Daily Market Edge,10th May 2025

Alpha from YT and CT, generated using Claude

Crypto Market Analysis: May 10, 2025

Overall Market Context

The crypto market is showing strong bullish signals with Bitcoin recently breaking above $100,000 and Ethereum experiencing a significant 22% daily surge. This price action has shifted market sentiment dramatically, with multiple influential traders calling the beginning of an "altcoin season." The total crypto market cap is approaching its previous all-time high of $3.9T, suggesting continued bullish momentum.

Key macroeconomic factors include:

Standard Chartered raising its Bitcoin prediction and suggesting the $120k Q2 target may be conservative

The OCC confirming that national banks can buy, sell, custody, and outsource crypto services

Growing institutional interest with BlackRock's SEC meetings regarding staking, tokenization, and ETF options

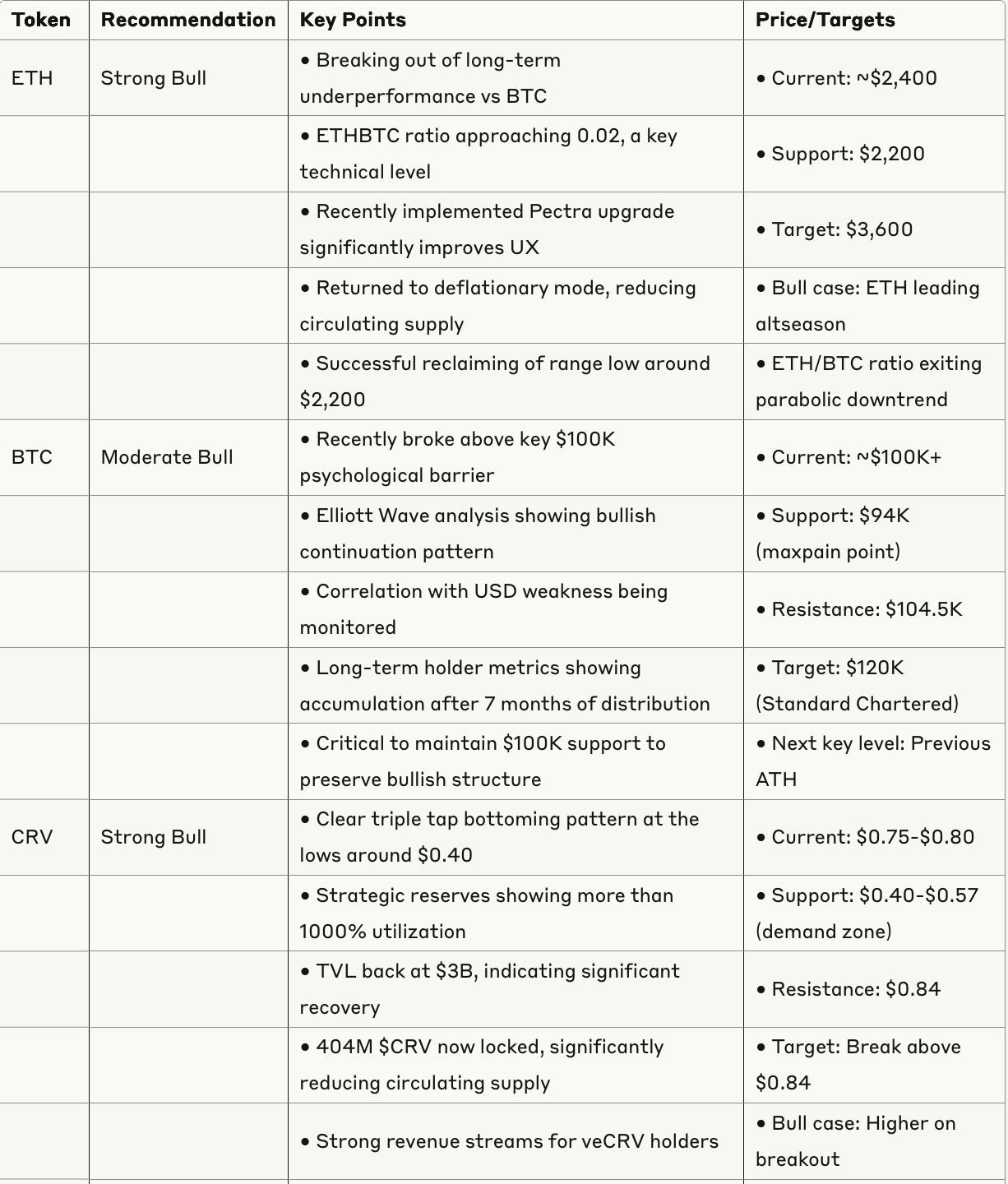

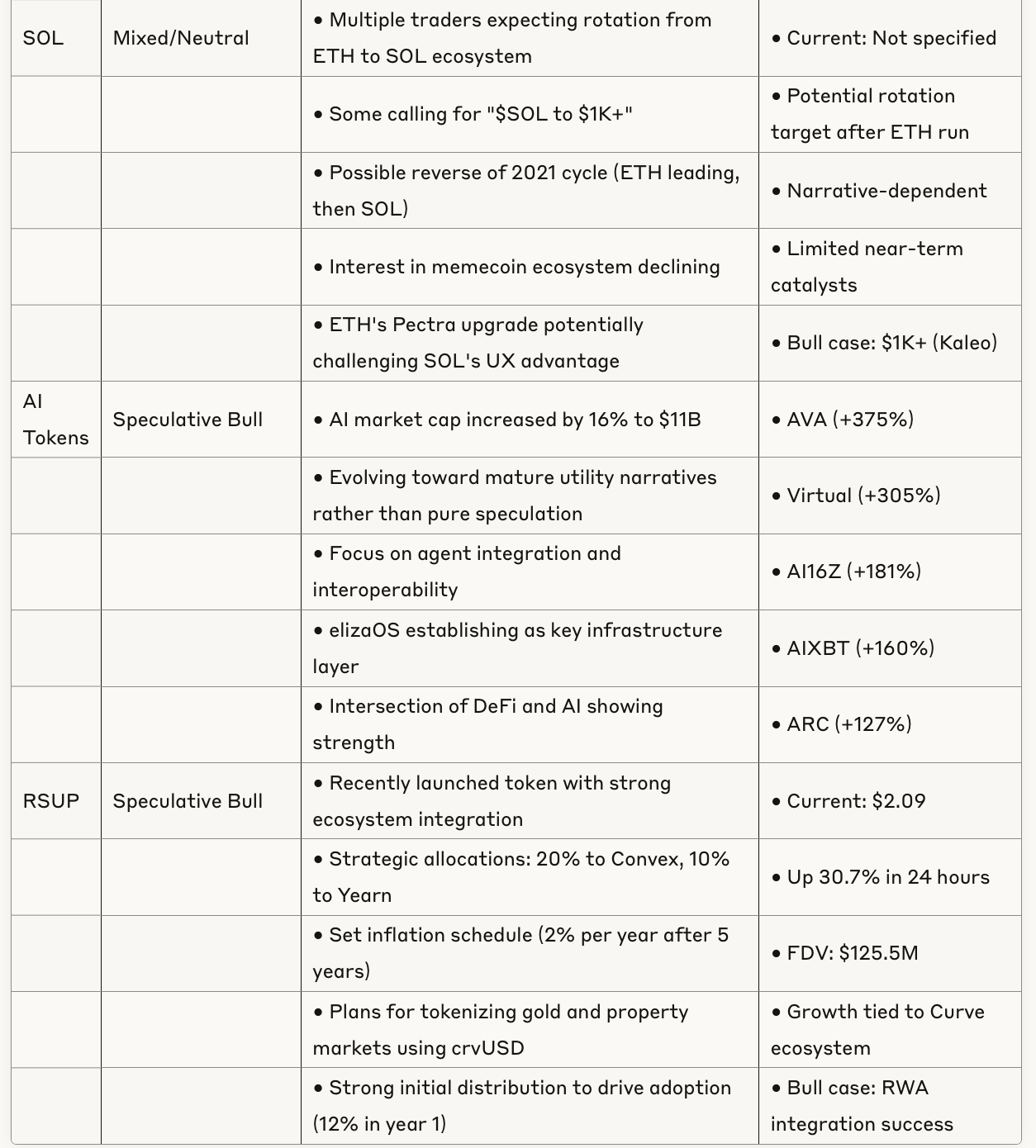

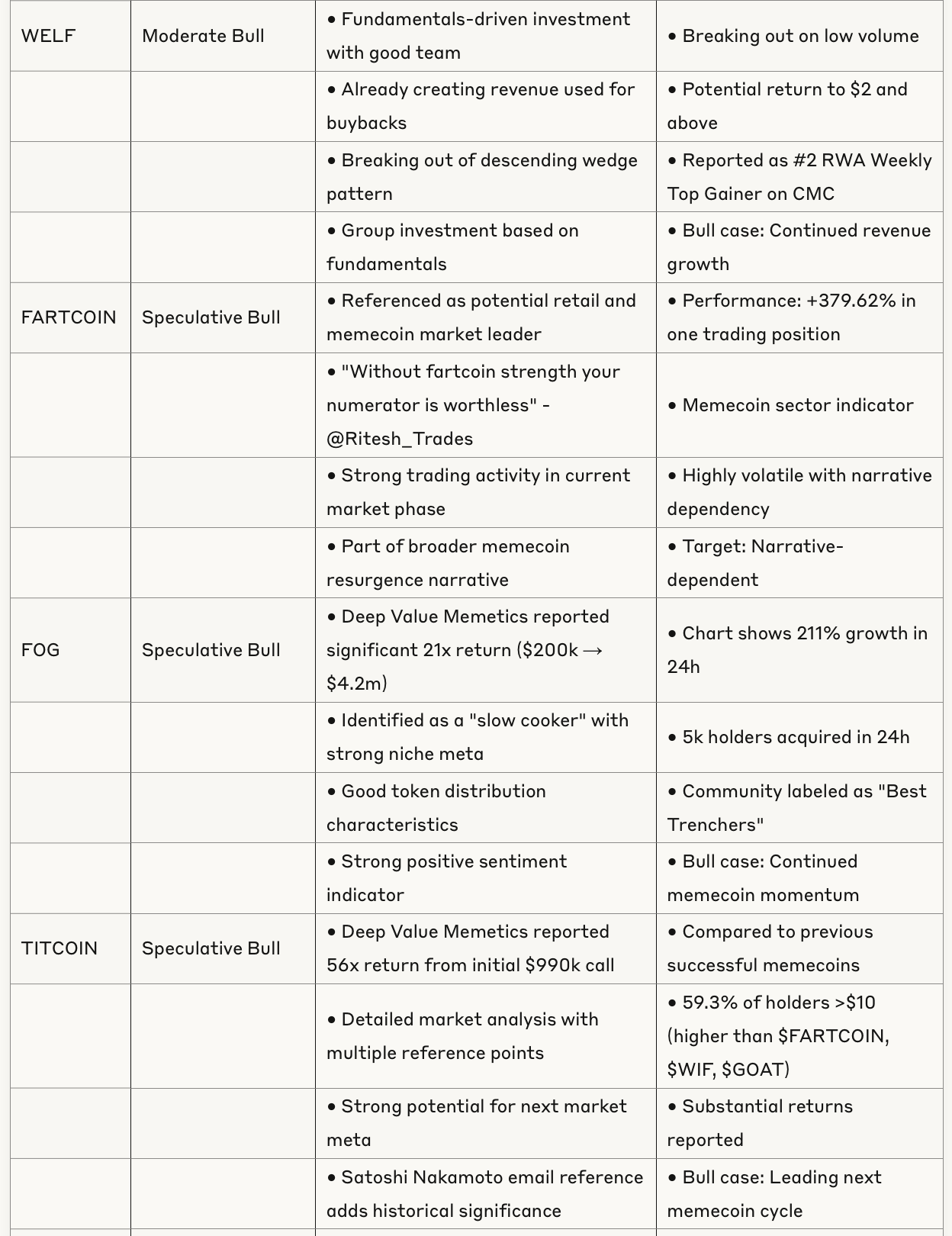

Token Analysis Table

Emerging Narratives

1. Altcoin Season Initiation

Multiple high-influence traders are indicating the start of "altcoin season" with ETH's breakout potentially serving as the catalyst. This shift from BTC dominance to broader market participation is showing early signs with tokens like INIT, MOODENG, and HYPE demonstrating substantial gains. As @CryptoKaleo noted: "It doesn't make sense that we won't see alts have an insane bubble in the current regulatory environment."

2. DeFi Yield Renaissance

Curve and Convex are experiencing a significant resurgence in activity and token price, driven by high yields and expanding use cases. Strategic reserves utilization exceeding 1000% indicates extraordinary demand for DeFi services. Multiple protocols are integrating with Curve's infrastructure, cementing its position as DeFi's liquidity backbone.

3. AI Token Ecosystem Growth

AI-related projects continue to show exceptional strength with multiple tokens posting significant gains over the past 30 days. The market is showing clear sector rotation toward AI agents and interoperable AI systems. Projects focusing on AI agent integration and utility rather than just speculative tokens appear to be gaining traction, with Virtual and AVA leading this trend.

4. Stablecoin Expansion

The total stablecoin supply has increased by over $9B in the past 30 days, indicating strong organic growth in the crypto economy. This growth coincides with statements from the US Treasury suggesting that "stable coin market capitalization could reach $2 trillion by 2028." Bank of America's potential entry (with $1.96 trillion in customer deposits) compared to the current $0.14 trillion stablecoin market cap suggests significant growth potential.

5. ETH Technical Resurgence

Ethereum has experienced a dramatic 22% daily move, driving extremely bullish sentiment. The ETH/BTC ratio has now exited the parabolic downtrend, ETH has flipped back into its deflationary mode, and the market is looking forward to the next big upgrade by year-end (Fusaka). The Pectra upgrade implementation brings significant UX improvements that could allow Ethereum to rival Solana's user experience.

Risk Assessment

Market-wide Risks

Over-leveraging in the current bullish environment could lead to flash crashes even within the broader uptrend

Potential market pullback expected in the coming weeks according to DeFi Education

Technical indicators potentially becoming "self-fulfilling traps" causing failures when crowd sentiment shifts

Token-specific Risks

ETH: Continued competition from other L1s and L2s could limit upside

BTC: Needs to maintain support above $100K to preserve bullish structure

CRV/CVX: DeFi-specific security risks remain a consideration

HYPE: Profit-taking in recently pumped tokens could lead to volatility

AI Tokens: Potential bubble in AI narratives with tokens outpacing actual utility

Timing Considerations

According to DeFi Education, "after this pullback we will be looking at our list of altcoins to find outperformers"

The ETH vs SOL narrative suggests a potential rotation between ecosystems, timing this shift will be critical

"Every cycle people believe that altcoins will never outperform again, and every cycle they are proven wrong"

Strategic Opportunities

Ethereum Ecosystem: Position in ETH and ETH ecosystem tokens as the potential leaders of the next market phase. ETH's technical breakout and improving fundamentals suggest continued strength.

DeFi Blue Chips: Focus on established DeFi protocols with strong fundamentals and revenue generation, particularly CRV and CVX which show significant value compared to their market caps.

AI Infrastructure: Target infrastructure projects in the AI token space rather than speculative plays, focusing on those with clear utility and integration capabilities.

Sector Rotation Awareness: Be prepared for potential rotation from ETH to SOL ecosystem tokens as the market cycle progresses, similar to the 2021 cycle but potentially in reverse order.

Cross-chain Infrastructure: Projects like Wormhole ($W) show strong potential due to their infrastructure position, with significant cross-chain volume and institutional adoption.

Conclusion

The crypto market appears to be in a strong bullish phase with Bitcoin breaking $100K and Ethereum showing exceptional strength. The market dynamics suggest the beginning of an altcoin season, with various sectors showing significant momentum.

Key recommendations:

Strong bull stance on ETH, CRV, and CVX based on technical, fundamental, and sentiment analysis

Moderate bull stance on BTC and XRP with clear technical structures and adoption metrics

Speculative bull stance on emerging narratives like AI tokens, HYPE, and RSUP

Strategic positioning for the potential sector rotation from ETH to SOL ecosystem

As noted in the DeFi Education article: "Those who do not adapt quickly are forced to chase after the fact. Those who adapt too late become exit liquidity for informed market participants." The current market environment rewards those who can identify and adapt to narrative shifts while maintaining disciplined risk management.