Daily Market Edge, 12th may

Edge from CT.YT.Substack

Overall Market Context

The cryptocurrency market is showing strong bullish momentum with Bitcoin trading near all-time highs at approximately $104,000-$106,000. The market appears to be entering what some influential traders describe as a potential "supercycle" or "generational bull run."

Key market dynamics include:

Bitcoin dominance (BTC.D) has decreased by approximately 4%, creating favorable conditions for altcoin performance

ETH/BTC ratio is showing signs of bottoming, indicating potential ETH outperformance in the coming cycle

Stablecoin transactions have surpassed Visa transactions in 2024, highlighting increasing mainstream adoption

Recent U.S.-China trade agreement announcement is creating positive macro sentiment

Market structure appears to be shifting, requiring traders to adjust their entry and exit strategies

Primary risk factors include:

Low trading volume during the recent uptrend, suggesting potential for rapid reversals

Extremely bullish sentiment potentially creating an echo chamber effect

Geopolitical tensions, including a reported missile strike on a Pakistan nuclear facility

Potential unwinding of Ethena ETH positions affecting market structure

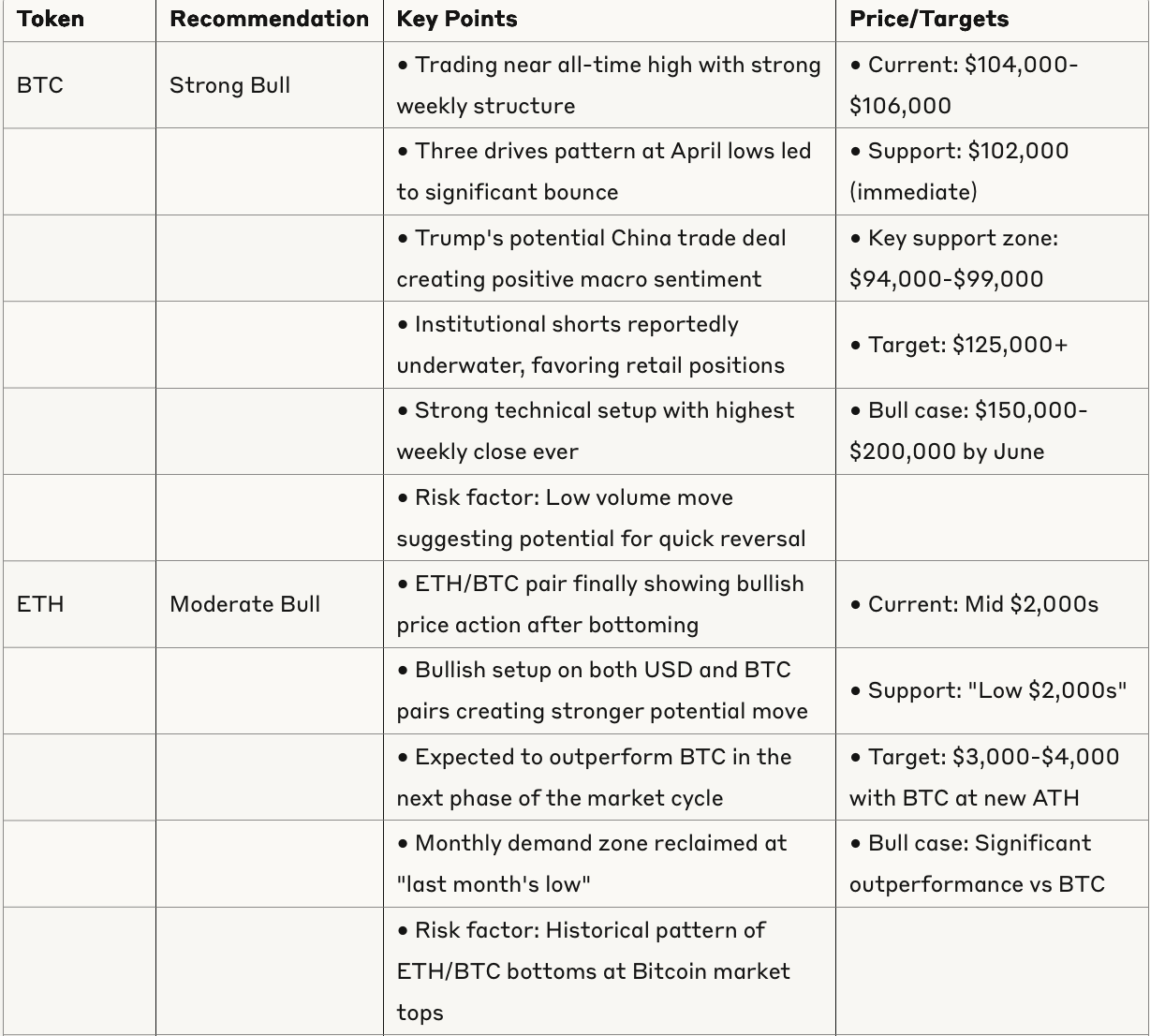

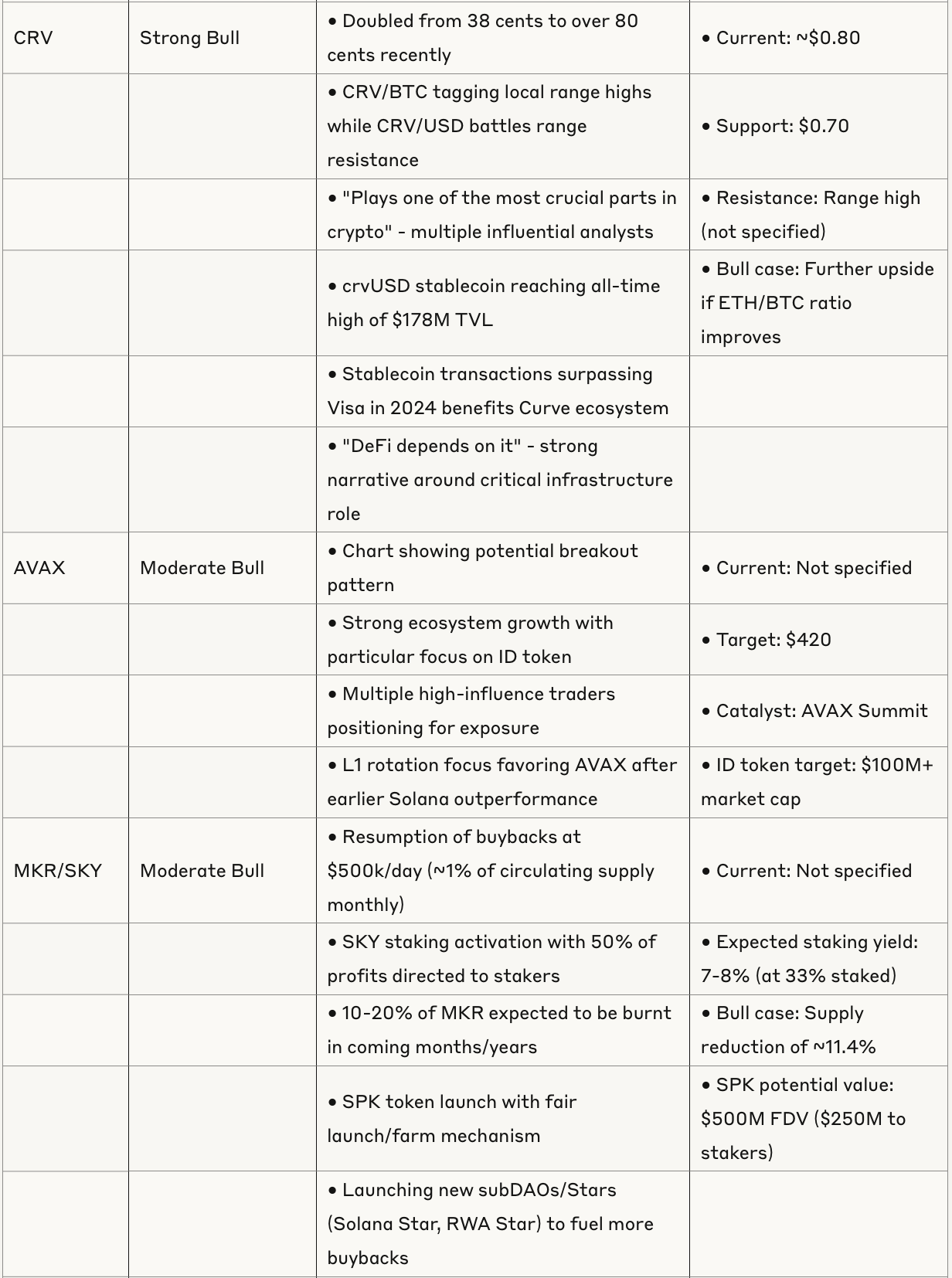

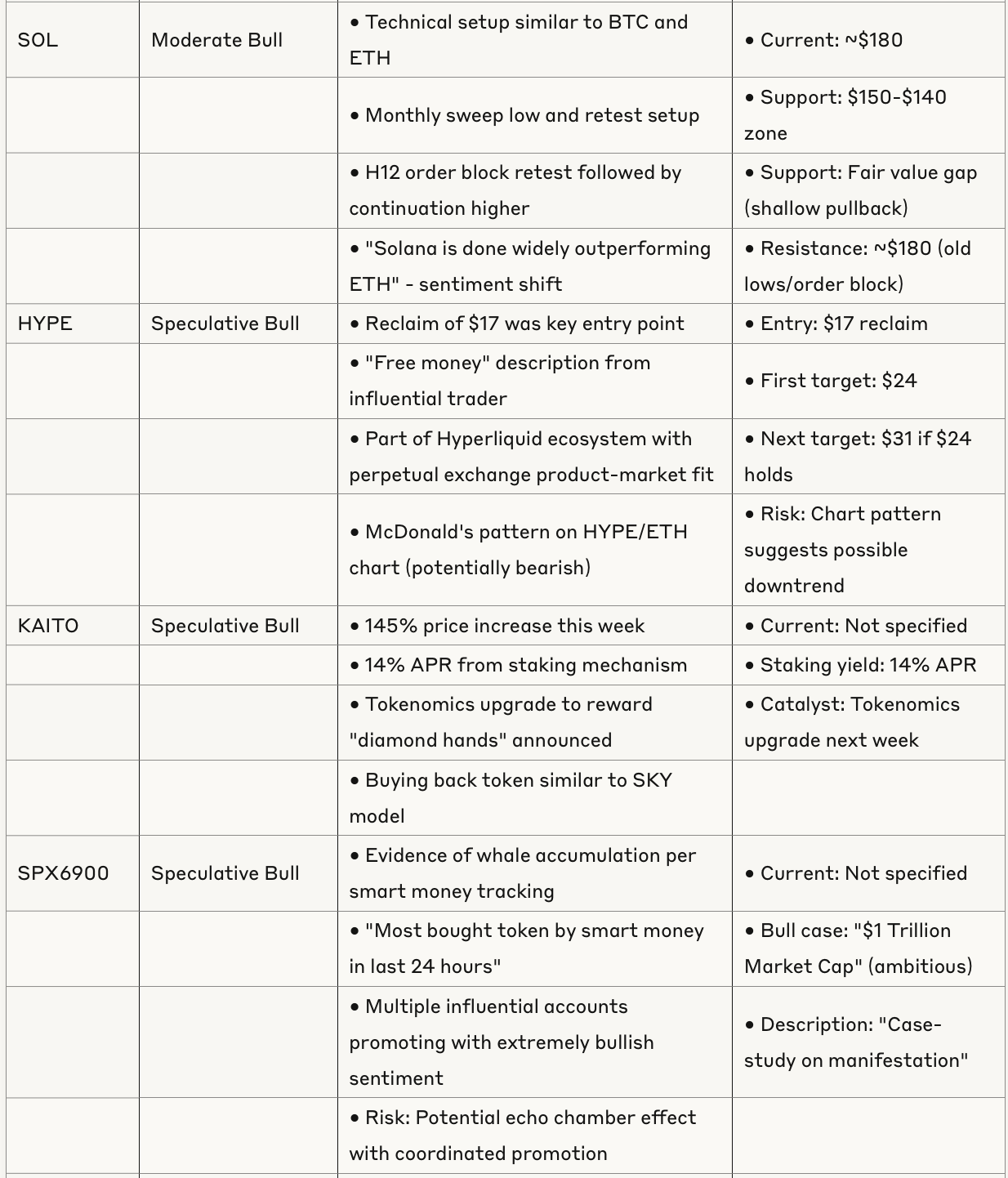

Token Analysis

Overall Market Context

The cryptocurrency market is showing strong bullish momentum with Bitcoin trading near all-time highs at approximately $104,000-$106,000. The market appears to be entering what some influential traders describe as a potential "supercycle" or "generational bull run."

Key market dynamics include:

Bitcoin dominance (BTC.D) has decreased by approximately 4%, creating favorable conditions for altcoin performance

ETH/BTC ratio is showing signs of bottoming, indicating potential ETH outperformance in the coming cycle

Stablecoin transactions have surpassed Visa transactions in 2024, highlighting increasing mainstream adoption

Recent U.S.-China trade agreement announcement is creating positive macro sentiment

Market structure appears to be shifting, requiring traders to adjust their entry and exit strategies

Primary risk factors include:

Low trading volume during the recent uptrend, suggesting potential for rapid reversals

Extremely bullish sentiment potentially creating an echo chamber effect

Geopolitical tensions, including a reported missile strike on a Pakistan nuclear facility

Potential unwinding of Ethena ETH positions affecting market structure

Token Analysis

Emerging Sector Trends

DeFi Infrastructure

Stablecoin growth accelerating with crvUSD reaching new ATH

Capital efficiency becoming key competitive metric for DEXes

BrownFi showing 200x capital efficiency vs competitors (54% APY vs 3.7%)

Infrastructure tokens receiving more attention than pure speculative assets

RWA (Real World Assets)

"Everything will be tokenized" narrative gaining strength

SYRUP positioned as potential market leader over ONDO

Multiple mentions of RWA as a key sector for 2025

Gaming & Memes

YEET platform's gaming focus creating significant profit potential (1673.25x returns on "Lamb Chop" game)

Hosico mentioned as potentially "the largest fdv token to come out of bonk fun"

Three dominant alt sectors for 2025 identified: AI, Memes, and Ordinals

AI Integration

AVA described as "Audio-visual framework to bring all AI agents to life"

Frok AI project entering "airspace" with focus on intelligence priced similar to blockspace

AI-related tokens identified as one of the three main sectors for 2025

Notable Market Events

U.S.-China Trade Agreement: Establishment of trade consultation mechanism with tariff reduction expectations

Trump Executive Order on Drug Pricing: Order to reduce pharmaceutical prices by 30-80%

Sonic Announcement: Expected major announcement on May 15

Stacks sBTC: Cap increase for sBTC (Bitcoin-backed asset for DeFi) on May 15

VanEck Onchain Economy ETF: First actively managed crypto ETF launching May 14

Resolv Airdrop: Registration deadline May 16

Metis Network Upgrade: Going live May 14

APT Token Unlock: $65M worth unlocking May 12 (today)

Trading Psychology & Strategy

Multiple sources emphasize:

Importance of planning and having contingencies for different scenarios

Not chasing pumps and allowing "the pump to come to you"

Using current strength to rebalance portfolios away from underperforming assets

Documentation of both quantitative metrics and emotional states during trades

Cross-market analysis (e.g., ETH/USD and ETH/BTC pairs) providing stronger signals

Conclusion

The cryptocurrency market is showing strong bullish momentum with Bitcoin near all-time highs and favorable conditions emerging for altcoins. The shift in ETH/BTC ratio and decrease in Bitcoin dominance suggest potential for broader market participation. Key sectors to watch include DeFi infrastructure (particularly stablecoins), Real World Assets (RWA), AI integration, and gaming/meme ecosystems.

While sentiment is predominantly bullish, risk factors include low trading volume, extreme sentiment potentially creating an echo chamber, geopolitical tensions, and the possibility of rapid reversals. Traders are advised to maintain diversification, plan for multiple scenarios, and avoid chasing pumps in favor of strategic positioning.