Daily Market Edge, 14th May, 2025

Edge from CT and YT

Market Overview

The crypto market is showing strong bullish momentum across multiple sectors, with Bitcoin testing resistance at $104K, Ethereum demonstrating exceptional strength (53% weekly gain), and a wave of altcoin activity suggesting the beginning of a broader "alt season." The overall sentiment is overwhelmingly positive following a period of consolidation, with institutional adoption accelerating and emerging narratives around AI agents, "Internet Capital Markets," and Real World Assets (RWAs) driving specific token growth.

Key Market Indicators:

Bitcoin range: $95K-$104K with strong support at $97-98K

Ethereum broke out of oversold zone on 2-Year MA Multiplier indicator, showing 53% gains in past week

CPI came in at 2.3% (below 2.4% expectations)

Significant institutional involvement with major corporate Bitcoin purchases

Strong momentum in AI tokens, launch platforms, and RWA projects

Tariff tensions easing, potentially bullish for global markets

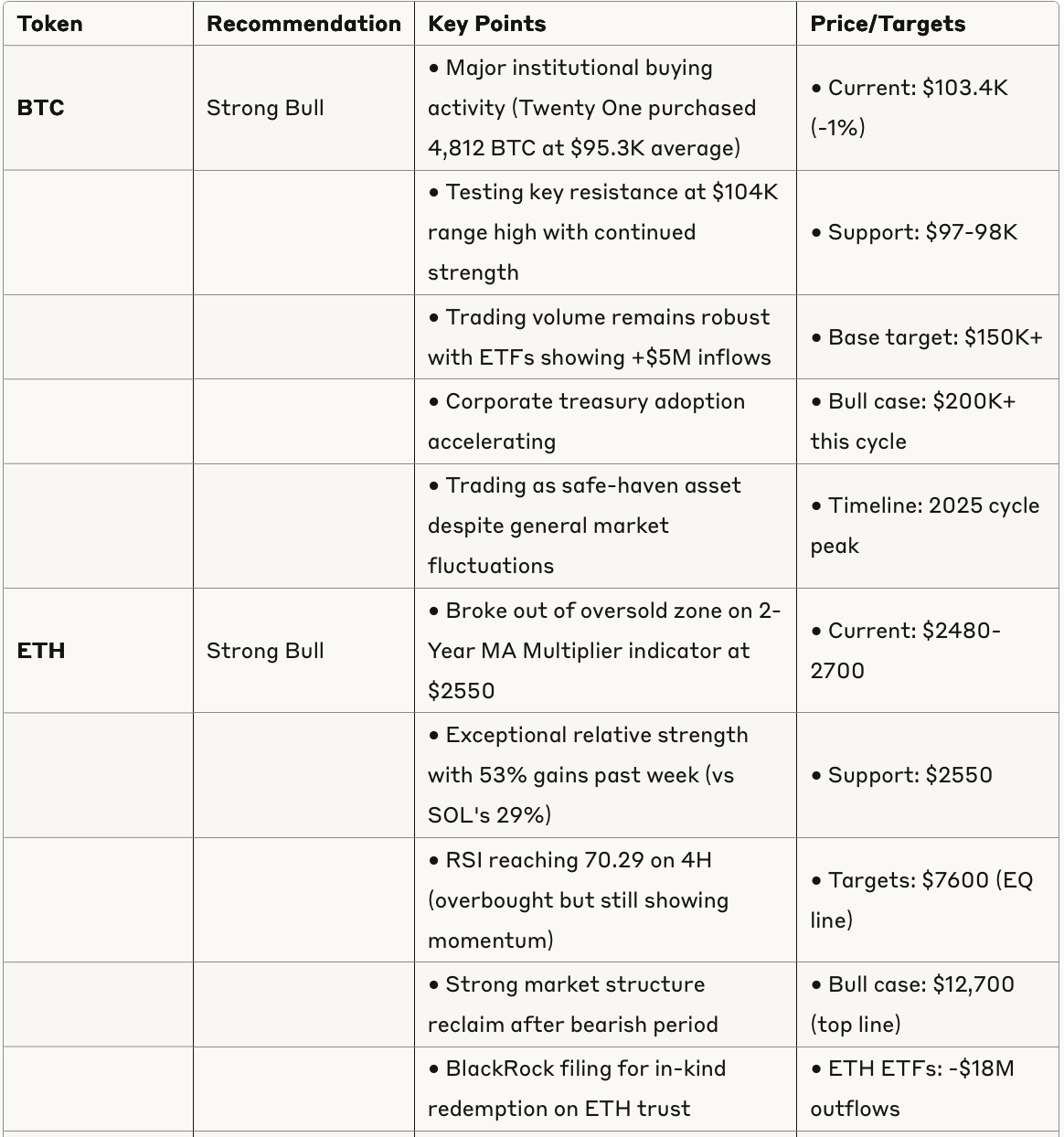

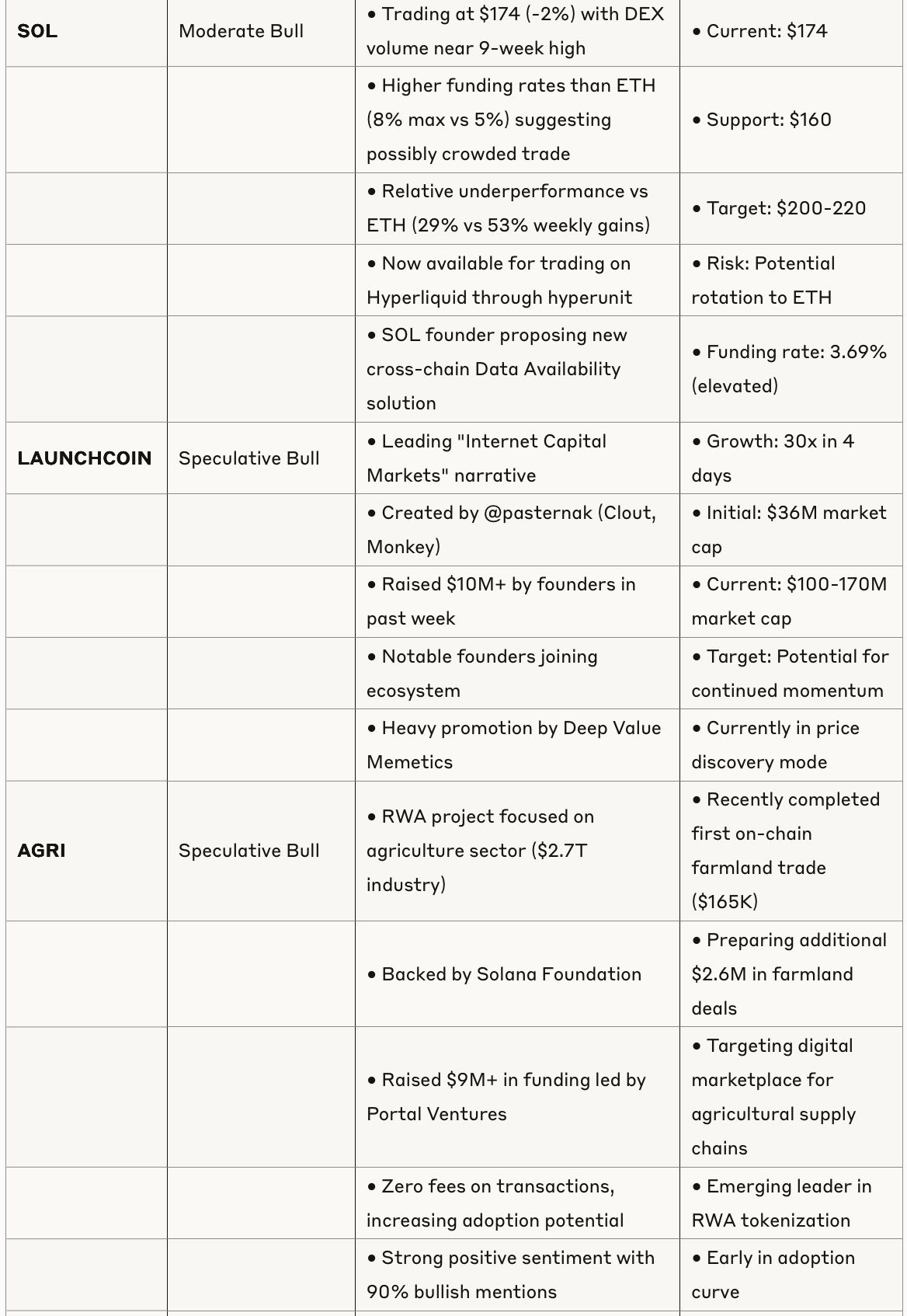

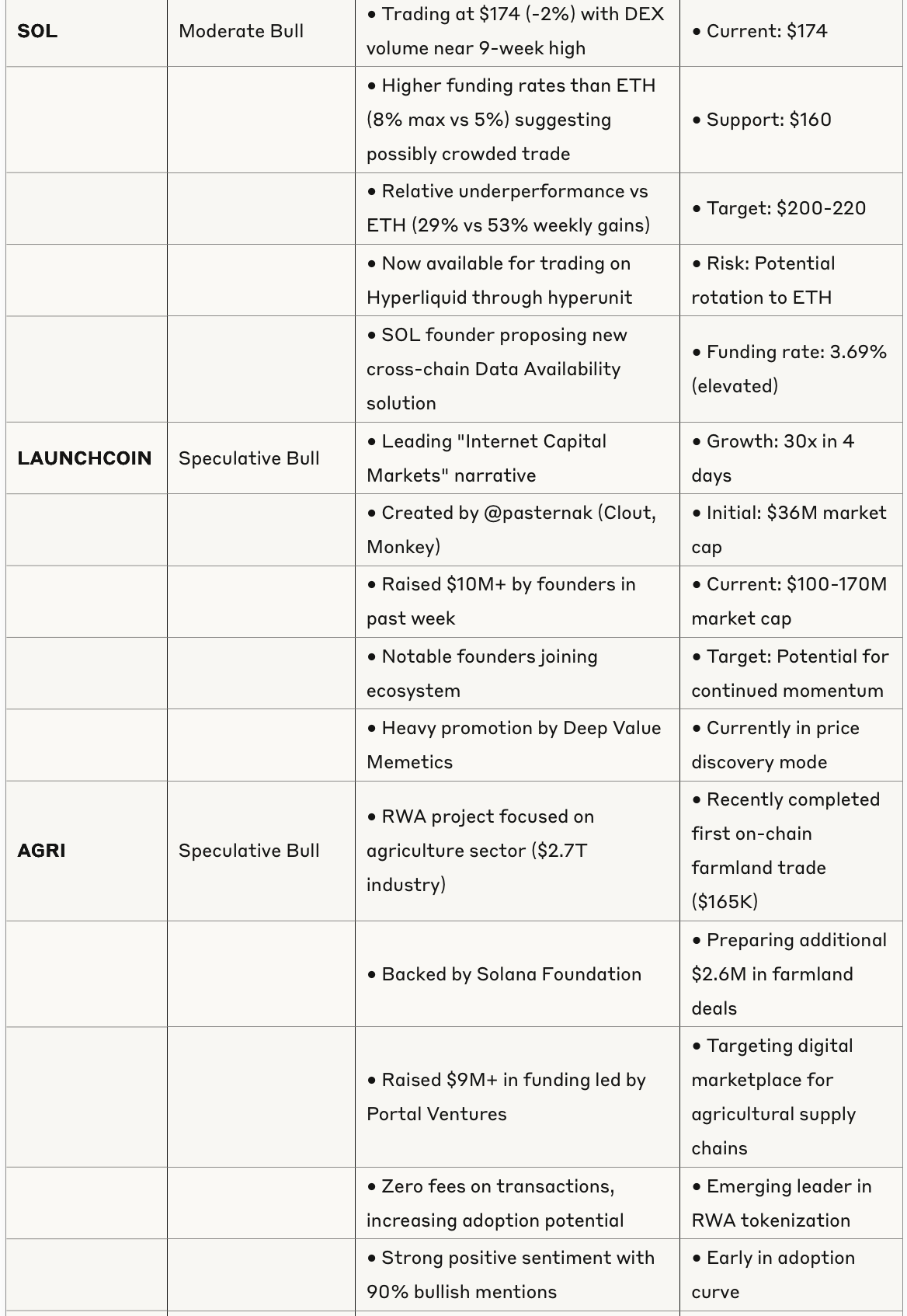

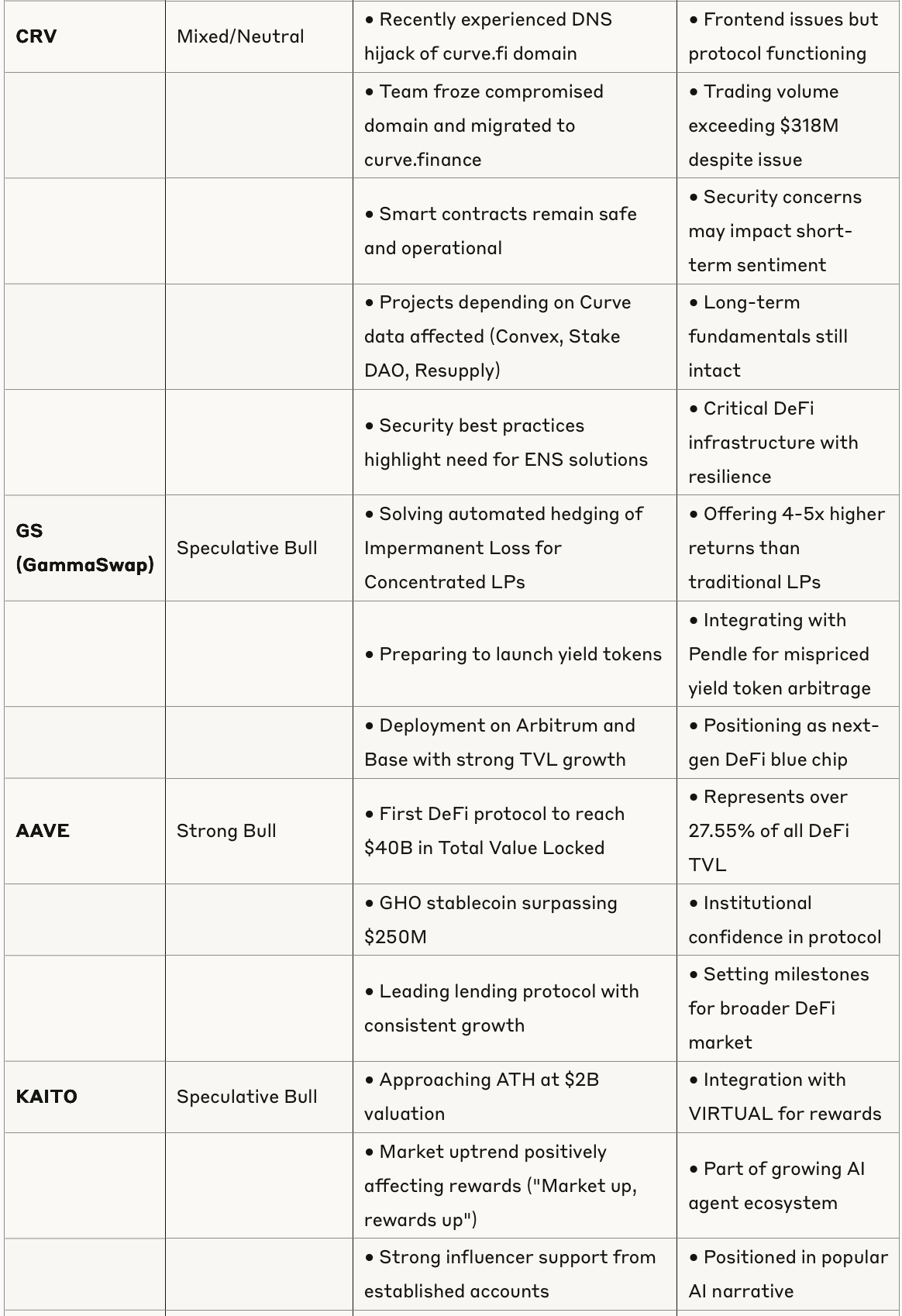

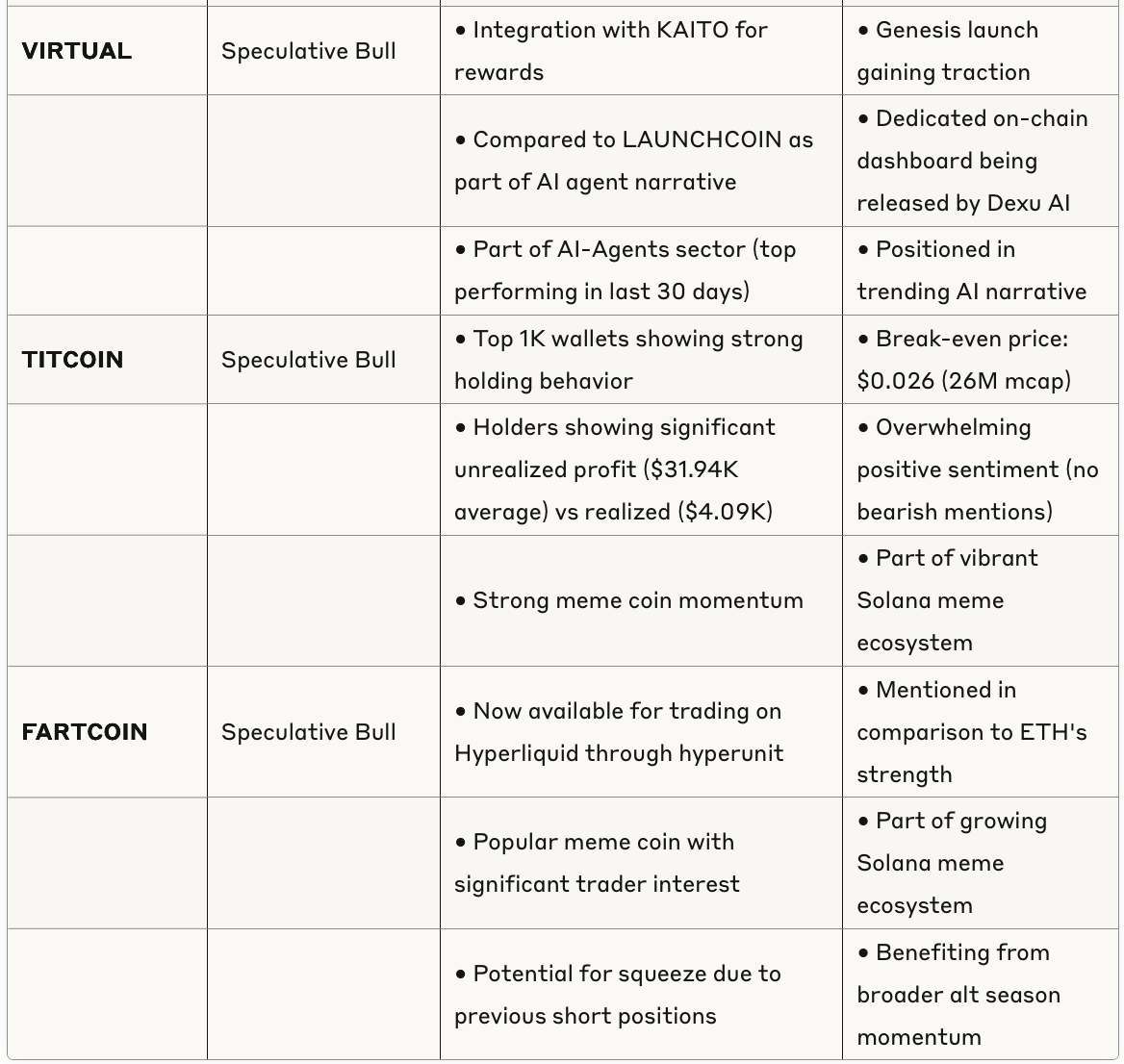

Token Analysis Table

Sector Analysis

AI & Agent Tokens

The AI-Agent vertical has been identified as the top-performing sector in the last 30 days, with projects like KAITO, VIRTUAL, ARC, and CODEC gaining significant traction. These tokens are focusing on practical utility rather than speculative AI implementations, with infrastructure projects receiving the most attention from influential traders.

Key Points:

AI infrastructure plays commanding serious attention from influential traders

Virtual Environments for Operator Agents (CODEC) showing technical innovation

Integration between projects creating ecosystem effects (KAITO + VIRTUAL)

Strong metrics-based growth (GENSYN reporting >56K on-chain accounts, >6.7M transactions)

Many tokens still down significantly from ATHs despite narrative strength (ARC 80%+ from highs)

Internet Capital Markets (ICM)

A new narrative labeled "Internet Capital Markets" is emerging as potentially equivalent to the AI agent meta, with LAUNCHCOIN leading this category. The concept centers around disrupting traditional VC models through tokenization and enabling direct creator fundraising.

Key Points:

LAUNCHCOIN up 30x in 4 days to $100M market cap

Founded by established crypto entrepreneurs (@pasternak from Clout, Monkey)

Notable founders joining the ecosystem: @ghoshal (DUPE), @alex_leiman (NOODLE), @jonathanzliu (SCHEJ)

$10M+ raised by founders in the past week

Strong positioning as "web2-web3 crossover" opportunity

DeFi Infrastructure

DeFi protocols continue to show resilience and innovation, with Aave reaching $40B TVL milestone and emerging protocols like GammaSwap and Resupply building on established DeFi primitives.

Key Points:

Curve's DNS hack highlighting both vulnerabilities and underlying protocol strength

GammaSwap solving automated hedging of Impermanent Loss for Concentrated LPs

Pendle positioning as a launchpad for growth & value discovery beyond yield protocols

Resupply leveraging Curve/Convex flywheel for enhanced yields

Security becoming increasingly important with recent exploits

Meme Economy

Meme coins continue to show strength despite the recent focus on fundamental projects, with tokens like TITCOIN and FARTCOIN attracting significant attention. The Solana ecosystem remains particularly active for meme launches.

Key Points:

TITCOIN showing strong holder metrics with significant unrealized profits

FARTCOIN available on Hyperliquid, expanding access

BONK meta potentially ending according to some traders

Rotation from "old memes" to new narratives occurring

Meme coins previously heavily shorted now experiencing squeezes

Risk Factors

Extreme Bullish Sentiment: The overwhelming bullish sentiment across nearly all analyzed tokens suggests potential for short-term exhaustion or correction.

Technical Conditions: ETH showing overbought conditions on 4H timeframe (RSI > 70) while Bitcoin tests significant resistance at $104K.

Security Vulnerabilities: Recent Curve Finance DNS attack and $3.3M in WBTC lost to phishing highlight ongoing security concerns in the ecosystem.

Crowded Trades: SOL showing signs of becoming a crowded trade with funding rates reaching elevated levels (3.69%).

Macro Uncertainties: Despite tariff tensions easing, market reactions to CPI data and Federal Reserve policy shifts could impact crypto markets.

Emerging Opportunities

RWA Tokenization: Projects bringing real-world assets on-chain, particularly in agricultural markets (AGRI completing first on-chain farmland trade).

Tokenized SaaS: Highlighted as "the next frenzy" with many startups generating significant fee revenue through tokenization models.

Cross-Chain Development: SOL founder proposing new cross-chain Data Availability solutions, SUI going live on Phantom, increased interoperability focus.

Yield Protocol Innovations: New approaches to yield generation and optimization through protocols like GammaSwap, Pendle, and Resupply.

Institutional DeFi: Growing institutional interest in DeFi primitives with Aave reaching $40B TVL milestone.

Conclusion

The crypto market is showing strong bullish momentum across multiple sectors with Bitcoin and Ethereum leading the charge. While some tokens are showing signs of potential short-term exhaustion, the overall market structure remains positive with strong support levels and increasing institutional adoption.

The emergence of new narratives around AI agents, Internet Capital Markets, and Real World Assets is driving specific token growth beyond the major cryptocurrencies. However, traders should remain cautious of extreme bullish sentiment and potential for corrections, particularly in tokens showing technical overbought conditions.

The market appears to be in a rotation phase from pure speculation toward quality and utility, with infrastructure projects gaining increased attention. Security remains a critical concern as highlighted by recent exploits, emphasizing the importance of protocol resilience and proper security practices.