Daily Market Update:24th April,2025

Daily alpha basis CT and YT

Market Overview

The crypto market is currently at a critical juncture with Bitcoin testing the $90-95K resistance zone while showing strength relative to equities. The broader market displays mixed signals with selective strength in specific sectors like Real World Assets (RWA) and protocol tokens generating significant fee revenue. Market sentiment leans cautiously bullish with growing concerns about macro risks, including tariff uncertainties and geopolitical tensions.

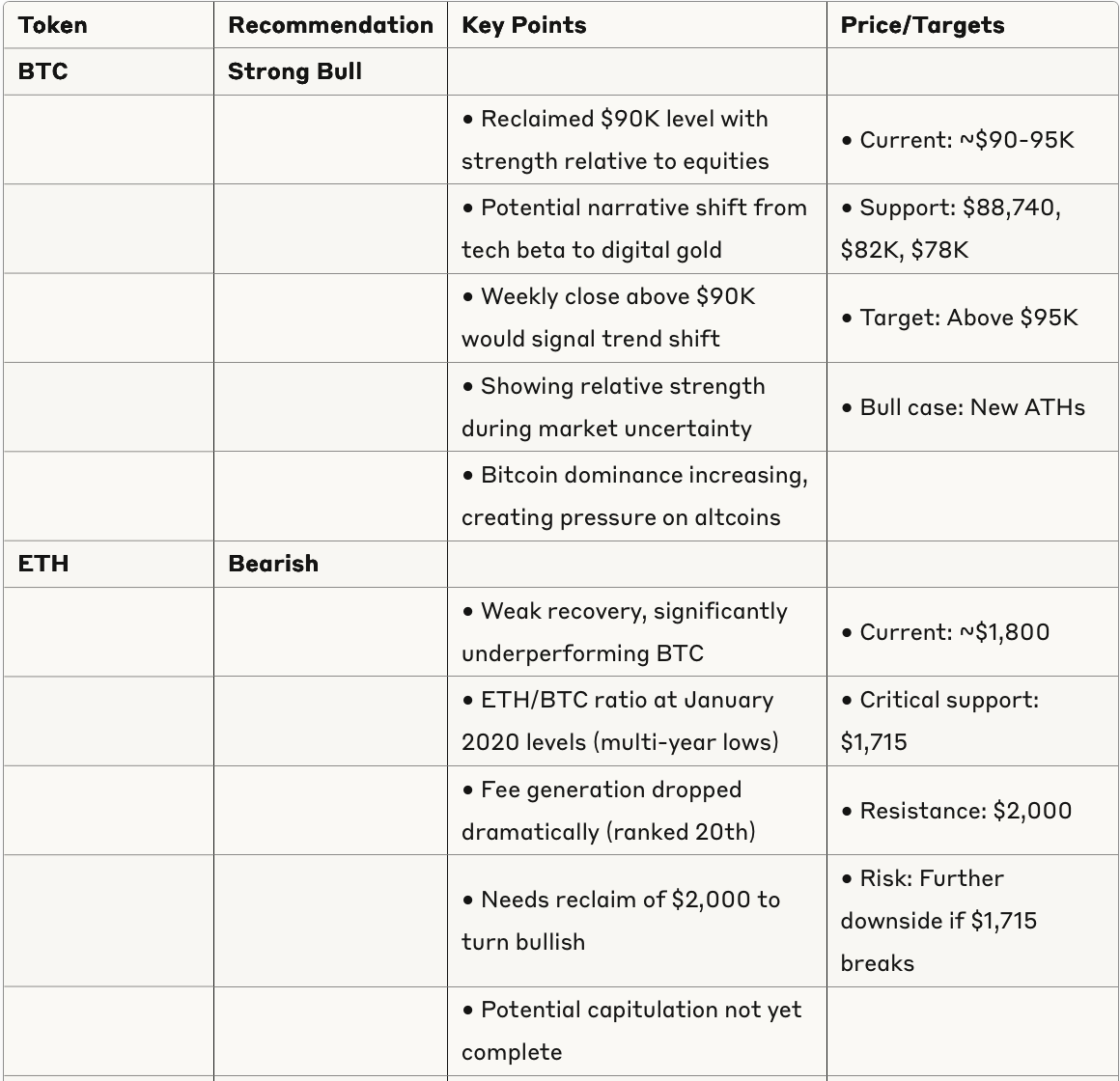

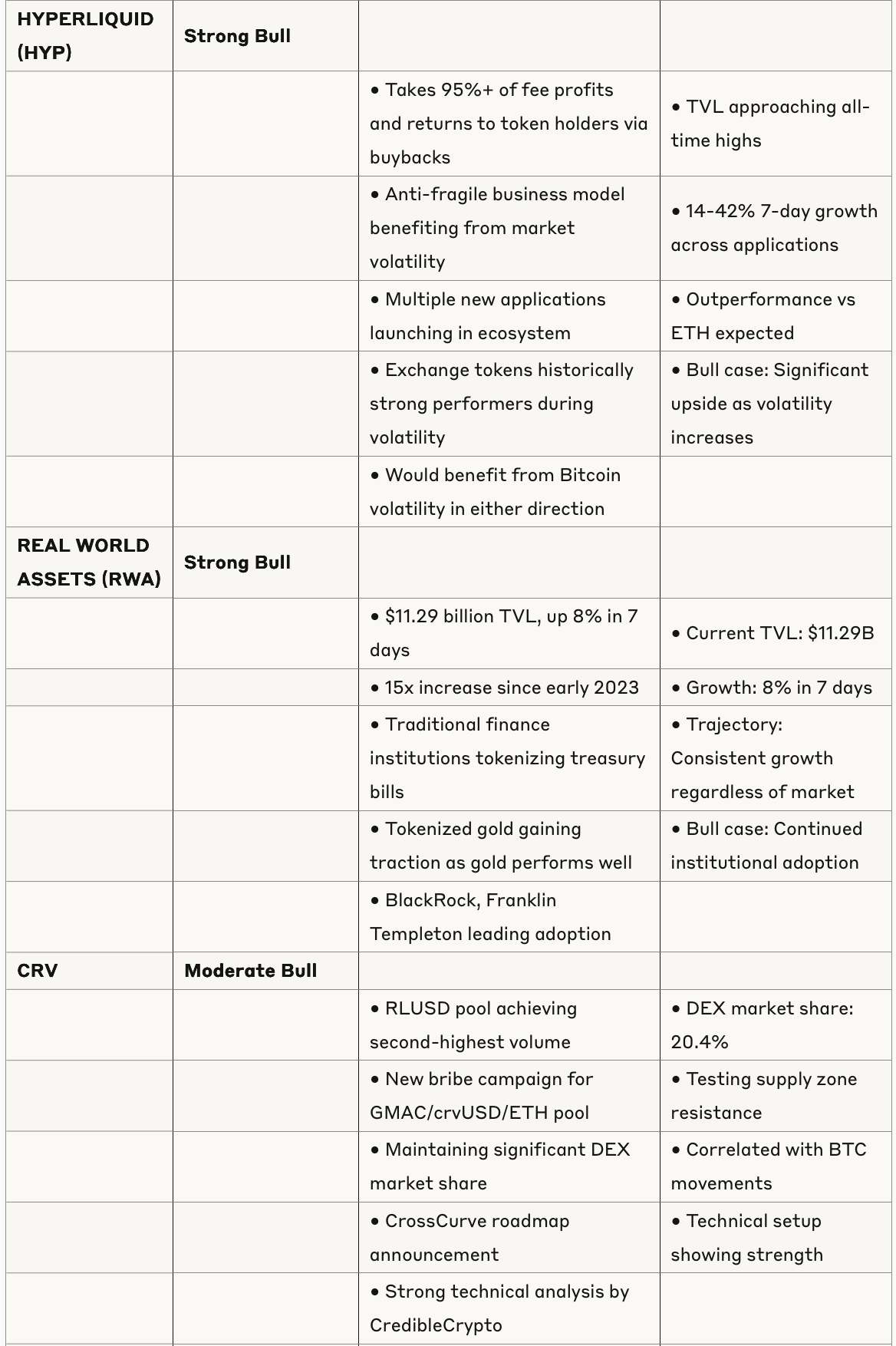

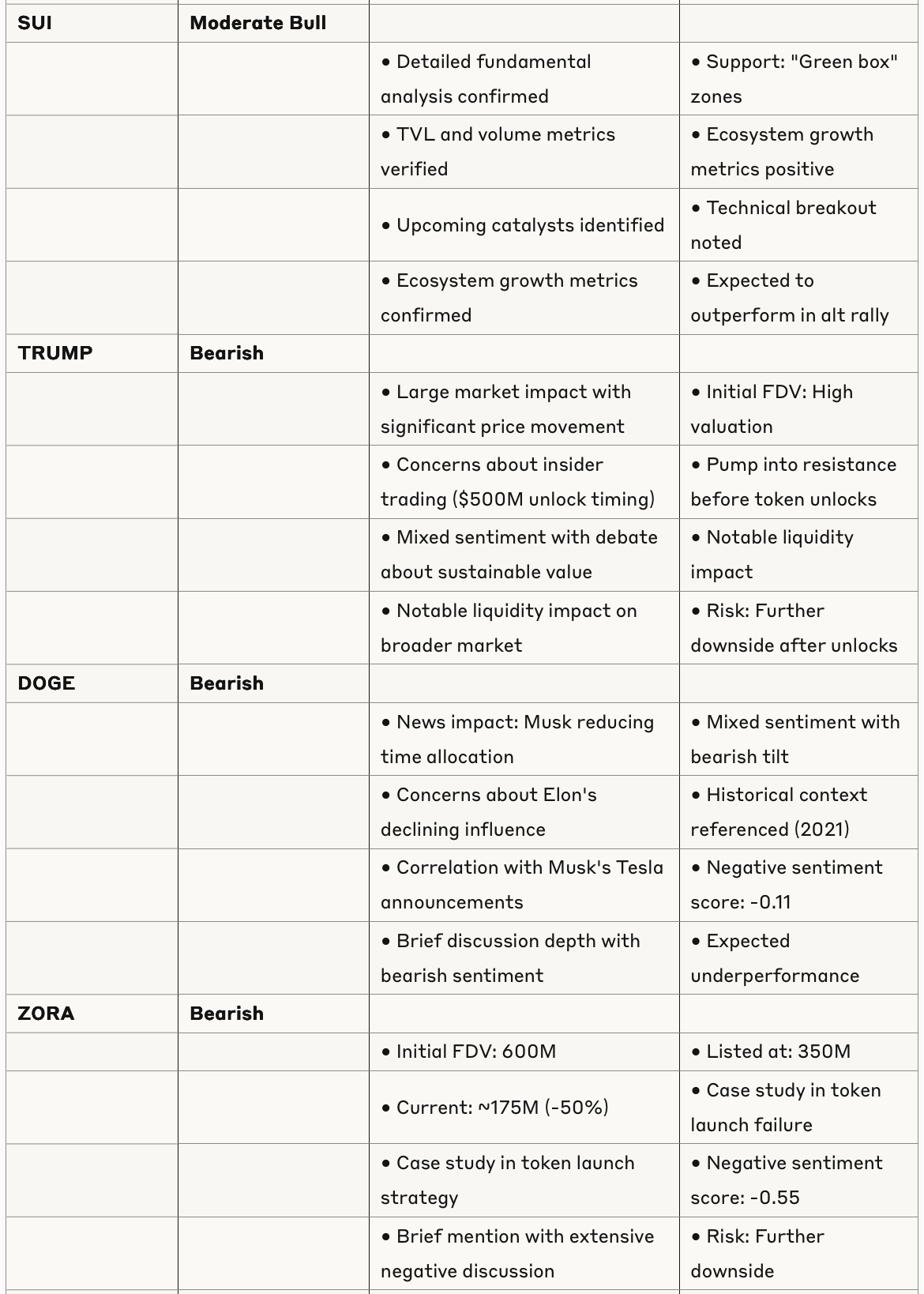

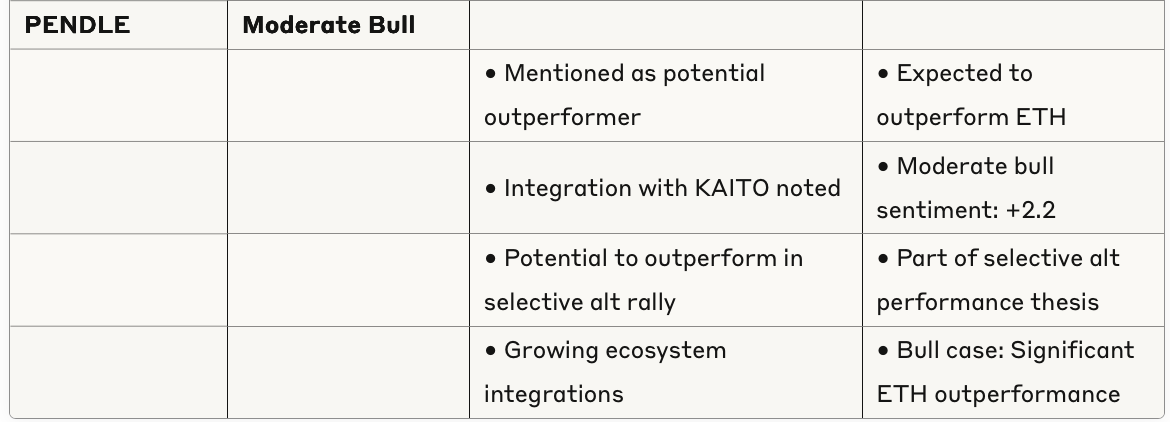

Token Analysis Table

Sector Analysis

Bitcoin & Major Assets

Bitcoin shows strength at a critical resistance zone ($90-95K), with potential for a significant move if weekly closes above $90K occur. The narrative shift from tech beta to digital gold appears underway, with Bitcoin showing relative strength versus equities during market uncertainty. Ethereum continues to underperform, with the ETH/BTC ratio reaching multi-year lows and fundamentals weakening as fee generation drops dramatically.

DeFi Ecosystem

The DeFi landscape shows selective strength with Curve Finance maintaining a 20.4% DEX market share and strong momentum in liquidity pools. The DEX market remains competitive with Uniswap (39%), Maverick Protocol (21.8%), and Curve Finance (20.4%) leading market share. RLUSD integration and new bribe campaigns highlight continued innovation in the space.

Exchange Tokens & Infrastructure

HYPERLIQUID stands out with its anti-fragile business model that benefits from market volatility. Taking 95%+ of fee profits and returning them to token holders via buybacks creates strong fundamentals. Multiple applications launching within the ecosystem show 14-42% 7-day growth, with TVL approaching all-time highs.

Real World Assets (RWA)

The RWA sector continues its explosive growth with $11.29 billion TVL, up 8% in 7 days and 15x since early 2023. Traditional finance institutions like BlackRock and Franklin Templeton are leading tokenization efforts for treasury bills, while tokenized gold gains traction as physical gold performs well. This sector shows consistent growth regardless of broader crypto market conditions.

Meme & Social Tokens

TRUMP and DOGE face bearish sentiment with specific catalysts driving negative outlook. TRUMP faces concerns about insider trading with $500M unlock timing, while DOGE suffers from news about Musk reducing his time allocation. Both tokens show mixed to negative sentiment scores and are expected to underperform the broader market.

Risk Assessment

Technical Risks

Bitcoin failure at $95K could create a potential lower high

Ethereum loss of $1,715 support would accelerate downside

High options open interest ($43B total) creates volatility risk

Significant delta exposure ($9B) could amplify market moves

Fundamental Risks

Student loan default crisis (5.3M Americans in default)

Potential credit score impact from defaults

Market risk from reduced consumer spending

Geopolitical tensions with Trump's China tariff announcements

Narrative Risks

ETH losing its dominant position in fee generation

Shifting narratives from pure speculation to staking yield

Growing emphasis on institutional accumulation

Increased focus on base layer tokens

Market Psychology & Risk Management

Position Sizing

"If you are deployed at any point in time 100%, I believe personally that that isn't entirely the way to play the game" - Blocmates

"As soon as you like 20-30-40-50% of your stack in one thing, that's a mistake" - Blocmates

Set predetermined capital allocation percentages (20-40% cash recommended)

Market Psychology

"This is the point of peak optimism that everyone is feeling right now" - Trader Mayne

During downtrends, relief rallies often create false confidence

Focus on decision quality, not outcome dependency

Recognize psychological traps during relief rallies in downtrends

Emerging Trends

RWA Growth: Traditional finance embracing tokenization at accelerating pace

Layer-2 Ecosystems: Hyperliquid and Unichain gaining significant traction

Bitcoin De-correlation: Potential shift from tech beta to digital gold underway

Fee Generation Shift: Ethereum's dominance in fees declining dramatically

Selective Alt Performance: Specific alts may outperform despite BTC dominance

Institutional Accumulation: Growing focus on strategic token accumulation by institutions

Conclusion

The crypto market shows a complex landscape with selective strength in specific sectors rather than broad-based bullishness. Bitcoin faces a critical test at $90-95K resistance, while Ethereum continues to underperform significantly. HYPERLIQUID and Real World Assets stand out as strong bullish opportunities with fundamental growth regardless of market conditions. Risk management remains paramount with positioning advice suggesting maintaining significant cash reserves (20-40%) and avoiding over-concentration in any single asset.