Daily Market Edge: 9th May, 2025

Data from YT/CT, made exclusively by using Claude

Overall Market Context

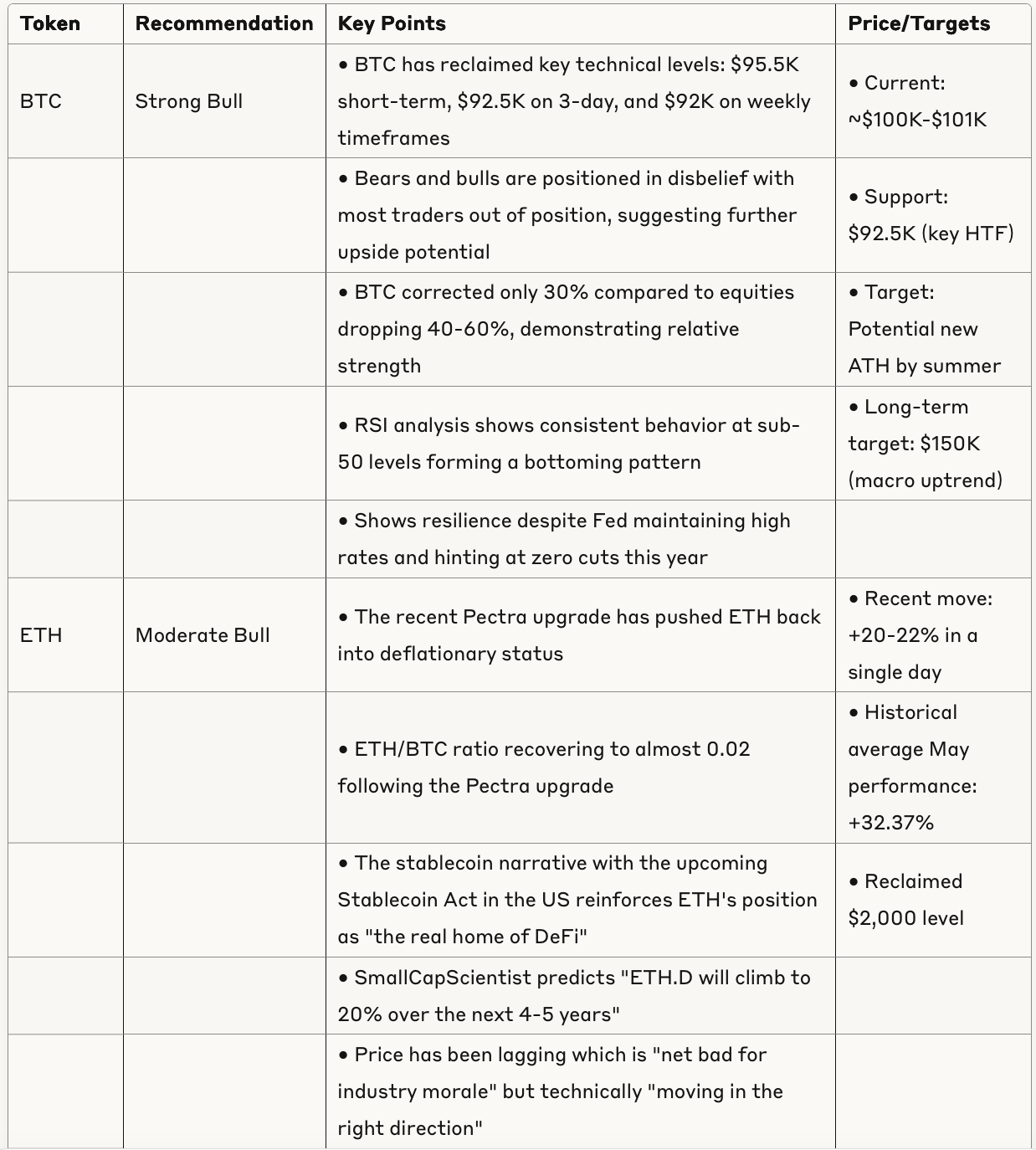

Bitcoin continues to show significant strength, having reclaimed the $100K level despite the Federal Reserve maintaining interest rates at 4.5% and hinting at potential zero cuts this year. The broader crypto market has been making higher lows, with Bitcoin approaching $100K and the S&P 500 recovering from its post-Liberation Day decline.

The ETH/BTC ratio has started to improve, potentially fueled by the recent Pectra upgrade which has also pushed Ethereum back into deflationary status. ETH/BTC is almost back to 0.02 following the Pectra upgrade, just one day after Bitcoin dominance reached a new top.

Market participants are showing strong optimism in specific sectors, particularly:

AI agent tokens (up 2-5x from recent lows)

Meme coins showing continued strength

Ethereum ecosystem following the Pectra upgrade

Selective Layer 1 ecosystems (particularly Sui)

Token Analysis Table

Sector Analysis

Stablecoin Ecosystem Growth

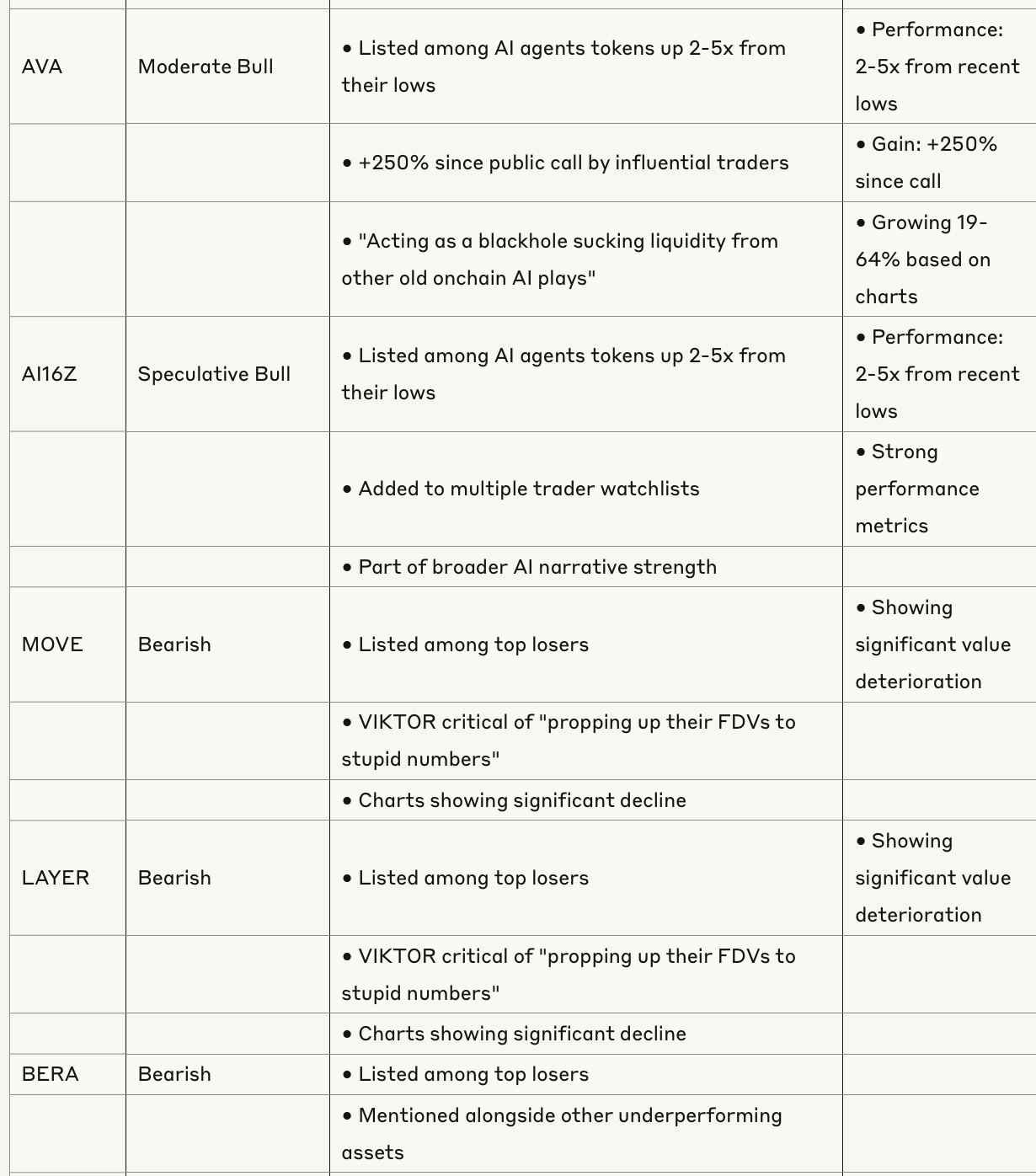

The stablecoin market has reached an all-time high with a total market cap of $241.92 billion. More than half of this value ($124.026B) resides on Ethereum, reinforcing its position as the home of DeFi despite recent price performance concerns.

Competition in the stablecoin space is intensifying, with crvUSD showing particularly strong growth of 57M in just 48 days, projecting a 438M annual growth rate. The reUSD/scrvUSD pool currently has the highest veCRV weight of all Curve pools, offering 15% APR.

Significant developments include:

Treasury Secretary Scott Bessent expressing disappointment over the Senate's failure to advance the GENIUS Act for stablecoins

Meta reportedly revisiting crypto/stablecoin strategy 3 years after abandoning previous efforts

GHO-related markets expanding with strong stable yields across Ethereum and Base

USDf gaining traction with USDC/USDf pool on Ethereum offering 30.7% APR

Lending Protocol Evolution

The lending sector shows significant innovation and competition:

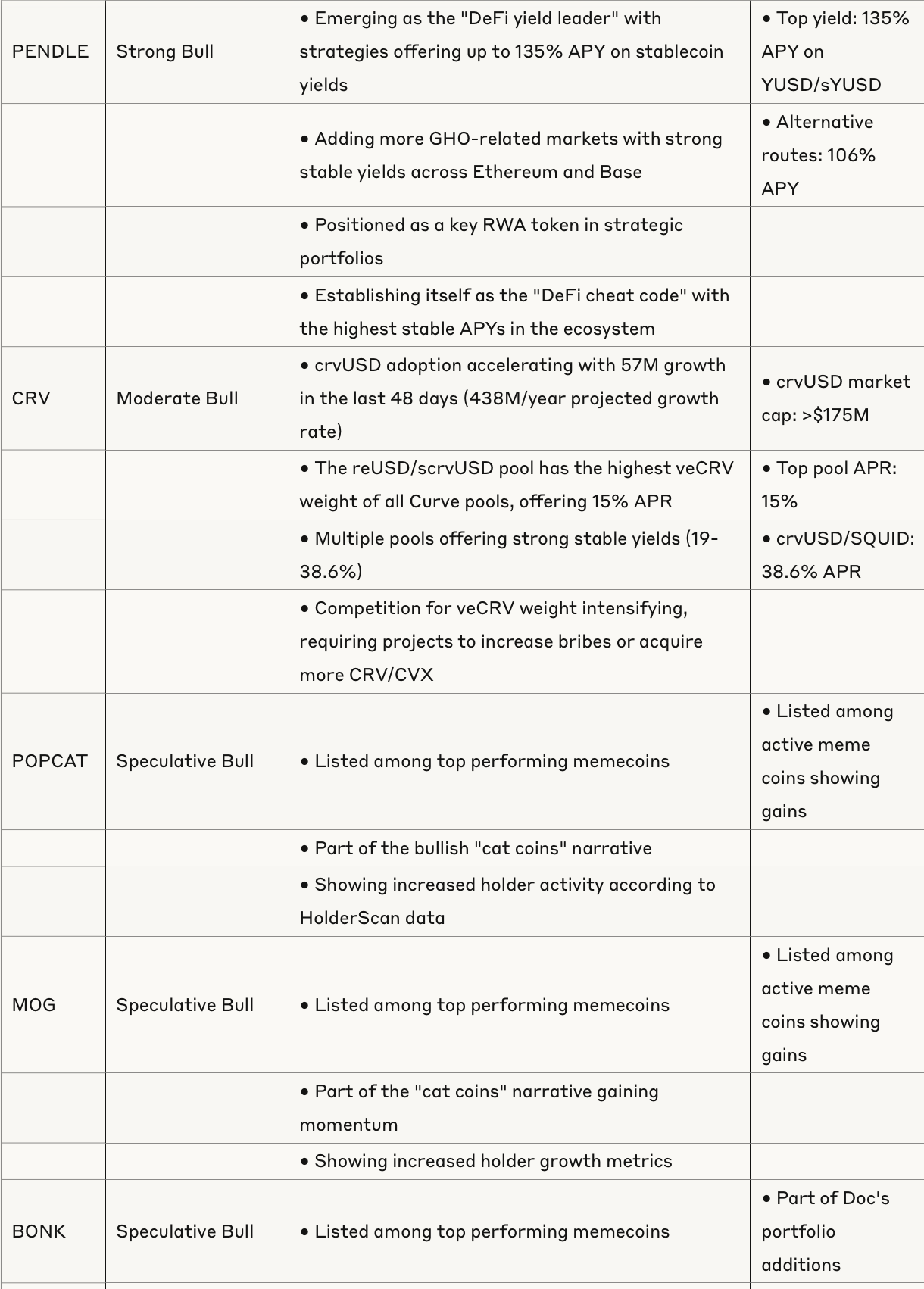

AAVE maintaining leadership position while facing challenges from newer players

Morpho (0.5%), Euler (0.2%), and Fluid (0.1%) gaining market share

Loop Scale introducing an order book-based approach that directly matches lenders and borrowers

Camino moving toward a modular architecture with Camino Lend V2

The architectural innovation in lending is moving from pool-based designs (introduced by Compound in 2018) to order book-based models that eliminate spread between supply and borrow rates, providing better rates for both lenders and borrowers.

Real-World Assets (RWA) Integration

RWA integration with crypto continues to develop:

PAXG futures launching on RabbitX, providing the first 24/7 on-chain perpetual futures market for gold-backed tokens

ONDO positioned as a core RWA holding in strategic portfolios

PENDLE expanding into various yield markets connected to real-world assets

This trend represents an important bridge between traditional finance and DeFi, potentially attracting more institutional capital.

Updated Strategic Investment Frameworks

1. Layer 1 Ecosystem Strategy

For investors looking to capitalize on Layer 1 ecosystem growth:

Core positions in Ethereum and Solana as established Layer 1s

Growth exposure to Sui ecosystem (SUI, DEEP, WAL) following its return to $40B FDV

Hyperliquid ecosystem through HYPE and HLP which are compared to "JLP/SOL but with added organic buying pressure"

2. AI Token Exposure Strategy

The AI token sector shows particular strength with:

VIRTUAL (+50% single day, 2-5x from lows)

AVA ("acting as a blackhole sucking liquidity from other old onchain AI plays")

AI16Z (part of broader AI momentum)

SEKOIA (SmallCapScientist doubled position, rebranded as @fewshot_)

Strategy should focus on tokens demonstrating both technological integration and strong price momentum.

3. Memecoin Rotation Strategy

The memecoin sector continues to show selective strength with specific narratives gaining traction:

Cat-themed tokens (POPCAT, MOG) showing significant holder growth

Dog-themed legacy coins (DOGE, FLOKI) maintaining relevance

Solana-based memes (BONK) seeing renewed interest

Recent launches generating attention (BOOP, PENGU)

The strategy involves rotating capital to capture emerging memecoin narratives while maintaining some exposure to established names.

4. Lending Protocol Positioning

With architectural innovation occurring in lending protocols:

Established leaders: AAVE (maintaining market position)

Curve ecosystem: CRV, CVX (yield optimization through veCRV bribes)

Innovative newcomers: Loop Scale (order book approach eliminating spread)

Module architecture: Camino (moving toward Lend V2)

5. Defensive Positioning for Summer Consolidation

With multiple traders expecting "summer chop" in Q2-Q3:

Core BTC holdings with $92.5K as key higher timeframe support level

Stablecoin yield farming through top opportunities (Pendle at 135% APY, Curve pools at 19-38%)

Selective alt exposure based on strong fundamentals and technicals

Avoiding tokens showing deteriorating on-chain metrics (HOUSE, GORK) or questionable valuations (MOVE, LAYER, IP)

Market Structure and Outlook

The broader market structure suggests we are in a transitional phase between accumulation and potential distribution at higher levels. Bitcoin approaching the $100K psychological barrier represents a critical inflection point, with traders preparing for potential short-term rejection while maintaining bullish longer-term outlook.

Ethereum's extraordinary 20-22% daily gain following the Pectra upgrade signals potential for altcoin outperformance if the ETH/BTC ratio continues to improve. The market appears to be establishing a more discerning approach to altcoin selection compared to previous cycles, with detailed technical analysis and fundamental questioning replacing indiscriminate enthusiasm.

While maintaining caution around immediate price levels and preparing for potential summer consolidation, the overall market structure remains bullish with expectations for continued upside in Q3-Q4 2025.

Key Events to Monitor

Bitcoin's behavior at the $100K level - breakthrough would likely accelerate momentum

ETH/BTC ratio development following the Pectra upgrade

crvUSD growth trajectory and adoption metrics

Stablecoin Act regulatory developments

Meta's potential re-entry into cryptocurrency space

Trump's pending trade deal announcements affecting market sentiment

This comprehensive analysis covers all tokens mentioned in the project knowledge while providing strategic frameworks for investors across different market segments and risk profiles.