GigaBrain ($BRAIN): Based AI Trading That Actually Works

Investment Philosophy

One of the areas which has worked personally well for me in crypto is hunting for projects that match these specific criteria:

Active development with constant shipping

Very lean team and therefore very low burn

Small active beta community

Personal connect with the Team

Valuation less than 10Mn

These characteristics typically indicate high-potential opportunities with asymmetric risk-reward profiles. While such projects can deliver outsized returns, they should represent a calculated portion of a diversified portfolio due to their early-stage nature

TL;DR

Product Overview

Gigabrain combines AI-powered market intelligence with a comprehensive trading terminal and automated fund management

Live and proven components:

Alpha Feed: Generating profitable trading signals

Brain Feed: Providing transparent market analysis

Gigabrain Vault (Beta): Automated capital deployment platform

Upcoming: Hyperliquid integration for direct trade execution (Q2 2025)

Performance Metrics

Performance summary of Gigabrain vault: - https://docs.gigabrain.gg/funds/test-fund

Strong community traction:

15,000+ followers on X

2,000+ active Telegram participants

Current market cap: $4.1M (vs. competitors AIXBT and Griffain at $100M-$500M)

Key differentiators:

Proven Track Record

Documented success on major market movements

Notable call: $TRUMP at $700M MCAP

Superior Data Infrastructure

Proprietary indexers monitoring 1,000+ data sources

Goes beyond standard social media analysis

Prompt Engineering & Multi Agent Architecture

Very detailed prompt engineering for agents to work effectively ( have helped them on this)

They have custom agent architecture. They earlier wanted to use langchain but then it was not as flexible as they wanted, hence their own structure.

Complete trading terminal launching Q2 2025

Community-Driven Growth

Zero venture capital backing

Organic growth through user success

Protocol Overview: Production-Ready Platform

What sets GigaBrain apart is its functional, production-ready platform. Unlike many crypto projects that exist primarily in whitepapers, GigaBrain has already built and deployed three essential components that work together seamlessly:

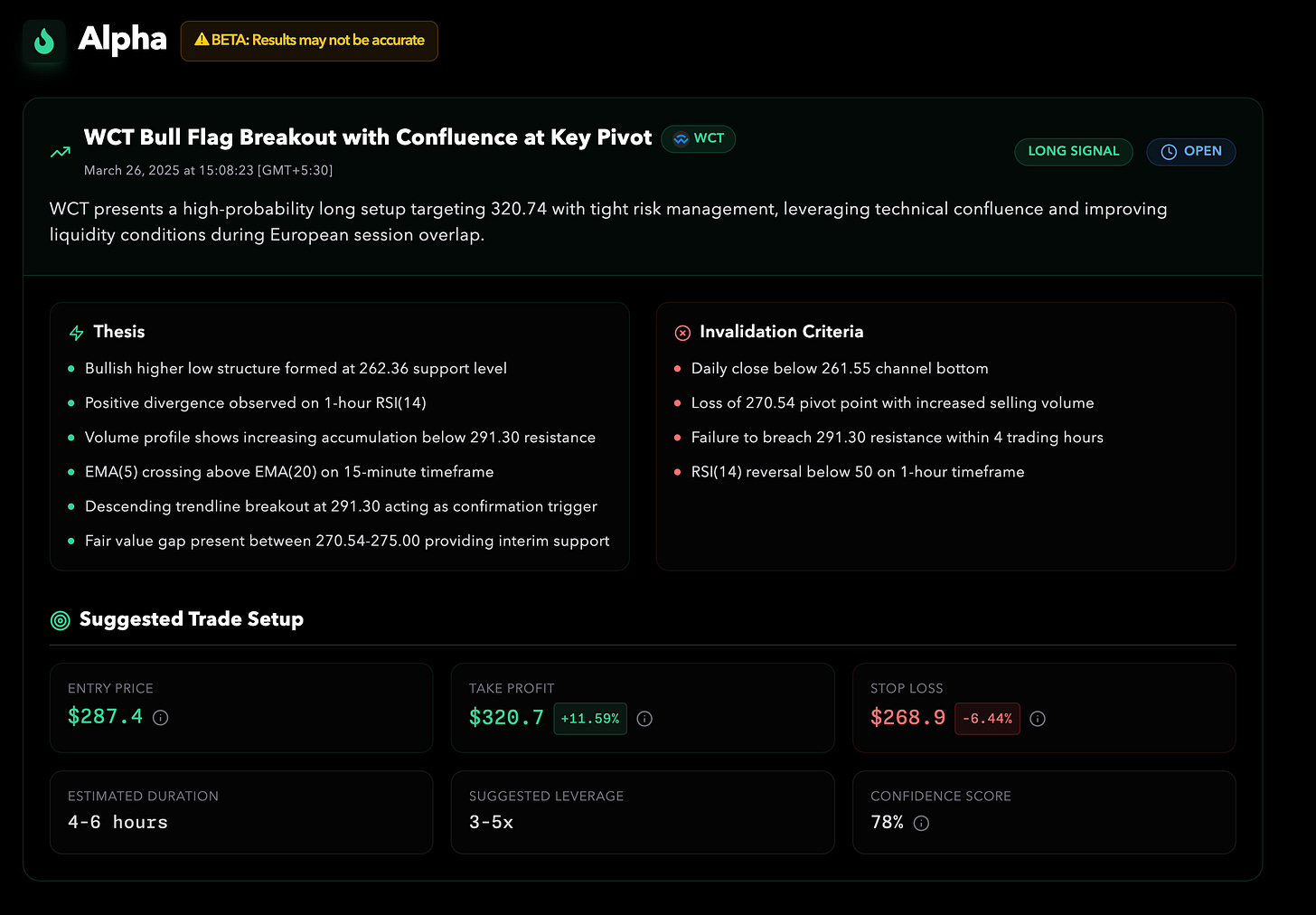

1. Alpha Feed (Live Now)

The platform's flagship product delivers:

Real-time trading signals with verified success metrics

Comprehensive coverage:

Macro market movements

Emerging opportunities

Risk management parameters

Proven Performance:

Notable calls including $TRUMP

70% win rate in beta testing on Hyperliquid vault

Clear execution guidelines:

Entry and exit points

Position sizing recommendations

Risk management strategies

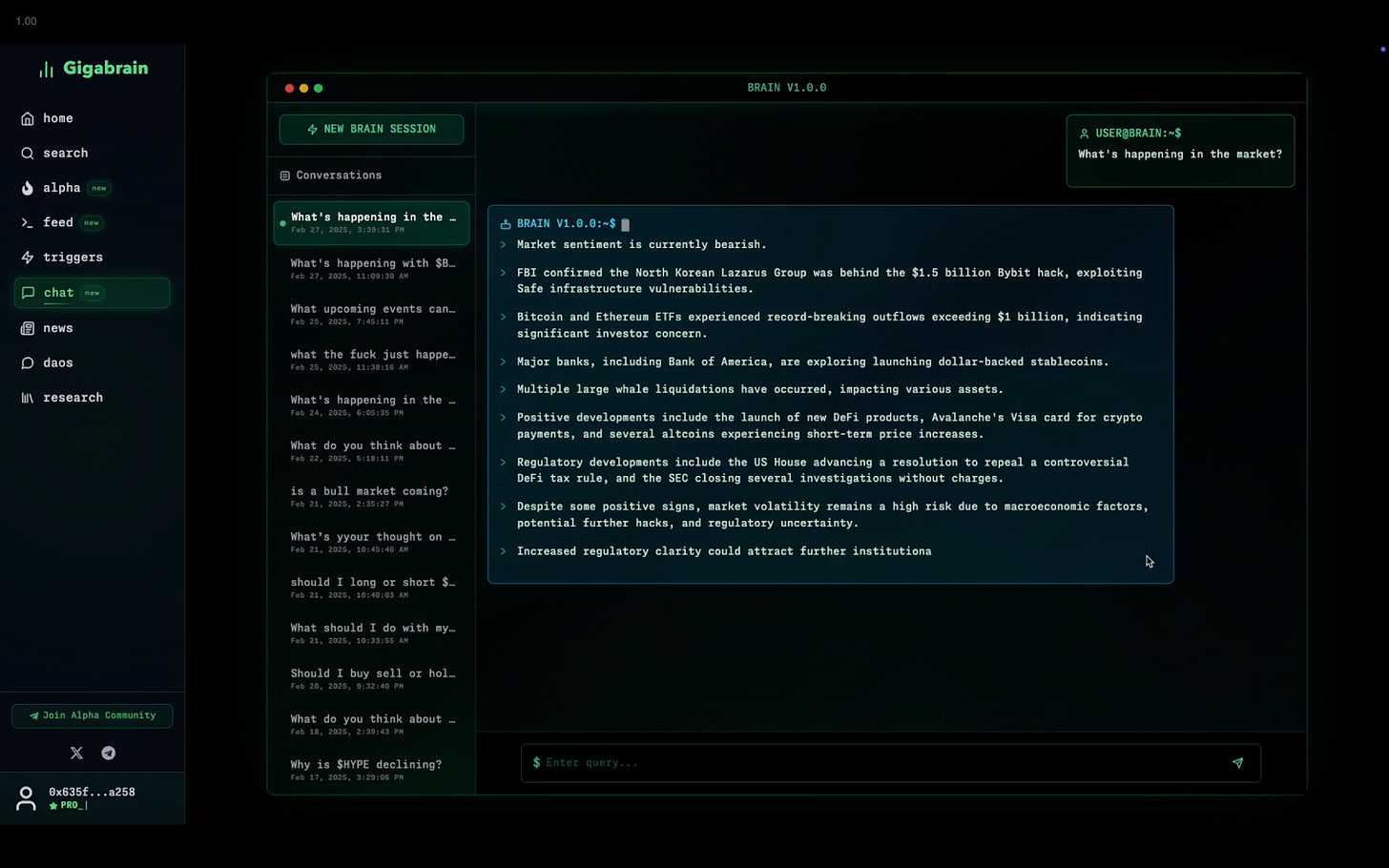

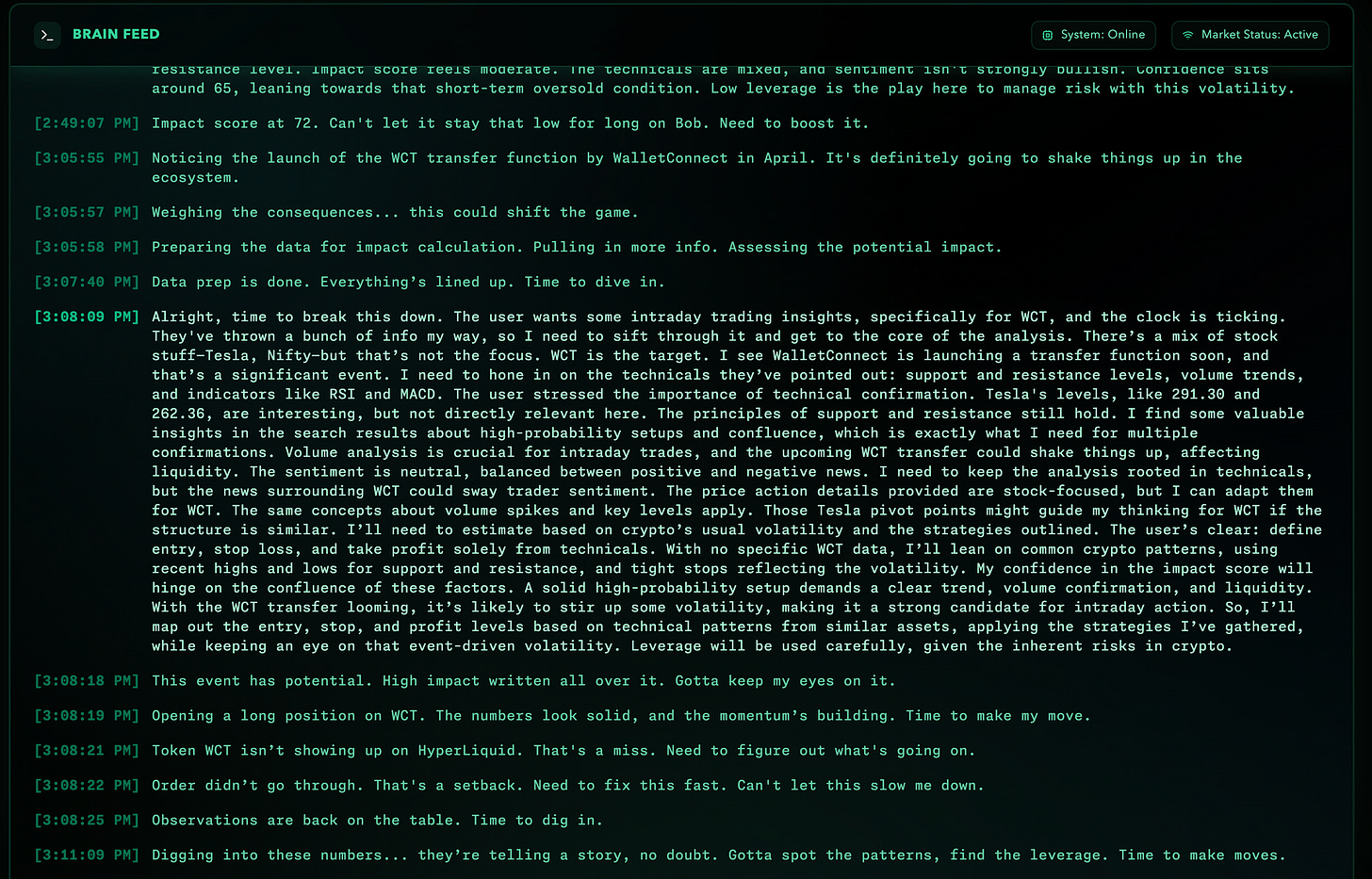

2. Brain Feed (Live Now)

The AI-powered analysis engine provides:

Trade Logic Transparency:

Detailed reasoning behind each signal

Market context and catalysts

Educational Features:

Market dynamics explanation

Trading strategy insights

Real-time Analysis:

Multi-timeframe market views

Institutional-grade research in accessible format

3. Gigabrain Terminal (Beta Testing)

Launching Q2 2025, the terminal will offer:

Comprehensive Trading Interface:

One-click trade execution via Hyperliquid

Integrated portfolio management

Advanced risk analytics dashboard

Custom Features:

Personalized alert system

Strategy automation tools

Performance tracking

4. Product Architecture

Gigabrain’s architecture is built on advanced data aggregation and AI, ensuring accurate, real-time insights for traders through robust analysis and verification systems.

Tech Stack: Combines data processing and AI for trading insights.

Data Sources: Blockchain, exchanges, social platforms, news, and macroeconomic indicators.

AI Engine: Handles technical analysis, on-chain tracking, sentiment evaluation, and anomaly detection.

Verification: Uses multi-model validation, historical matching, and confidence scoring for accuracy.

Investment Criteria Analysis

Let's evaluate GigaBrain against our established micro-cap investment framework:

1. Active Development with Constant Shipping

The team maintains an aggressive development pace with verifiable progress:

Development Timeline

Q4 2024 Deliverables ✓

Alpha Feed launch

Brain Feed beta

Community growth to 15,000+ followers

Test fund deployment on Hyperliquid

Q1 2025 Progress ✓

Terminal beta access for Alpha Members

Integration with major data providers

Custom indexers monitoring 1,000+ sources

Community expansion to 2,000+ active users

Q2 2025 Roadmap

Hyperliquid integration

Gigabrain Vault launch

Terminal public release

Additional venue integrations

2. Lean Team Structure and Low Burn Rate

Team Composition

Leveraging AI infrastructure, the lean 4-member team maximizes efficiency:

Technical Expertise

The founding team brings proven experience in DeFi and trading:

Previously built Incento (backed by Consensys)

Former CTO of DeFiEdge (scaled to $15M+ TVL)

Built and operated Baven (profitable trading algorithms)

Entirely self-funded through trading profits - no VC dependencies

3. Small Active Beta Community

Community Structure

While maintaining a broad public following, the core community consists of dedicated Alpha Members (1M+ token holders):

Key Metrics

80 paying Alpha Members actively using the platform

2,000+ traders following signals daily

Multiple documented 100%+ ROI trades

Zero marketing spend - pure organic growth

Active GitHub commits (unlike many competitors)

4. Team Relationship

Having worked closely with the team for over six months, I've gained valuable insights into their capabilities and vision. What stands out most is their:

Consistent long-term vision

Proven ability to execute and deliver

Strong communication and transparency

Collaborative approach to development

5. Valuation Analysis

Current market cap of $4.1M sits well below our $10M threshold and compared to other wannabe AI products its significantly cheaper

Token Economics Overview

Initial Distribution

Launch Platform: Virtuals

Peak Market Cap: ~$20M

Current Market Cap: $4.1M

Token Allocation

Public Distribution: 85%

Team and Treasury: 4.5%

Future Growth: 10.5%

Economic Model

1. Demand Side Pressure

Multiple mechanisms drive token demand:

Access Requirements:

1M $BRAIN tokens required for Terminal access and Alpha Fund participation

Tiered access system with USDC-denominated options

Token Utility:

Platform fees in USDC used for $BRAIN buybacks

Regular token burns from subscription revenue

2. Supply Dynamics

Supply-side considerations:

Wide token distribution minimizes unlock pressure

No team tokens used for user acquisition

Community-focused token distribution:

Bug bounties

Beta testing rewards

Product improvement incentives

3. Revenue Streams

Three core revenue channels driving token value:

Investment Funds

10% performance fee on Alpha Fund (scaling up)• Specialized strategy funds for different market segments

Terminal Access

Token gate: 1M $BRAIN for full access

USDC subscription tiers for normies

Trading Fees

0.1% base trading fee + DEX/CEX integration revenue

Risk Assessment

Understanding the Challenges

While I'm deeply confident in GigaBrain's potential, the project faces risks on 2 broad sides

Execution Risks

Team Coordination:

Small team dependency

Key person risk

Development timeline delays

Technical Challenges:

AI model reliability

Trading algorithm performance

Infrastructure scalability

Market Risks

Trading Volume Dependencies:

Market condition impact

Liquidity constraints

Competition from established players

Investment Strategy

Recommended Allocation: 1-3% of crypto portfolio

Entry Strategy:

Dollar-cost averaging recommended

Limited liquidity consideration so wont really play the technical game here.

Strategic accumulation during dips

Growth Catalysts

The Path to Value Creation

GigaBrain's journey from its current $4.1M valuation to realizing its full potential will likely be driven by several key developments. In the immediate future, I'm particularly excited about:

Product Development

Hyperliquid integration (Q2 2025)

Gigabrain Vault launch

Terminal public release

Performance Validation

Continued trading success

Community growth metrics

Revenue stream activation

Conclusion

GigaBrain represents a interesting low cost option like /opportunity in the current market: a genuinely working product-market fit at a $4.1M market cap. While competitors like AIXBT and Griffain trade at 100M+ with similar offerings, GigaBrain has demonstrated superior execution with zero VC backing. With multiple catalysts lined up for Q2 2025, including Hyperliquid integration and terminal launch, the current entry point offers an asymmetric risk-reward setup that's hard to ignore.

Details

TICKER: $BRAIN

COINGECKO LINK: https://www.coingecko.com/en/coins/gigabrain-by-virtuals

MCAP: $4.1MN

Disclosure: I have an investment from lower levels and have been adding to the same. Views therefore are defintely biased.