Daily Macro & Crypto Update: January 24, 2025

Market Charts

1. Macro Overview

2. Crypto Markets

3. Dominance Charts

Market Analysis

1. Web2 Macro: Risk-On or Risk-Off?

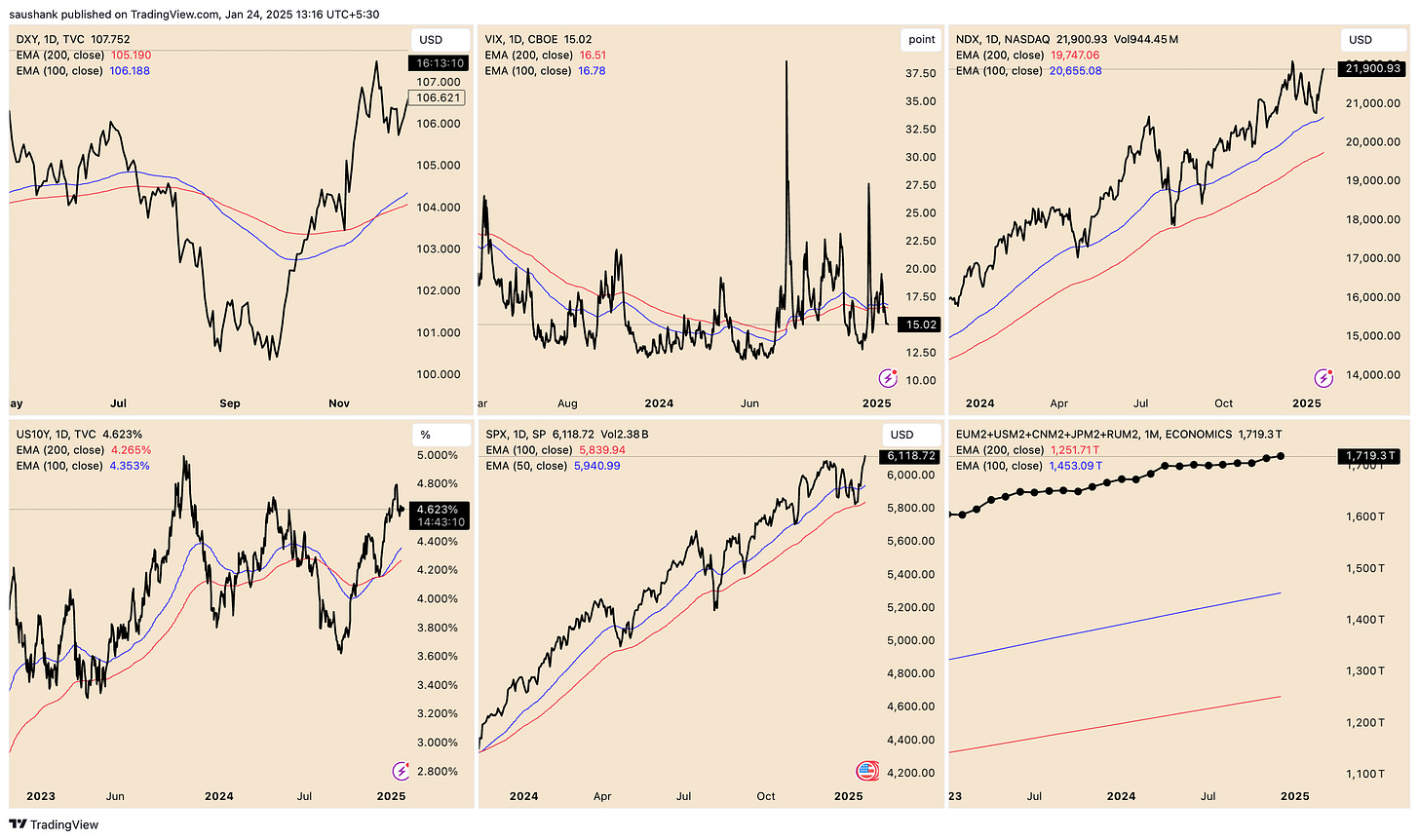

Equities (SPX, NDX) & VIX

Equities continue grinding higher, with the VIX near multi-year lows (~15), reflecting a broadly risk-on equity environment.

USD & Rates

The DXY holding above ~107 suggests a firm dollar, which can be a headwind for global liquidity. Meanwhile, the 10-year yield near 4.6% underscores persistent rate pressures—this can eventually dampen appetite for speculative assets if yields climb further.

Conclusion: While the strong dollar and elevated yields inject caution, the overall equity rally and subdued VIX indicate a moderately risk-on backdrop for now.

2. Web3 (On-Chain & Crypto-Specific) Indicators

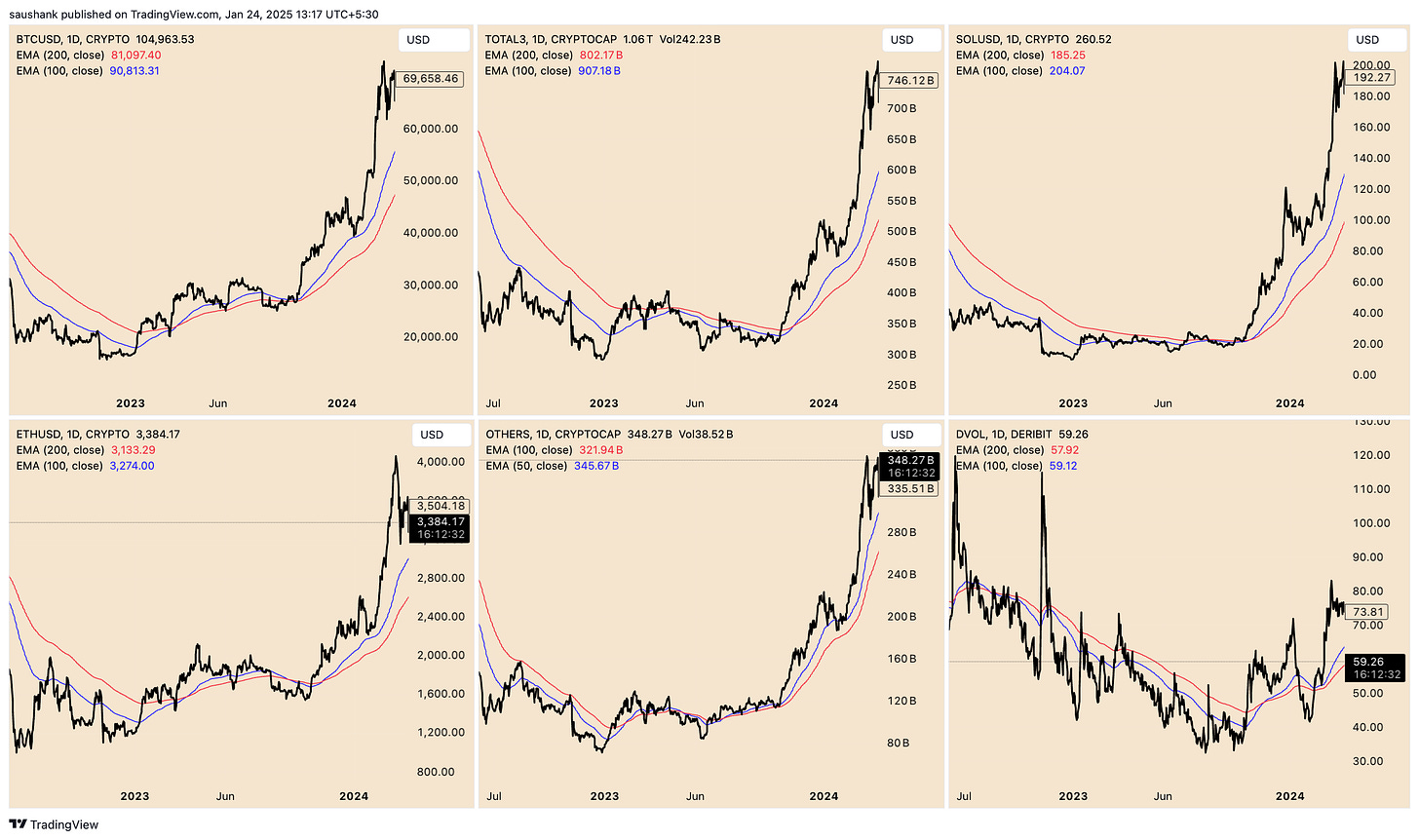

Funding Rates & Open Interest

Funding rates remain positive but not excessively high for BTC and ETH, indicating mildly bullish leverage without severe froth. Open Interest is slightly down, suggesting some profit-taking but not a full-scale exit.

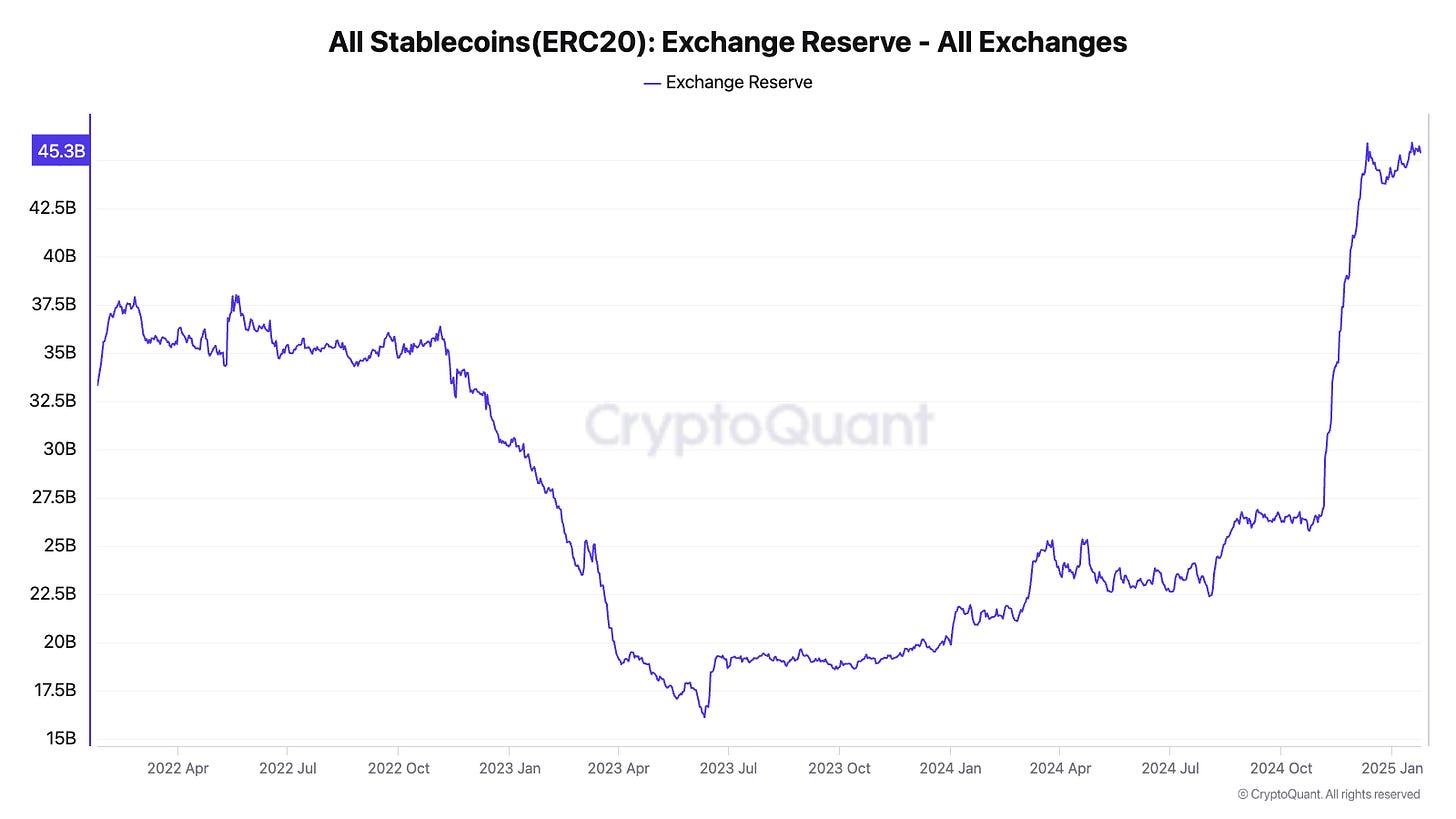

Stablecoin Flows & Exchange Balances

Declining stablecoin dominance and elevated stablecoin exchange reserves show there's still available liquidity to deploy into crypto.

Leverage Ratios

Both BTC and ETH leverage ratios continue to climb, increasing the potential for larger price swings in either direction.

RSI Levels

On higher timeframes (BTC & ETH price charts), RSI is hovering around neutral-to-slightly-bullish ranges, suggesting room for further upside if demand remains strong.

Conclusion: Crypto conditions are not blatantly overextended. The market appears positioned for potential further runs—with a higher leverage profile and enough stablecoin dry powder ready to move.

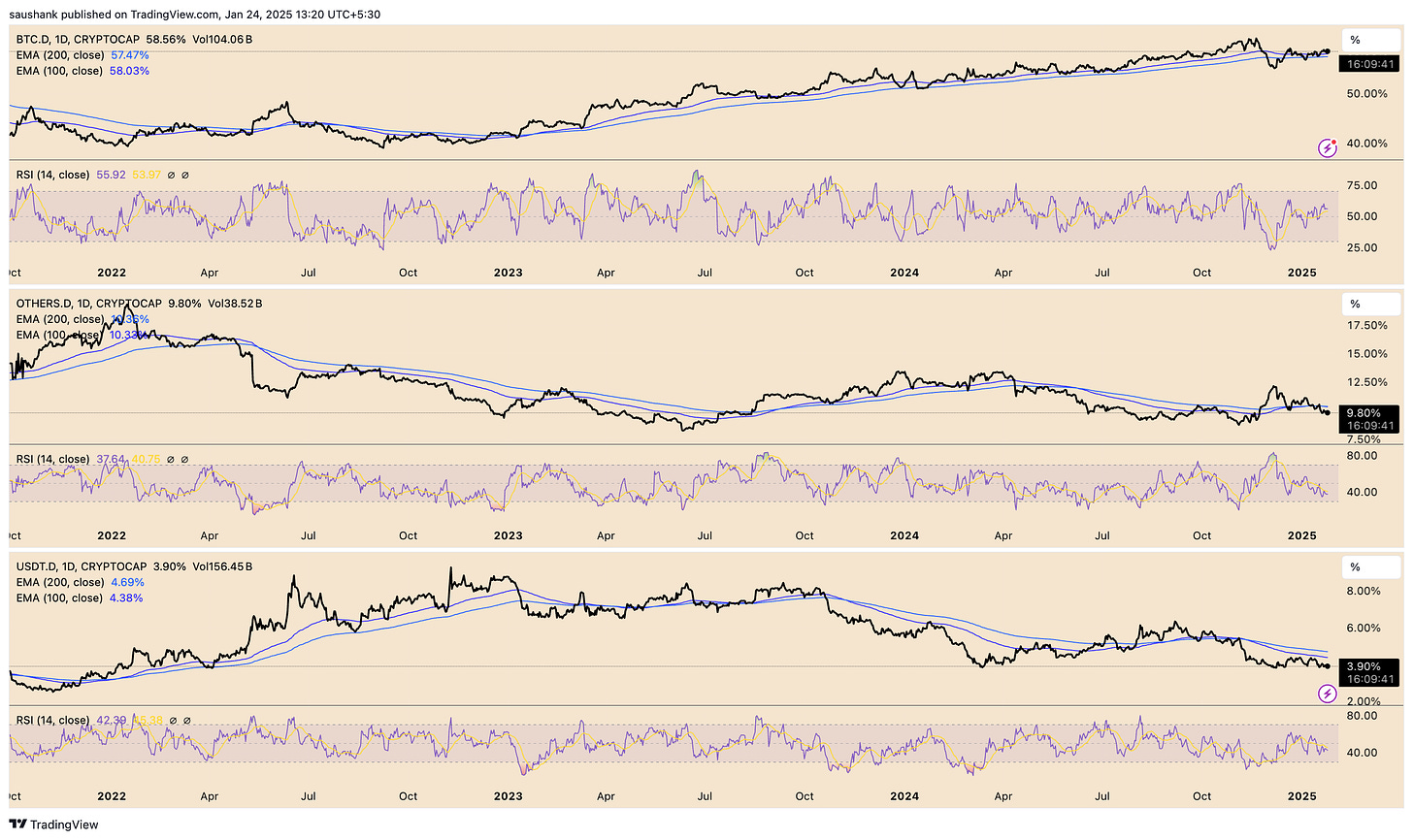

3. Dominance Charts: Timing an Altcoin Run

BTC Dominance (BTC.D)

BTC.D remains above its 100-day and 200-day EMAs, with an RSI around the mid-50s, indicating continued preference for BTC without being overbought. A break below these EMAs, with RSI under 50, would signal a rotation from BTC into alts.

Others Dominance (OTHERS.D)

Still below its key EMAs and with an RSI around 40, suggesting altcoins are oversold but need a catalyst—namely a drop in BTC.D—to spark an altcoin run.

USDT Dominance (USDT.D)

Trending lower below its 100- and 200-day EMAs, with RSI near 40. Capital is leaving stablecoins, supporting higher-beta crypto assets, but so far it's mostly channeling into BTC rather than alts.

Conclusion: Altcoins are positioned for a potential run if BTC.D decisively breaks its uptrend. Until that happens, the market appears to favor Bitcoin over the broader alt space.

Key Takeaways

Macro: Moderately risk-on, but watch the strong dollar and rising yields.

Crypto-Specific: Mildly bullish leverage, ample stablecoin reserves, no glaring overextension signals.

Dominance: BTC remains the leader; a break in BTC.D below key EMAs could trigger a robust altcoin rotation.

Bottom Line: If broader risk sentiment holds and BTC.D weakens, we could see the emergence of an "alt season." Until then, Bitcoin is likely to remain the primary beneficiary of incoming liquidity.