Daily Market Update: 5th May,2025

Alpha from CT and YT

Market Overview

The current crypto market shows several key narratives driving sentiment and price action. Bitcoin is demonstrating significant resilience compared to traditional tech stocks, trading only 15% below its all-time high despite market turbulence. This contrasts with major tech stocks like AAPL (-35%), NVDA (-44%), and TSLA (-56%), suggesting Bitcoin has established itself as a relative safe haven during recent economic uncertainty.

The memecoin market appears to be in a mature phase with clear winners emerging. Some projects are experiencing extraordinary 24-hour gains ($CHILLHOUSE +437%, $STADIUM +392%, $CHACHA +327%) while others show more modest growth, indicating highly selective capital allocation rather than broad-based enthusiasm.

A notable "gold rush" or "gold season" is emerging in the DeFi space, with increased interest in gold-backed tokens and yield opportunities. This trend appears to be driving development activity with "200 plus new stable coins" mentioned in relation to this narrative.

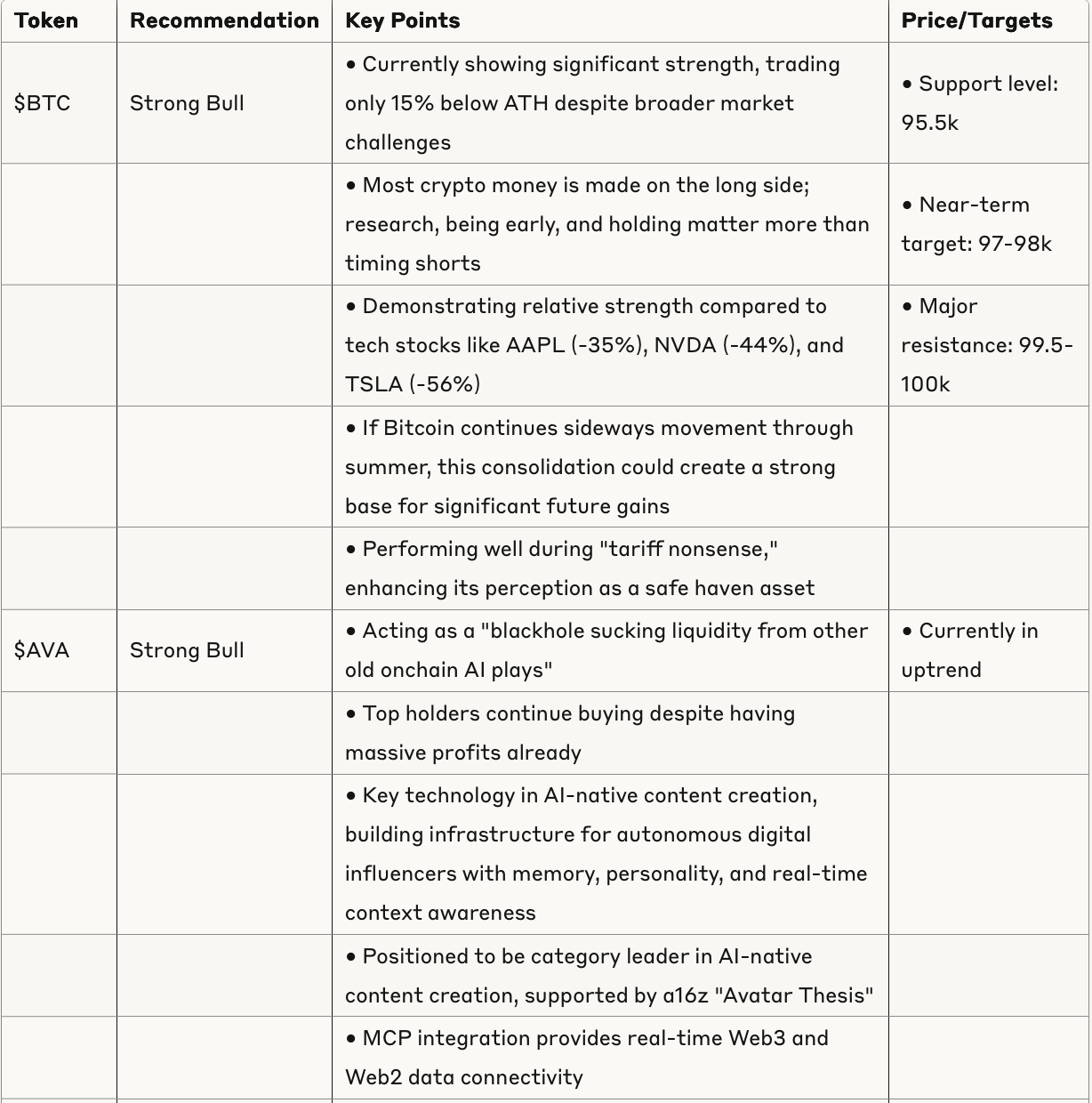

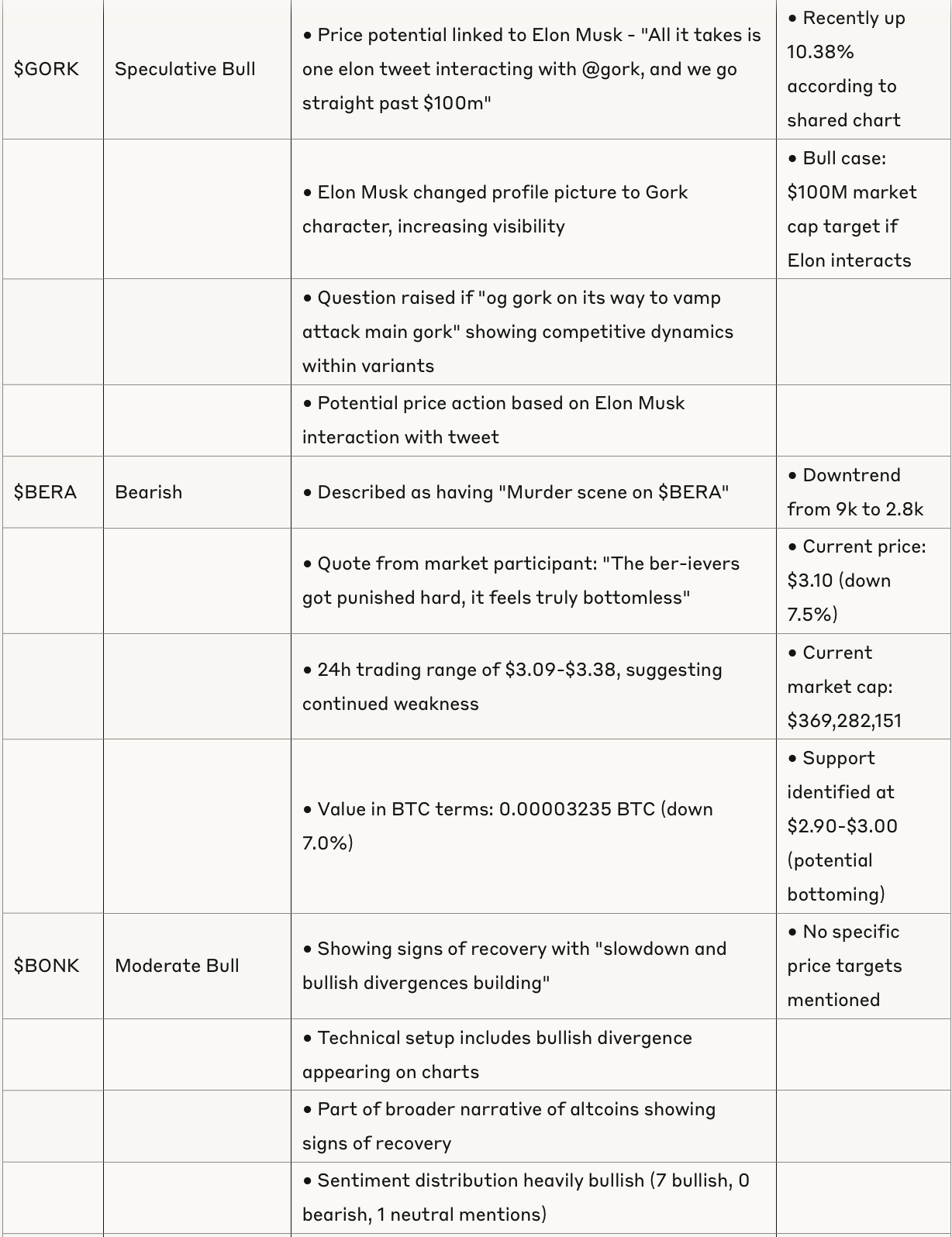

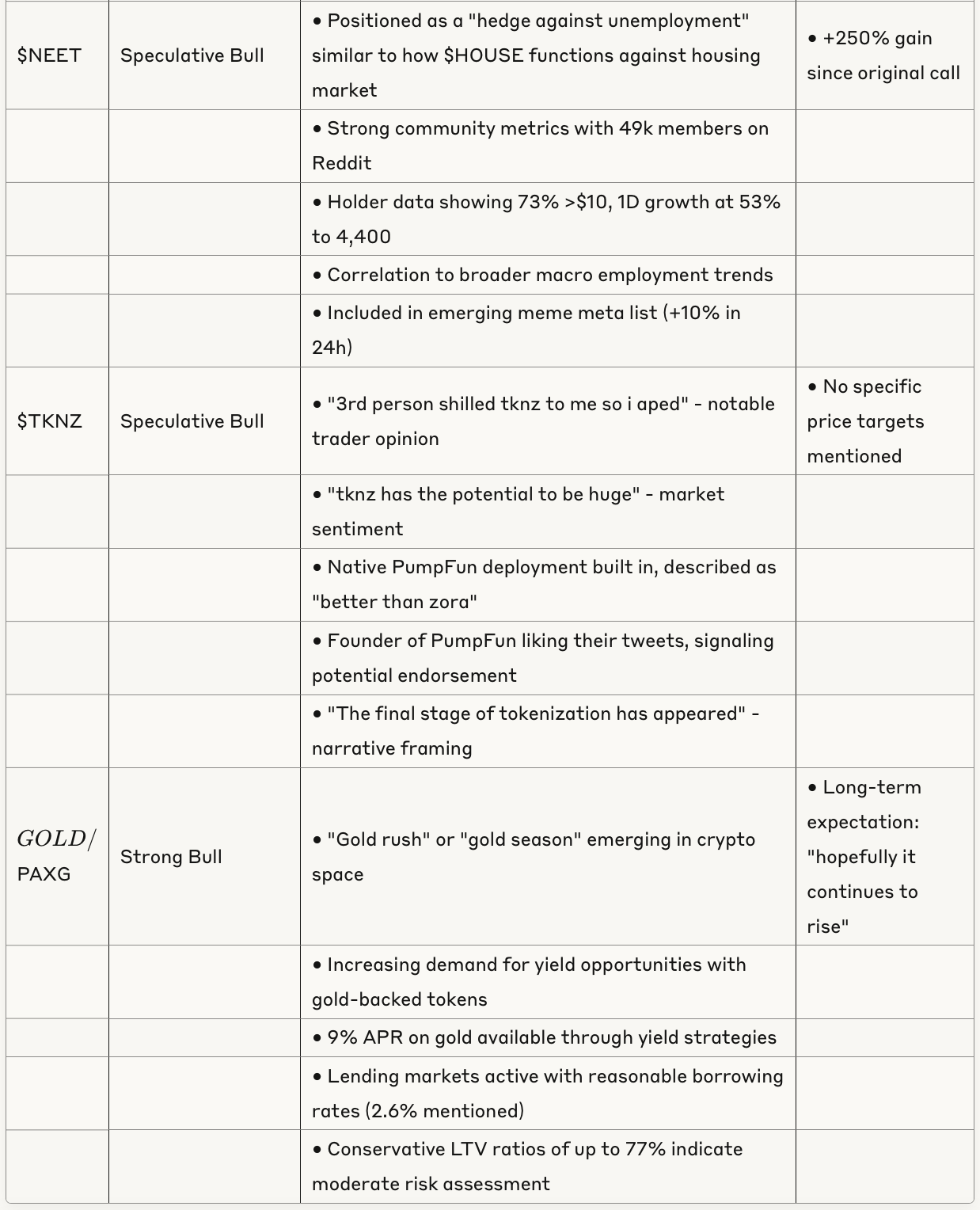

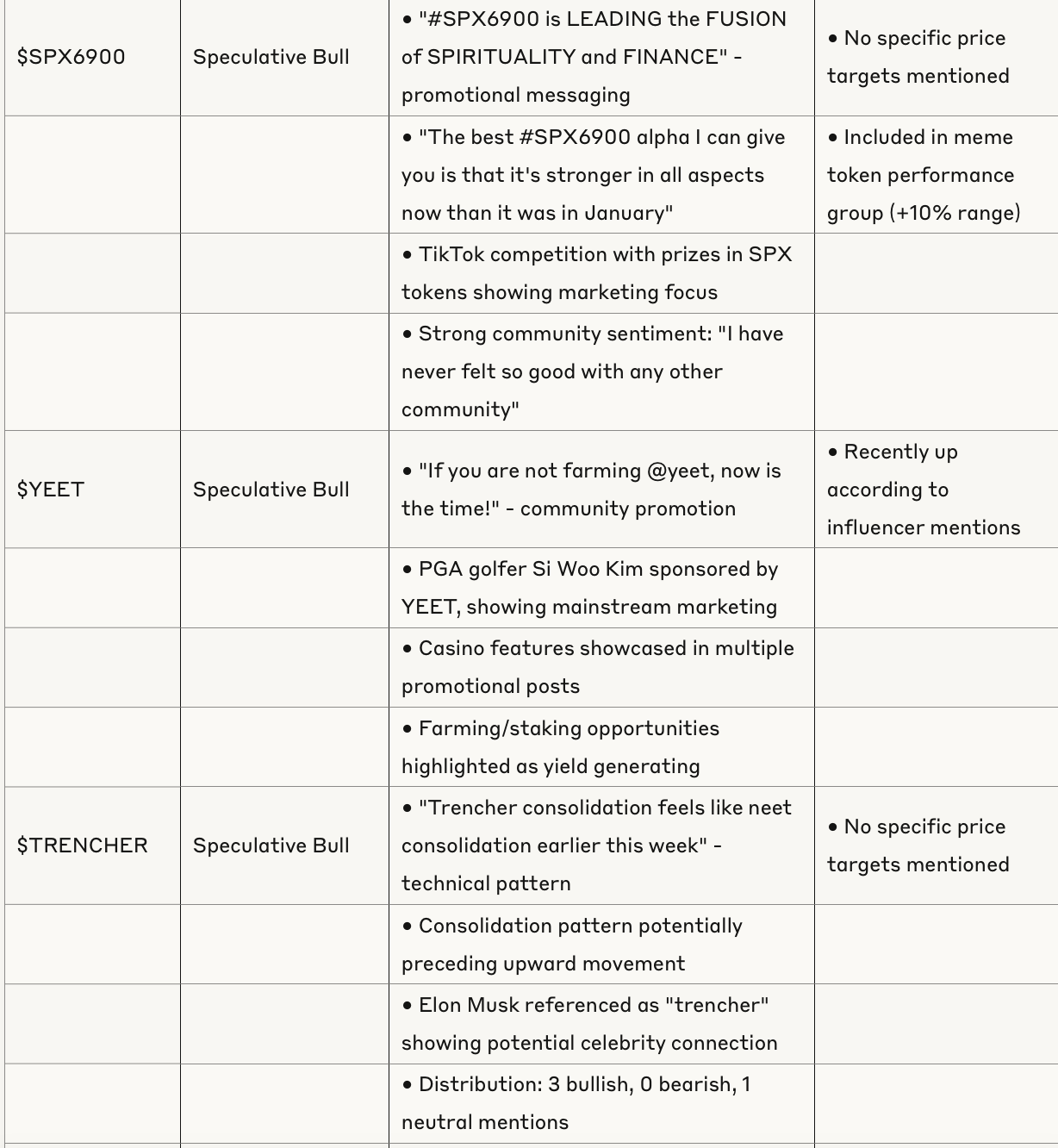

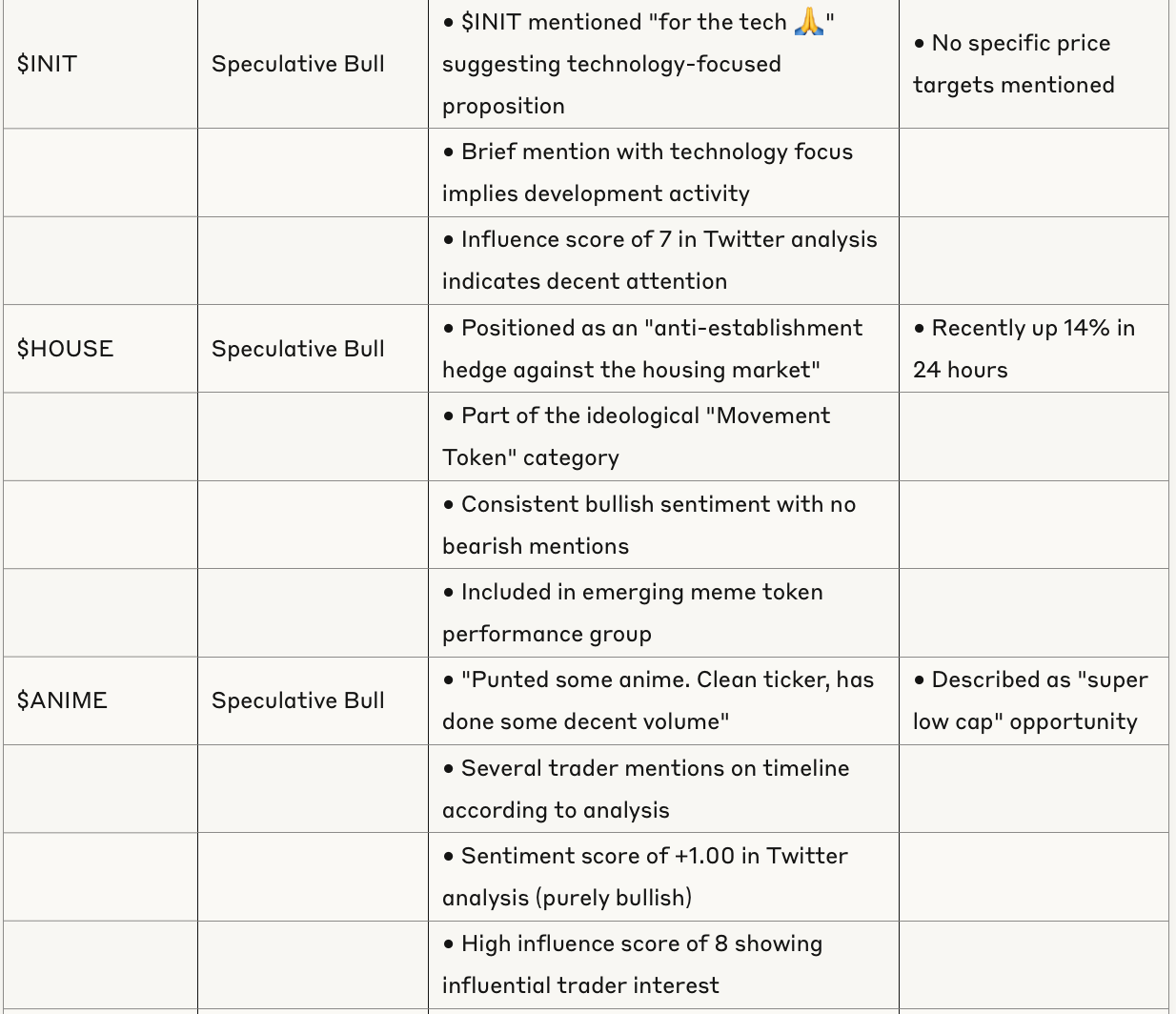

Token Analysis Table

Sector Analysis

Memecoins

The memecoin market appears to be in a mature phase, with traders noting similarities to late-stage NFT market activity in previous cycles. New projects continue to launch but with increased focus on utility and integration rather than purely speculative narratives. Significant 24-hour performance disparities are evident across meme tokens, with some seeing extraordinary gains: $CHILLHOUSE (+437%), $STADIUM (+392%), $CHACHA (+327%), while others show more modest growth: $TROLL (+57%), $WIZARD (+10%), $HOUSE (+14%), $RFC (+13%).

AI Tokens

The AI content creation ecosystem is emerging as a significant narrative, with $AVA (Hologram Labs) positioned as building infrastructure for a new era of AI-native digital influencers with full context awareness via MCP integration. This technology enables autonomous agents with memory, personality, and real-time context awareness, with positioning as a category leader supported by a16z's "Avatar Thesis."

Gold-Backed Tokens

A "gold rush" or "gold season" is developing in the DeFi space, with growing interest in gold-backed tokens and yield opportunities. This trend is driving development activity with "200 plus new stable coins" mentioned. Lending markets for gold-backed tokens are active with reasonable borrowing rates (2.6% mentioned) and conservative LTV ratios of up to 77%, indicating moderate risk assessment in the sector.

Bitcoin Ecosystem

Development of DeFi infrastructure on Bitcoin via ordinals is an emerging trend, with various token standards (BRC20, CBRC20) being explored. Development limitations on the Bitcoin ordinals platform are highlighted as a challenge for builders.

Market Sentiment & Trading Strategies

Trading strategies currently being discussed favor selective positioning in technically strong projects rather than broad market exposure, with several traders highlighting the importance of taking profits and maintaining defensive positioning heading into new trading weeks.

Expert opinion suggests that while shorting can be used to "juice returns," most crypto money is made on the long side where "research, being early, and holding matter much more than timing shorts." The recommendation is to first qualify on "easy shorts" as shorting is a specialist strategy.

Most influential traders are maintaining a balanced view, acknowledging potential short-term risks while indicating positive medium-term outlooks, particularly for Bitcoin's positioning as a hedge against economic uncertainty.

Risk Factors

Premium indicators (Coinbase and Kimchi) suggest possible short-term caution heading into Monday's trading sessions.

Gold price volatility is acknowledged: "it's not like it's not a dollar, so it's not going to be 1 to 1 correlated," indicating risk even in supposedly safer assets.

Development limitations on the Bitcoin ordinals platform are highlighted as a challenge for builders exploring new token standards.

Many crypto investors have "paid their dues by being down a fair bit of portfolio" - indicating past volatility and losses.

Conclusion

The May 2025 crypto market shows a maturing ecosystem with distinct narratives across different sectors. Bitcoin demonstrates resilience compared to traditional tech stocks, while selective altcoins show strong momentum based on fundamental developments and community engagement. The gold-backed token space is experiencing significant growth with yield opportunities, and memecoin market activity resembles late-stage patterns from previous cycles. Trading strategies currently favor selective positioning in technically strong projects rather than broad exposure, with emphasis on research, early positioning, and strategic profit-taking.