Daily Market Edge, 13th May 2025

Edge from CT, YT

Overall Market Context

The crypto market is currently in a bullish recovery phase after experiencing a significant correction in April 2025. Bitcoin has rallied approximately 40% from its $75K low to current levels around $104-105K in just four weeks. This rapid recovery has created both opportunity and caution among traders and investors.

Key market themes:

Bitcoin nearing all-time highs around $104-105K, ranking 6th in global assets by market cap ($2.042T)

Bitcoin dominance has recently declined from 65% to 62%, suggesting potential alt season activity

CPI forecast for April 2025 is 2.3% YoY according to Truflation data, with inflation appearing to stabilize

US-China tariff reduction (from 125% to 10%) is bullish for equities and potentially crypto

Strong institutional interest continues with ETF inflows and BlackRock meetings with SEC

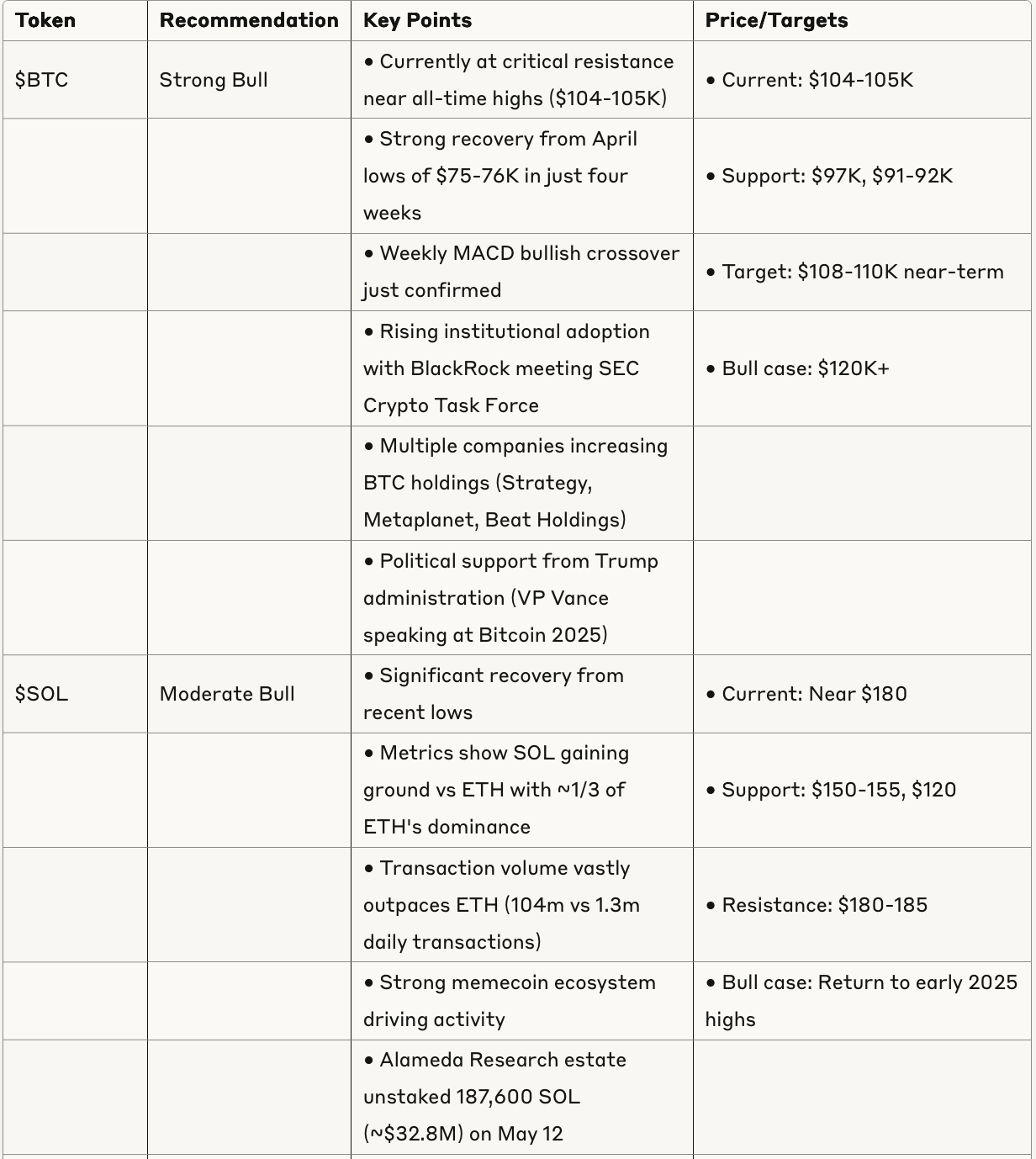

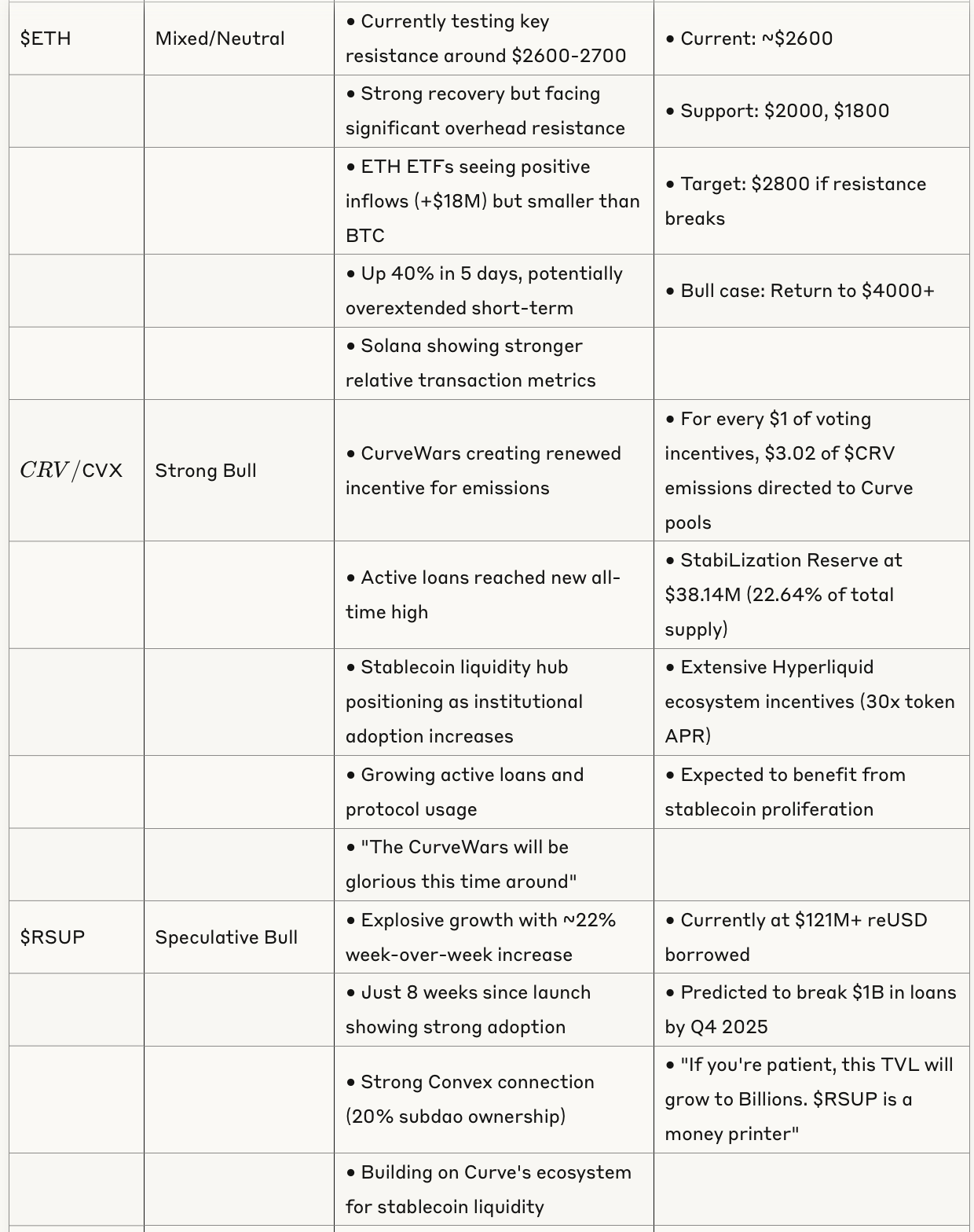

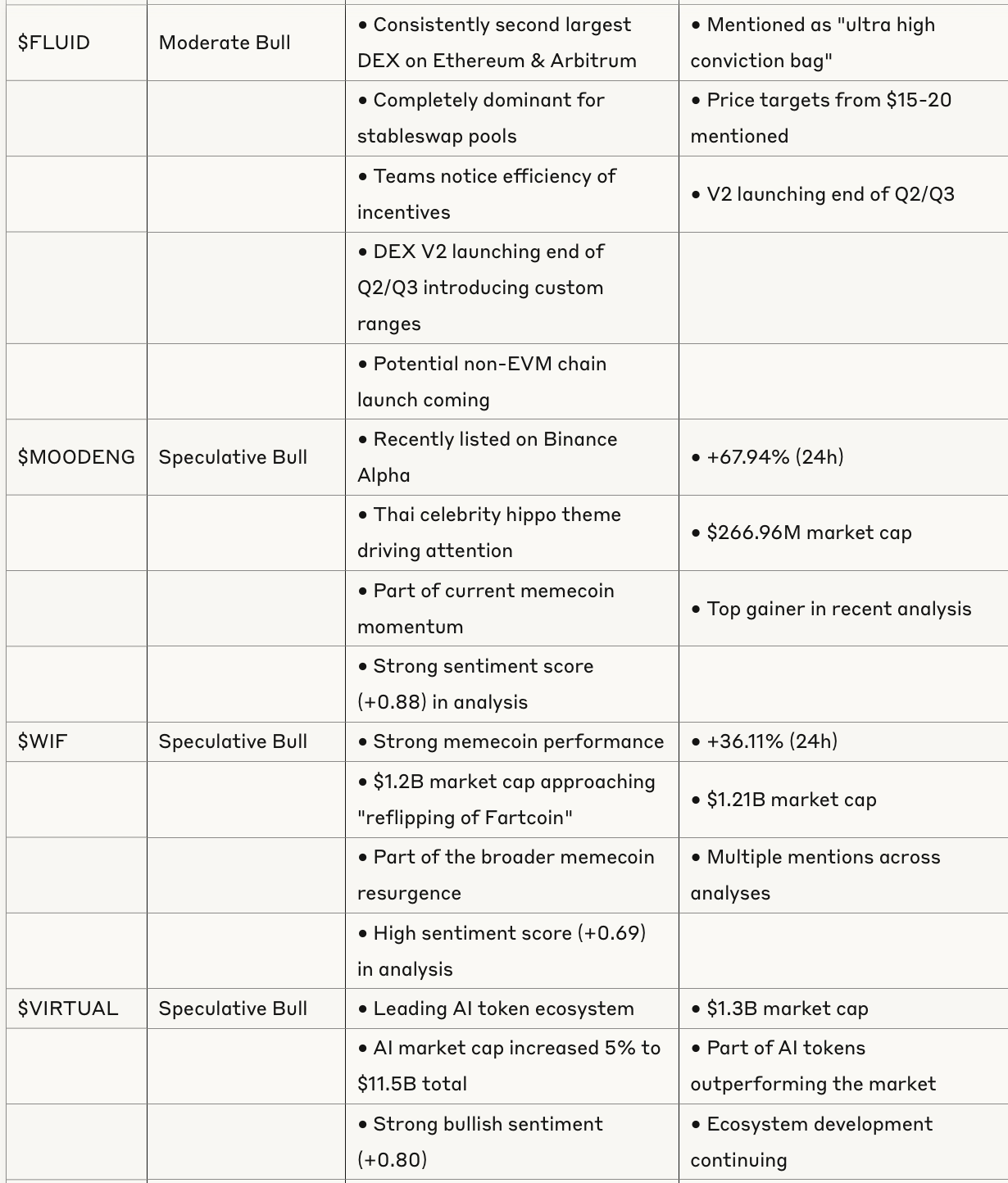

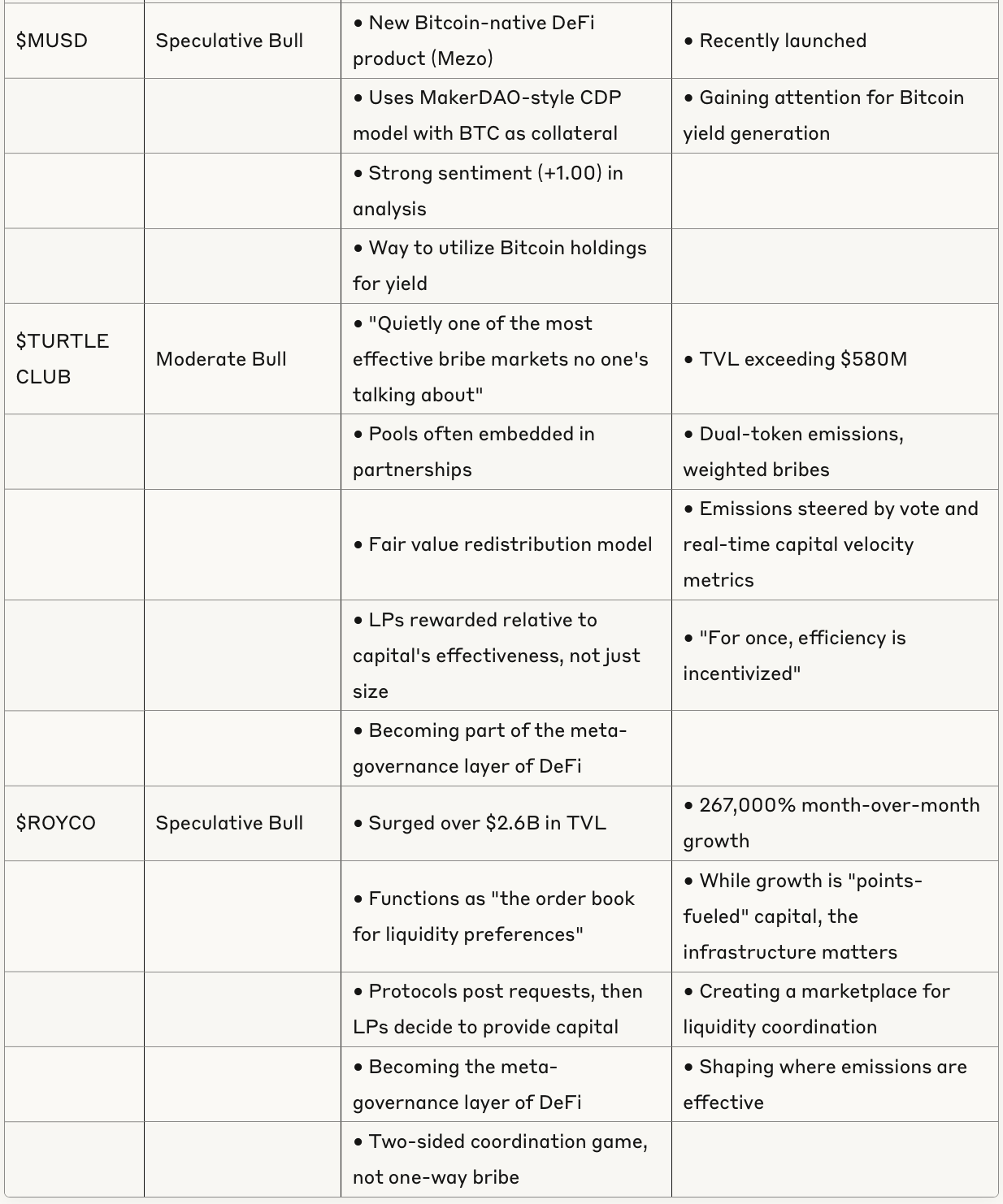

Token Analysis

Sector Analysis

DeFi Yield Renaissance

The DeFi sector is experiencing a significant yield renaissance with multiple protocols offering substantial returns. Key observations:

Stablecoin Proliferation: Major institutions embracing stablecoins with sentiment that "huge parts of the economy will be rebuilt with stablecoins"

Curve Ecosystem Expansion: Multiple projects building on top of Curve (Resupply, Stake DAO, etc.) with strong metrics and growth

Base Chain Activity: Notable yield farming opportunities on Base chain with significant APY potential

Liquidity Coordination Markets: Emerging models like Turtle Club and Royco creating more efficient allocation of capital and emissions

Memecoin Resurgence

Meme tokens are experiencing a significant resurgence in this market phase:

6 out of 9 top performing tokens in top 200 are meme coins

Total meme market cap back to $80B

Binance Alpha listed Solana-based memecoins MOODENG and GOAT

Multiple meme coins showing significant gains; $MOODENG, $WIF, $GOAT, $PNUT up 3-4x in one week

AI + Crypto Integration

The intersection of AI and crypto continues to gain traction:

AI market cap increased 5% to $11.5b total

Notable performers include: Pippin (+75%), Lmt (+60%), Neur (+55%), Hyper (+50%)

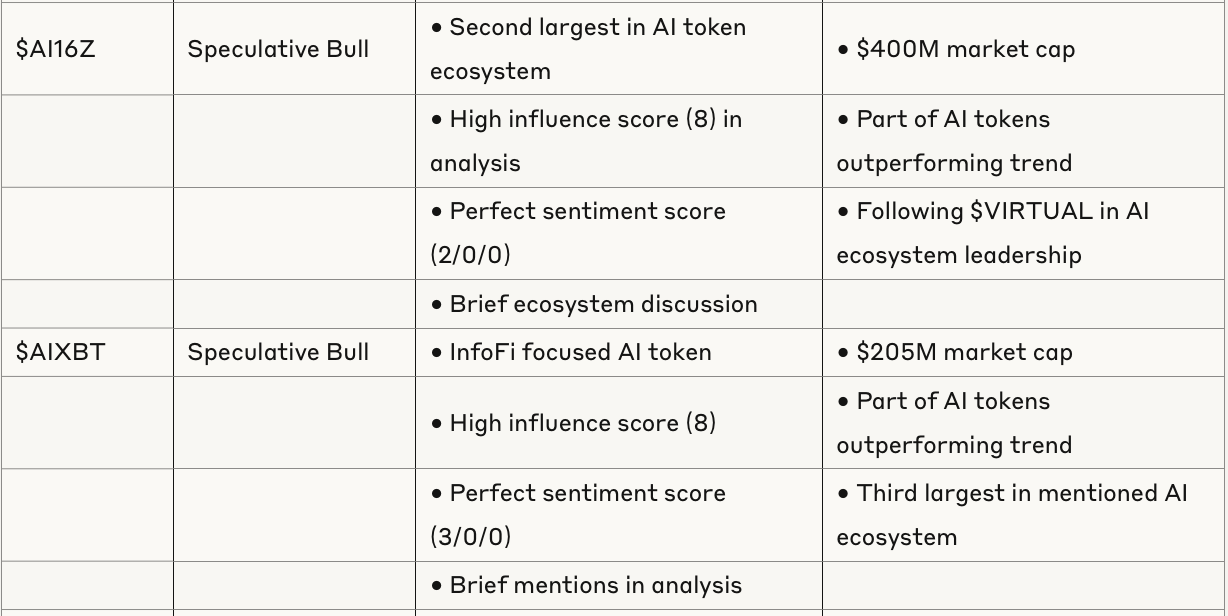

Virtual ecosystem leads with $1.3b market cap followed by AI16z ($400m) and AIXBT ($205m)

Multiple mentions of AI-related developments (Kaito AI announcing updates)

Institutional Developments

Strong institutional positioning continues:

BlackRock held a meeting with the SEC's Crypto Task Force on May 9

Topics included staking, tokenization, ETF approval criteria, and ETF-related options

BTC ETFs: +$321mn inflows

ETH ETFs: +$18mn inflows

David Bailey's 'Nakamoto' raising $700M to buy Bitcoin

Stripe rolled out stable-coin checkout and payout tools after $1.1B Bridge acquisition

Risk Assessment

Short-term Risks

Bitcoin at critical resistance ($104-105K) could face rejection

Tuesday's CPI data (May 13) could introduce volatility

Altcoin open interest up $5B, suggesting potential "top in 2-3 weeks"

Muted BTC reaction to positive macro news could indicate exhaustion

Extended rally from April lows potentially overextended

Medium-term Considerations

U.S.-China trade deal temporary (90 days), creating uncertain future outlook

Altcoin season potentially overheating according to multiple metrics

Retail entry phase beginning (indicated by "Etherium" search trend)

Potential correlation risks with traditional markets

Q1 US economy contraction (-0.3%) - first time in 3 years

Long-term Outlook

Strong institutional positioning continues with ETF flows

BTC cycle analysis suggests early stages of longer-term bullish phase

Political support from current administration (VP Vance speaking at Bitcoin 2025)

Sovereign wealth funds reportedly buying BTC

Signs of broader crypto adoption across traditional finance

Strategic Positioning

Based on the analysis, here are key strategic considerations:

Bitcoin: Look for potential pullbacks to $97K or $91-92K zones for entry, with targets at $108-110K near-term and $120K+ for bull case. Weekly MACD crossover suggests strong momentum.

Altcoin Selection: Focus on tokens with fundamental utility and strong ecosystems rather than purely speculative plays. DeFi yield protocols and AI-related tokens show particular strength.

DeFi Positioning: The "DeFi Yield Renaissance" suggests opportunity in protocols with real utility and revenue generation. Curve ecosystem (CRV/CVX) and new yield innovations (RSUP) appear particularly promising.

Meme Exposure: Consider limited, strategic exposure to established meme tokens (WIF)ornewlylistedexchangetokens(WIF)ornewlylistedexchangetokens(MOODENG) as momentum plays, but maintain strict risk management.

Risk Management: Exercise caution with overall market positioning given the rapid recovery and potential for short-term pullbacks. Use supports at $97K and $91-92K for BTC as guides.

This market appears to be in the early-to-mid stages of a significant bull cycle with strong fundamentals and institutional backing, though short-term caution is warranted after the rapid recovery from April lows.