Market Edge, 10th June, 2025

Edge from CT/YT using Claude

Overall Market Context

Market Phase: Bitcoin-led bull market with altcoin positioning phase

Key Catalyst: BTC approaching $110K all-time high, regulatory tailwinds from SEC innovation exemption

Institutional Flow: $837M net inflows into ETH ETFs over 15-day streak

Sentiment: Transition from cautious optimism to aggressive bullishness

Cycle Position: Early-to-mid bull market with infrastructure focus over speculation

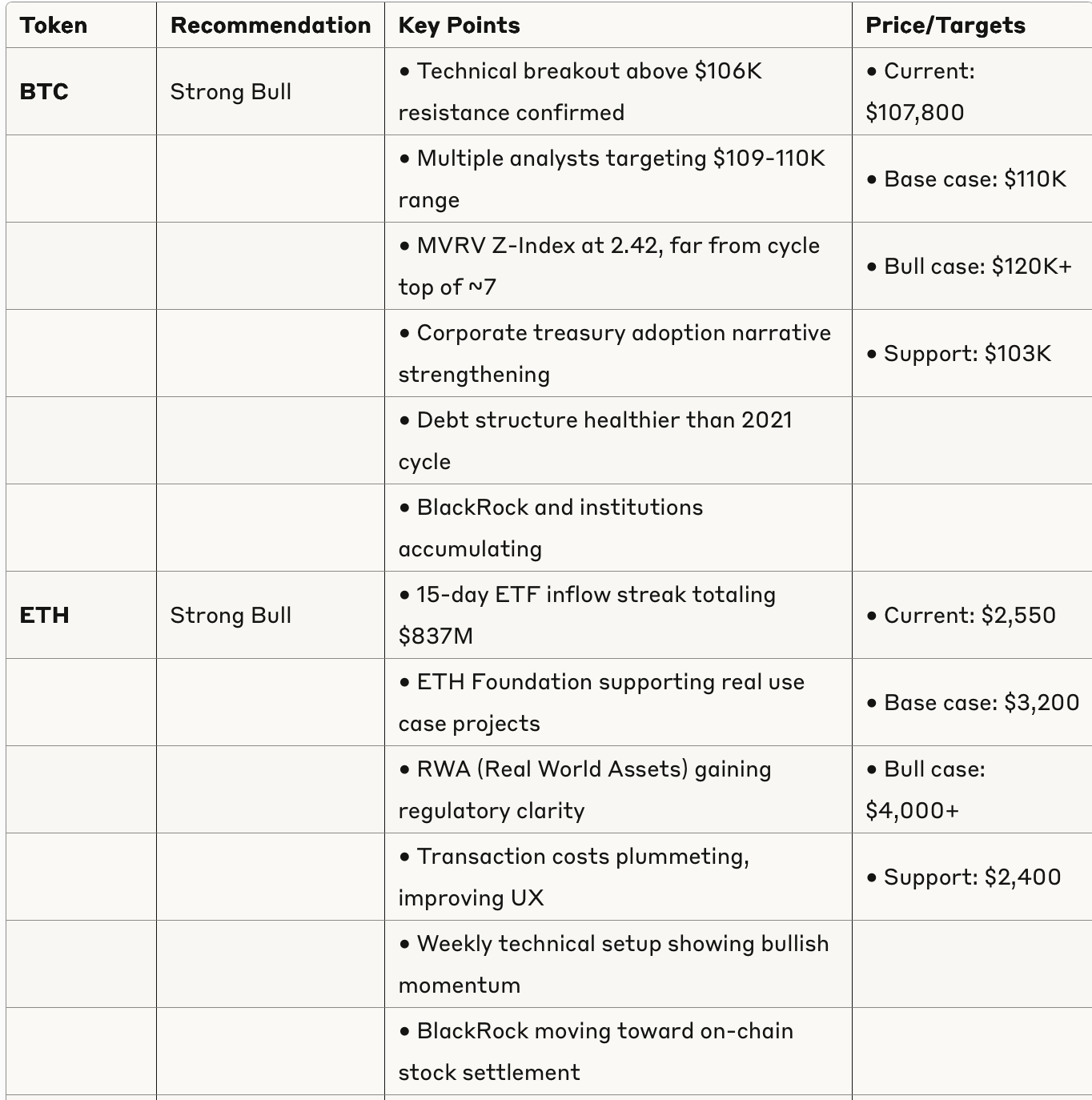

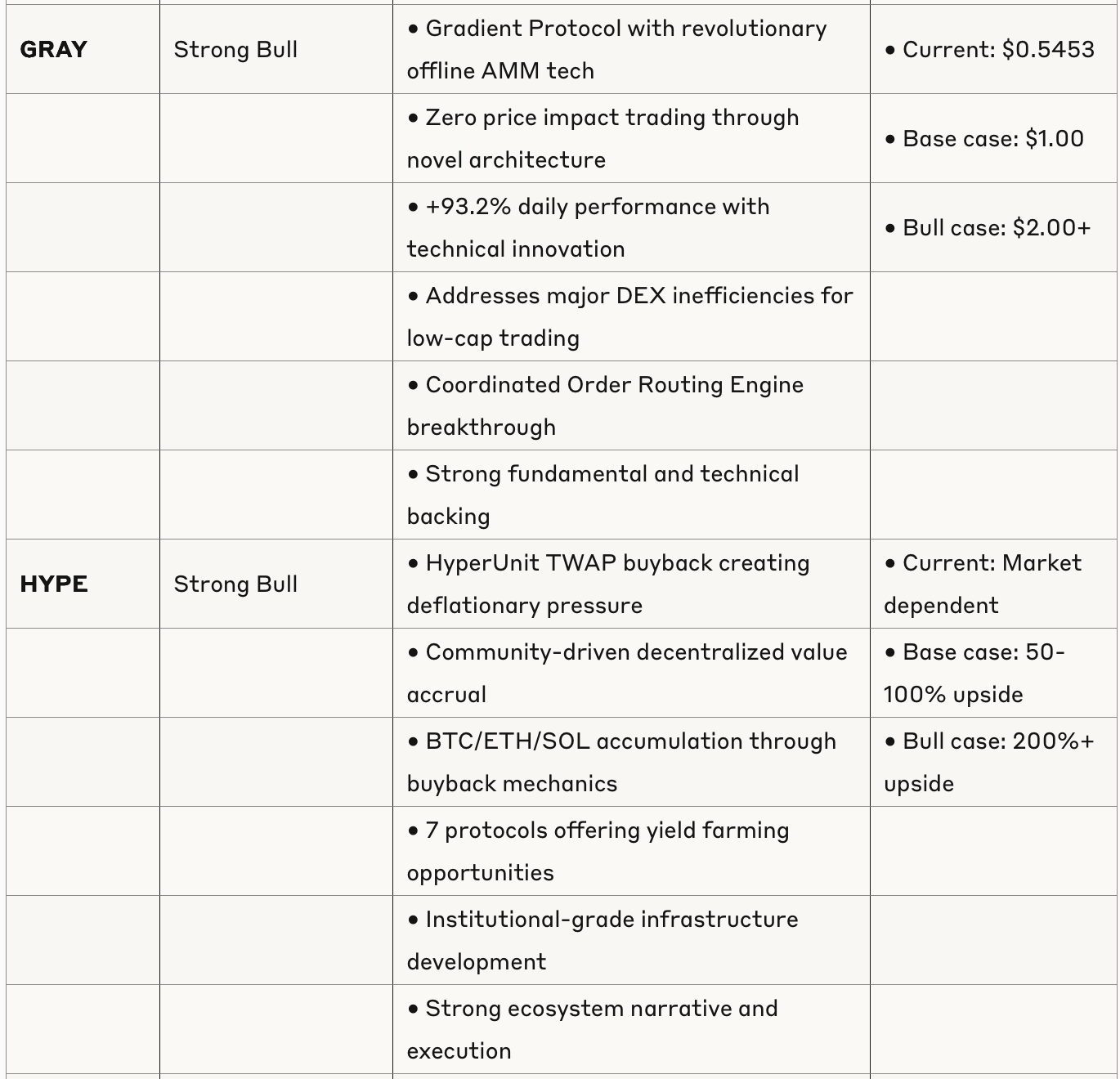

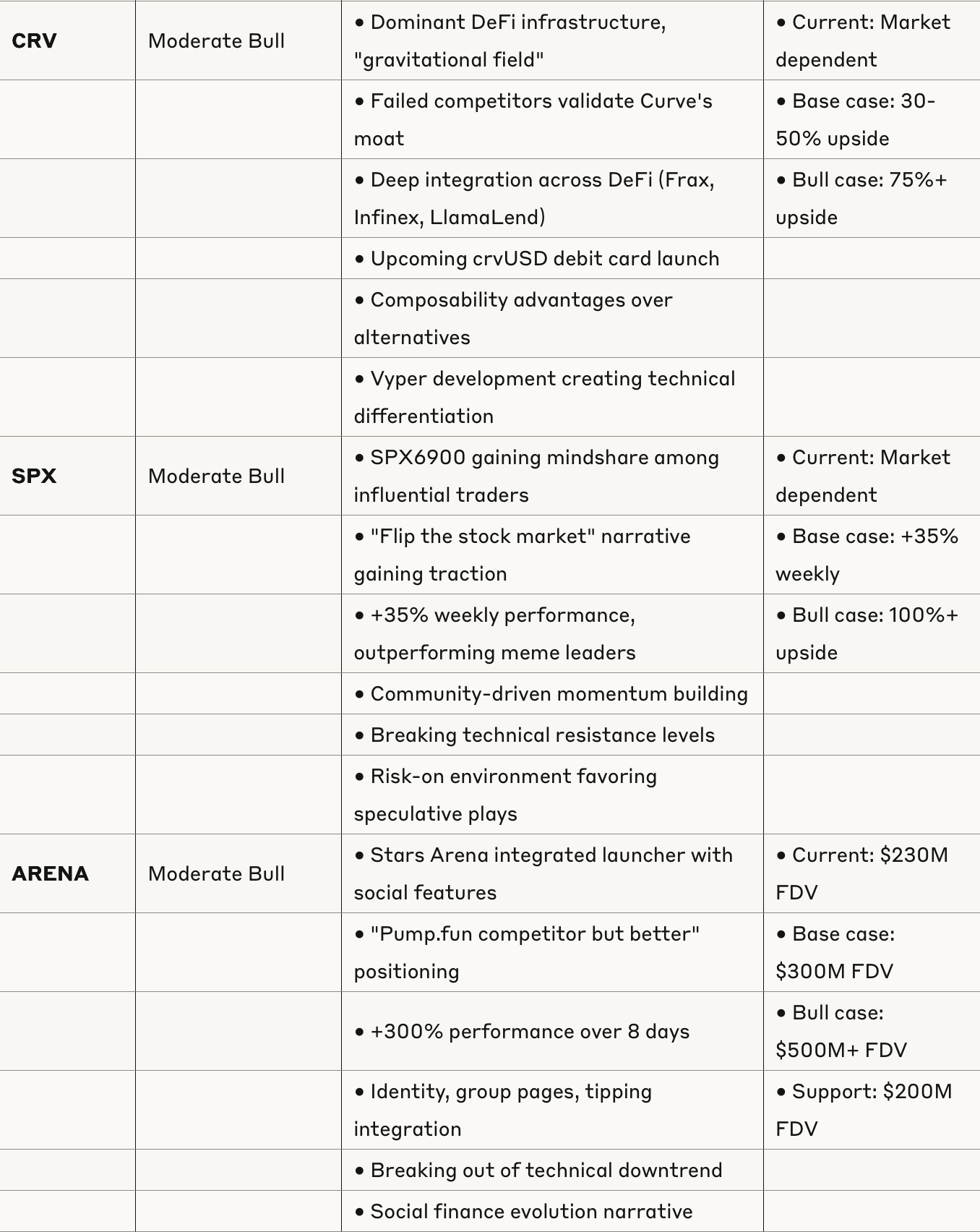

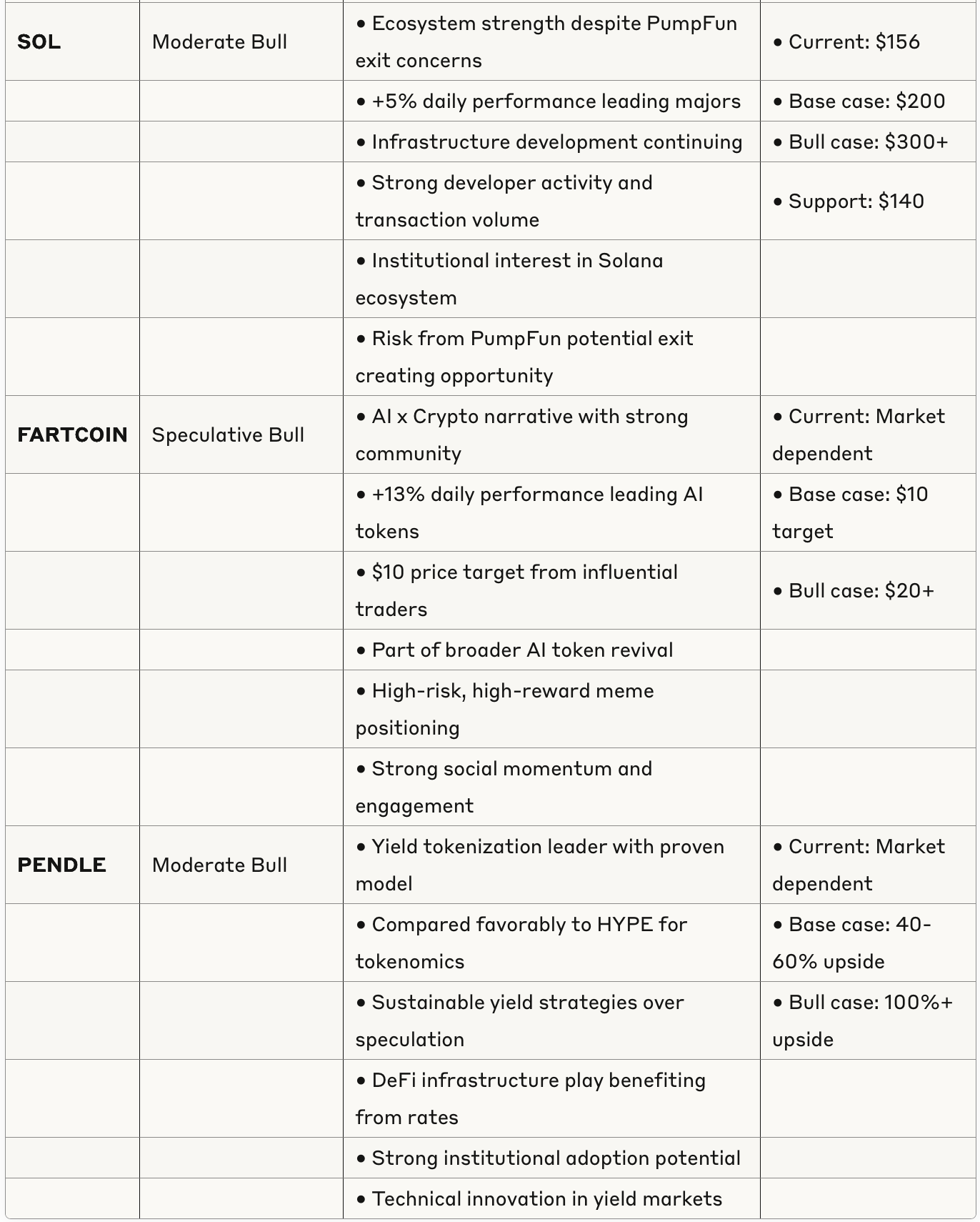

Token Analysis Table

Sector Analysis

Major Cryptos (BTC/ETH)

Outlook: Extremely bullish with institutional backing

Catalysts: Corporate treasuries, ETF flows, regulatory clarity

Risk: Macro headwinds, potential leverage liquidations

DeFi Infrastructure

Leaders: GRAY, HYPE, CRV, PENDLE

Narrative: Real utility over speculation, sustainable yields

Catalyst: SEC innovation exemption framework

Meme/Community Tokens

Positioning: Selective bullishness on quality projects

Leaders: SPX, FARTCOIN, ARENA

Risk: High volatility, narrative dependent

AI x Crypto

Trend: Revival phase with FARTCOIN leading

Opportunity: Early positioning for next cycle

Risk: Speculative nature, limited fundamentals

Risk Assessment

Market-Wide Risks

Potential "largest bubble" warnings from traditional analysts

2-year yield inversion suggesting bear market within 12 months

Over-leverage concerns as open interest increases

Regulatory uncertainty despite positive developments

Sector-Specific Risks

DeFi: Smart contract risks, regulatory changes

Memes: Extreme volatility, narrative shifts

AI Tokens: Limited utility, speculation-driven

Technical Risks

BTC rejection at $110K could trigger broader correction

Alt season timing uncertainty

Liquidity concerns in smaller cap tokens

Key Narratives to Monitor

Bitcoin Treasury Adoption: Corporate balance sheet adoption accelerating

DeFi Infrastructure Evolution: Real utility gaining over speculation

Regulatory Clarity: SEC innovation exemption implementation

AI x Crypto Revival: Early positioning opportunity

Stablecoin Growth: $250B market approaching utility inflection

Investment Thesis Summary

The market is transitioning from speculative excess to infrastructure-focused growth. Bitcoin's approach to $110K serves as the foundation for broader crypto adoption, while DeFi protocols with real utility (GRAY, HYPE, CRV) are positioned for sustainable growth. Selective exposure to community-driven projects (SPX, ARENA) offers upside participation, while maintaining core positions in BTC/ETH provides portfolio stability.