Market Edge

Market Phase: Late Bull Market with Institutional Rotation

Key Macro Factors:

Inflation Cooling: Three consecutive good readings (2.4%, 2.3%, 2.4%) supporting Fed dovish pivot

DXY Weakness: Decline from 108→98 historically bullish for crypto with 3-month lag

M2 Expansion: Money supply growth supporting risk assets

Institutional Flows: Record ETH ETF inflows ($240M) signal smart money positioning

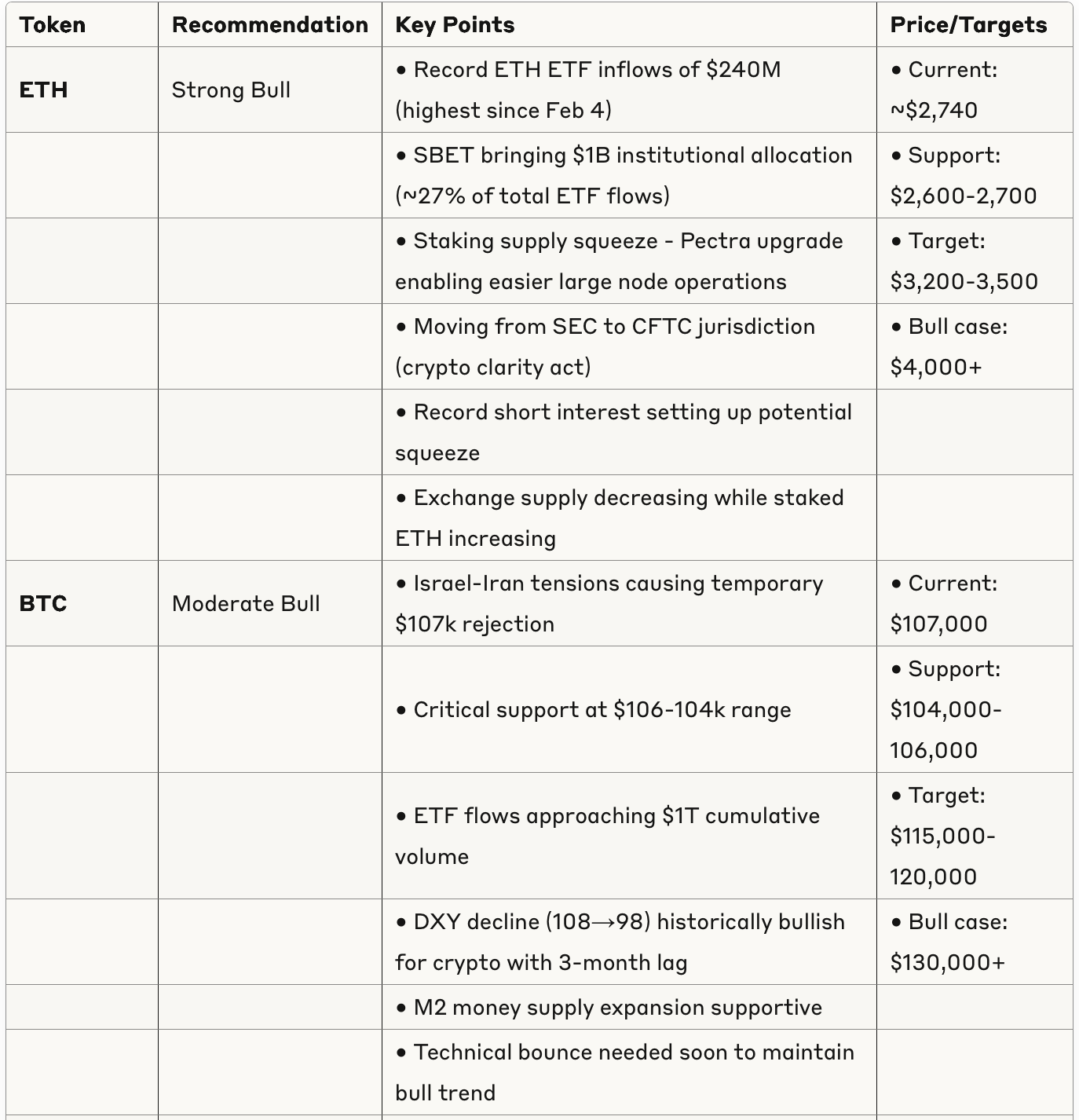

Token Analysis Table

Dominant Narratives

ETH Infrastructure Play: Staking, DeFi regulation, and supply dynamics creating perfect storm

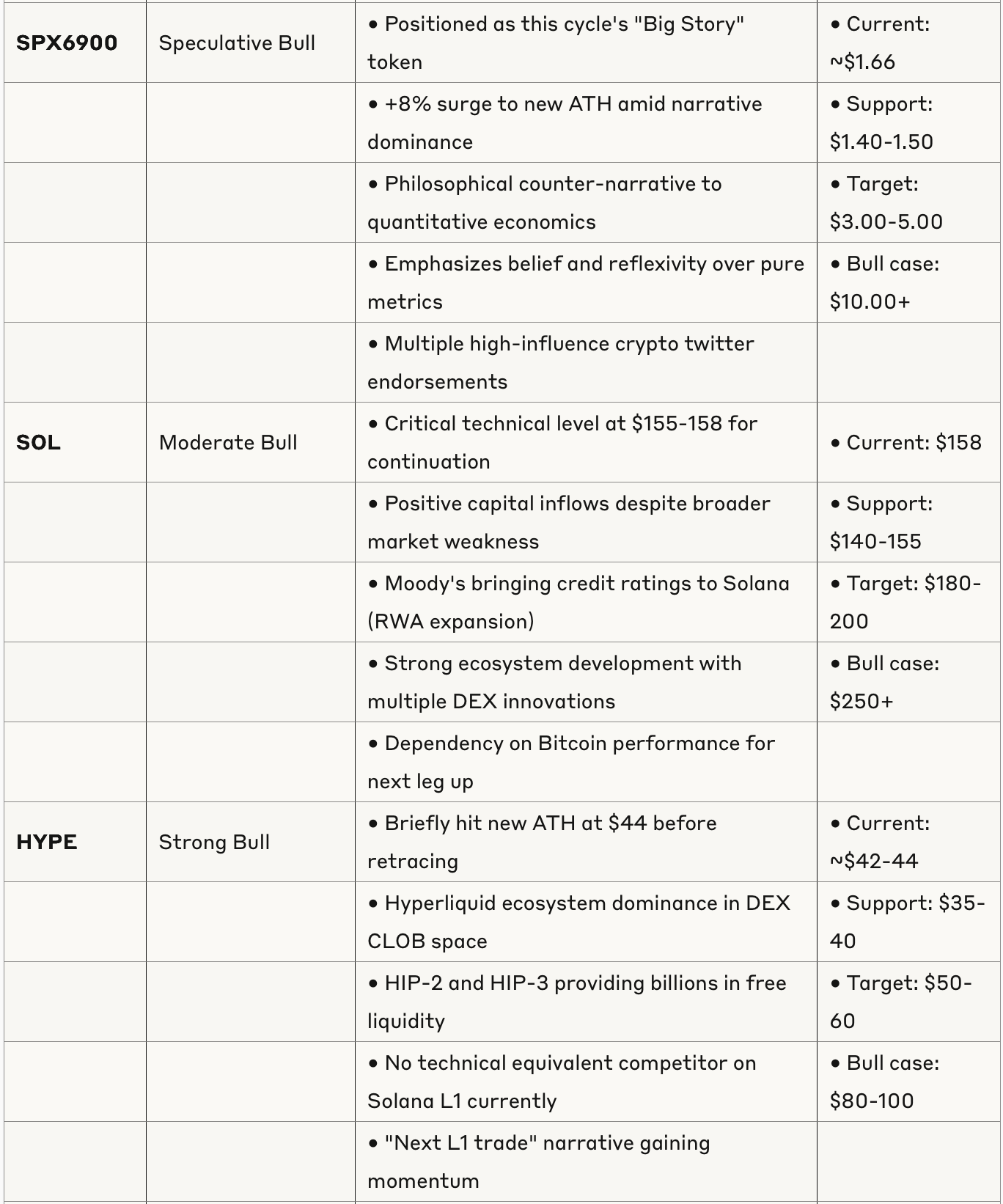

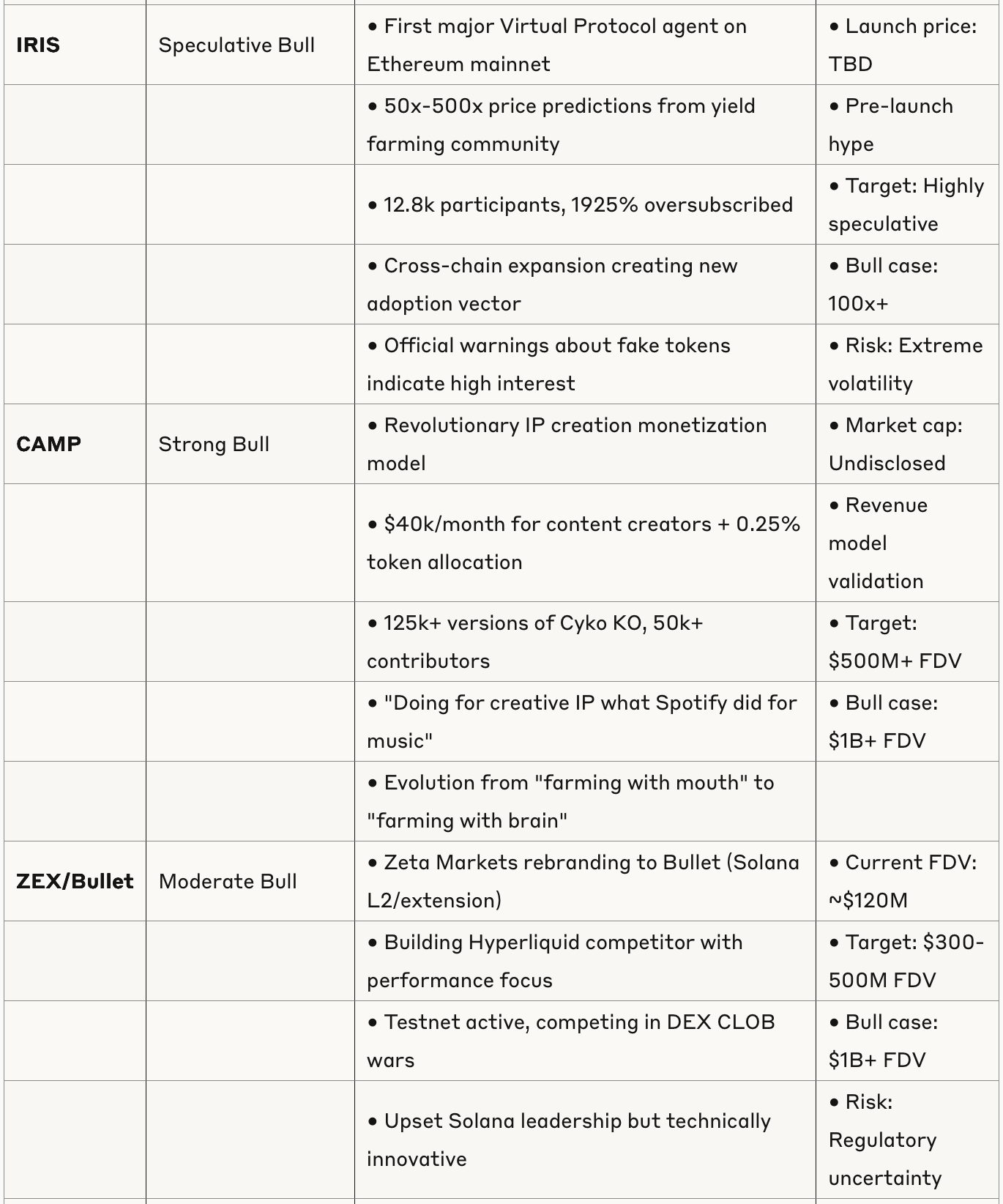

AI Agent Economy: IRIS, CAMP, and creator monetization tokens leading innovation

DEX Wars: HYPE, Bullet, and other CLOB solutions competing for market share

Philosophy vs Metrics: SPX6900 representing shift toward qualitative market analysis

Sector Rotation Patterns

From: Meme coins and speculative plays

To: Infrastructure, DeFi, and creator economy tokens

Next: Likely RWA and institutional-grade DeFi solutions

Risk Assessment

Market-Wide Risks

Geopolitical: Israel-Iran tensions causing temporary selloffs

Technical: BTC critical support at $104-106k must hold

Sentiment: Extreme predictions (50x-500x) indicate speculative excess

Regulation: Ongoing clarity needed for DeFi and staking

Token-Specific Risks

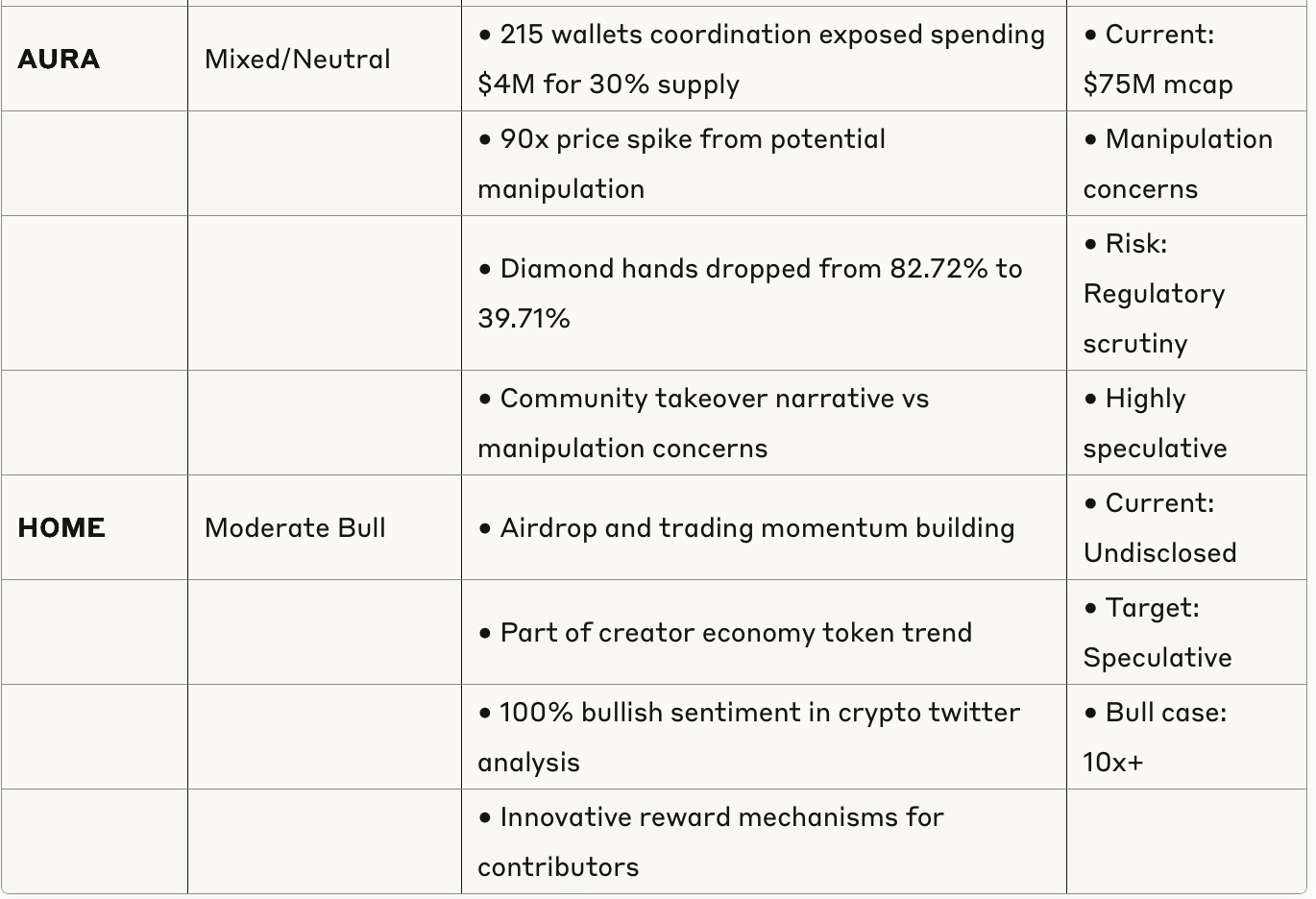

AURA: Clear manipulation evidence, regulatory scrutiny likely

IRIS: Extreme volatility expected, fake token proliferation

SPX6900: Narrative-driven with limited fundamental backing

Bullet: Regulatory uncertainty around Solana extensions

Timing Considerations

Summer Chop: Expected consolidation period despite bullish fundamentals

Fed Policy: Rate decisions impact risk asset flows

ETF Flows: Institutional buying patterns creating supply squeezes

Airdrop Calendar: Major token unlocks and distributions ahead

Bottom Line Assessment

The crypto market is experiencing a sophisticated institutional rotation with record ETF flows driving supply-demand imbalances, particularly in ETH. While geopolitical tensions create short-term volatility, the underlying trends of staking regulation, creator economy monetization, and DEX infrastructure development remain strongly bullish through July 2025.

Key Catalyst Timeline:

Immediate: BTC bounce from $104-106k support

Near-term: ETH regulatory clarity and staking approval

Medium-term: Creator economy token adoption and RWA expansion