Daily Update: 25th April, 2025

Insights from YT and CT

Market Overview

The crypto market in April 2025 demonstrates a complex landscape with multiple competing narratives and varying performance across different sectors. Bitcoin has reasserted its "safe haven" status, while altcoins show sector-specific strength primarily in AI, DeFi yield, and infrastructure tokens. Institutional adoption continues to accelerate with several high-profile developments, and the market is witnessing a gradual shift from pure speculation to value and utility-based investment theses.

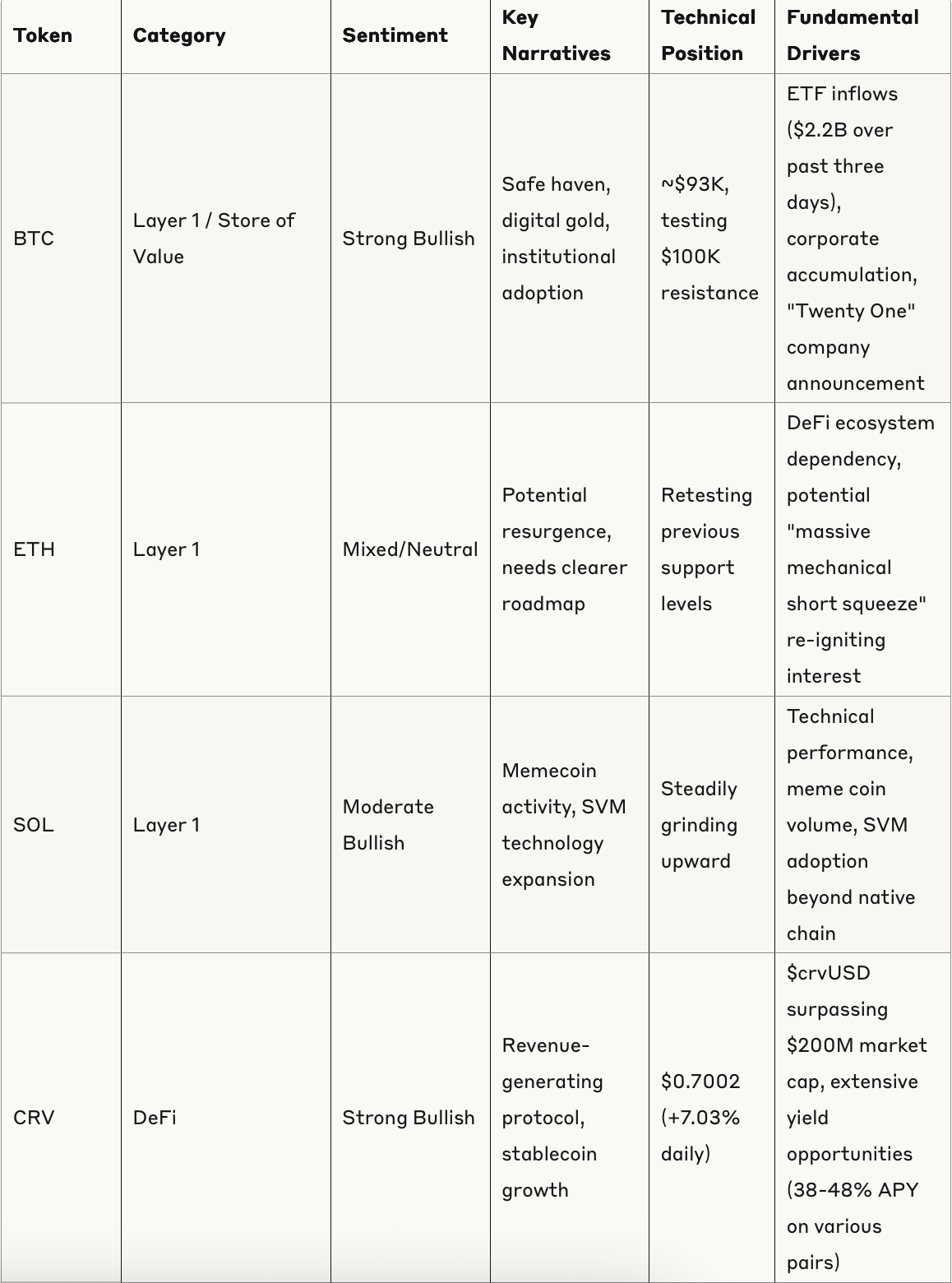

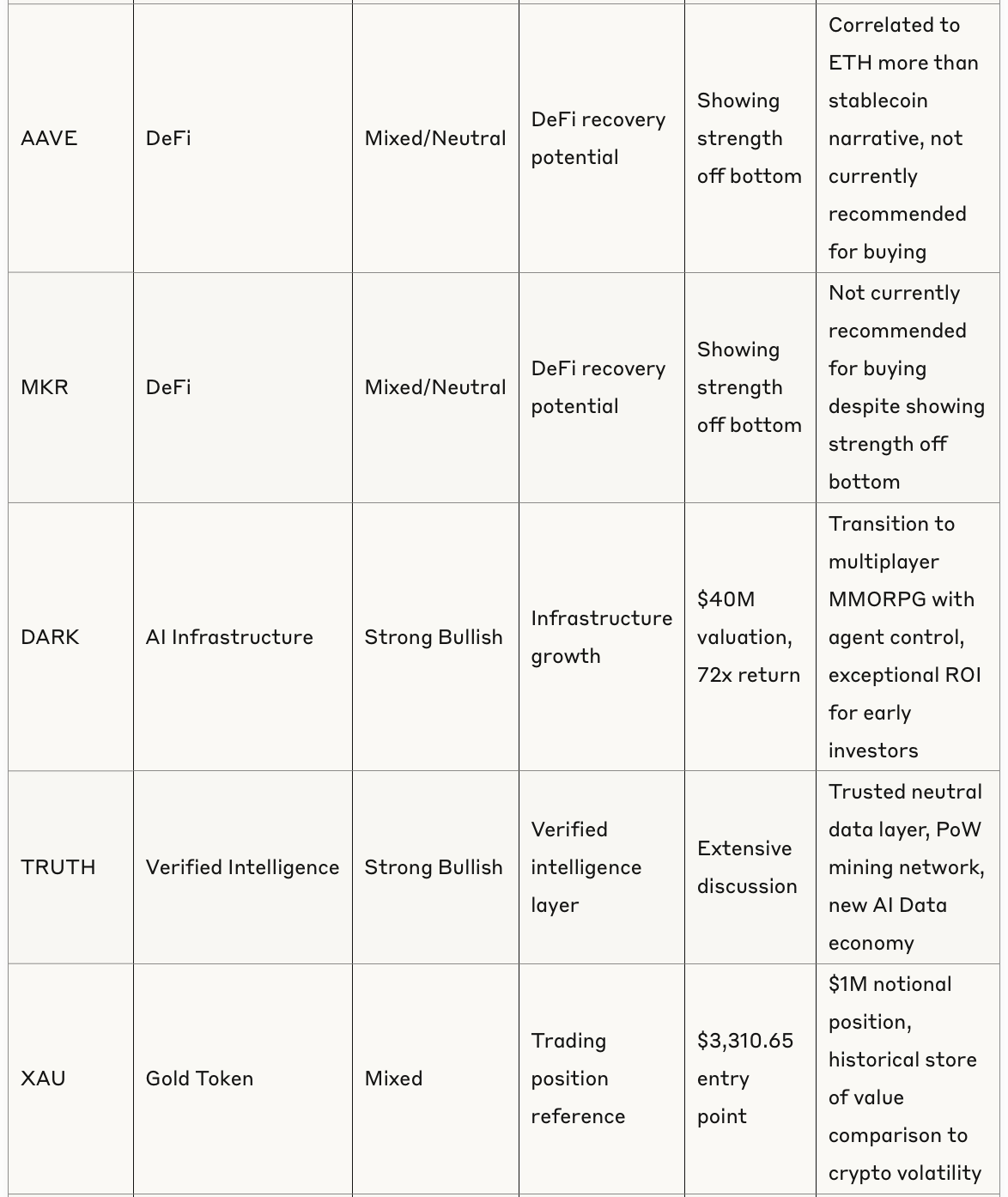

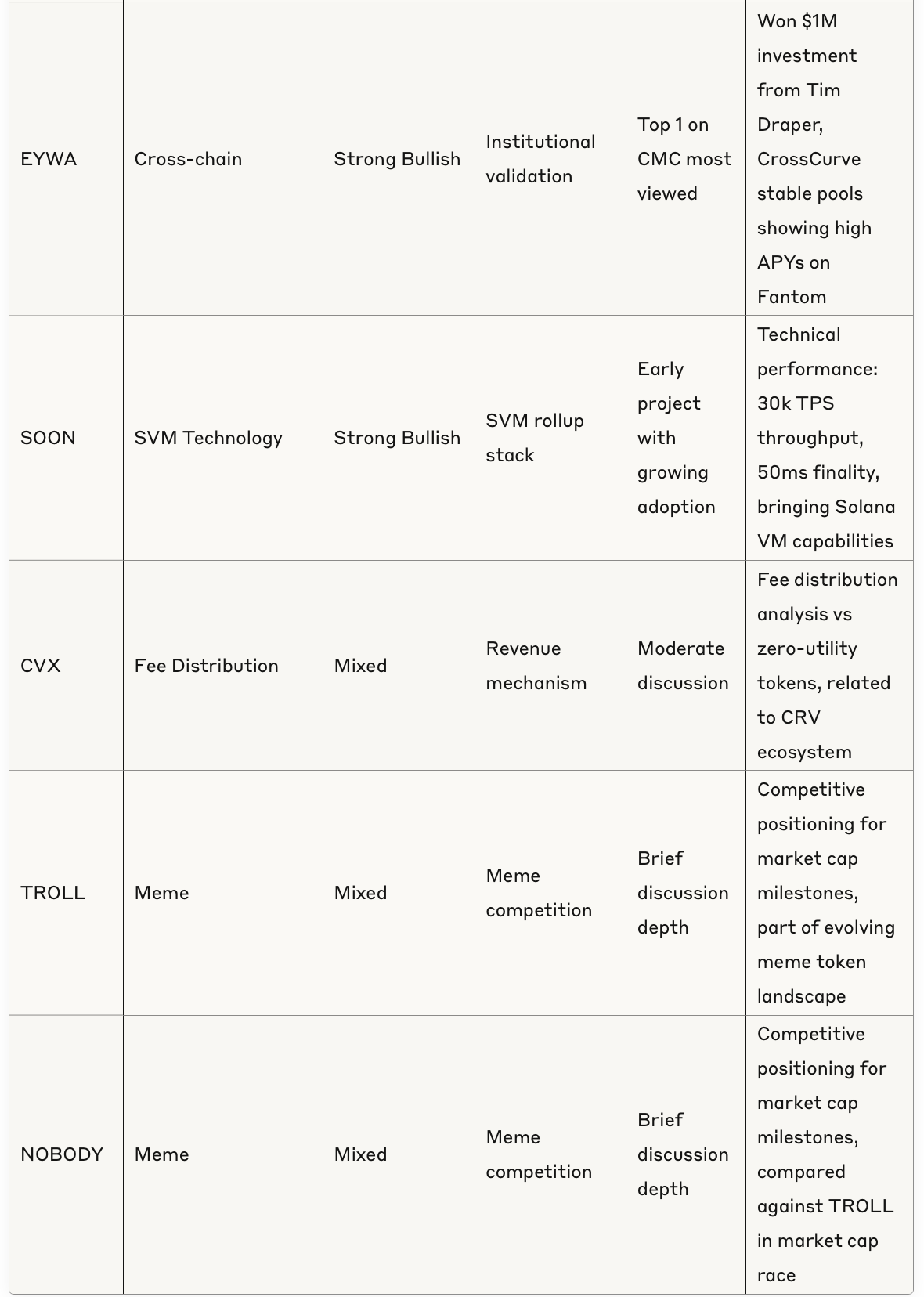

Token Analysis Table

Sector Performance Analysis

Bitcoin and Bitcoin Ecosystem

Bitcoin has reclaimed its "safe haven" or "digital gold" narrative and is showing strong performance at around $93,000, with resistance at $100,000 and support at $88,000. The asset has held up extremely well relative to stocks and is back at all-time highs compared to traditional markets. Key drivers include:

Institutional Adoption: The announcement of "Twenty One" company as a partnership between Tether, SoftBank, Bitfinex, Cantor, and Jack Mallers represents a major institutional milestone.

ETF Performance: Strong ETF flows with over $2.2 billion in inflows over past three days. BlackRock's $IBIT is seeing the highest daily inflows in 4 months ($643.2M).

Corporate Accumulation: Identified as a key catalyst for the next leg up in BTC price.

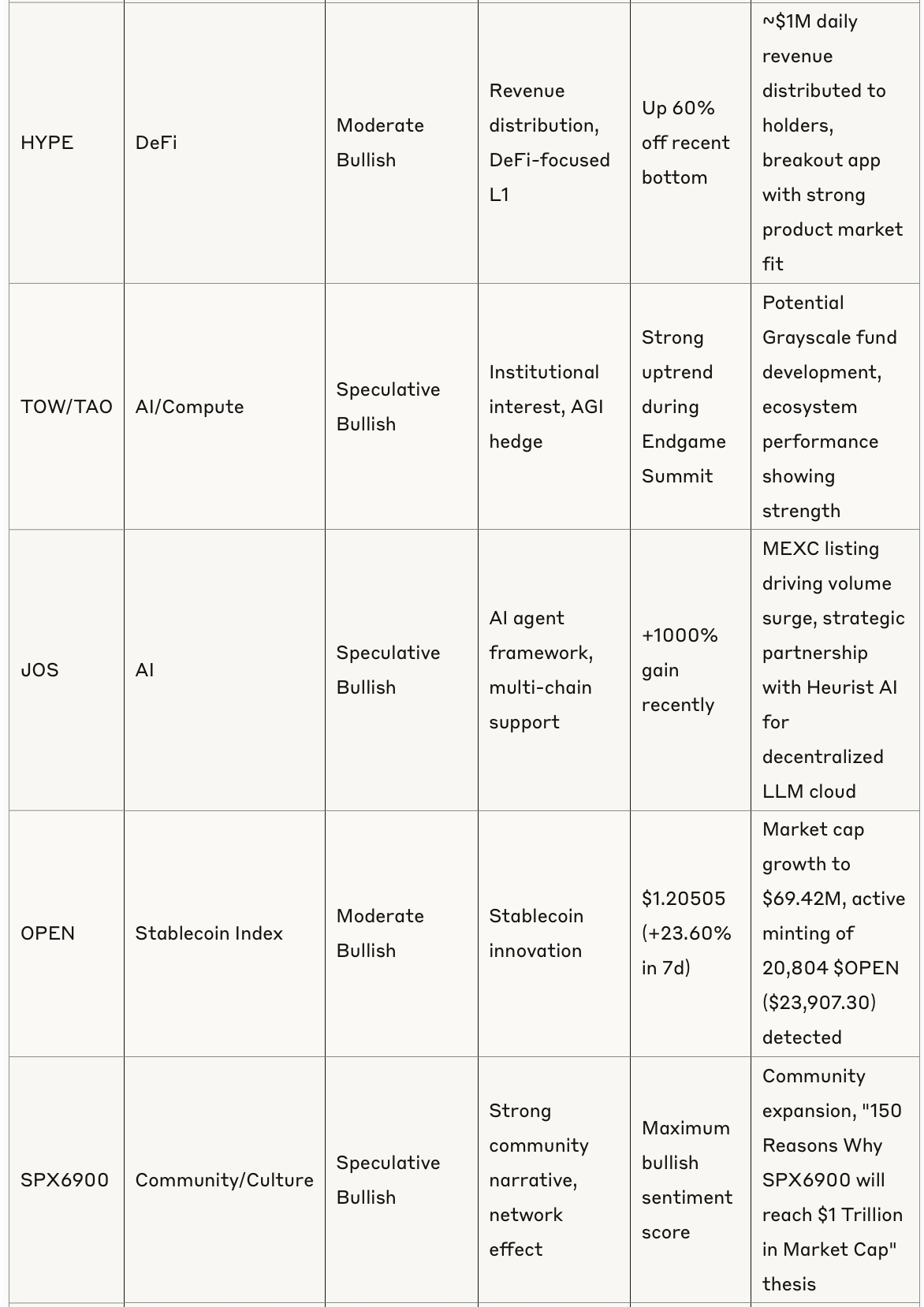

Bitcoin ecosystem tokens like $STX are benefiting from this narrative, with Stacks showing strong performance as a leader in the BTC ecosystem narrative that emerged in late 2023.

Ethereum and Layer 1s

Ethereum is showing mixed signals with some recent strength after months of weakness. It is currently retesting important support areas, with the potential to break the pattern of rejecting and making new lows. The key narratives around ETH include:

Potential Resurgence: After SOL ecosystem dominance, some analysts see potential for "massive mechanical short squeeze re-igniting interest in the ETH eco-system."

Communication Challenges: ETH needs to improve messaging and roadmap clarity to maintain momentum.

DeFi Correlation: Tokens like AAVE, UNI, and LDO remain highly correlated to ETH performance.

Solana continues to show strength with steady price increases. The SOL ecosystem is experiencing renewed meme coin activity, and its SVM (Solana Virtual Machine) technology is expanding beyond the native ecosystem. The technical performance remains strong with high throughput and quick finality.

AI and Compute Tokens

AI tokens are showing a clear segmentation between infrastructure, application, and specialized tokens:

TAO: Positioned as a hedge against AGI, with strong community momentum from the Endgame Summit. Some analysts project a "4 or 5x over next three months" with long-term targets in the 3000-3200 range, potentially placing it in the top 10 cryptocurrencies.

JOS: AI agent and swarm framework with multi-chain support showing gains of +1000% recently. Key drivers include its partnership with Heurist AI, MEXC listing, and GitHub reviewer agent development.

DARK: Infrastructure growth token transitioning to multiplayer MMORPG with agent control, showing a 72x return to reach $40M valuation.

TRUTH: Verified intelligence layer project focused on trusted neutral data, PoW mining network, and new AI data economy applications.

WLD: Potential swing trade into the April 30th event, though not recommended as a long-term hold due to "massive inflation/unlocks."

The overall AI narrative remains strong in the broader technology landscape, with crypto projects increasingly focusing on specific implementations rather than general AI hype.

DeFi and Yield Generation

DeFi tokens are showing renewed strength with a focus on revenue generation and yield opportunities:

CRV: A standout performer having reclaimed $0.70 (+7.03% daily), with $crvUSD surpassing $200M market cap. The token is benefiting from extensive yield options (38.5%-47.9% APY) and significant institutional interest with $CRV deposits on BitGo surging to 20 million tokens.

HYPE: Makes approximately $1 million daily in revenue distributed to token holders, with prices up 60% from recent bottoms. The project is described as a "breakout app with strong product market fit" and has "upside potential as a leading DeFi-focused L1."

GS (GammaSwap): Innovative trading infrastructure combining spot and options markets with a triple rewards structure for liquidity providers.

Stablecoins: Significant innovation in this sector with $crvUSD, $RLUSD, and $dUSD establishing strong positions through yield generation and advanced pegging mechanisms.

The market is witnessing a "Real Yield Renaissance" with significant emphasis on sustainable yield strategies. Some pairs offer triple-digit APYs (e.g., dUSD/sfrxUSD at 99.6%), attracting substantial liquidity.

Meme and Community Tokens

The meme token landscape shows mixed performance:

SPX6900: Strong community sentiment and narrative with ambitious projections ("$1 Trillion in Market Cap"). The token is described as a "precision-built engine for human connection" with extensive network effect documentation.

TRUMP: Creating market disruption with mixed sentiment. The "Trump token dinner with president announcement" is noted as impacting broader market momentum.

TROLL and NOBODY: Engaged in competitive positioning for market cap milestones.

As noted in one analysis: "The case for memecoins has become significantly weaker as the marginal mass retail buyers everyone expected over the last year never arrived." Most recurring value is captured by trading tools that facilitate memecoin activity (PumpFun, Photon, etc.).

Conclusion

The crypto market in April 2025 demonstrates a maturing landscape with increasing institutional adoption and a shift toward value-based investing. Bitcoin maintains its position as the market's foundation, while various altcoin sectors develop their own narratives around utility, yield, and technological innovation.

The most promising sectors currently include:

Revenue-generating DeFi protocols with sustainable yield models

AI tokens with specific implementation advantages and clear use cases

Innovative stablecoins bringing yield generation to previously static assets

Bitcoin ecosystem plays benefiting from institutional adoption

Investors are advised to take a more disciplined approach to profit-taking and position management while maintaining exposure to high-quality projects with strong fundamentals and unique value propositions. The shift from pure speculation to utility-based valuation represents a significant maturation of the market, though risks remain in terms of yield sustainability, technical vulnerabilities, and potential market timing challenges later in the year.