Daily Market Update: 16th April

Alpha from CT and YT using Claude

Overall Market Context

The crypto market is positioned at a critical decision point, with mixed signals creating a complex environment. Bitcoin is showing relative strength compared to traditional markets despite broader volatility, testing key resistance levels with technical analysis suggesting potential for further upside.

Institutional adoption continues with steady ETF inflows for Bitcoin, major acquisitions, and development of tokenized real-world assets (RWA). Concurrently, macro economic concerns persist with Goldman Sachs projecting zero growth for 2025, market bearishness indicators at 2008 levels, and trade war concerns impacting markets globally.

Memecoins are experiencing renewed interest despite the mixed macro environment, while infrastructure development continues across multiple platforms. A philosophical divide is emerging between Ethereum and Solana approaches, potentially influencing developer and capital allocation decisions.

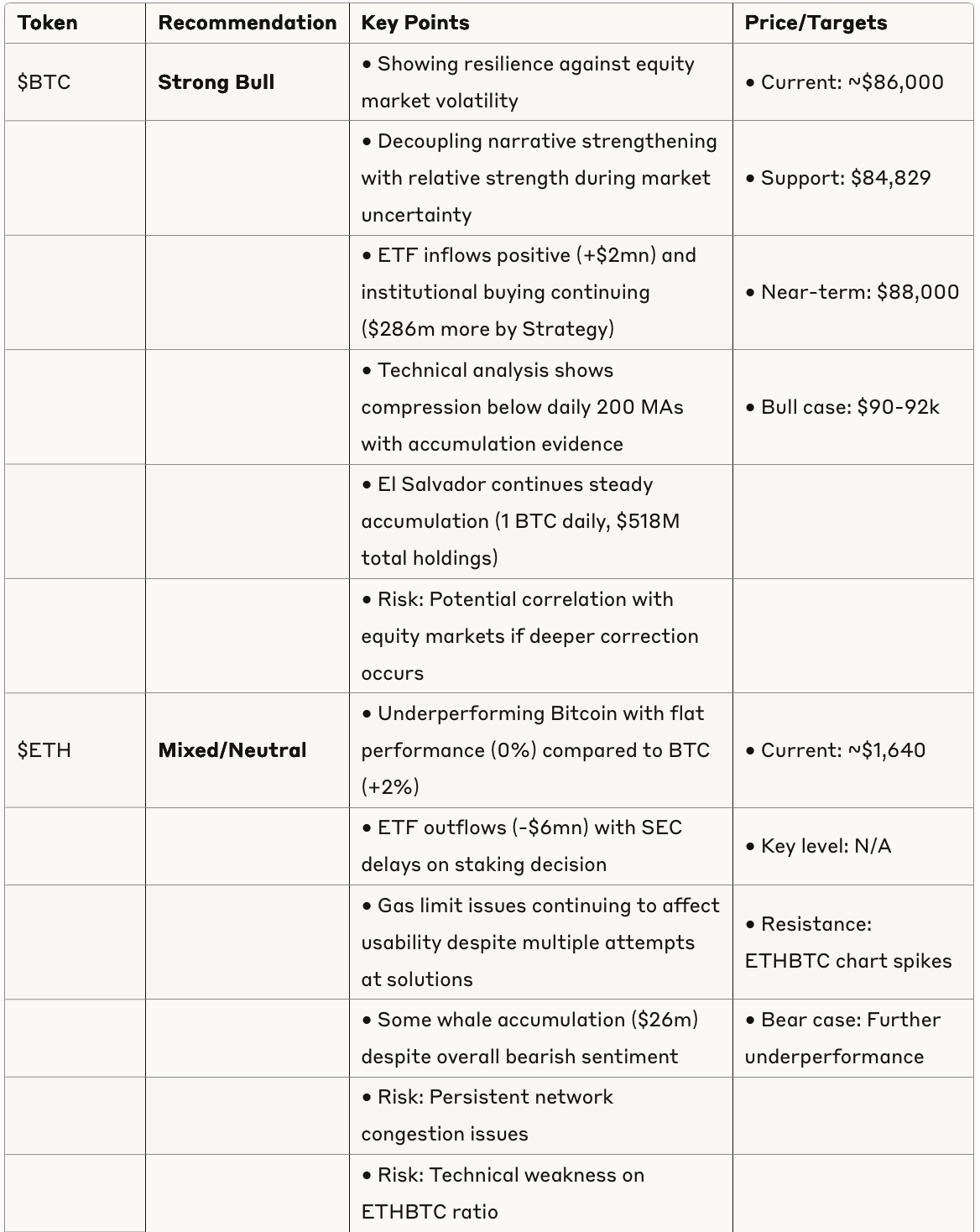

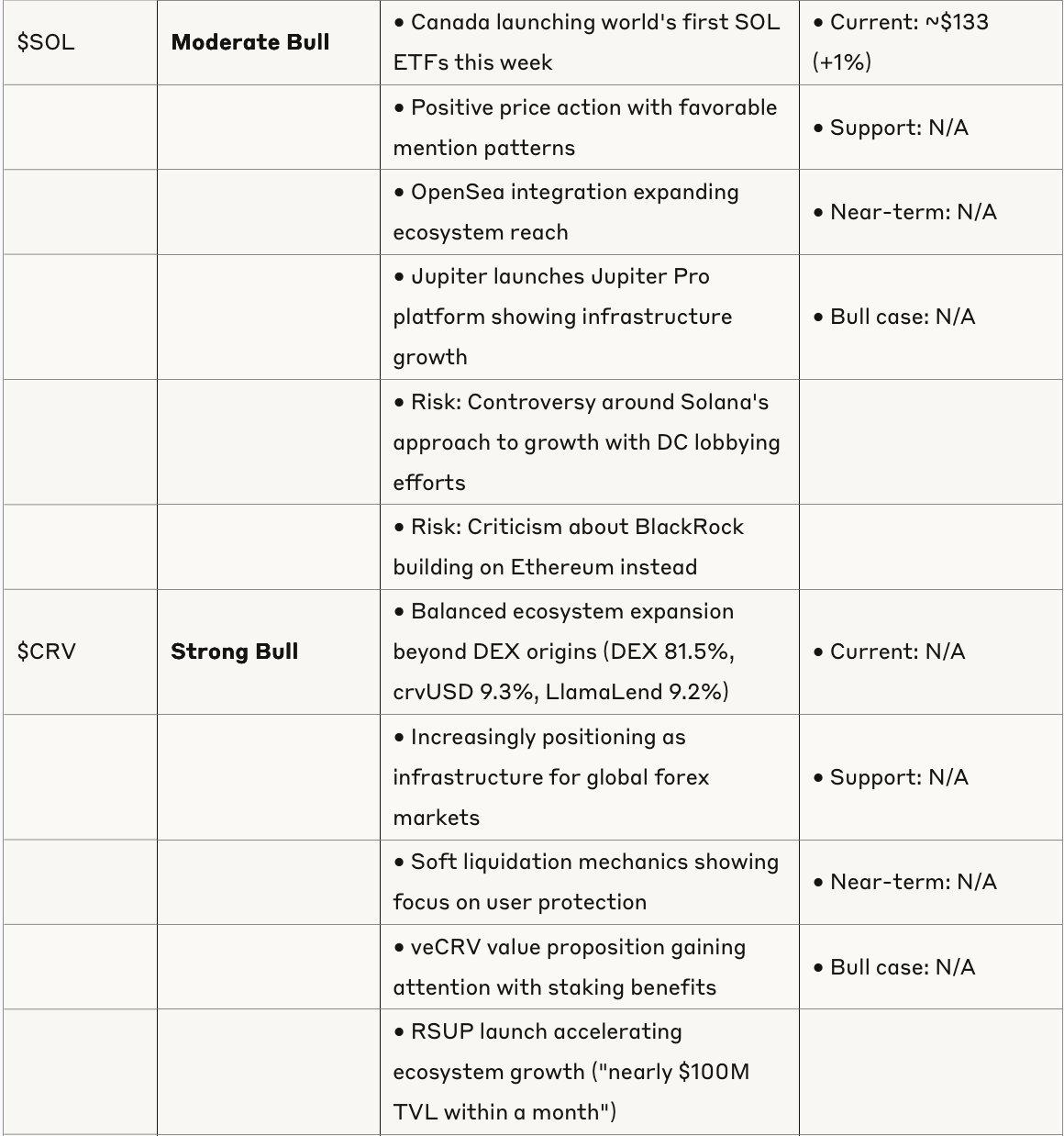

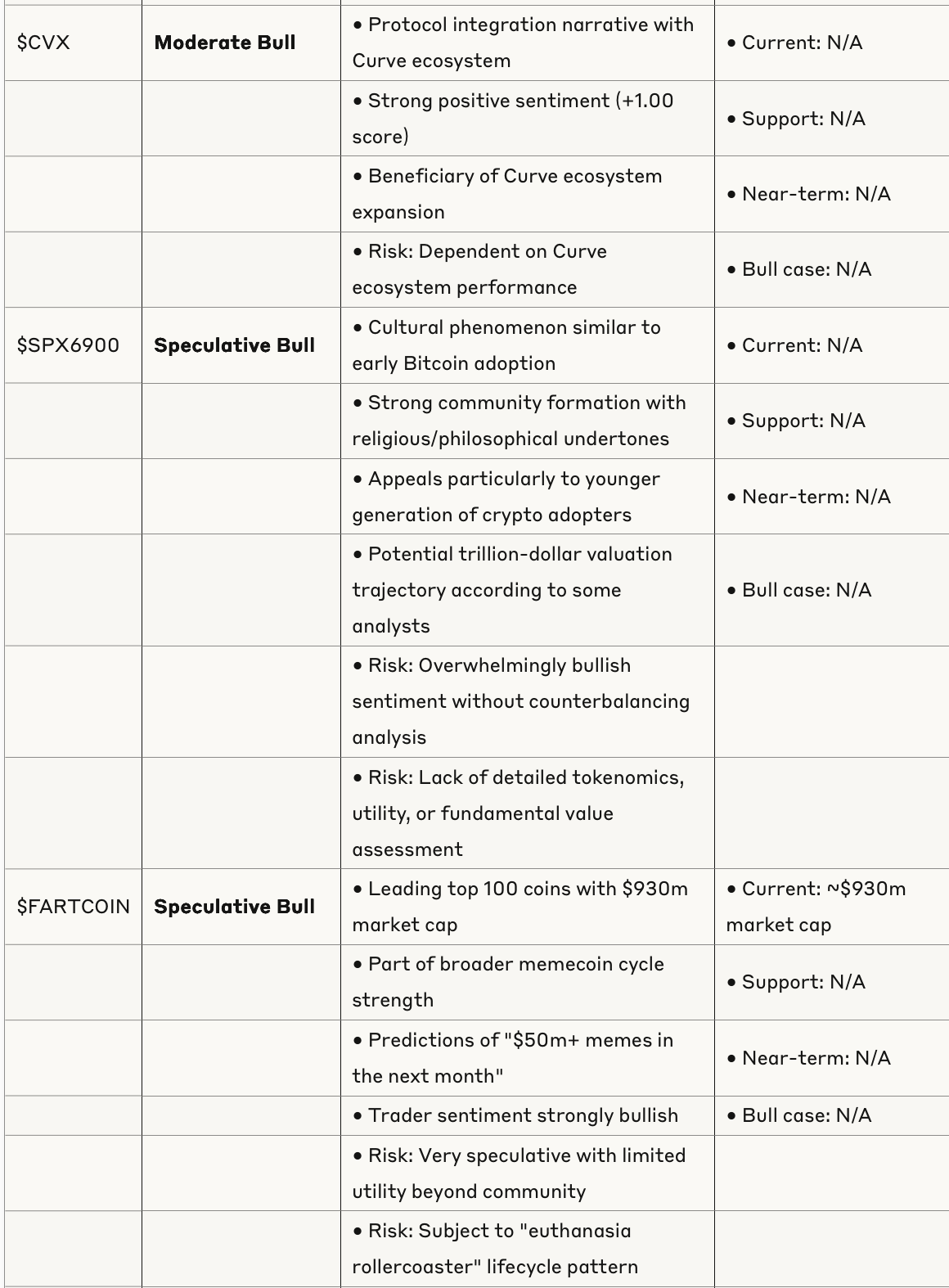

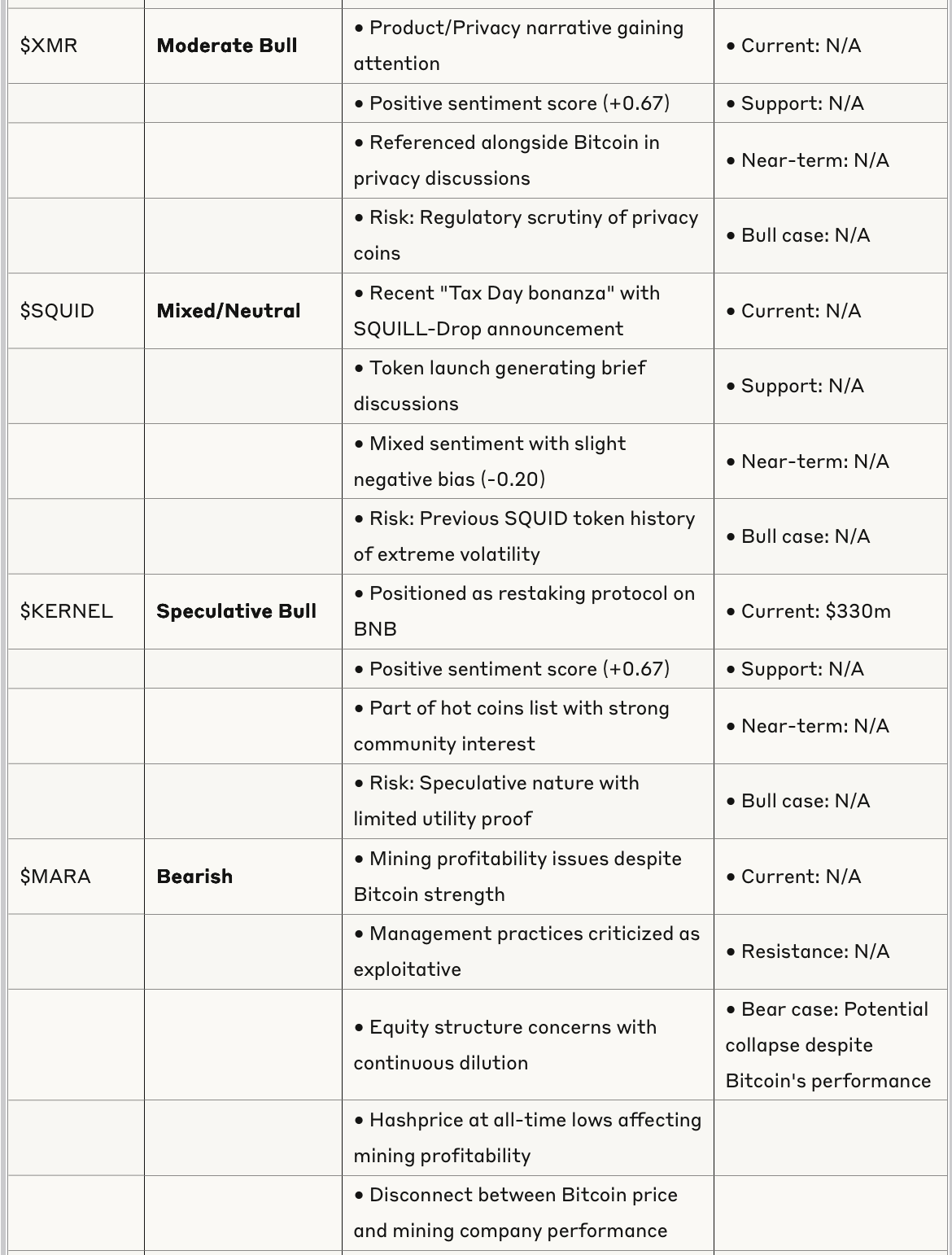

Token Analysis Table

Emerging Trends & Narratives

1. Bitcoin Decoupling Narrative

Bitcoin is showing increasing resilience against equity market volatility, with multiple analysts noting its relative strength compared to traditional markets. The decoupling narrative is strengthened by institutional adoption through ETFs and strategic acquisitions, as well as nation-state involvement like El Salvador's steady accumulation strategy (1 BTC daily, $518M total holdings). Technical analysis suggests potential for further upside with compression below key moving averages and significant absorption at support levels indicating accumulation.

2. Real World Assets (RWA) Acceleration

Tokenized real-world assets are experiencing significant institutional traction, growing 2.5x in the past year to reach $11B in total value. Traditional finance assets like US Treasuries and gold ($1.5B tokenized) are driving adoption rather than exotic crypto offerings. BlackRock's BUIDL fund at $2.37B demonstrates major institutional validation of the RWA narrative. This sector is increasingly positioned as "the future of finance" rather than just a DeFi innovation, creating a strong bridge between traditional and decentralized finance.

3. Yield Farming Renaissance

High yields are returning to focus with multiple protocols offering substantial APRs and token incentives, particularly around stablecoins like scUSD. Opportunities include 60% APR + 12x points for scUSD on Bungee/Sonic, 46% APY boost on Pendle, and significant multipliers across various protocols (Sonic 12x, Silo 3x, Rings 1.5x). These time-limited campaigns (April 14-21 timeframe) represent short-term opportunities for yield-seeking investors, though they carry risks of collapse after incentives end.

4. Ethereum vs. Solana Philosophical Divide

A fundamental ideological debate is emerging about blockchain development philosophies, with Ethereum accused of prioritizing ideology over product market fit, while Solana embraces a more pragmatic approach but faces criticism for political maneuvering. Key developments include Solana Foundation hiring a DC lobbyist, multiple influencers weighing in on the debate, and references to BlackRock building on Ethereum rather than Solana. This divide could influence developer and capital allocation decisions in the near term.

5. Defensive Market Positioning

Despite bullish sentiment in specific sectors, many influential traders are taking defensive positions while maintaining long-term optimistic outlooks. Concerns about tightening financial conditions persist despite recent market recovery, with bond yields remaining elevated and indicators suggesting potential for further volatility. This cautious positioning contrasts with the bullish narratives in specific tokens and sectors, creating a complex market dynamic.

6. Memecoin Cycle Strength

Memecoins are experiencing renewed interest despite the mixed macro environment. FARTCOIN leads top 100 coins with $930m market cap, while multiple traders predict significant growth in the meme sector ("$50m+ memes in the next month"). The memecoin lifecycle pattern shows inevitable boom-bust cycles, with recommendations to "exit on rallies or ride the euthanasia rollercoaster." SPX6900 emerges as a cultural phenomenon with strong community backing and religious/philosophical undertones, drawing comparisons to early Bitcoin adoption.

Risk Factors

1. Macro Economic Concerns

Goldman Sachs expects zero growth for 2025

Market bearishness indicators at 2008 levels

US corporate bankruptcy rate highest in 15 years

Trade war concerns potentially triggering global recession

S&P 500 forms death cross

Financial conditions tightest since 2020

2. Infrastructure Vulnerabilities

Exchanges (Binance, KuCoin, MEXC) reporting issues due to AWS

Wallet drainer risks and security concerns

Mining sector facing profitability challenges despite Bitcoin strength

Hashprice at all-time lows affecting mining economics

3. Regulatory Developments

SEC delays on ETH ETF staking decision

Increasing political involvement with lobbying efforts

Potential for more restrictive regulations as institutional adoption increases

Geopolitical factors including US-China tensions becoming increasingly relevant

4. Speculative Excess

Overwhelmingly bullish sentiment on specific tokens (SPX6900, memecoins) without balanced analysis

Lack of critical assessment of fundamentals in popular narrative-driven tokens

Short-term yield farming opportunities potentially creating unstable incentive structures

Altcoin lifecycle patterns suggesting inevitable collapse for many smaller projects

Actionable Insights

Bitcoin Positioning: Consider maintaining or increasing Bitcoin exposure given its relative strength against traditional markets and technical setup for potential upside toward $90-92k.

Yield Opportunities: The scUSD liquidity mining campaign (April 14-21) represents a time-sensitive opportunity with unusually high APRs and point multipliers across multiple protocols, but requires careful risk management.

RWA Exposure: Explore exposure to tokenized real-world assets as this sector shows strong institutional adoption and bridges traditional finance with crypto markets, potentially offering more stable growth than purely speculative tokens.

Infrastructure Caution: Exercise caution with mining stocks and infrastructure plays despite Bitcoin's strength, as these sectors face unique challenges with profitability and competition.

Defensive Hedging: Consider maintaining some defensive positioning given macro concerns and mixed signals in the broader market, especially with influential traders taking cautious stances despite bullish sentiment in specific sectors.

Memecoin Management: If participating in memecoin opportunities like FARTCOIN or SPX6900, implement strict risk management and exit strategies given the historical lifecycle patterns of such tokens.

Ecosystem Diversification: The Curve ecosystem shows balanced growth across multiple verticals, suggesting potential opportunities across DEX, lending, and stablecoin sectors rather than concentrated exposure.

Geopolitical Awareness: Monitor global political dynamics as factors that could influence crypto market movements, particularly US-China relations and regulatory developments.