Daily Market Edge, 7th May 2025

Insights from CT and YT

Market Overview

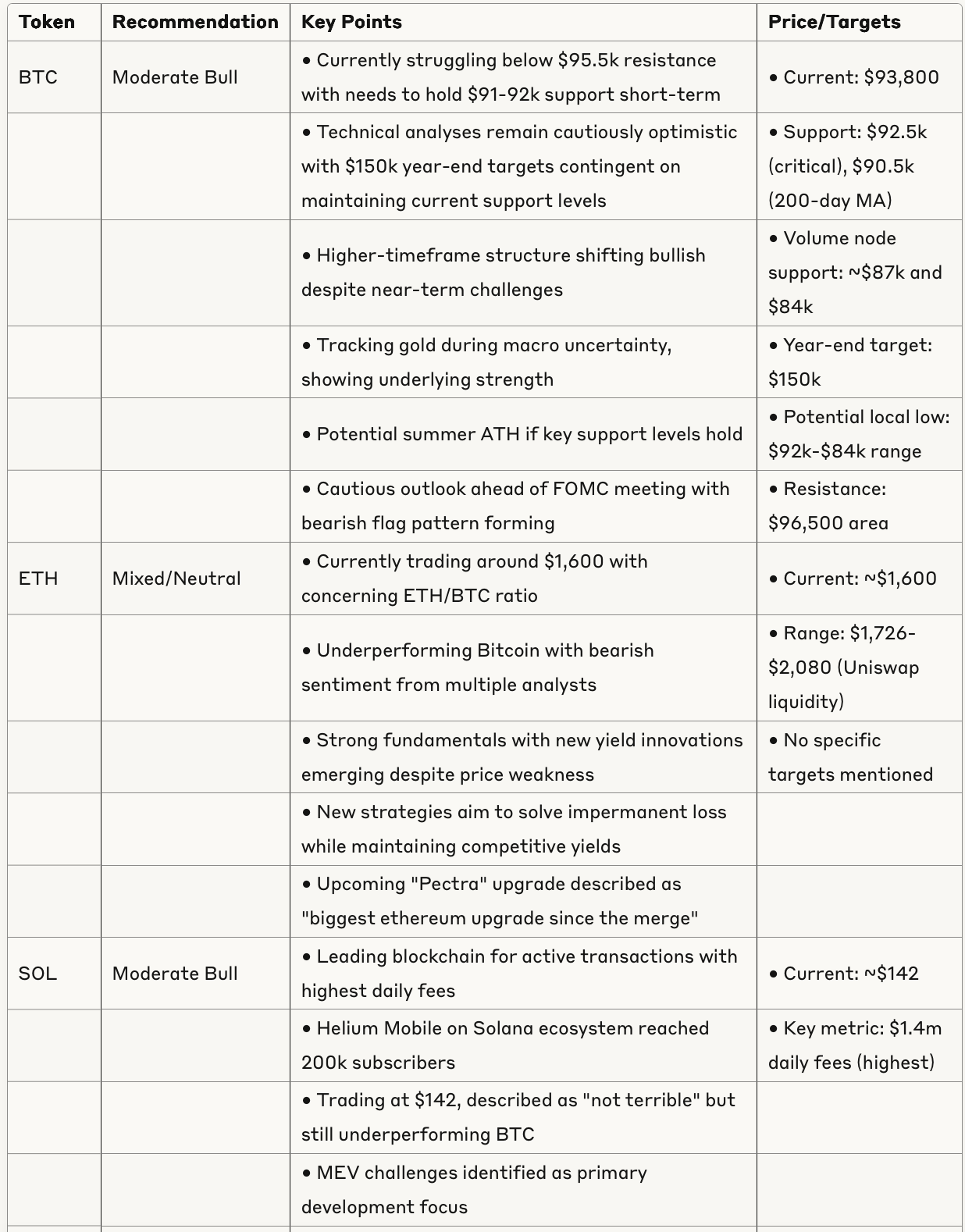

The crypto market is currently in a cautious state with Bitcoin trading below the $95.5k mark. Attention is focused on key support levels, particularly the $91-92k range which needs to hold in the short term. Despite some technical challenges, higher-timeframe structures are showing bullish signals for crypto as we move through Q2 into Q3-Q4 2025.

As of May 6th, 2025, major cryptocurrencies are continuing their decline, with Bitcoin currently at $93,800. This pullback comes amid the broader context of increasing U.S.-China trade tensions and ahead of tomorrow's FOMC meeting, both of which are contributing to market uncertainty.

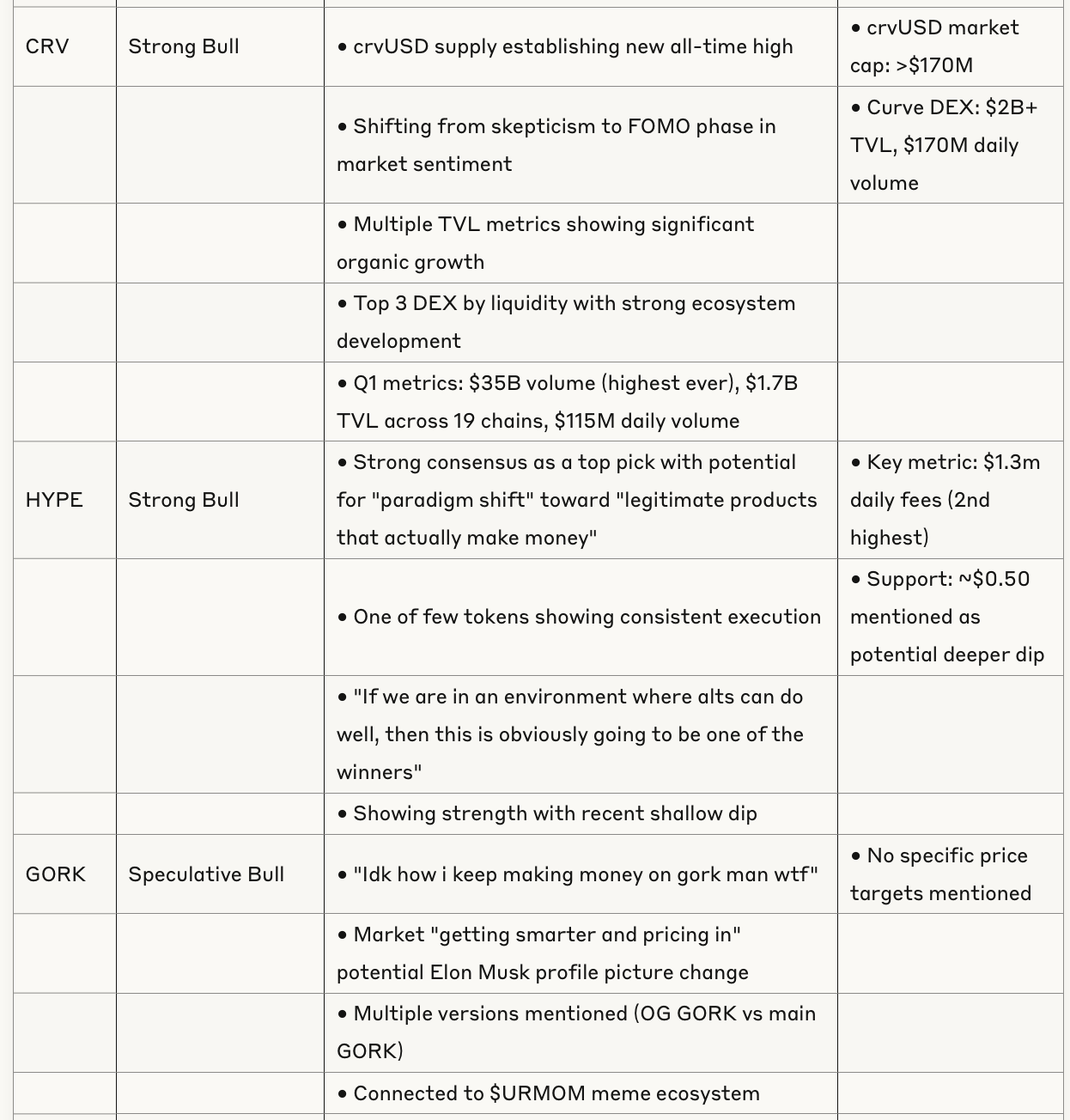

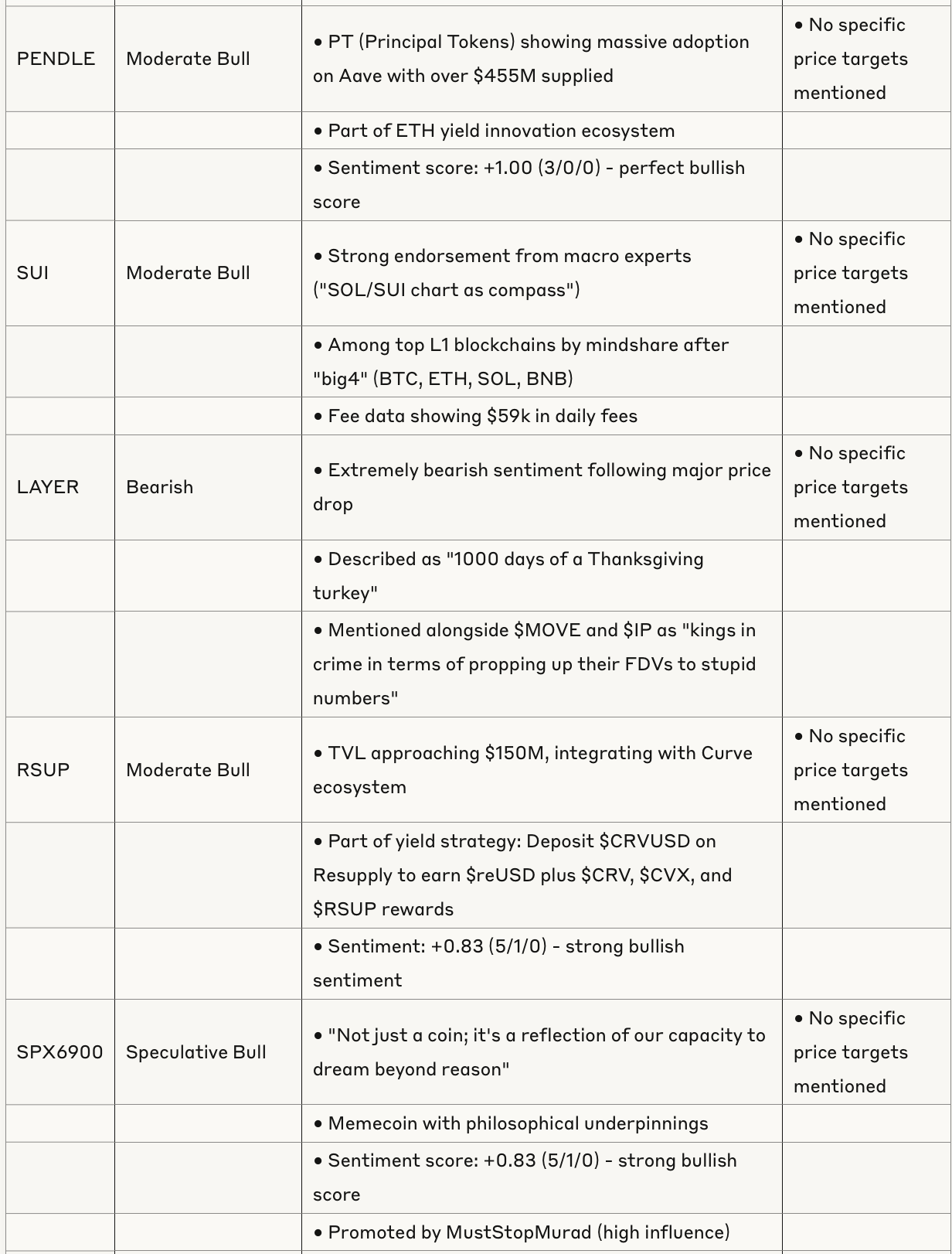

Token Analysis

Market Dynamics

Catalysts & Risk Factors

FOMC Meeting (May 8th): Tomorrow's FOMC meeting is creating cautious sentiment, with many analysts expecting a pullback from the S&P 500's nine consecutive green closes. Multiple traders are positioning for potential volatility around this event, with the majority leaning bearish in the short term.

U.S.-China Tariff Situation: The lagging effects of U.S./China tariff tensions are a significant concern for markets. If negotiations don't succeed quickly, the outlook for U.S. stocks appears particularly challenging.

Institutional Adoption: Bernstein is predicting $330 billion in corporate Bitcoin inflows by 2029, suggesting continued institutional interest despite current price action.

Technical Sentiment

The crypto market sits at a critical juncture with Bitcoin consolidating in a key range while narrative dominance increasingly trumps execution quality. The strength shown in fee generation for SOL and HYPE indicates real usage despite concerns, while the rise of philosophical and meme narratives suggests a diversification of investment theses beyond pure utility.

Technical analyses remain cautiously optimistic for Bitcoin, with $150k year-end targets contingent on maintaining current support levels. The increasing focus on narratives over fundamentals bears watching, as does the concentration of activity on fewer chains despite the proliferation of newer protocols.

Market Structure

The May 6th crypto Twitter discussions reveal a market focused on sustainable yield and DeFi fundamentals rather than speculative narratives. The contrast between growing TVL/fundamentals and perceived low social engagement suggests a potential market phase transition where fundamentals may be beginning to overshadow purely speculative narratives.

There's an interesting observation on market psychology where "crypto twitter evolved to be centered around making money. When people stopped making easy money, they moved on to other interests." This potentially explains the "dead" feeling despite market caps approaching all-time highs.

Strategic Outlook

Short-Term (1-4 Weeks)

Bitcoin likely to establish a local low this week between $92k and $84k, which could present a good entry opportunity.

Caution advised around FOMC meeting with potential for increased volatility.

Key support levels to watch include $92.5k, the 200-day MA at $90.5k, and volume node support at ~$87k and $84k.

Mid-Term (1-3 Months)

Bitcoin expected to push toward ATH this summer if key support levels hold.

ETH yield innovation through strategies like GammaSwap Yield Tokens projecting 15-25% yields.

Narrative shifts bringing previously ignored tokens like CRV into FOMO phase as fundamentals improve.

Long-Term (6-12 Months)

Bitcoin projected to reach $150k by December according to technical analysis.

Bernstein predicting $330B in corporate BTC inflows by 2029, suggesting substantial long-term institutional interest.

Environment potentially favors established protocols with real utility over newer, more speculative projects as market matures.

Conclusion

The crypto market is navigating a complex landscape of technical consolidation, narrative shifts, and external economic pressures. While Bitcoin maintains relative strength against traditional markets and trades above $93k, it faces critical technical levels that will determine trajectory through Q2-Q3.

DeFi fundamentals appear to be strengthening quietly, with protocols like Curve showing impressive growth metrics despite modest price action. The rise of sustainable yield strategies and focus on real utility suggests a maturing market, while narrative-driven meme tokens continue to attract speculative capital.

For investors, key strategies include monitoring Bitcoin's support at $92.5k-$90.5k, considering strategic entry during potential pullbacks, and focusing on tokens with strong fundamental metrics like CRV, HYPE, and SOL that can leverage their established ecosystems through any market turbulence.