Daily Market Edge, 15th May 2026

Edge from CT & YT. Made using Claude

Market Overview

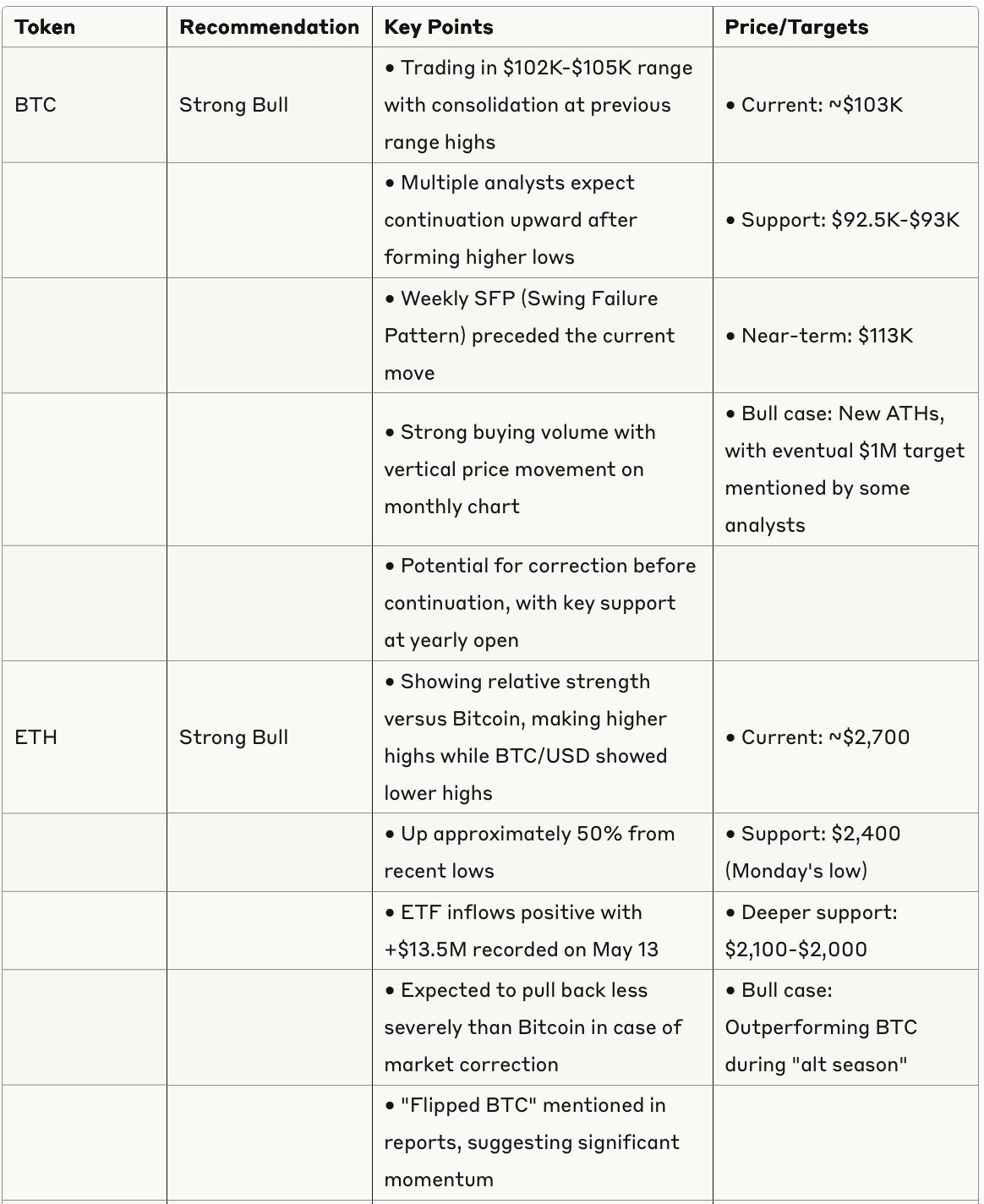

The crypto market is currently showing strong bullish momentum with Bitcoin trading in the $102K-$105K range after a significant rally (~42% from recent lows). Ethereum has shown even stronger performance, up approximately 50% with recent price action. The macroeconomic environment appears supportive, with positive CPI data pointing toward potential Fed rate cuts in the near future.

A notable shift is occurring in market dynamics: Bitcoin dominance appears to have topped, historically signaling the start of "alt season" where alternative cryptocurrencies outperform Bitcoin. There's a growing focus on Internet Capital Markets (ICM) tokens, with substantial attention directed toward platform tokens like LAUNCHCOIN and various application tokens built on these platforms.

Token Analysis

Key Market Narratives

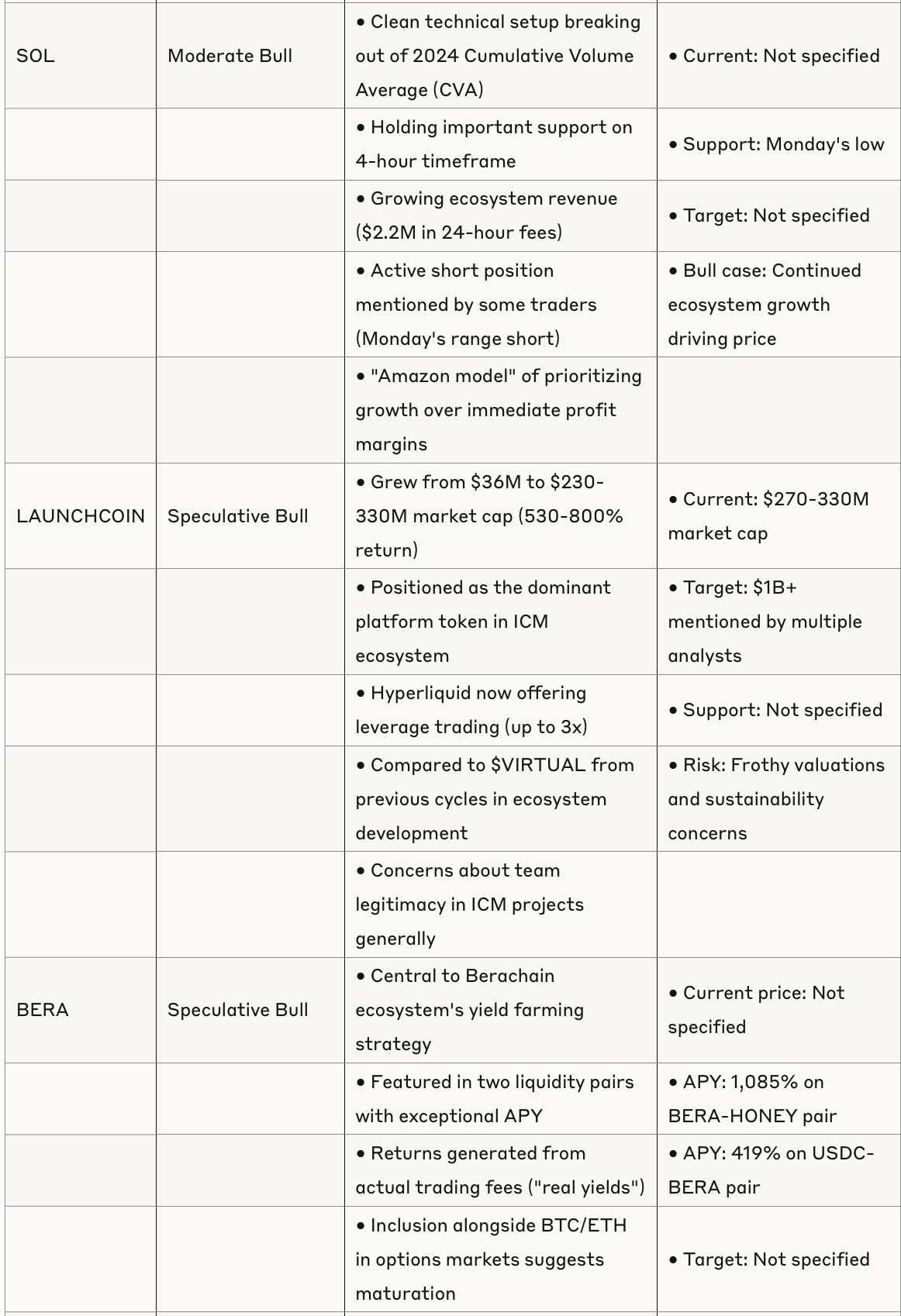

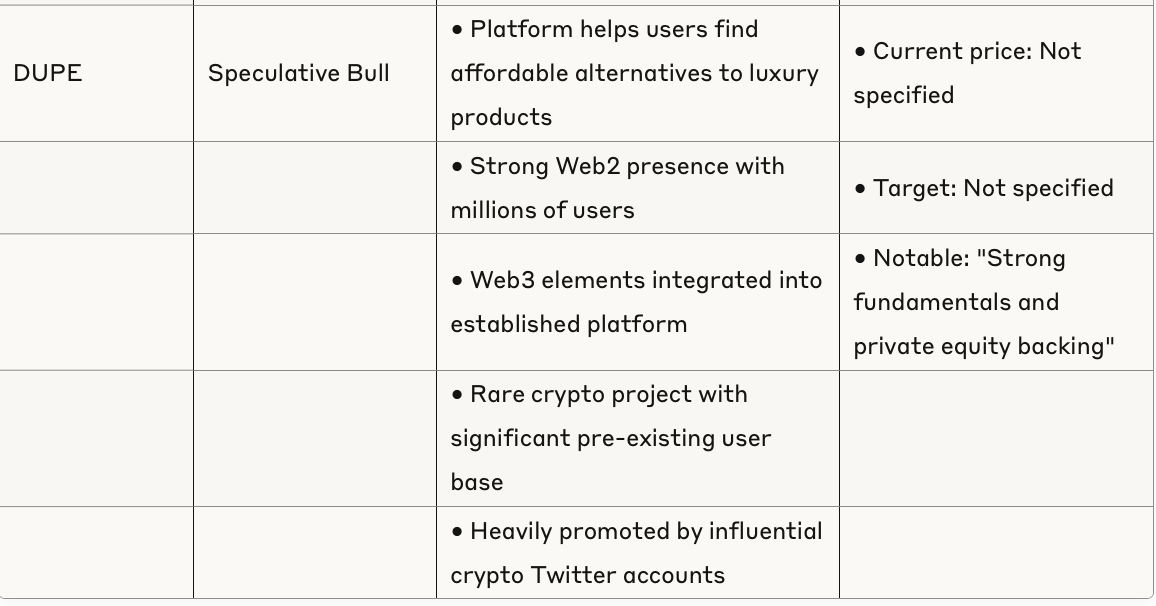

1. Internet Capital Markets (ICM)

The dominant narrative centers around Internet Capital Markets (ICM) and "launchcoins" - tokens associated with decentralized capital formation platforms. Projects like LAUNCHCOIN and the BELIEVE ecosystem are generating substantial revenue by enabling direct fundraising for ideas and projects. This trend is being described as potentially revolutionary, with some traders comparing it to a compressed version of ICO returns where founders can bootstrap through crypto rather than traditional venture capital.

Key observations:

LAUNCHCOIN emerged as the dominant platform token (currently at $270-330M market cap)

Secondary "app tokens" within the ecosystem (UNICORN, YAPPER) showing strong momentum

Market expectations of LAUNCHCOIN potentially reaching $1B+

Emerging pattern comparing platform tokens to previous cycles where platform plays outperformed most apps

Warning signs about sustainability and team legitimacy issues

2. Yield Farming Renaissance

High-yield opportunities are gaining significant attention, particularly within the Berachain ecosystem. BERA and HONEY tokens are central to liquidity provision strategies with reported APYs exceeding 1,000% in some pairs. The emphasis is on "real yield" generated from trading fees rather than token emissions.

Key observations:

BERA-HONEY pair offering 1,085% APY

USDC-BERA pair offering 419% APY

Returns claimed to come from "trading fees (real yields)"

Options markets developing with fee incentives for sellers

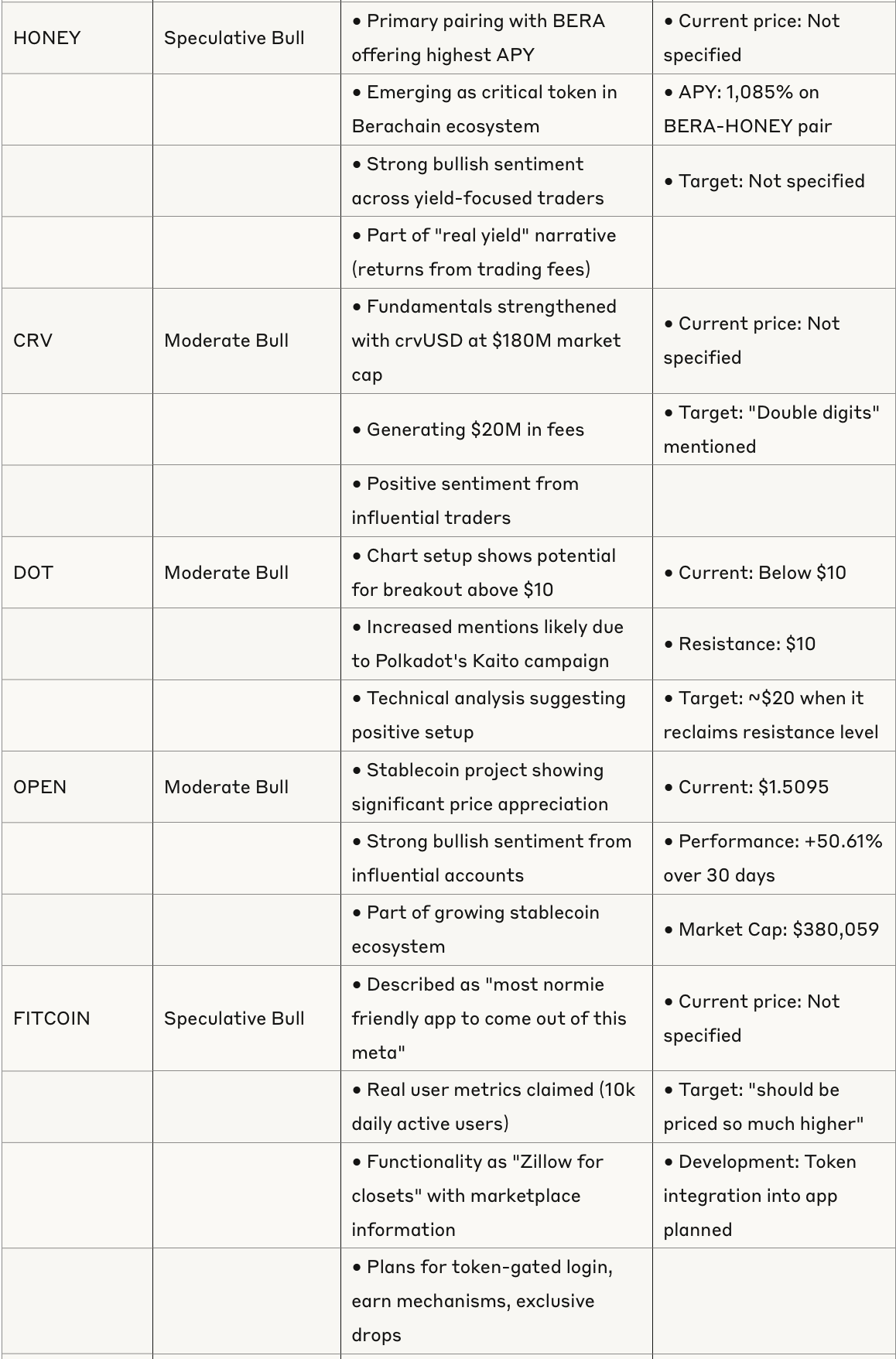

3. AI Integration in Crypto

Multiple AI-focused projects are gaining attention, with KaitoAI being prominently mentioned in connection with market analysis tools and integration with various crypto ecosystems. The intersection between AI functionality and token incentives is growing.

Key observations:

AI tokens gaining: Com (+60%), Dpcore (+30%), Tibbir (+15%), Lmt (+15%), Griffain (+10%)

CODEC positioned for AI and robotics applications

KaitoAI mentioned in connection with yapper leaderboards and market analysis tools

YAPPER described as "deepfake AI app for creating hilarious high quality videos"

4. ETF Flows and Institutional Participation

Ethereum ETFs showed positive inflows (+$13.5M) while Bitcoin ETFs experienced outflows (-$91.4M) on May 13, potentially signaling a rotation from BTC to ETH among institutional investors. This aligns with the broader market narrative of alt season beginning as Bitcoin dominance tops out.

Key observations:

ETH ETFs: +$13.5M net daily flow on May 13

BTC ETFs: -$91.4M net daily flow on May 13

Breakdown showing FBTC with -$91.4M outflow

ETH inflows distributed across ETHV (+$3.0M), EZET (+$3.1M), and ETH (+$7.4M)

Risk Factors

Market-Wide Risks

Extended Rally Exhaustion: BTC up 42% and ETH up 50% from recent lows, suggesting potential for profit-taking and consolidation before continued upside.

Macro Uncertainty: While CPI data is positive, continued market dependence on Fed policy decisions creates vulnerability.

Gold Weakness: Gold showing a decline and potential "failed cycle" according to some analysts, which could have macro implications.

Token-Specific Risks

ICM Sustainability: Serious concerns about the quality of many ICM projects, with allegations of "fake teams installed by incubators" and limited long-term viability.

Memecoin Lifecycle: Short lifespans observed for many speculative tokens, with one analyst noting "99% of these tokens will end up this way."

Liquidity Concentration: Rotation between ICM tokens creating boom/bust cycles as liquidity moves from one token to another.

Technical Risks

Key Resistance Levels: Bitcoin approaching significant resistance at $105K-$106K.

Potential Correlation Breakdown: Historical patterns suggest altcoin outperformance as Bitcoin dominance declines, but this correlation could fail.

Over-extended Timeframes: Several analysts noting the need for consolidation on higher timeframes before continued upside.

Trading Strategies & Insights

Primary Strategies

Platform over Apps: Focus on major platform tokens (LAUNCHCOIN) with selective exposure to the most promising app tokens.

Real Yield Focus: Target protocols generating actual revenue rather than purely speculative tokens.

Selective Entry Timing: According to analysis of day/time trading patterns:

Best long entry: Wednesday evening into Thursday (avg 11.95% upward move)

Best short entry: Thursday evening into Friday (avg 14.58% downward move)

Risk Management Approaches

Avoid Roundtripping: Several traders warning against "roundtripping" profits as markets consolidate.

Primary vs Secondary Strategy: Focusing major risk on areas of expertise while taking smaller positions in secondary opportunities.

Clear Invalidation Levels: For Bitcoin, maintaining the yearly open as a key level to invalidate the bullish thesis.

Conclusion

The crypto market is showing strong bullish momentum with Bitcoin consolidating near $103K-$105K and Ethereum demonstrating relative strength. The macroeconomic backdrop appears supportive with positive CPI data, and historical patterns suggest we may be entering "alt season" as Bitcoin dominance tops out.

Key narratives driving the market include Internet Capital Markets (ICM), yield farming opportunities (particularly in the Berachain ecosystem), and AI integration in crypto applications. While sentiment is broadly bullish, there are significant concerns about project quality and sustainability, especially within the ICM sector.

For investors, the primary strategy appears to be focusing on quality platform tokens with selective exposure to promising applications, while being cautious of frothy valuations and questionable team legitimacy. The market is likely entering a phase where careful token selection will be crucial to navigate potential minefields of low-quality projects designed primarily for short-term profit.