Daily Market Update: 26th April,2025

Alpha from CT and YT

Overall Market Context

The crypto market is showing a mixed but cautiously optimistic sentiment after a period of correction. Bitcoin is trading in the $90-95K range, acting as a critical resistance level that could determine the market's next major move. There's a notable decoupling of Bitcoin from traditional risk-on assets, with increasing correlation to gold's recent performance.

Key macro factors influencing the market include:

Trump administration's crypto-friendly policies creating regulatory tailwinds

Stablecoin market expanding rapidly, projected to reach $1T soon and $3.7T by 2030

Institutional integration accelerating with Schwab announcing crypto trading plans

Sector rotation evident with AI and meme tokens gaining momentum

Ethereum showing significant underperformance against Bitcoin and alternative L1s

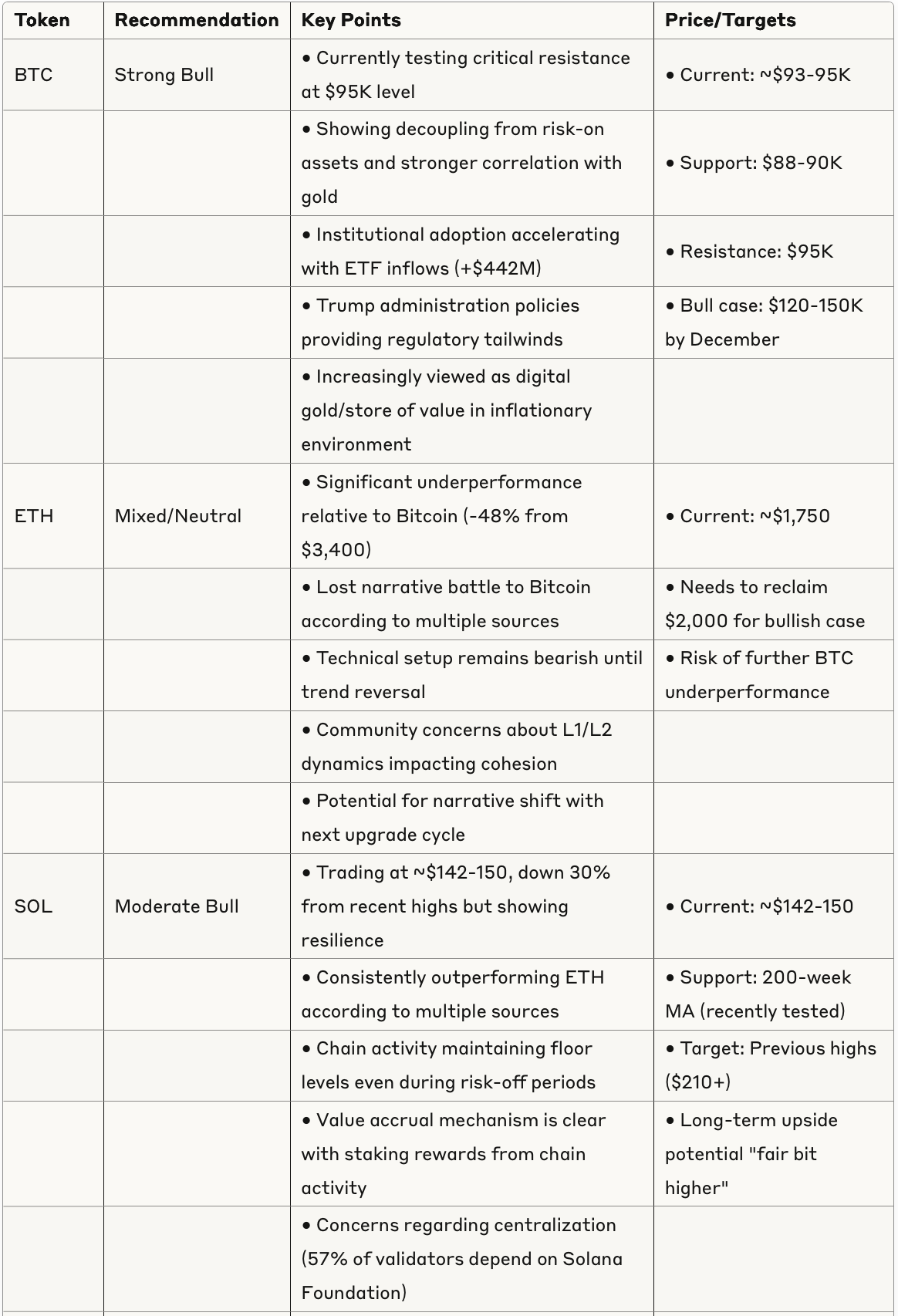

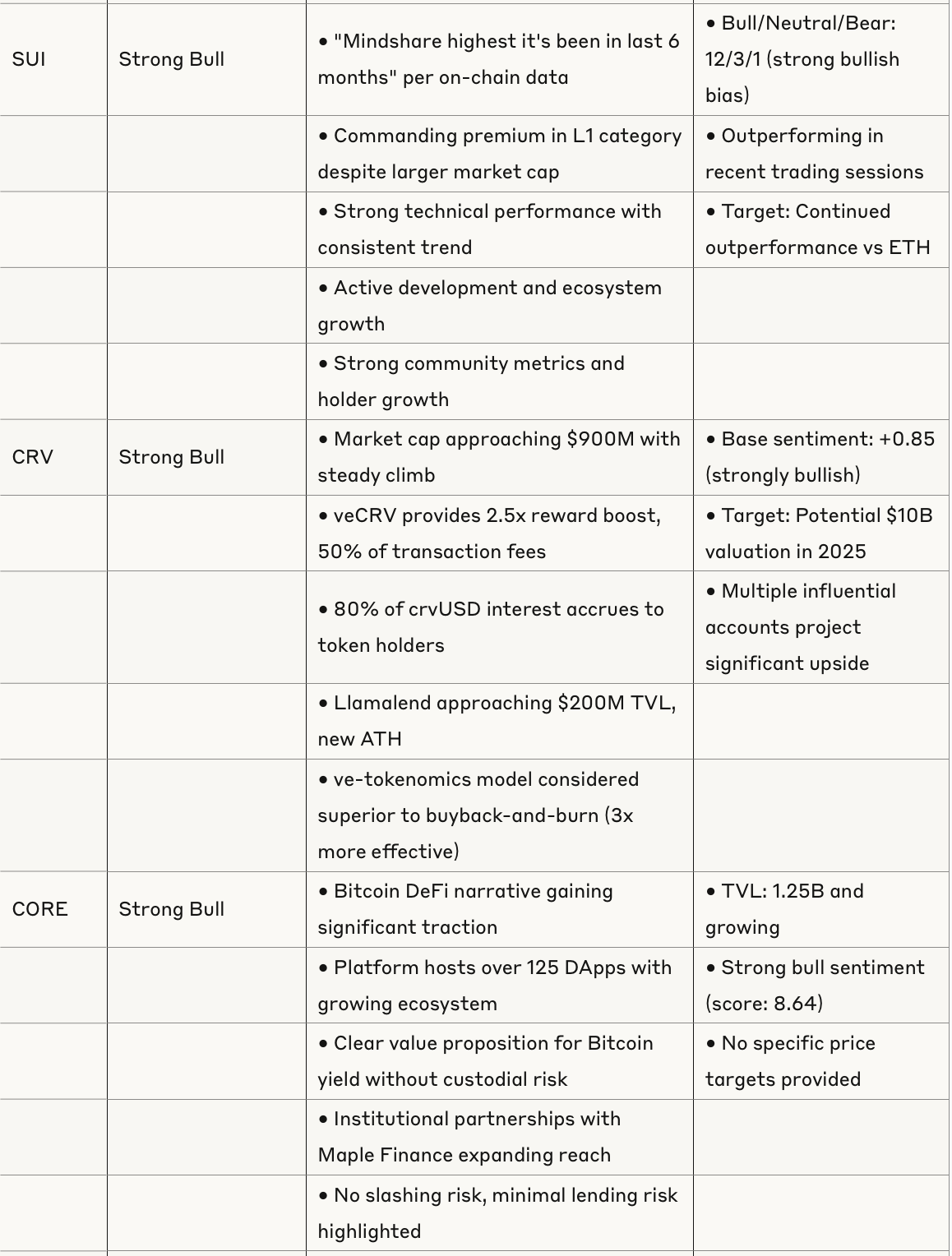

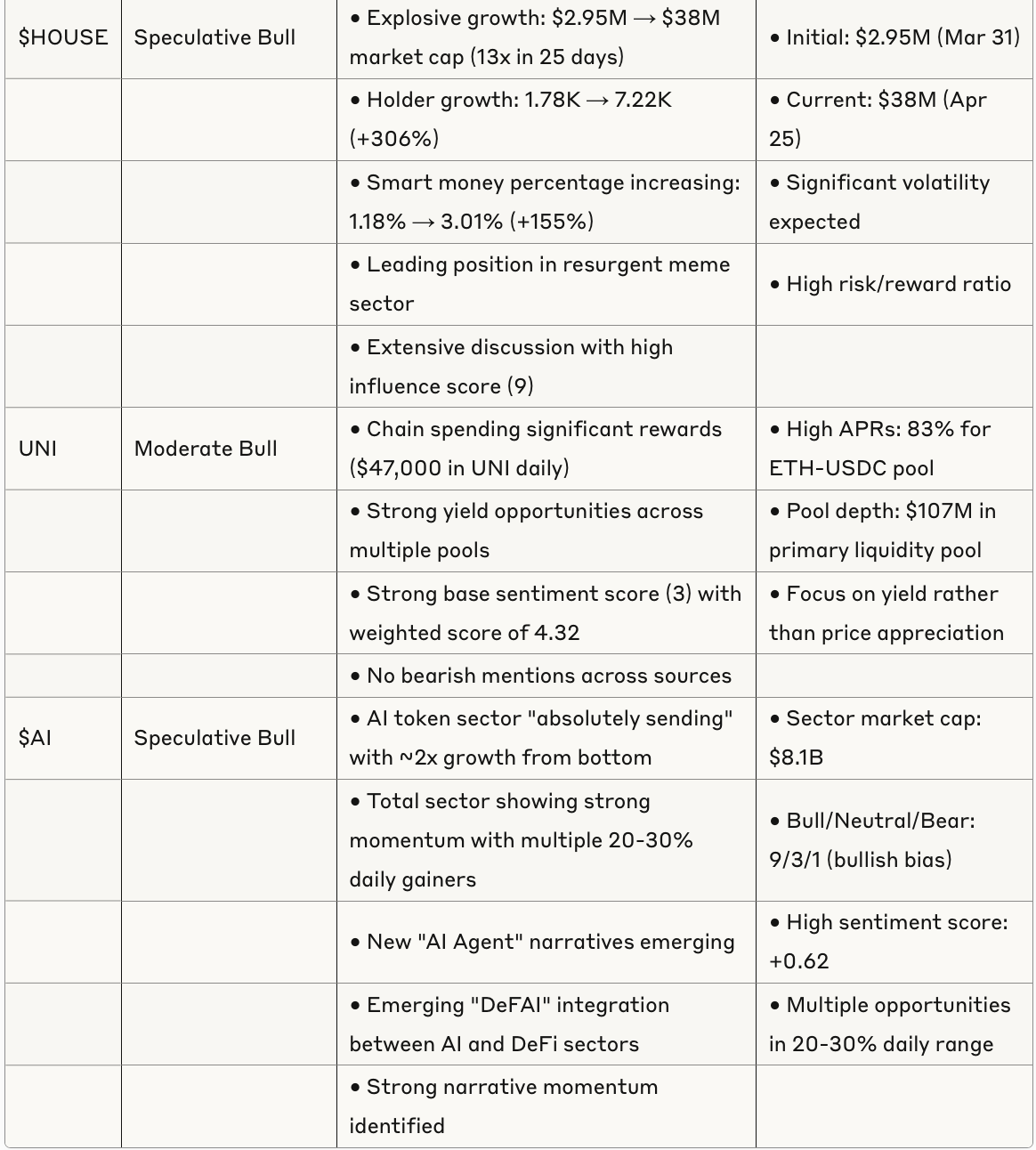

Token Analysis Table

Emerging Sector Trends

Stablecoin Expansion

The stablecoin sector is experiencing explosive growth with market cap reaching $237.5B and projections of reaching $1T sooner than expected. Citigroup predicts total supply to hit $3.7T by 2030. Major developments include:

New index product ($OPEN) launched to track 8 next-gen stablecoin networks

USDT and USDC maintaining 88% combined market share

Regulatory clarity expected to further accelerate adoption

New institutional partnerships forming around stablecoin infrastructure

Meme Token Resurgence

Meme tokens have reclaimed the second position in trading volume, surpassing DeFi. Key observations:

$HOUSE emerging as a standout performer with 13x return in 25 days

$FARTCOIN and $BONK showing moderate bullish sentiment

High rotational velocity with frequent sector narrative shifts

Increased retail participation driving speculative activity

Multiple traders acknowledging risk while participating in the trend

AI Token Ecosystem

The AI token sector shows strong momentum with approximately 2x growth from recent bottoms:

Total sector market cap at $8.1B

New projects like $DPCore gaining attention

Multiple tokens showing 20-30% daily gains

"AI Agent" narratives evolving into "DeFAI" integration opportunities

Institutional interest in AI infrastructure growing

Bitcoin DeFi Development

Bitcoin-based DeFi products are gaining significant traction:

Core (CORE) highlighted as a leading platform with 1.25B TVL

Yield opportunities without custodial risk becoming attractive

Institutional partnerships expanding Bitcoin collateralization use cases

Bitcoin Strategic Reserve concept gaining adoption

Opportunities for 5% in-kind BTC yield emerging

Risk Assessment

Market-Wide Risks

BTC currently testing critical resistance at $95K - rejection could trigger broader market correction

Multiple traders suggesting another possible dip before continued uptrend

"The amount of pure dogshit pumping rn should make anyone cautious" - @crypto_condom

Potential for rapid sector rotation causing volatility in specific tokens

"Dollar Doom Loop" concerns mentioned in institutional commentary

Token-Specific Risks

ETH: Continued underperformance vs BTC and alternative L1s

SOL: Centralization concerns with 57% of validators dependent on Solana Foundation

Meme tokens: Extreme volatility with potential for sudden reversals

AI tokens: Potential narrative exhaustion if development milestones not met

Yield products: Unsustainable APYs could lead to sudden contractions

Technical Considerations

Mean-reverting pair trades showing dangerous potential according to @thedefivillain

Many tokens showing technical indicators of being overbought in the short term

Market structure suggests possibility of another lower high before continuation

Risk of correlation breakdown during market stress events

Conclusion

The crypto market shows signs of renewed strength with Bitcoin taking the lead role as a store of value rather than a pure risk asset. Institutional adoption continues to accelerate, with Trump administration policies providing regulatory tailwinds. Bitcoin appears positioned for potential new all-time highs if it can break through the $95K resistance level.

Alternative L1s like Solana and SUI continue to demonstrate strength against Ethereum, which remains in a challenging position. DeFi innovations focusing on Bitcoin integration and stablecoin infrastructure represent promising value sectors amid more speculative meme and AI token trends.

For investors, maintaining a balanced portfolio with core positions in Bitcoin and select quality L1s while taking measured exposure to emerging narratives appears to be the optimal strategy. The evidence suggests continued bullish momentum for the crypto market broadly, though with potential volatility ahead as key resistance levels are tested.