Daily Market Update: 6th May, 2025

Insights from CT and YT

Market Overview

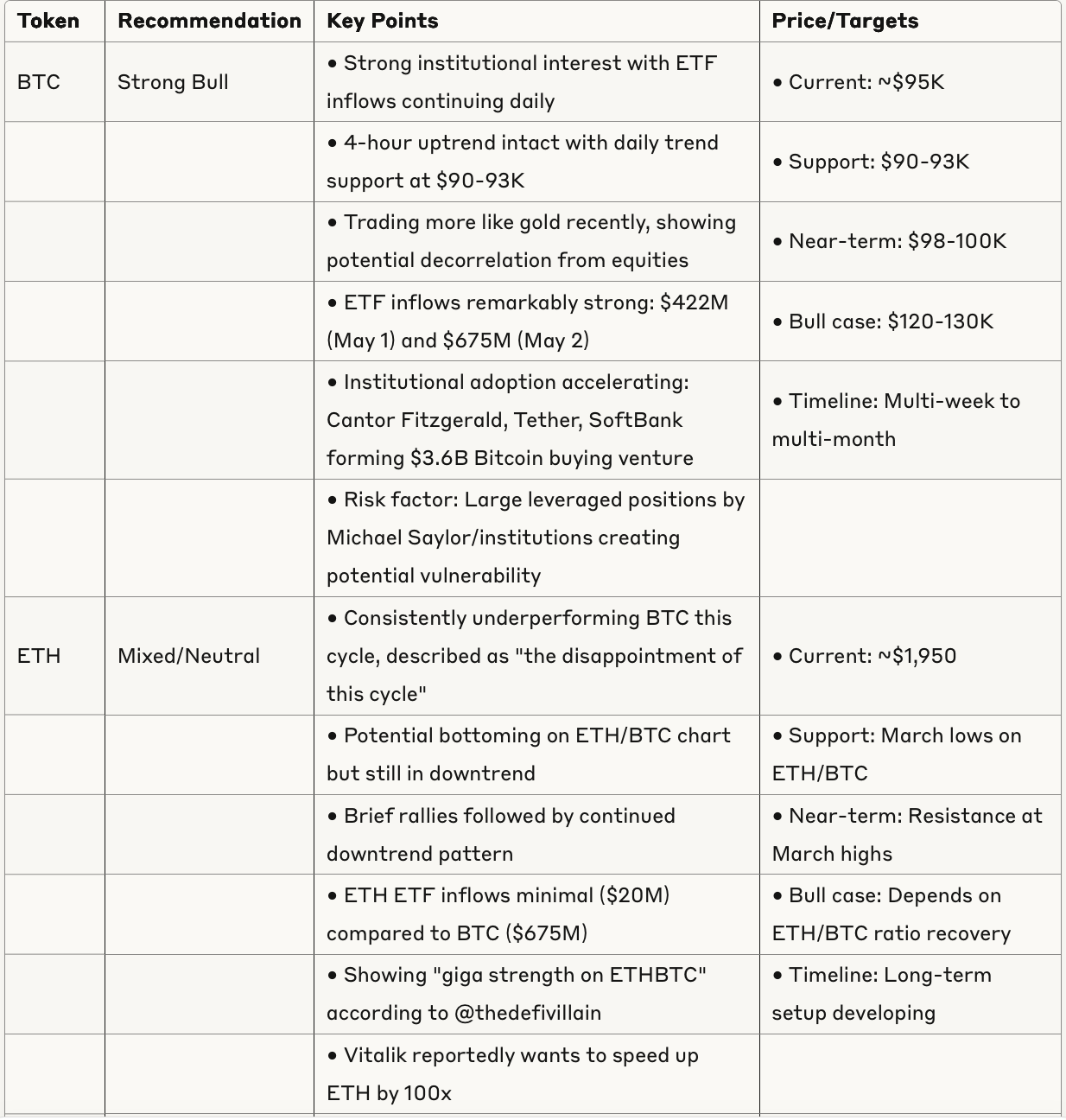

The overall crypto market is showing significant divergence between assets, with Bitcoin maintaining strength while the majority of altcoins struggle. Bitcoin is trading around $95K after briefly approaching $100K, with strong support evident at the $90K level. The market appears to be in a digestion phase following the recent rally from $85K to $98K, with traders taking profits and repositioning.

Gold is showing impressive strength, up a notable 3% in a single day, indicating potential growing fear in traditional markets. Equity markets remain choppy but are showing signs of stabilization after a tariff-related selloff, with traders awaiting impacts on corporate earnings.

Financial conditions have loosened considerably with both the DXY (Dollar Index) and oil prices declining. Market sentiment shows Bitcoin decoupling from equities to some extent, trading more like gold recently. There is a prevailing view that once market FUD (Fear, Uncertainty, Doubt) is relieved from deals and sentiment changes, prices have "no place to go but up," though this might take days or weeks to materialize.

The DeFi sector shows signs of maturation with AAVE's dominance highlighted, while newer narratives around tokenization and AI are gaining traction in the ecosystem.

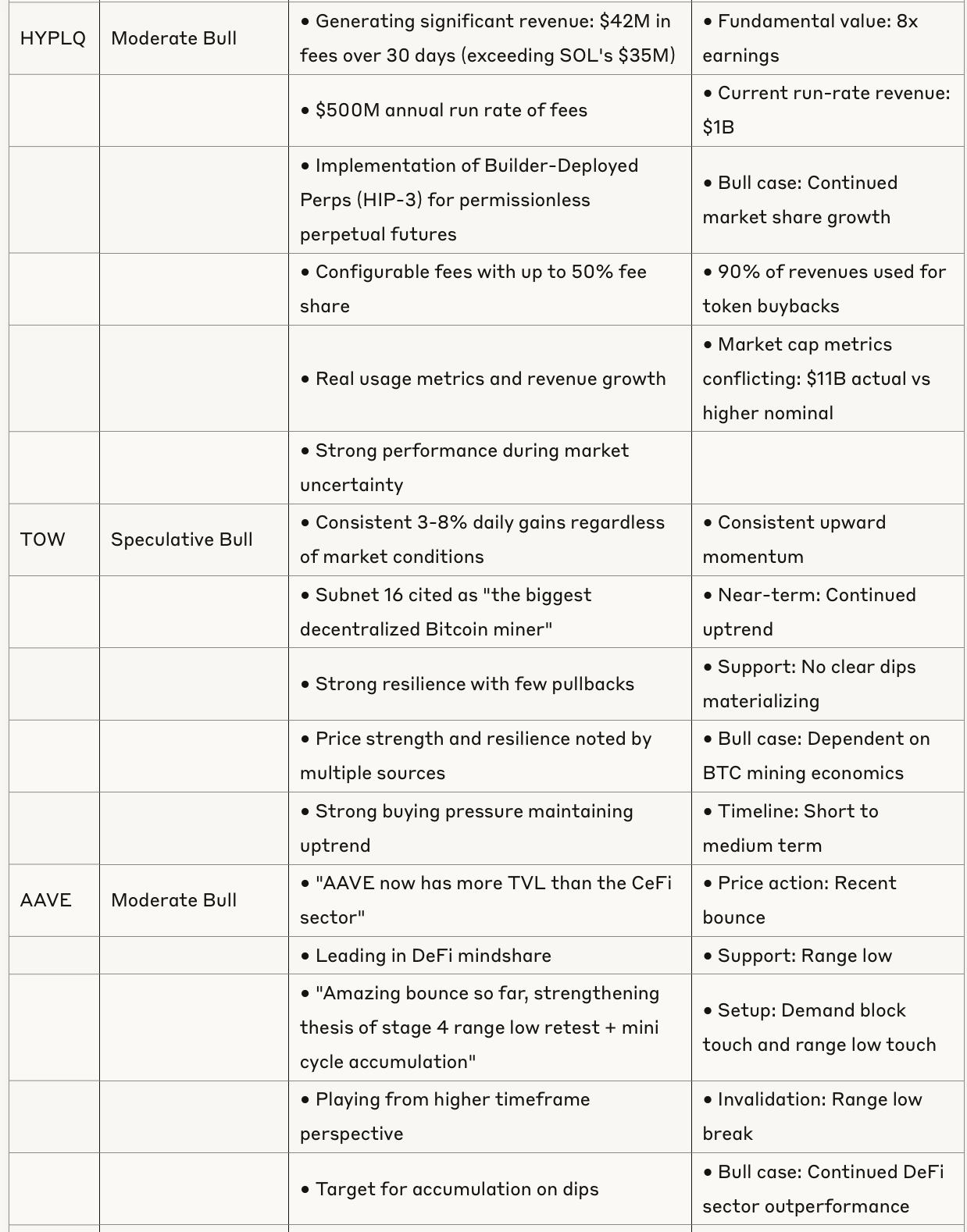

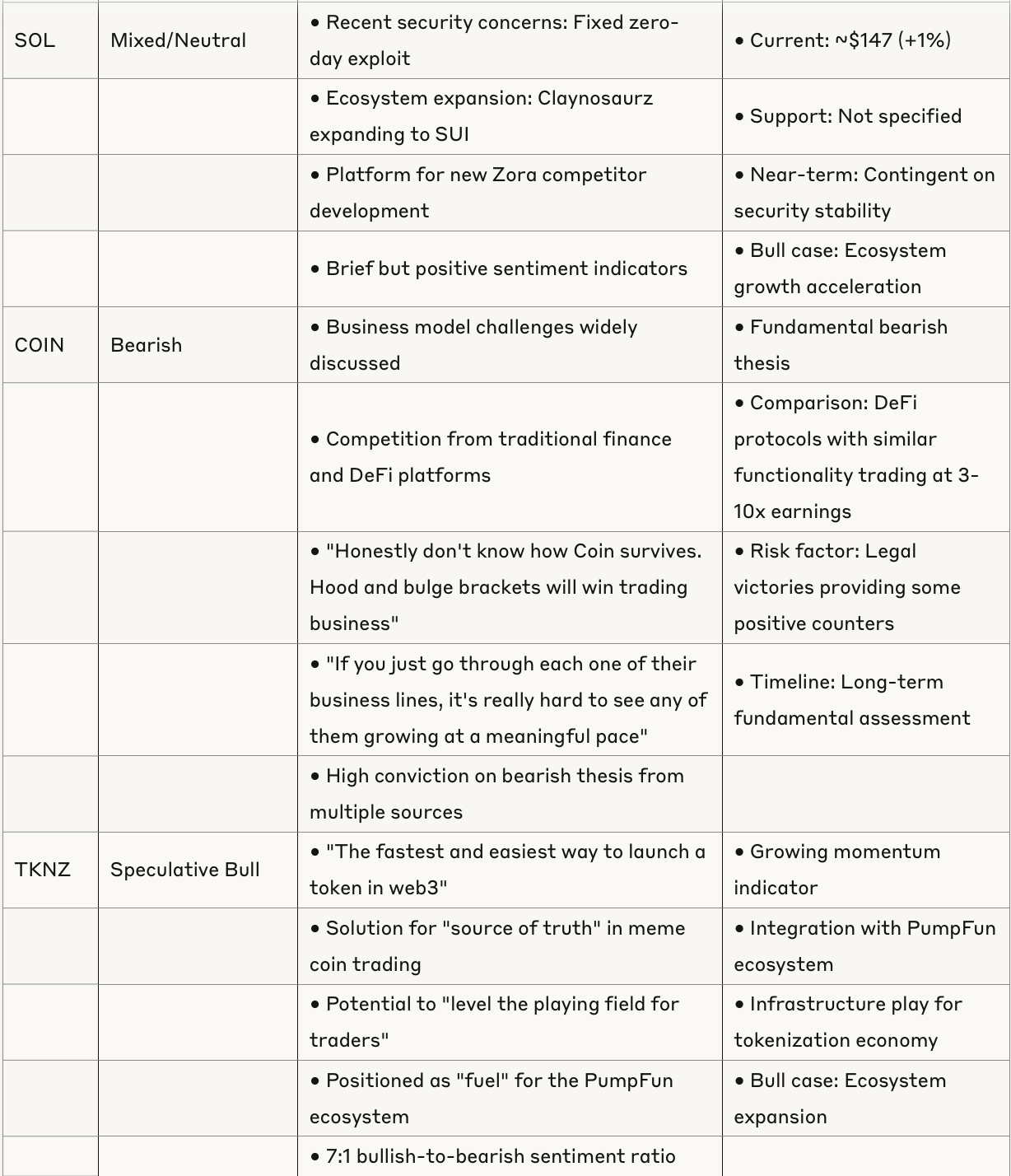

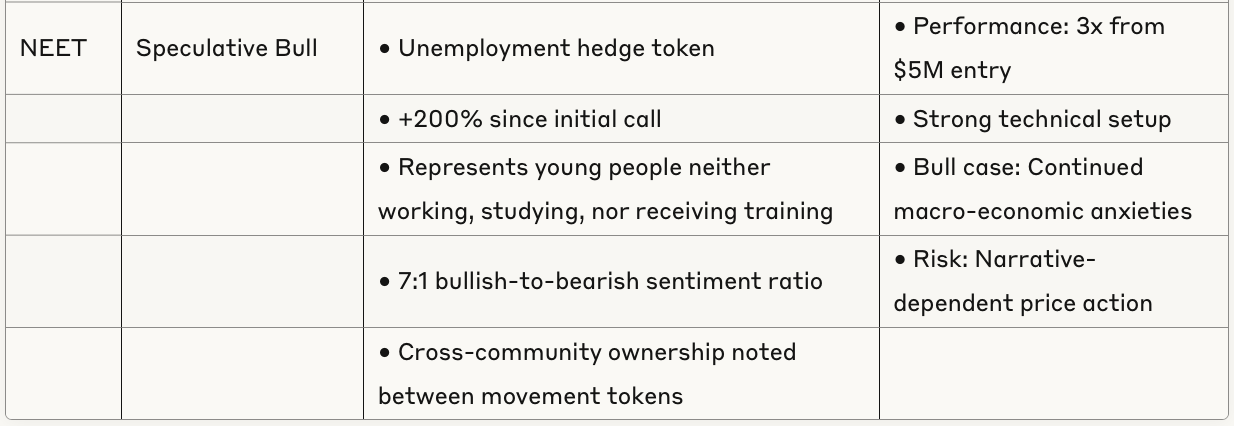

Token Analysis Table

Market Trends and Narratives

Institutional Adoption Acceleration

The cryptocurrency market environment is heavily influenced by significant regulatory developments. The current administration appears to be embracing crypto more openly, with the SEC pausing enforcement actions and dropping investigations including the PayPal PYUSD stablecoin investigation. This regulatory shift is creating a more favorable environment for institutional adoption.

Institutional involvement has become a dominant narrative, with several major announcements: Cantor Fitzgerald, Tether, and SoftBank forming a $3.6 billion Bitcoin buying venture; Federal Reserve lifting bank restrictions on crypto activities; and SoFi resuming crypto investing in 2025 citing favorable regulations. Even Nvidia is reportedly considering adding Bitcoin to its balance sheet.

ETF Flows and Market Divergence

The Bitcoin ETF continues to show remarkable inflows, with recent days seeing $422 million (May 1st) and $675 million (May 2nd) in investments. This stands in stark contrast to Ethereum ETF flows, which are relatively minuscule. This divergence highlights the market's focus on Bitcoin over other digital assets.

Stablecoin Market Dynamics

SDT dominance fell from 70% to 62% in the last 6 months, reaching the lowest level in two years. Last month Tether added over $5 billion in market cap compared to USDC's $980 million, which has flattened the decline. A key question in the market is whether USDT dominance will rise again or if increased competition will continue the downtrend.

Movement Token Narrative

A significant discussion around "movement tokens" like $HOUSE (housing market hedge) and $NEET (unemployment hedge) has emerged, with reports of substantial returns (28x and 3x respectively). These tokens appear to represent macro-economic anxieties, driving interest in alternative hedges. Cross-community ownership has been noted between these tokens.

DeFi Maturation and Revenue Focus

DeFi protocols and AI-related tokens are showing particular strength in the current market environment, with projects that generate actual revenue and usage outperforming speculative assets. This suggests a market shift toward fundamentals rather than pure speculation.

AAVE is highlighted as a successful DeFi project with more Total Value Locked (TVL) than the entire CeFi sector, showing DeFi's growth toward institutional-level adoption.

Tokenization Infrastructure Growth

The most dynamic narrative energy is concentrated in the tokenization infrastructure space (TKNZ, PumpFun) and community coordination models evolving from "cabals" to networks (Kaito). TKNZ appears positioned at the intersection of multiple growth vectors in the ecosystem.

Risk Assessment

Market-Wide Risks

FOMC Meeting: The upcoming FOMC meeting on Wednesday could create market volatility, potentially triggering a correction in Bitcoin before continuation toward $100K resistance.

Institutional Overleverage: Concerns have been raised about Michael Saylor's aggressive Bitcoin acquisition approach at Microstrategy, with comparisons made to past overleveraged firms. Some analysts believe this approach creates systemic risk if prices decline dramatically.

Regulatory Fragmentation: The mix of policy notes (Arizona veto of BTC bill, EU privacy token ban coming in 2027) highlights ongoing regulatory divergence across jurisdictions that could create uncertainty.

Technical Risks

BTC Range Break: If Bitcoin loses the range low (high 80s/low 90s), traders may become more cautious in the short term despite the longer-term bullish outlook.

Altcoin Divergence: Significant divergence between assets continues, with Bitcoin showing strength while many altcoins struggle. The most resilient assets appear to be those with real utility, cash flow, or unique technological advantages.

Conclusion

The crypto market in early May 2025 shows a maturing landscape with increased institutional participation, regulatory clarity, and a growing focus on revenue-generating projects. Bitcoin continues to lead the market, hovering near the $95K level with strong support at $90-93K and a path toward $100K. ETF inflows remain robust for BTC but minimal for ETH, highlighting the divergence between these assets.

Several key narratives are driving the market: institutional adoption acceleration, DeFi sector maturation, tokenization infrastructure development, and "movement tokens" as economic hedges. The market appears to be in a transitional phase, digesting recent gains while preparing for potential short-term volatility from the upcoming FOMC meeting.

Overall sentiment remains predominantly bullish for quality assets, particularly those generating revenue and showing strong fundamentals. Risk factors include potential overleverage in institutional positions, regulatory fragmentation, and technical resistance levels that may cause short-term corrections before continuation of the prevailing uptrend.