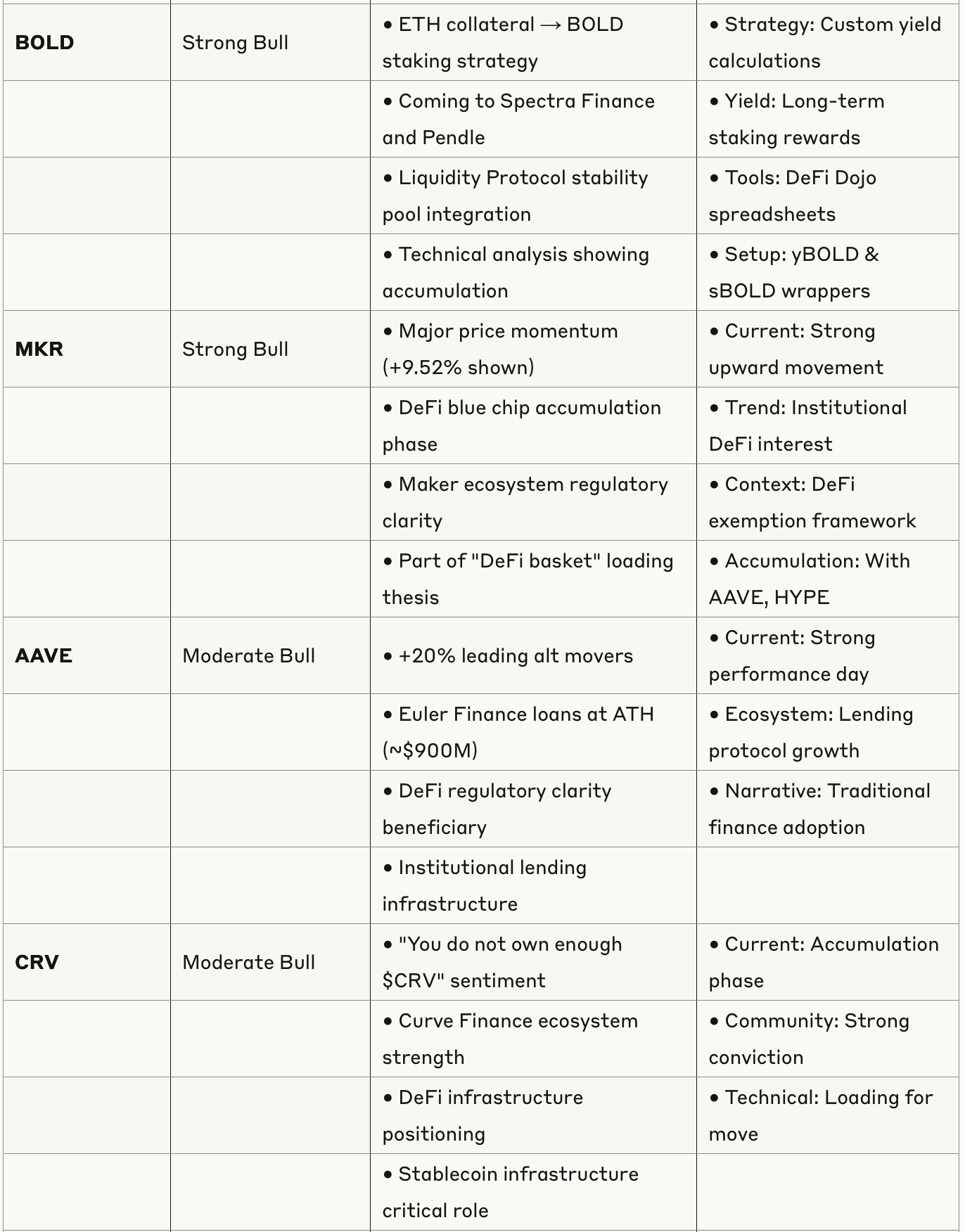

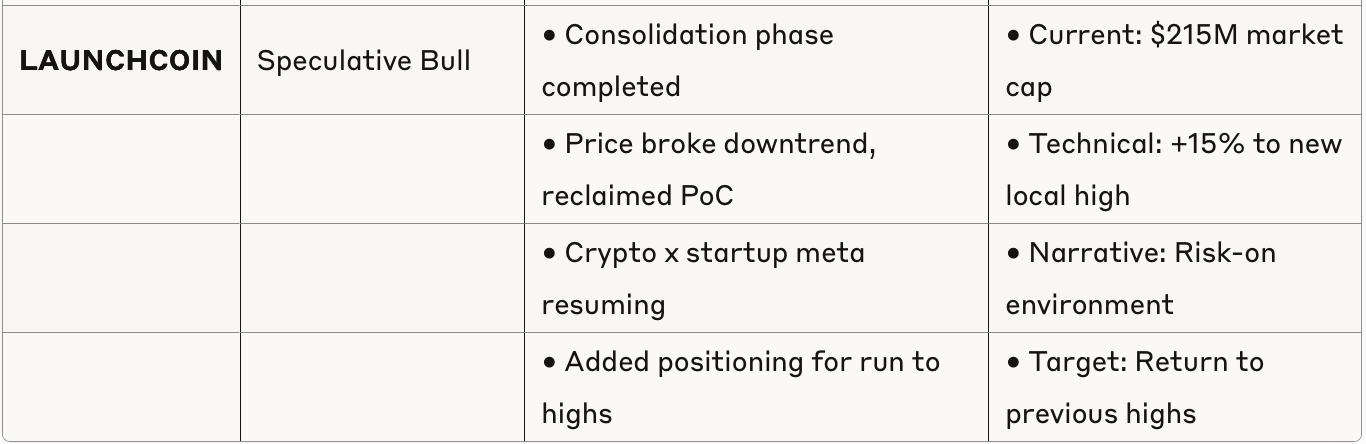

Token Analysis Table

Risk Assessment

Market-Wide Risks

CPI Event: Could trigger profit-taking volatility

Technical Resistance: Multiple tokens approaching key levels simultaneously

Funding Rates: Some alts showing stress (AXL at -5119% APR)

Positioning: Short-term crowding in popular trades

Token-Specific Risks

BTC: $110.6k resistance, CPI volatility

ETH: Options concentration at $2,700-3,000

SOL: Daily downtrend resistance, ETF timing uncertainty

Memecoins: High volatility, narrative-dependent

Small Caps: Liquidity risks in volatile markets

Timing Considerations

Short-term (1-2 weeks): CPI volatility, profit-taking possible

Medium-term (1-3 months): ETF approvals, regulatory framework

Long-term (6+ months): Institutional adoption acceleration

Key Takeaways

Highest Conviction Signals

ETH: Technical breakout + institutional flows + regulatory clarity

BTC: New ATH approach with corporate treasury support

HYPE: Proven revenue model with sustainable distribution

DeFi Blue Chips: Regulatory exemption framework beneficiaries

Emerging Opportunities

Solana ETF: 3-5 week approval timeline

Revenue-Sharing Protocols: Institutional interest in cash flow generation

Memecoin Institutionalization: Corporate allocation considerations

Yield Strategies: Sophisticated DeFi tools and automation

Market Structure Evolution

Traditional finance embracing blockchain rails

Regulatory framework supporting innovation

Revenue models maturing beyond speculation

Institutional adoption accelerating across sectors