Daily Market Edge: 16th May, 2025

Edge from CT & YT. Built using Claude

Overall Market Context

The crypto market is currently showing mixed signals after a strong bull run that pushed Bitcoin above $100,000. Bitcoin is trading at approximately $102,300, down 2% in the last 24 hours, with other major cryptocurrencies also showing slight pullbacks (ETH -3% at $2,550, XRP -6% at $2.47, SOL -6% at $171).

Despite this short-term correction, the macro trend remains bullish with significant institutional involvement. Bitcoin ETFs recorded positive net daily flows of +$319.5M on May 14, 2025, with Ethereum ETFs adding +$63.5M on the same day. This continued institutional interest, coupled with President Trump being "on track to sign comprehensive crypto legislation, including stablecoin and market structure bills, before the August congressional recess", suggests a supportive regulatory environment developing.

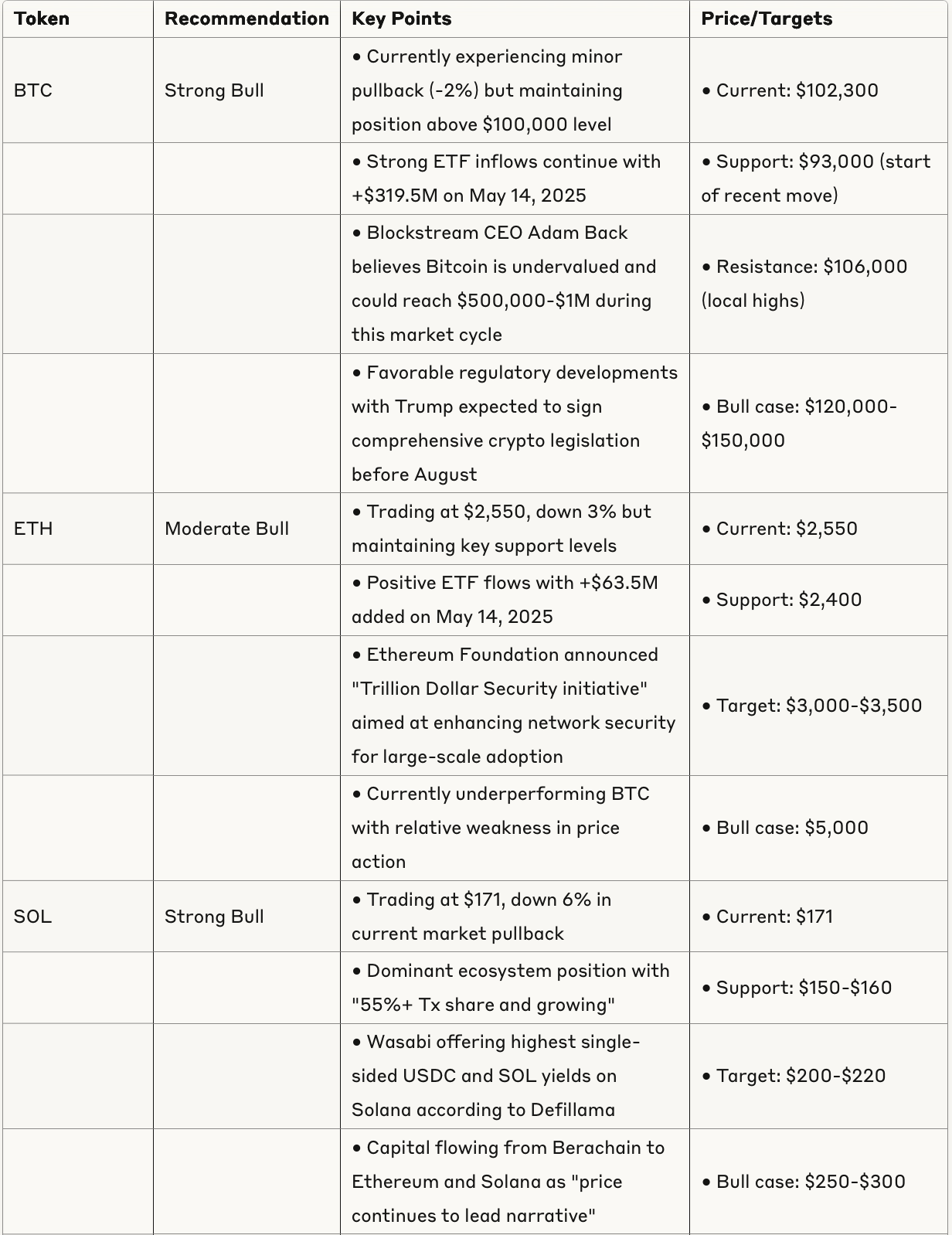

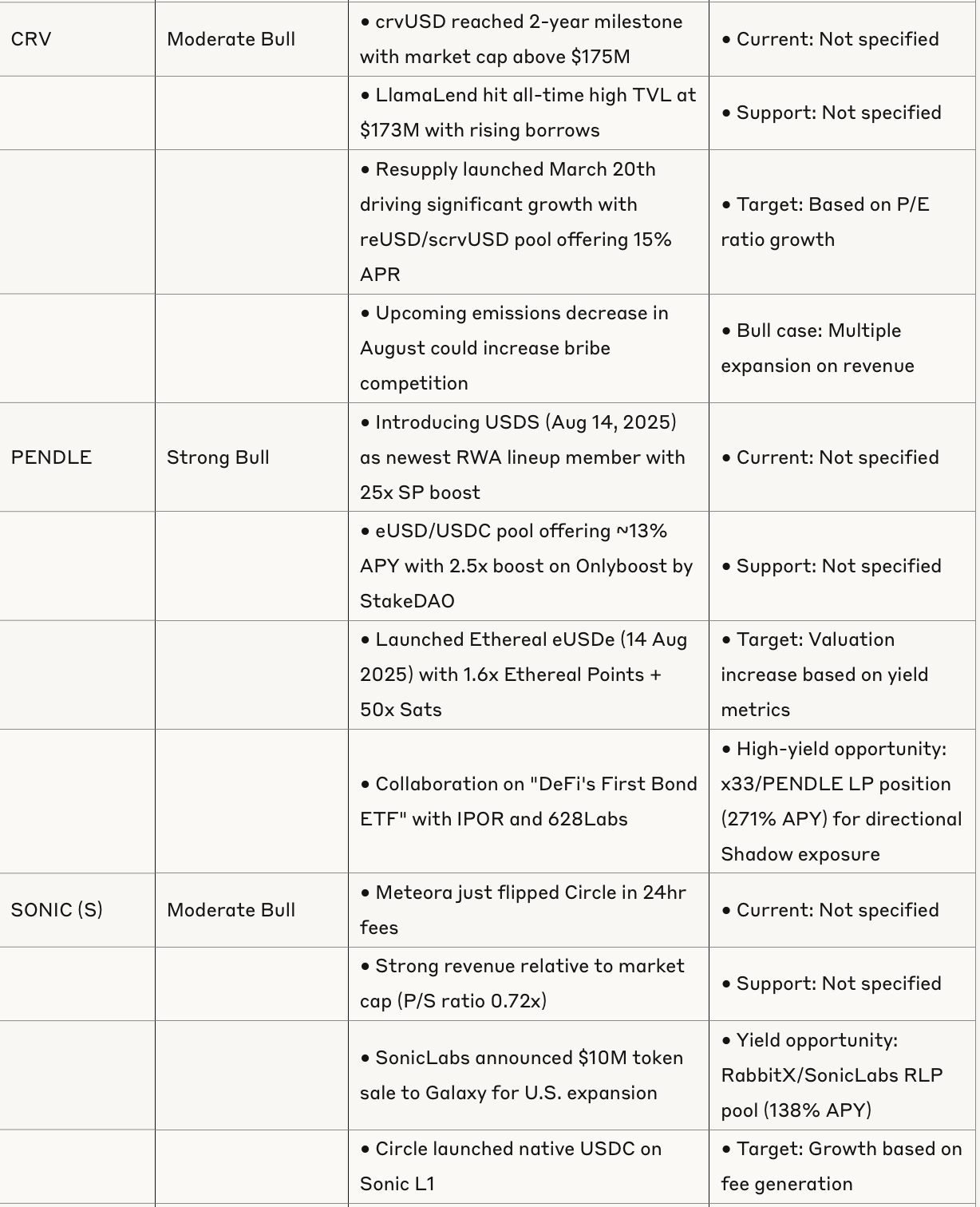

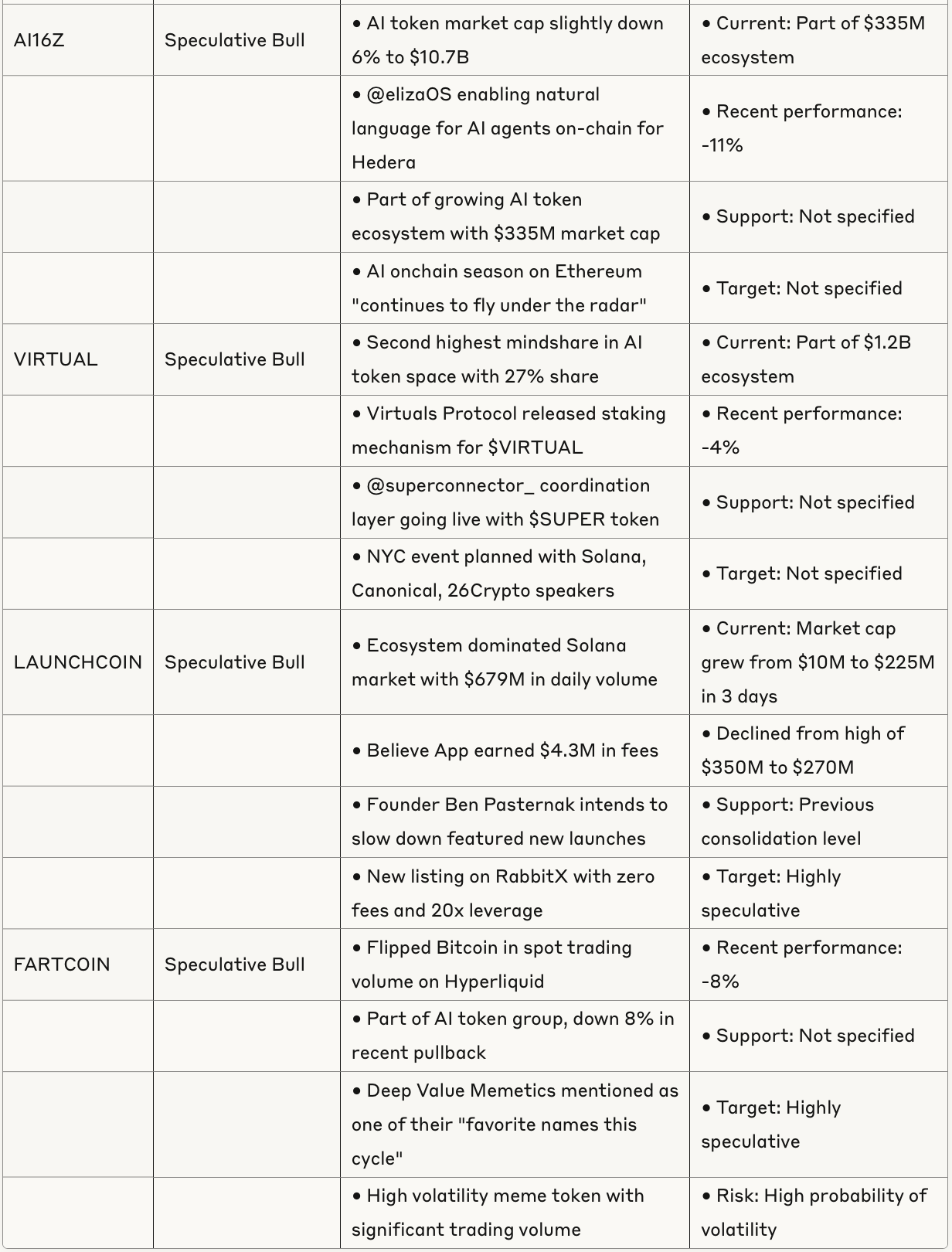

Token Analysis Table

Emerging Trends & Narratives

1. Traditional Finance Integration

JPMorgan completed its first-ever transaction involving tokenized U.S. Treasuries on a public blockchain, utilizing Chainlink and Ondo Finance. This represents a significant milestone in bridging traditional finance with blockchain technology. This trend shows TradFi moving beyond "walled garden" approach to public ledgers, potentially opening the door for further institutional adoption.

2. AI & Crypto Convergence

The AI token sector continues to gain traction despite recent price pullbacks. The overall AI market cap fell 6% to $10.7B, but development activity remains robust. Notable developments include Tether unveiling QVAC (QuantumVerse Automatic Computer), a decentralized AI platform designed to operate independently on personal devices and WalletConnect incorporating AI agents and mobile-friendly features.

3. Internet Capital Markets (ICM)

A new trend emerging on Solana, similar to previous AI launchpad platforms. Capital is increasingly flowing from Berachain and Solana to Ethereum as price continues to lead narrative. Tokens like STARTUP (+1000%), UNICORN (+250%) and YAPPER (+26000%) have seen explosive growth within this narrative.

4. DeFi Yield Optimization

Multiple protocols are competing for liquidity through point systems and incentives, with rising bribe competition for gauge weights, particularly in the Curve ecosystem. There's an increased focus on real yield rather than token incentives alone, with projects like Pendle and Sonic Labs offering compelling yield opportunities.

5. Security & Self-Custody

Coinbase shared a cyber criminal data exploit and extortion attempt which impacted <1% of users and no funds, highlighting the importance of security in the crypto ecosystem. This has reinforced the narrative around self-custody and security infrastructure development.

Risk Assessment

Market Risks

Technical Overextension: Bitcoin and major cryptocurrencies have seen significant price appreciation and may be due for a correction or consolidation period.

Regulatory Uncertainty: Despite positive developments, regulatory clarity remains incomplete and subject to change.

Liquidity Concentration: Trading volume is becoming increasingly concentrated in specific tokens and platforms, which could lead to liquidity issues during market stress.

Token-Specific Risks

Meme/Speculative Tokens: FARTCOIN, LAUNCHCOIN, and similar tokens carry extremely high volatility risk with limited fundamental value.

AI Token Sustainability: The AI token sector is heavily narrative-driven and may face challenges in maintaining momentum without demonstrating clear utility.

DeFi Protocol Competition: Intense competition for liquidity in the DeFi space could lead to yield compression and reduced profitability for platforms.

Actionable Insights

High-Yield Opportunities:

RabbitX/SonicLabs RLP pool (138% APY)

x33/PENDLE LP position (271% APY) for directional Shadow exposure

Borrowed USDC against crypto collateral on SiloFinance (-1.3% to -4.7% APR)

Strategic Positioning:

Maintain core positions in Bitcoin and Ethereum while being selective with altcoin exposure

Consider diversification into DeFi protocols with sustainable revenue models

Monitor for potential sector rotation from speculative tokens back to major cryptocurrencies

Risk Management:

Implement stop-loss strategies for speculative positions

Maintain adequate liquidity for potential buying opportunities during market corrections

Consider reducing leverage given the extended nature of the current market cycle

Conclusion

The crypto market remains in a bullish phase despite short-term corrections, with institutional adoption accelerating through ETFs and traditional finance integration. Bitcoin continues to lead the market, maintaining strength above $100,000, while Ethereum and other major cryptocurrencies show relative weakness but retain upside potential.

Emerging narratives around AI integration, Internet Capital Markets, and yield optimization are driving specific token performance, though with heightened volatility and risk. The regulatory environment appears to be improving, with potential landmark legislation expected in the coming months.

Investors should balance core positions in established cryptocurrencies with selective exposure to high-potential sectors while maintaining strict risk management practices, especially for speculative positions. The current market shows characteristics of mid-cycle dynamics, suggesting room for further growth while being mindful of increasing volatility and potential consolidation periods ahead.